Wireless Temperature Sensors Market Report Scope and Overview:

The Wireless Temperature Sensors Market size was valued at USD 2.29 Billion in 2025 and is expected to reach USD 4.99 Billion by 2035, growing at a CAGR of 8.11% over the forecast period of 2026-2035.

The wireless temperature sensors market is witnessing strong growth due to rising adoption in industries like healthcare, automotive, and manufacturing. These sensors provide robust real-time monitoring and are readily incorporated into an existing set up. The demand for automation, energy efficiency, and remote monitoring systems is enhancing its implementation. The development of wireless accesss and miniaturization of sensors also contribute to its growth. They can be used in both harsh and difficult environments, in, for example, modern industrial and smart infrastructure applications.

Wireless Temperature Sensors Market Size and Forecast:

-

Market Size in 2025E: USD 2.29 Billion

-

Market Size by 2033: USD 4.99 Billion

-

CAGR: 8.11% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Wireless Temperature Sensors Market - Request Free Sample Report

Wireless Temperature Sensors Market Highlights:

-

Rapid industrial automation is accelerating adoption of wireless temperature sensors for real-time monitoring, productivity improvement, and downtime reduction across manufacturing and process industries

-

Growing demand for remote and flexible monitoring solutions is driving integration of wireless temperature sensors with existing IoT and industrial automation infrastructures

-

High usage in hazardous and hard-to-access environments such as oil & gas, power generation, and chemical processing is strengthening market demand due to safety and operational efficiency benefits

-

Data security concerns, signal interference, and reliability issues are limiting adoption in mission-critical applications, particularly in healthcare, aerospace, and defense sectors

-

Rising focus on environmental monitoring, smart agriculture, and climate-based decision-making is creating new growth opportunities for wireless temperature sensors

-

Expansion of green buildings and energy-efficient HVAC systems, supported by global sustainability regulations, is boosting long-term market potential

The U.S. Wireless Temperature Sensors Market size was USD 0.54 billion in 2025 and is expected to reach USD 0.91 billion by 2035, growing at a CAGR of 6.16 % over the forecast period of 2026–2035.The US wireless temperature sensors market growth is driven by increasing adoption in industrial automation, smart homes and HVAC systems. Increasing penetration of battery-operated and wireless instruments in the process and utility industries is driving the market. Moreover, the regulations related to workplace safety and environmental monitoring have been promoting the use of wireless temperature sensors in various sectors.

According to research, around 72% of U.S. factories reported using wireless temperature sensors to improve uptime and reduce equipment failure risks.

Wireless Temperature Sensors Market Drivers:

-

Rapid industrial automation and demand for remote monitoring drive widespread adoption of wireless temperature sensors across multiple sectors.

Increasing industrial automation space coupled with rising demand for remote monitoring is the key factor driving the growth of the market of wireless temperature sensors. Factories and processing plants are moving in the direction of real-time temperature monitoring to enhancing productivity and minimizing downtime. Wireless systems enable the integration of the system also with the existing IoT infrastructures while limiting the cost for wiring, yielding flexibility in services. Moreover, with applications monitoring in dangerous or inconvenient working conditions, their further use in oil & gas, power, and chemical industries where safety and efficiency are primary concerns, improves its adoption.

According to research, over 70% of industrial facilities are integrating wireless temperature sensors into their automation systems to enable real-time process control and predictive maintenance.

Wireless Temperature Sensors Market Restraints:

-

Concerns over data security and signal reliability affect user confidence in mission-critical applications using wireless temperature sensors.

Internet of things temperature sensors are transmitting based wireless and are plagued by signal disrupts, cyber security issues and data integrity. In industries like healthcare, aerospace, and defense, where accuracy and security are essential, a momentary pause or an unauthorized breach could lead to life-and-death consequences or compromised privacy. Performance may be affected by other wireless devices, network congestion, or systems' configuration and system failures. These constraints decrease the trust that users have in deploying these sensors for mission critical situations, thereby limiting the growth potential of these sensors in some applications and regulated industries.

Wireless Temperature Sensors Market Opportunities:

-

Increasing focus on environmental monitoring and sustainability offers new avenues for wireless temperature sensors across smart agriculture and green buildings.

The rise in the adoption of wireless temperature sensors in the smart agriculture for the monitoring of soil and climate conditions in order to aid crop yield is also supporting the smart temperature should market growth. Also these sensors you see in green buildings are used for smart HVAC control which leads to energy savings. Stringent government regulations regarding green technology and carbon emission reduction also drive the adoption. The wireless technology of these sensors allows them to be easily distributed over large (or difficult to access) areas and offers data-based decision support in relation to environmental issues. These new uses are creating new markets for sensing technology to support a sustainable world.

According to research, over 100 countries have implemented energy-efficiency mandates for buildings, accelerating demand for smart sensor-based HVAC control systems.

Wireless Temperature Sensors Market Segment Analysis:

By Type

Thermocouples segment dominated the largest share in the Wireless Temperature Sensors Market, accounting for approximately 38.05% of the global revenue in 2025, due to their broad range of temperatures, resilience and cost effectiveness; which also makes them perfect for tough and/or industrial applications. Technologically advanced wireless sensors based on thermocouples are available and are offered by temperature sensors companies such as Honeywell International Inc., for example for the industrial sector. Low maintenance and easy incorporation in wireless systems continue to augment their use, and maintain their position in various demanding applications globally.

Thermistors are expected to register the fastest CAGR of about 9.67% from 2026 to 2035 because of the enhanced sensitivity and detection accuracy for the weak temperature variations. These features are also important for new applications in the fields of wearables, medical and smart household systems. For example, Texas instruments Incorporated provides miniaturized, low power thermistor solutions for small footprint wireless applications. They are increasingly being adopted across intelligent device populations owing to the rising needs for real-time health and environment tracking.

By Application

The industrial segment dominated the largest share in the Wireless Temperature Sensors Market with a revenue share of about 31.92% in 2025, because it is heavily used in manufacturing, logistics and energy, where watching in real-time is the difference between efficient and unsafe. Emerson Electric Co. plays a major role with its wireless temperature monitoring systems designed for industrial automation. With the reality of predictive maintenance and digital transformation, the need for reliable wireless temperature sensing is more critical than ever in large-scale, heavy industries.

Consumer electronics is projected to grow at the fastest CAGR of approximately 9.37% from 2026 to 2035, fueled by the smart devices and home automation wave. Small and low power sensors are increasingly important in technologies such as wearables and the Internet of Things. STMicroelectronics is working on wireless temperature sensors for placement in smartwatches, phones and home devices. Driven by the needs for transparent interconnectivity and increased functionality, this area will experience explosive growth and broader deployment.

By Connectivity

The Wi-Fi segment dominated the largest share of 38.49% in 2025, owing to its high data rate support and ease of integration with current networks. It is very popular in industrial and commercial monitoring and control. The Wi-Fi-based sensor platforms to acquire data for environmental and building control/IoT are available from Siemens AG. These perspectives offer real-time alarms and remote accessibility that can maximize operational productivity and guarantee temperature resistant procedures at all ranges.

Bluetooth connectivity is projected to grow at the fastest CAGR of around 9.02% from 2026 to 2035, owing to low power consumption and ease of integration with mobile and wearable equipments. Bluetooth-based sensorimotor systems for health care and consumer use are becoming popular. TE Connectivity Ltd. is among the leading suppliers of Bluetooth Low Energy temperature sensors that enable small, battery-operated devices. The increasing requirement for the wireless-enabled, energy-efficient temperature measuring instruments is further accelerating the market growth.

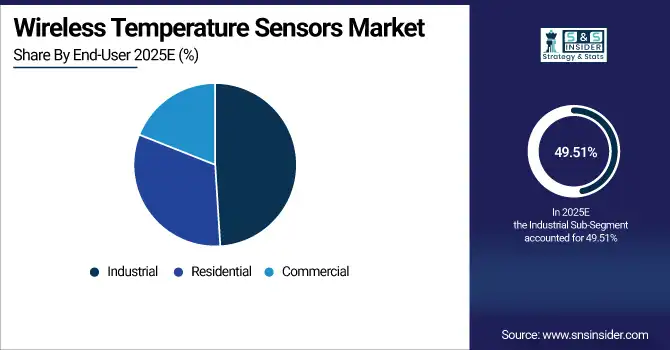

By End-User

The industrial dominated the Wireless Temperature Sensors Market with a share of about 49.51% in 2025, because of vigorous uptake in industries such as energy, logistics, and manufacturing. In these areas, temperature monitoring is required continuously and precise for safety reasons and to comply with local regulations. ABB Ltd. provides wireless temperature sensor systems for high-end process applications. Their durability, volume scalability and ease of fitting into mass-production operations all help them further dominate in this critical end-user segment.

The residential segment is expected to expand at the fastest CAGR of approximately 9.12% from 2026 to 2035, with smart home usage only growing. Customers are increasingly looking for simple and wireless options to control temperature in their homes. Schneider Electric offers fancy home temperature monitoring devices that can be connected to mobile apps and voice assistants. The growing need for the connected home and energy efficiency solutions will translate into the residential segment being the most important growth market of the future.

Wireless Temperature Sensors Market Regional Analysis:

North America Wireless Temperature Sensors Market Trends:

The North America region dominated the highest revenue share of 36.38% in the global market in 2025, supported by robust industrial infrastructure, early uptake of smart technologies, and a wide demand base across healthcare and manufacturing applications. The area also enjoys government regulation that makes it take energy efficiency and keeping people safe in their workplace. The reason why the uptake of wireless temperature sensors thrives in the region is that of high R&D investment and the existence of a developed IoT ecosystem.

-

The U.S. leads the North America wireless temperature sensors market, due to its growing IoT industry, demand for automation and increase in the smart homes and industrial sector. Its ecosystem driven by innovation and high R&D capacities reinforce its advanced market position.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Wireless Temperature Sensors Market Trends:

Asia Pacific is projected to expand at the fastest CAGR of approximately 9.44% from 2026 to 2035, due to the fast-paced industrialization, the growing demand for consumer electronics, and increasing spending on smart infrastructure. Developing economies such as China and India have experienced a significant rise in the market demand for wireless monitoring solution in the residential, commercial, and industrial sectors. Government directives on digitalization and smart cities are further boosting the use of wireless temperature sensors in the high-growth region.

-

China dominates the Asia Pacific wireless temperature sensors market due to mass production of consumer electronics, rapid industrialization and favorable government support for implementation of IoT and smart factory. Its market leadership is enhanced by strong demand from the electronics, automotive and energy industries.

Europe Wireless Temperature Sensors Market Trends:

Europe plays a vital role in the Market, due to the presence of developed manufacturing industry, the strong emphasis on eco-friendly technology solutions and rising deployment of smart home and industrial automation. Rising R&D activities in the region and strict environmental regulation are anticipated to contribute towards the increased integration of wireless temperature sensors for applications including energy management, precision agriculture and patient monitoring systems.

-

Italy leads the Market in Europe due to its significant inclination for industrial automation, energy efficient products and smart manufacturing. The increasing use in automotive, HVAC, as well smart homes systems are driving the market in Italy as well.

Latin America and Middle East & Africa Wireless Temperature Sensors Market Trends:

The Middle East & Africa market is led by the UAE, which has witnessed fast smart infrastructure development and is focusing on the deployment of IoT across industries. Brazil leads in Latin America with industrial growth, increasing demand in agriculture and energy fields and the expanding use of automation and smart monitoring systems.

Wireless Temperature Sensors Market Competitive Landscape:

Emerson Electric Co. is a global technology and engineering leader founded in 1890 in St. Louis, Missouri, that designs and manufactures industrial automation solutions, process control systems, measurement instrumentation, and precision tools for a wide range of commercial and industrial markets; over its 130+ year history it has grown from an electric motor and fan maker into a Fortune 500 company with a strong global presence and diversified portfolio supporting efficiency and innovation across sectors.

- In December 2024, Emerson released the updated Rosemount 248 Wireless Transmitter with WirelessHART support, LCD diagnostics, and an extended-range antenna for efficient field temperature monitoring.

Schneider Electric SE, established in 1836, is a global leader in energy management and industrial automation. The company provides solutions for power distribution, building automation, digital energy, and smart infrastructure, serving industries such as utilities, manufacturing, data centers, and commercial buildings worldwide with a strong focus on sustainability and efficiency.

- In January 2025, Schneider expanded its EcoStruxure line with wireless temperature and humidity sensors for HVAC and energy systems, advancing smart building automation and environmental control.

Wireless Temperature Sensors Market Key Players:

-

Honeywell International Inc.

-

Schneider Electric SE

-

Emerson Electric Co.

-

Siemens AG

-

ABB Ltd.

-

Texas Instruments Inc.

-

Analog Devices, Inc.

-

Microchip Technology Inc.

-

Yokogawa Electric Corporation

-

Omega Engineering Inc.

-

TE Connectivity Ltd.

-

NXP Semiconductors N.V.

-

Sensirion AG

-

Bosch Sensortec GmbH

-

Thermo Fisher Scientific Inc.

-

Monnit Corporation

-

Vaisala Oyj

-

Swift Sensors, Inc.

-

JUMO GmbH & Co. KG

-

Axzon, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.29 Billion |

| Market Size by 2035 | USD 4.99 Billion |

| CAGR | CAGR of 8.11% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Thermocouples, Thermistors, Resistance Temperature Detectors, Infrared Temperature Sensors, Others) • By Application (Healthcare, Industrial, Automotive, Aerospace & Defense, Consumer Electronics, Others) • By Connectivity (Wi-Fi, Bluetooth, Zigbee, Others) • By End-User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International Inc., Schneider Electric SE, Emerson Electric Co., Siemens AG, ABB Ltd., Texas Instruments Inc., Analog Devices, Inc., Microchip Technology Inc., Yokogawa Electric Corporation, Omega Engineering Inc., TE Connectivity Ltd., NXP Semiconductors N.V., Sensirion AG, Bosch Sensortec GmbH, Thermo Fisher Scientific Inc., Monnit Corporation, Vaisala Oyj, Swift Sensors, Inc., JUMO GmbH & Co. KG, Axzon, Inc. |