Well Completion Equipment Market Report Scope & Overview:

To get more information on Well Completion Equipment Market - Request Free Sample Report

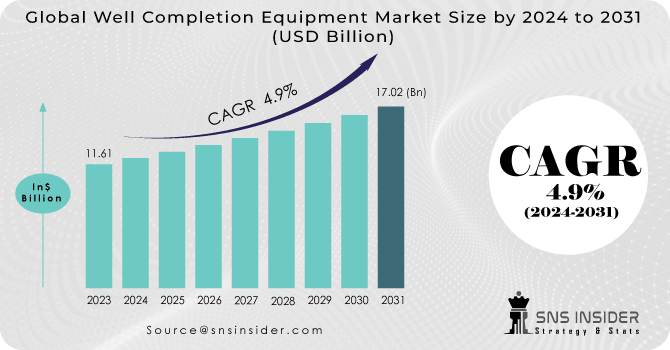

The Well Completion Equipment Market Size was estimated at USD 11.61 billion in 2023 and is expected to arrive at USD 17.84 billion by 2032 with a growing CAGR of 4.89% over the forecast period 2024-2032. This report offers a unique perspective on the Well Completion Equipment Market by analyzing regional well completion activities and utilization rates to assess market efficiency and demand fluctuations. It provides cost benchmarking by region, highlighting price trends and operational expenditures. Additionally, the study covers technological adoption rates, tracking advancements like smart completions and AI-driven monitoring. Export/import data offers insights into global trade dynamics and supply chain shifts. To enhance uniqueness, the report also examines ESG impact on well completion strategies, automation trends in completion processes, and breakthroughs in materials for high-pressure, high-temperature (HPHT) wells, shaping future market trends.

Market Dynamics

Drivers

-

Rising global energy demand is driving increased oil and gas exploration, boosting the need for advanced well completion equipment.

The increasing global demand for energy has significantly driven investments in oil and gas exploration, fueling the growth of the well completion equipment market. As traditional reserves dwindle, operators are pushing the exploration of unconventional resources such as shale gas, tight oil, deepwater, and other technologies aimed at completing wells that can produce these energy sources. Increasing hydraulic fracturing and horizontal drilling activities, especially in North America, are driving growth in the market. Also, national oil companies (NOCs) and independent operators are raising CAPEX levels to boost well performance and increase hydrocarbon recovery. Growing exploration activities in emerging markets in the Middle East, Africa, and Latin America are offering fresh growth opportunities. Some of the Trends to Watch in the Industry Digitalization, automation, and real-time monitoring are key industry trends being embraced in completion systems to improve operational efficiency. With the increase in exploration activities, the demand for effective and economical well completion solution is likely to grow steadily.

Restraint

-

High initial investment and maintenance costs of advanced well completion technologies limit adoption among smaller operators due to financial constraints and market uncertainties.

Advanced well completion technologies, such as multi-stage hydraulic fracturing, intelligent completions, and sand control systems, require substantial capital investment. These high upfront costs for equipment, infrastructure, and maintenance are a challenge, especially for small- and medium-sized operators that have very limited budgets. Also, the upkeep and upgrade of these complex systems is an ongoing cost (specialized labor, replacement parts, compliance with demanding industry regulations, etc.). These costs are often hard to justify for smaller oil and gas companies, however, particularly under volatile market conditions where changes in the price of crude oil can impact decisions on whether to invest. Thus, this means many operators choose to stick with more traditional shovel seismic completion, seeing many advanced technologies not broadly adopted into practice. The high upfront costs of energy storage invest an even harder decision, especially in regions where profit margins are lower and regulatory environments are less certain. In rising to this challenge, companies are investigating low-cost solutions, rental models, and collaborative arrangements to lower the barriers of entry to deploy advanced well completion technologies.

Opportunities

-

The demand for eco-friendly well completion technologies is rising due to sustainability goals, regulatory pressures, and innovations in low-impact drilling solutions.

The growing emphasis on sustainability in the oil and gas sector is driving the development of eco-friendly well completion technologies. Some companies are opting for increasingly greener options like waterless hydraulic fracturing, reusable and biodegradable drilling fluids, and better well stimulation technologies that have less environmental impact. Increasing carbon footprints and stricter government regulations are driving the need for efficient completion equipment that helps in minimizing the environmental footprints. Technological advancements such as real-time digital monitoring and automated well control systems further assist operators in efficiently utilizing resources and mitigating waste. Moreover, the utilisation of carbon capture and storage (CCS) in well completion processes is trending, that's also aligned with global sustainability objectives. Sustainable well completion technologies are expected to gain investment from operators focused on meeting environmental, social and governance (ESG) standards, highlighting large growth opportunities for market manufacturers and service providers.

Challenges

-

Implementing advanced well completion techniques requires skilled expertise, precise execution, and seamless coordination to ensure efficiency, safety, and well integrity.

Implementing advanced well completion techniques involves significant operational complexity and technical challenges, requiring skilled expertise and precise execution. New well-completion techniques like multi-stage hydraulic fracturing, intelligent completions, and the use of new extended-reach drilling require high-end tools and experienced professionals to optimize performance with safety tools as the priority. Mistakes that occur during the execution of this process can result in well integrity issues, reduced production efficiency, or worse, expensive failures. Moreover, this needs cooperation between different components further than service providers by integrating advanced technologies such as automation along with integrated sensors as well as automated control systems. HPHT reservoirs and deepwater environments compound the complexity of harsh operating conditions. In addition, operators face the added challenges of regulatory compliance, local environmental concerns, and the operational costs associated with advanced completion techniques. Therefore, the solutions need significant workforce training, research, and rigorous project planning before implementation to make them operational and at the same time to maximize well performance while being safe as well as cost-effective.

Segmentation Analysis

By Type

The Packers segment dominated with a market share of over 32% in 2023, due to its integral part in zonal isolation and sealing between the casing and production tubing. These are devices that would prevent fluid migration between various formation zones and improve well integrity and production. Packers are widely used both in land and offshore drilling operations on HPHT (high pressure and high temperature) wells. They also have the edge of improved wellbore stability, reduced casing damage, and optimized reservoir performance to aid in their market dominance. Growth in the use of enhanced oil recovery (EOR) methods and deep-water drilling works provides the EOR Market as well. Also, smart packers with real-time monitoring are expected to remain at the forefront for the next few years.

By Products

Intelligent Well Completion Equipment is the fastest-growing segment in the Well Completion Equipment Market, driven by technological advancements in digital oilfields and increasing demand for real-time data monitoring. Operator Automate production, reservoir management, and well performance to automated control systems and smart sensors. As oil and gas reservoirs become more complex (in particular deepwater and unconventional fields), there has been a greater demand for intelligent completions to reduce operational risk and to optimize efficiency. Furthermore, increasing utilization of IoT and AI analytics in the oil & gas industry will further drive the demand for these systems. With companies increasingly concentrating on extracting oil and gas cost-effectively and sustainably, intelligent well completion technology is gaining considerable traction.

By Application

The Onshore segment dominated with a market share of over 62% in 2023, due to the large number of oil and gas reserves located on land, especially in key areas such as North America, the Middle East, and parts of Asia. Onshore projects require less investment in infrastructure, which makes onshore operations less expensive compared to offshore. Moreover, onshore drilling pads are typically easier to reach, which streamlines logistics and minimizes technical challenges. As a result, onshore oil and gas projects become more appealing to firms wanting to cut costs and increase their productivity. Consequently, the onshore segment has yet again captured a larger market share owing to lower capital expenditures and a simpler installation process.

Need any customization research on Well Completion Equipment Market - Enquiry Now

Key Regional Analysis

North America region dominated with a market share of over 42% in 2023, due to its well-established oil and gas industry, particularly in the United States and Canada. Advanced technology, advanced infrastructure, and high investments in exploration and production activities are benefits enjoyed in the region. The U.S. has been a major contributor driven by shale oil and gas, which are seeing heightened demand for well completion equipment. The oil sands in Canada and offshore drilling also help the market gain significance in this part of the world. Moreover, the leadership in the global well completion equipment market is also supported by North America's well-structured regulations, skilled workforce, and advancements in drilling & completion methods. Together these factors keep North America as the leading region.

The Asia-Pacific region is the fastest-growing in the Well Completion Equipment Market, fueled by rising energy demand and rapid industrialization. The growing investments of China, India, and Australia in oil and gas exploration, demand innovative good management technologies for well completion. Offshore drilling and production in the region are also on the upswing led by the development of offshore, or continental shelf, oil fields in Malaysia, Indonesia and Australia. This has increased the need for well completion equipment required for the successful extraction of resources. All this means makes Asia-Pacific an important milestone within the global market growth.

Some of the major key players in the Well Completion Equipment Market

- Schlumberger Ltd. (Well completion tools, intelligent completions, sand control systems)

- Baker Hughes, Inc. (Liner hangers, packers, wellbore isolation tools)

- Halliburton Company (Frac plugs, multi-stage completion systems, sand control solutions)

- Weatherford International Plc (Liner systems, wellbore cleanup tools, inflow control devices)

- National Oilwell Varco, Inc. (Completion fluids, well stimulation equipment, frac sand handling)

- Nabors Industries Ltd. (Directional drilling tools, wellbore intervention solutions)

- Trican Well Service Ltd. (Hydraulic fracturing systems, coiled tubing services, cementing solutions)

- Superior Energy Services (Well intervention tools, completion packers, flow control equipment)

- Packers Plus Energy Services, Inc. (Open-hole multi-stage completion systems, packers, isolation tools)

- NCS Multistage (Multi-stage fracturing systems, sliding sleeves, coiled tubing solutions)

- Tenaris S.A. (Premium casing & tubing, well integrity solutions)

- Forum Energy Technologies (Wellhead completion tools, artificial lift equipment)

- Core Laboratories (Reservoir monitoring tools, perforating systems)

- Welltec (Well completion robotics, expandable metal technology)

- Tendeka (Sand control solutions, inflow control devices)

- C&J Energy Services (Cementing solutions, well stimulation equipment)

- Innovex Downhole Solutions (Liner hangers, frac plugs, downhole isolation tools)

- Oil States International, Inc. (Subsea completion systems, sand control technologies)

- GKD Industries (Wellhead completion solutions, production packers)

- Tam International (Inflatable packers, swellable packers, zonal isolation tools)

Suppliers for (well construction and completion equipment, including downhole tools and wellbore technologies) on the Well Completion Equipment Market

- Schlumberger Limited (SLB)

- Weatherford International

- NOV Inc. (National Oilwell Varco)

- Helmerich & Payne, Inc.

- Cameron International (Schlumberger)

- Baker Hughes

- Halliburton

- TechnipFMC

- OneSubsea (Schlumberger)

- Tenaris

Weatherford International Plc-Company Financial Analysis

Recent Development

In February 2024: Oil States, a global leader in offshore systems, downhole perforating and completions technologies, and wellsite rental equipment and services, unveiled a new portfolio of technologies tailored for the Saudi Arabian market. This includes the new Stage Frac Tool for wellhead isolation, the award-winning Active Seat Gate Valve, the innovative ActiveHub digital platform for remote wellsite monitoring and control, and the industry-first MPD-Ready System for Jack-Ups.

In February 2024: Innovex International, Inc., a prominent provider of products and technologies for the oil and gas industry, announced the completion of its acquisition of the remaining equity stake in Downhole Well Solutions, LLC (“DWS”). Innovex had previously made a minority investment in DWS in May 2023 and is excited to strengthen its successful partnership with DWS and its management team.

| Report Attributes | Details |

| Market Size in 2023 | USD 11.61 Billion |

| Market Size by 2032 | USD 17.84 Billion |

| CAGR | CAGR of 4.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multistage Fracturing Tools, Smart Wells, Valves, Liner Hangers, Packers, Sand Control Tools, Others) • By Product (Traditional Well Completion Equipment, Intelligent Well Completion Equipment) • By Application (Onshore, Offshore) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schlumberger Ltd., Baker Hughes, Inc., Halliburton Company, Weatherford International Plc, National Oilwell Varco, Inc., Nabors Industries Ltd., Trican Well Service Ltd., Superior Energy Services, Packers Plus Energy Services, Inc., NCS Multistage, Tenaris S.A., Forum Energy Technologies, Core Laboratories, Welltec, Tendeka, C&J Energy Services, Innovex Downhole Solutions, Oil States International, Inc., GKD Industries, Tam International. |