Welding Products Market Report Scope & Overview:

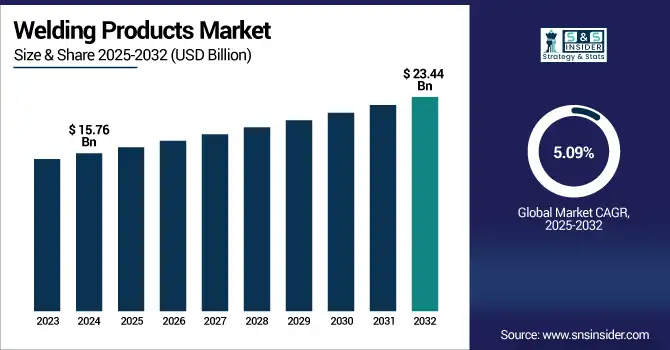

The Welding Products Market size was valued at USD 15.76 billion in 2024 and is expected to reach USD 23.44 billion by 2032, growing at a CAGR of 5.09% over the forecast period of 2025-2032.

To Get more information on Welding Products Market - Request Free Sample Report

The welding products market is currently witnessing high growth due to the growth of construction, automotive, shipbuilding, and heavy engineering industries. The welding equipment and consumables market is characterized by stick electrodes, solid wires, flux-cored wires, and SAW wires and fluxes used in arc welding, resistance welding, laser beam welding, and oxy-fuel welding. Current trends, such as technological evolution and automation of the welding equipment market, are adapting to the latest trend of welding technology–smart systems, robotic welding, sensor-based technologies, and others, which enhance productivity, precision, and safety.

Other important welding products market trends include increasing incorporation of IoT and AI in welding processes, higher demand for energy-efficient equipment, and growing focus on eco-friendly welding consumables. The welding products industry is also responding to an increasing demand for cost-effective, high-performance products capable of meeting changing safety and quality specification requirements. Innovations in welding automation, along with the increasing demand for high-strength, lightweight materials, are expected to be a chief factor driving the welding products market growth. The welding products market is quite dynamic and competitive due to the increasing investments by manufacturers in the research and development of next-generation welding technologies that serve the old and new applications.

Welding Products Market Dynamics:

Drivers:

-

Infrastructure Surge Sparks Strong Demand for High-Performance Welding Products Globally

The demand for welding products is being significantly driven by the rising global infrastructure and construction boom. Infrastructure, including bridges, pipelines, power plants, and transportation networks, requires substantial investments that require extensive use of welding-based structure fabrication and assembly technologies and consumables. Studies show that global construction output is anticipated to increase by 85% by 2030, propelled primarily by rapid urbanization and industrialization on emerging markets, including those in India and China, and the continued modernization in the U.S. Such large-scale projects require dependable, high performing welding solutions for safety, durability, and to meet stringent standards. This is resulting in strong market growth for welding products as a result of the expansion of high-efficiency automated welding technologies in the public and private infrastructure-supported economies.

Restraints:

-

High Capital Requirements and Equipment Costs Restrict Advanced Welding Technology Adoption Among SMEs

High initial investment and equipment costs are one of the significant restraints in the welding products market. The capital costs to purchase and set up advanced welding technologies at a facility, which could include laser, robotic, and hybrid systems, are significant and require integration with current/new production lines. Such systems usually need dedicated software, training, and infrastructure, resulting in higher all-in costs to roll out. This is economically justified in the case of large-scale manufacturers as it provides optimal production and efficiency, but for small and medium enterprises (SMEs), affording these technologies is an obstacle to mass adoption. Moreover, continuous maintenance requirements and spare costs push up the total cost of ownership. This financial hurdle delays the penetration of technology across the industry, particularly in price-sensitive markets, thereby restricting the growth of the market and modernization among smaller players.

Welding Products Market Segmentation Outlook:

By Technology

The resistance welding segment dominated the market and accounted for 32% of the welding products market share. It is a widely used method in mass production industries, particularly within the auto and electrical industries, as it can produce robust, long-lasting joints at high speed. Due to its minimal requirement in terms of consumables, and it can be easily automated, it is gaining a lot of popularity. Besides, the process is eco-friendly and consumes low power, which is why it is widely adopted in those developed countries that strive to achieve clean manufacturing practices. These characteristics have made it the most prominent welding type used in industry to this day.

Oxy-fuel welding is emerging as the fastest-growing segment in the welding products market due to its versatility and cost-efficiency, especially in repair and maintenance operations. This method is widely used in sectors including construction, pipeline installation, and shipbuilding, where portability and on-site welding are crucial. It requires less sophisticated equipment, making it accessible in developing regions where infrastructure development is surging. Additionally, its ability to cut and weld a variety of metals boosts its adoption, contributing to rapid growth, particularly in countries with expanding manufacturing and fabrication industries.

By Product

Stick electrodes held the largest share in the welding products market in 2024, contributing 38% due to their extensive use in manual arc welding applications. Because they are simple in form, easy to transport, and effective outdoors and in remote areas, they are among the most commonly used in industries such as pipeline construction, shipbuilding, and general repair work. They work with a wide variety of metals and thrive in poor conditions, such as wind or rain, only further affording them a dominant position. While stick electrodes continue to be a low-cost product for companies performing small to mid-scale welding operations, more sophisticated automated welding technologies have become popular.

Solid wires are the fastest-growing product segment in the welding products market, driven by increasing demand for gas metal arc welding (GMAW/MIG), especially in high-volume production environments. They enable higher deposition rates, cleaner welds, and less post-weld cleanup than conventional stick electrodes. They are expected to see particularly robust growth in automotive manufacturing, construction, and heavy machinery sectors, where precision, rapidity, and efficacy are a must-have. The move towards automation and productivity in different industries is expected to fuel the demand for solid wire in both the developed and developing regions at a rapid pace.

By End-use

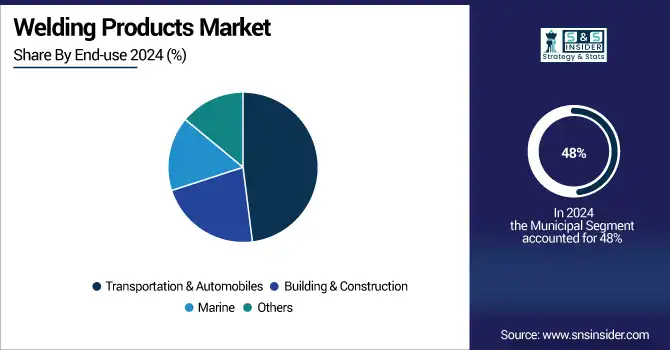

The transportation and automobile segment dominated the welding products market in 2024, holding a significant 48% share. This growth can be attributed mainly to the uninterrupted need for welding in the vehicle chassis, engine units, body structures, and assembly lines. Demand for advanced welding solutions is also driven by the increasing demand for electric vehicles (EVs) and lightweight materials. This segment continues to dominate the market in terms of value due to high production volumes, combined with more stringent safety and durability standards, which contribute to a constant need for reliable and accurately welded technology.

The building and construction segment is the fastest-growing end-use segment in the welding products market, fueled by rapid urbanization, infrastructure modernization, and industrial development globally. The welding process is important for Structural Steel Fabrication, Pipe Welding, HVAC Systems, and Architectural Frames. Welding products and technologies are utilized in the various sectors where construction is booming in emerging economies, with a focus on the Asia-Pacific, Africa, and the Middle East. Construction activities, including residential and commercial, will be driven by government initiatives focused on smart cities, affordable housing, and transportation infrastructure, which in turn drive welding applications.

Welding Products Market Regional Analysis:

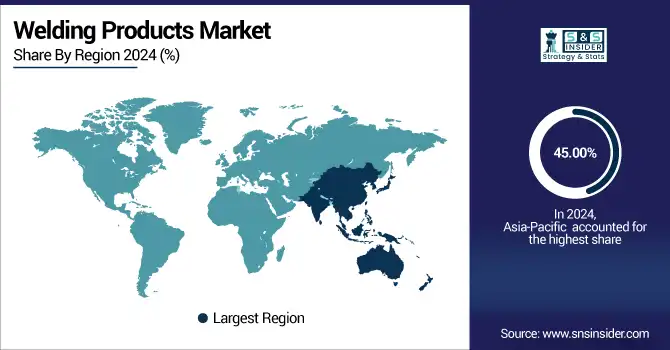

Asia-Pacific dominated the global welding products market in 2024, accounting for approximately 45.00% of the total market share. This leadership is primarily driven by rapid industrialization, expanding construction activities, and the strong presence of automotive, shipbuilding, and manufacturing sectors, particularly in countries including China, India, South Korea, and Japan. Favorable government policies promoting infrastructure development and foreign investments have also contributed to increased demand for advanced welding equipment and consumables.

Asia-Pacific is also the fastest-growing region in the welding products market, propelled by ongoing megaprojects, urbanization, and rising exports from the heavy machinery and automotive sectors. The growing demand for high-efficiency and precise welding technologies, coupled with the integration of automation and Industry 4.0 practices, is encouraging industries in the region to upgrade their welding infrastructure. Governments are investing heavily in infrastructure projects, such as smart cities, transportation networks, and renewable energy facilities, which significantly boost the requirement for welding equipment and consumables.

China is the dominant country. It holds the largest market share due to its massive manufacturing sector, extensive infrastructure projects, and strong presence of steel and automotive industries. China's continuous industrial expansion, government-led construction initiatives, and leadership in global welding equipment production make it the key driver of market growth in the region.

North America holds a significant share in the global welding products market, supported by strong demand across sectors, such as construction, oil & gas, aerospace, and automotive manufacturing. The region benefits from the presence of leading welding technology providers and a highly skilled workforce that drives innovation in welding techniques, including laser and robotic welding. The U.S. and Canada are key contributors, with ongoing investments in infrastructure renovation, pipeline development, and renewable energy projects fueling product demand. Moreover, stringent safety and quality standards encourage the adoption of high-performance welding consumables and automated systems.

The U.S. is the dominant player in North America, valued at USD 2.10 billion in 2024 and projected to reach USD 3.06 billion by 2032, growing at a CAGR of 4.83%. This growth is fueled by rising infrastructure development, expanding manufacturing activities, and increasing adoption of automated welding technologies. The strong presence of key industry players and demand from sectors like automotive and aerospace further support market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Welding Products Market are:

Welding Products Companies are Lincoln Electric Company, Obara Corporation, Metrode Products Ltd., Ador Welding Limited, Kemppi Oy, Kiswel, Inc., Sandvik AB, Colfax Corporation, Hyundai Welding Co., Ltd., and Veostalpine AG.

Recent Developments:

-

March 2024: Lincoln Electric organized a seminar titled “Welding Solutions for Energy, Oil & Gas” in Houston, where it introduced advanced welding technologies like HyperFill Twin-Wire and STT pipe welding systems to enhance pipe and pressure-vessel operations.

-

January 2024: Lincoln Electric launched the Mechanized Pipeliner AutoShield, an automated pipeline welding solution developed to boost productivity and accuracy in large-scale construction projects.

-

October 2025: Hyundai Welding announced its new manufacturing facility in Chennai, Chennstar Pvt Ltd, set to begin operations in October 2025, focusing on producing FCAW and GMAW welding products for the Indian market

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 15.76 Billion |

| Market Size by 2032 | USD 23.44 Billion |

| CAGR | CAGR of 5.09% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Arc Welding, Resistance Welding, Oxy-Fuel Welding, Laser Beam Welding, Others) • By Product (Stick Electrodes, Solid Wires, Flux-Cored Wires, Saw Wires and Fluxes, Others) • By End-use (Transportation & Automobiles, Building & Construction, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lincoln Electric Company, Obara Corporation, Metrode Products Ltd., Ador Welding Limited, Kemppi Oy, Kiswel, Inc., Sandvik AB, Colfax Corporation, Hyundai Welding Co., Ltd., Veostalpine AG |