Wireless Connectivity Chipset Market Size Analysis:

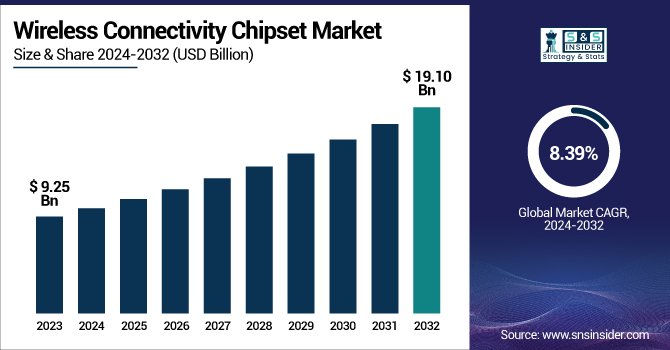

The Wireless Connectivity Chipset Market was valued at 9.25 Billion in 2023 and is projected to reach USD 19.10 Billion by 2032, growing at a CAGR of 8.39% from 2024 to 2032.

To Get more information on Wireless Connectivity Chipset Market - Request Free Sample Report

The key factors attributing this market growth are the rising developments in technologies like AI and Machine Learning that are making wireless connectivity more powerful by allowing devices to be smart and efficient. The demand for high-speed and low-latency communication in IoT and automotive and smart city applications is greatly affecting the demand for advanced wireless chipsets, as are the effects of 5G and beyond. We are also seeing a trend driven by environmental sustainability; there is a greater focus on energy efficient chipsets that can reduce the environmental impact of connected devices. In addition, standardization and interoperability are increasing the compatibility and efficiency of wireless chipsets across different platforms and industries.

In the U.S. Wireless Connectivity Chipset Market, which was valued at USD 2.82 billion in 2023, the market is expected to reach USD 4.52 billion by 2032, growing at a CAGR of 5.37%. This area is experiencing strong growth, driven by adoption of 5G networks and the use of AI-powered applications that require advanced connectivity solutions. The increased adoption of connected devices in the categories of smart home, mobile handsets, automotive, and industrial automation is fueling the growth of the market. Also, the U.S. is working on security and data privacy that need more secure and reliable wireless chipsets. These factors, along with the continuous technological innovations are likely to accelerate the growth of the wireless connectivity chipset market in U.S. during the forecast period.

Wireless Connectivity Chipset Market Dynamics:

Drivers:

-

Rising Global Connectivity and AI-Driven Innovation Drive Growth in the Wireless Chipset Market

The wireless connectivity chipset market is experiencing robust growth driven by a convergence of rising internet penetration, rapid mobile device adoption, and cutting-edge technological advancements. As of 2025, 5.56 bln people nearly 68% of the global population are online with mobile phones enabling 96.3% of internet access and generating 63% of web traffic. This digital surge, driven by an upsurge of 136 million annual users, highlights the growing demand for reliable, high-performance wireless solutions. At the same time, developments from 5G to 6G, led by initiatives such as China’s IMT-2030 Promotion Group and MediaTek’s AI-embedded chipsets like Kompanio 838 and Filogic 860, are facilitating quick, faster, more efficient connectivity across smart TVs, Chromebooks, and enterprise applications. As many as 1.26 billion households in the world are estimated to own computers by 2025 As the world becomes more mobile-first, connected, the demand for secure, interoperable, and power-efficient chipsets in the form of Wi-Fi 7 and Bluetooth modules will remain high.

Restraints:

-

The Impact of Rising Intellectual Property Conflicts on the Growth and Innovation in the Wireless Connectivity Chipset Market

Intellectual property (IP) conflicts pose a significant challenge to the wireless connectivity chipset market, as rising patent litigations and licensing disputes over proprietary wireless technologies can impede market progress. As companies race to develop advanced wireless solutions, the competition for patents intensifies, particularly in areas like Wi-Fi, Bluetooth, and 5G connectivity. Such IP-related concerns require costly legal battles which delay the launch of products and incur high expenses resulting from payment of licensing fees. Alternating these can be arduous for a petty manufacturer, which does not have funds to fight in the courts or to pay for the licenses needed to hang on Also, IP conflicts can hinder innovation and keep investments in research and development slower when businesses are very conservative about technical breakthroughs. In the end, these challenges decelerate the market’s expansion and hinder the efficient introduction of new and upgraded wireless solutions.

Opportunities:

-

Increased Demand for Wireless Connectivity Driven by Connected Homes and Expanding Internet Penetration

The rise in internet penetration, reaching 5.4 billion users globally in 2023, has significantly fueled the adoption of smart home devices, including voice assistants, smart lighting, and security cameras, driving the demand for advanced wireless connectivity solutions. Innovations in home automation, such as Amazon Echo and Google Home, have created an ecosystem where Bluetooth and Wi-Fi chipsets are essential for seamless communication between devices. Additionally, with Wi-Fi technology improving, data-heavy services like video streaming and cloud solutions are becoming more widespread, further increasing the need for efficient wireless solutions. Efforts like Japan's 5G infrastructure expansion and the growing use of educational technology continue to drive internet adoption, particularly in homes and enterprises, requiring advanced wireless communication ICs to meet these evolving demands.

Challenges:

-

Rising Cybersecurity Concerns and the Need for Enhanced Security in Wireless Connectivity Chipsets

As more devices become interconnected through Wi-Fi, Bluetooth, and 5G networks, the potential for exploitation of chipset vulnerabilities increases. Hackers can target weaknesses in wireless chipsets to access sensitive data, breach user privacy, and disrupt operations, creating substantial risks for consumers and enterprises alike. These security breaches can lead to severe financial losses, reputational damage, and a loss of consumer trust in wireless technology. As a result, there is a continuous demand for robust encryption protocols and advanced security features within chipset designs. With cyber-attacks becoming more sophisticated, manufacturers face the challenge of creating secure wireless plans providing data integrity and privacy between the connected devices. As a result, the issue of improving security continues to be a major goal for the wireless connectivity chipset sector.

Wireless Connectivity Chipset Market Segment Analysis:

By Type

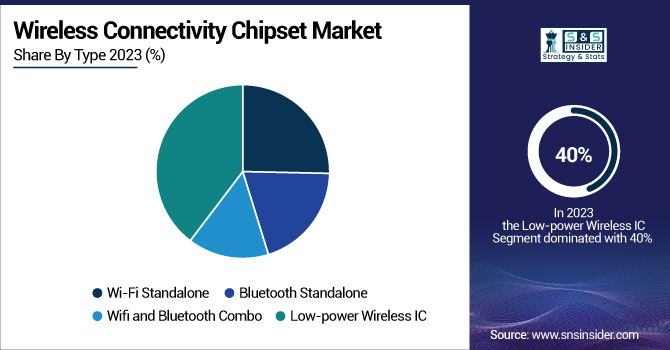

The Low-Power Wireless IC segment dominated the wireless connectivity chipset market in 2023, accounting for approximately 40% of the total revenue. This trend is attributed to the growing need for energy-efficient solutions in various applications such as IoT devices, smart homes, wearables and automotive systems. These are low power applications that consume very little power to work and cater high performance and connectivity with low latency for portable devices. With industries moving towards Internet of Things (IoT) and automation, the demand for energy-efficient, long-life solutions is increasing, and low-power ICs are paramount class of ICs that have supported the seamless communication of connected devices. Advances in wireless systems, including Bluetooth Low Energy (BLE) and Zigbee, are also spurring innovation and propelling the low power wireless IC solutions market.

The Wi-Fi and Bluetooth combo segment is expected to be the fastest-growing segment in the wireless connectivity chipset market from 2024 to 2032. The rising need for combo chipsets (that provide both Wi-Fi and Bluetooth connectivity in single chipset) is fueling this growth. This combo chipsets bring various benefits when it arrives to cost factor, power use, and space-saving solutions, and also focused on wide platforms targeting smartphones, wearables, smart home, automotive devices. The adoption of combo chipsets is being driven by the seamless communication between devices via Wi-Fi and Bluetooth, including smart speakers, wireless headphones, and IoT devices.

By Application

The mobile handsets segment dominated the wireless connectivity chipset market, accounting for around 30% of the total revenue in 2023. driven by the increasing demand for smartphones and the needs for connectivity chipsets [to provide connectivity for advanced communication technologies including 5G, Wi-Fi, and Bluetooth]. Modern mobile handsets need powerful, high-end chipsets that can provide for a host of tasks such as uninterrupted internet connectively, video streaming, voice assistants, and mobile gaming. With increasingly sophisticated smartphones, integrated and energy-efficient wireless chipsets become even bigger demands. Qualcomm's Snapdragon series and MediaTek's Dimensity chipsets are some of the examples where innovations of chipset technology improvements in performance, better 5G experience, and power-saving solutions balance with consumer demands. Moreover, growing deployment of 5G networks around the world is only driving the demand for advanced chipsets in mobile devices. During the forecast period, the mobile handset segment is anticipated to maintain its leading position owing to the advancement of smartphone technologies and the demand for faster and more reliable connectivity for consumers.

The automotive segment is experiencing the fastest growth in the wireless connectivity chipset market, with a significant surge expected during the 2024-2032 period. Increased adoption of advanced technology like autonomous driving, connectivity, and advanced driver-assisted systems (ADAS) in automobiles drives the need for advanced connectivity solutions. THE leading providers of smart and connected vehicles are gravitating towards using wireless communication for seamless data transfer between multiple components for real time navigation, infotainment, and over-the-air updates for existing vehicles. Automotive manufacturers are gearing up to build efficient EVs including smart transportation solution, high-performance chipsets, and software that can elevate the safety, efficiency, and overall user experience of vehicles as the electric vehicle (EV) segment continues to grow. Technologies like 5G, Wi-Fi 6, and Bluetooth are pivotal in enabling in-car connectivity, and as automotive technology continues to advance, the demand for reliable and secure wireless chipsets will only increase, making the automotive segment a key growth driver in the market.

Wireless Connectivity Chipset Market Regional Outlook:

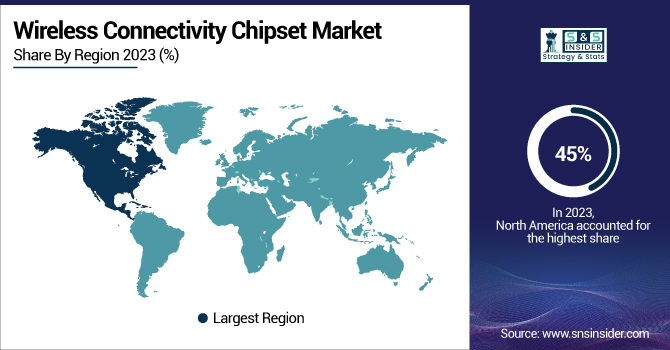

In 2023, North America held the largest share of the wireless connectivity chipset market, accounting for around 45% of global revenue. Major technological advances, adequate infrastructure, and high adoption of connected devices in sectors can explain the region’s dominance. The U.S. is the center of wireless technology innovation, given by the high level of 5G and IoT adoption the region will demand high-performance chipsets. Another factor driving growth, due to the explosive growth of data centers and the automotive sector in addition to strong sales in the consumer electronics space. Moreover, increasing investment in smart cities, smart buildings, and connected home solutions across North America drives demand for various wireless connectivity solutions in the region. In 2023, 23% of the whole chipset sales were facilitated through the U.S, owing to their well-structured tech domain, alliances and governmental help for innovation in technology.

The Asia-Pacific region is expected to experience the fastest growth in the wireless connectivity chipset market from 2024 to 2032, driven by rapid digitalization, increased smartphone penetration, and the presence of large-scale 5G networks. Infrastructure investments by countries like China, India, and Japan are driving the need for advanced connectivity solutions. The increasing adoption of consumer electronics such as smart devices and IoT applications contributes the growth in this region. Moreover, government policies promoting technological advancement, such as China’s plans for 5G deployment, are also development in the region wireless chipset market. This growth trend is underpinned by a vibrant tech ecosystem alongside an increasing consumer appetite for connected devices.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Companies in Wireless Connectivity Chipset Market along with their Products:

-

RF Micro Devices (USA) - Wireless RF components, power amplifiers, connectivity solutions.

-

Qualcomm (USA) - Snapdragon processors, 5G modems, Wi-Fi, Bluetooth chipsets, connectivity solutions.

-

Samsung Electronics (South Korea) - Exynos processors, Wi-Fi chipsets, Bluetooth chips, 5G solutions.

-

Dialog Semiconductor (UK) - Power management ICs, Wi-Fi, Bluetooth solutions, wireless charging ICs.

-

Skyworks Solutions (USA) - Wireless connectivity solutions, power amplifiers, RF components.

-

MediaTek (Taiwan) - Wi-Fi, Bluetooth, 5G, and mobile processors for smartphones, smart TVs, and IoT devices.

-

Nordic Semiconductor (Norway) - Bluetooth Low Energy (BLE) solutions, wireless chips for IoT.

-

NXP Semiconductors (Netherlands) - Wi-Fi, Bluetooth, 5G connectivity, IoT solutions, automotive chips.

-

Infineon Technologies (Germany) - Automotive wireless solutions, RF components, Bluetooth, Wi-Fi chips.

-

Cypress Semiconductor (USA) - Bluetooth, Wi-Fi, IoT solutions, connectivity ICs, memory ICs.

-

STMicroelectronics (Switzerland) - Wireless connectivity for automotive, IoT, Wi-Fi, Bluetooth solutions.

-

Texas Instruments (USA) - RF solutions, Bluetooth, Wi-Fi, and power management ICs.

-

Intel (USA) - 5G modems, Wi-Fi, Bluetooth solutions, network processors.

-

Marvell Technology (USA) - Networking solutions, Wi-Fi, 5G, Bluetooth connectivity solutions.

-

Broadcom Inc. (USA) - Networking, Wi-Fi, Bluetooth, 5G, broadband ICs.

List of suppliers that provide raw materials and components for the Wireless Connectivity Chipset Market:

-

BASF

-

Dow Inc.

-

3M

-

DuPont

-

Sumitomo Chemical

-

Henkel AG

-

Laird Performance Materials

-

Advanced Energy Industries, Inc.

-

Corning Inc.

-

Amphenol Corporation

-

SK hynix

-

Mitsubishi Chemical Corporation

-

KEMET Corporation

-

Murata Manufacturing Co., Ltd.

-

Taiyo Yuden Co., Ltd.

Recent Development:

-

October 17, 2024, Qualcomm’s India President, mentioned on October 17, 2024 that the time being, the adoption is growing continuously because of the increasing role of 5G Fixed Wireless Access (FWA), along with the declining chipset prices. The company's RedCap chipset and its partnership with Xiaomi to produce affordable 5G smartphones are driving this trend.

-

Sep 4, 2024, NETGEAR partners with Samsung Electronics to enrich WiFi 7 Experiences with Seamless Interoperability and Roaming between NETGEAR's Access Points and Samsung's Client Chipsets

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.25 Billion |

| Market Size by 2032 | USD 19.10 Billion |

| CAGR | CAGR of 8.39 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Metal-Oxide Varistor, Transient Voltage Suppressor, Gas Discharge Tube, Mixed Technology Devices) • By Form Factor (Surface Mount, Through Hole, Chip) • By Application (Consumer Electronics, Telecommunications, Automotive, Renewable Energy, Industrial Equipment) • By End Use (Residential, Commercial, Industrial, Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | RF Micro Devices (USA); Qualcomm (USA); Samsung Electronics (South Korea); Dialog Semiconductor (UK); Skyworks Solutions (USA); MediaTek (Taiwan); Nordic Semiconductor (Norway); NXP Semiconductors (Netherlands); Infineon Technologies (Germany); Cypress Semiconductor (USA); STMicroelectronics (Switzerland); Texas Instruments (USA); Intel (USA); Marvell Technology (USA); Broadcom Inc. (USA). |