Moisture Analyzer Market Size & Growth:

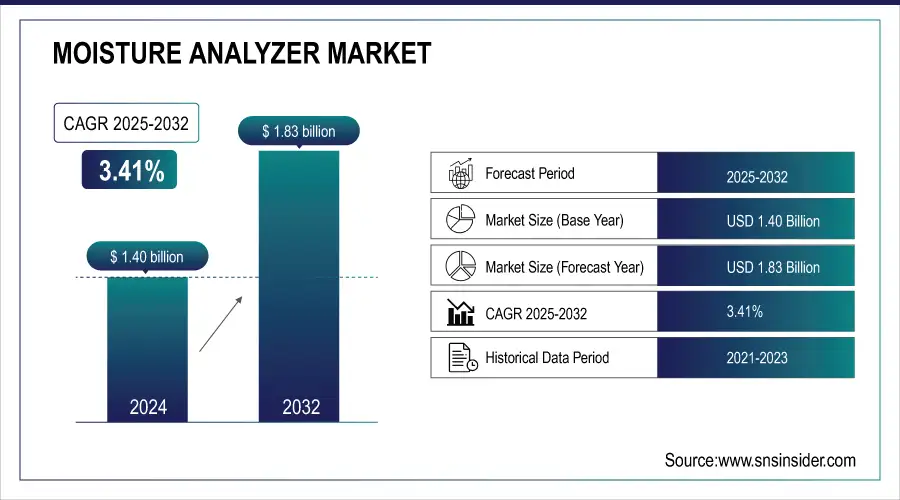

The Moisture Analyzer Market Size was valued at USD 1.40 billion in 2024 and is expected to reach USD 1.83 billion by 2032, growing at a CAGR of 3.41% from 2025-2032.

The moisture analyzer market is expanding due to rising demand for precise moisture measurement across food, pharmaceutical, chemical, and packaging sectors. Growth is driven by quality control needs, regulatory compliance, technological innovations like inline and non-destructive analyzers, and increasing automation alongside industrial expansion in emerging markets.

Moisture Analyzer Market Size and Forecast

-

Market Size in 2024: USD 1.40 Billion

-

Market Size by 2032: USD 1.83 Billion

-

CAGR: 3.41% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Moisture Analyzer Market - Request Free Sample Report

Moisture Analyzer Market Trends

-

Rising demand for precision moisture measurement across industries such as food & beverage, pharmaceuticals, chemicals, and plastics is driving the moisture analyzer market.

-

Strict quality control and regulatory standards are encouraging adoption of advanced moisture analysis instruments.

-

Increasing use in laboratories, production lines, and R&D facilities to ensure product consistency and safety supports growth.

-

Technological advancements such as infrared, microwave, and Karl Fischer titration-based analyzers enhance accuracy and speed.

-

Growing automation in manufacturing and laboratory processes is fueling the integration of smart and digital moisture analyzers.

-

Expansion of end-user industries including agriculture and environmental testing further contributes to market expansion.

-

Portable and compact device innovations are increasing accessibility and field-based applications globally.

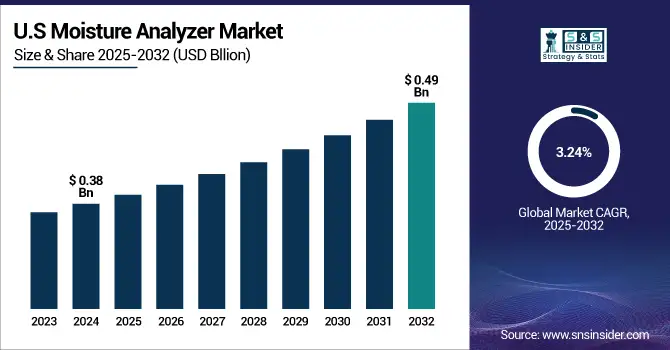

U.S. Moisture Analyzer Market was valued at USD 0.38 billion in 2024 and is expected to reach USD 0.49 billion by 2032, growing at a CAGR of 3.24% from 2025-2032. The U.S. Moisture Analyzer market is driven by growing demand for quality control in food products, formulations in pharmaceuticals, and the availability of developed automatic and real-time moisture measurement technologies from industries.

Moisture Analyzer Market Growth Drivers:

-

Rising Demand for Accurate Moisture Analysis Drives Growth in Food Pharmaceutical Chemical and Semiconductor Industries

Rising focus on measuring moisture contents correctly in different sectors is driving the moisture analyzer market Industries such as food and beverage, pharmaceutical, and chemical need accurate moisture content measurement to ensure product quality, regulatory compliance, and process efficiency. Demand for non-destructive and real-time moisture analyzers is driving market growth due to advancements in technology. The demand for in-line moisture analyzers has increased due to the automation of manufacturing processes. The increased demand for high-precision analysis in semiconductor manufacturing and water treatment is also contributing to the growth of the market. Besides, the increasing awareness about the relevance of moisture management during storing and transporting products is propelling the adoption of moisture analyzers.

Moisture Analyzer Market Restraints:

-

Challenges in Moisture Analyzer Market Include Limited Adaptability and Accuracy for Advanced Applications in Industries

The moisture analyzer market faces the restriction of limited adaptability of some analyzer technologies to deal with diverse materials. However, there are some moisture analyzers, especially those whose design dates back many years ago, or those based on classic methods such as drying ovens may not be as accurate as needed for newer and sophisticated applications. Older technologies are unable to cope, especially when it comes to new frontrunners like pharmaceuticals and semiconductors, where greater precision and speed are needed. Likewise, temperature and humidity fluctuations also impact the performance and reliability of the moisture analyzer especially for capacitance or microwave techniques which may not perform in unstable environments.

Moisture Analyzer Market Opportunities:

-

Growth Opportunities in Moisture Analyzer Market Driven by Technological Developments and Emerging Industry Applications

There are immense growth opportunities in the moisture analyzer market with various technological developments and emerging applications. The growing application of portable and handheld analyzers in agriculture, food, and pharmaceutical industries is one of the major growth areas because of the convenience and flexibility they offer in moisture analysis. Additionally, the increasing emphasis on sustainable production and environmentally friendly solutions presents lucrative opportunities for moisture analyzers in biomass, water treatment, and recycling sectors. With a continued push from industries to improve productivity and minimize waste, in-line and real-time moisture analyzers promise significant opportunities to optimize processes in high-volume manufacturing scenarios.

Moisture Analyzer Market Challenges:

-

Hurdles in Moisture Analyzer Adoption Include Compatibility Issues and Lack of Skilled Personnel for Advanced Technologies

One of the main hurdles is the compatibility of moisture analyzers with industrial processes. Although the current in-line and real-time analyzers have great potential in process optimization, their implementation in the already existing production line can be challenging and needs considerable modifications in the equipment and workflow. However, the presence of limited skilled personnel for operating and maintaining these advanced Moisture analyzers limits their adoption in industries based in these regions with scarce technical expertise. Another issue is to educate industries on the most recent developments in moisture analyzing techniques with many industries still dependent on practices of yesteryear that tend to delay the adoption process of more advanced and economical technologies.

Moisture Analyzer Industry Segments Analysis

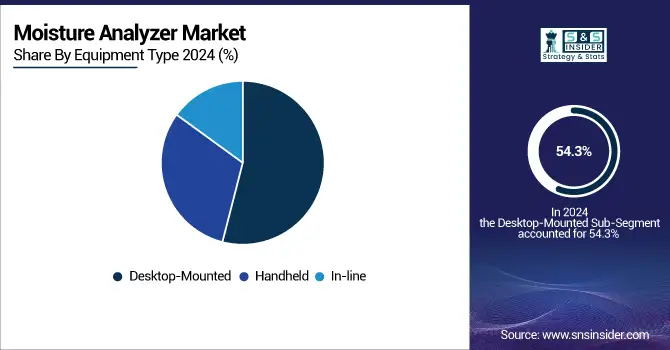

By Equipment Type, Desktop-Mounted analyzers dominate the Market, In-line analyzers are expected to grow fastest

The moisture analyzer market was dominated by Desktop-Mounted, with a 54.3% share of the market in 2024. They are commonly used in laboratories and industries which require very high accuracy and precision. The importance of analyzers that can be desktop-mounted lies in their reliability as well as versatility and the fact that they can be used for a variety of sample sizes. In addition to being market leaders, their easy user interfaces and simple calibration add up to their continuous success in the market. These methods are particularly common in the food and beverage, pharmaceutical, and chemical industries where moisture analysis is crucial to maintaining product quality and regulatory compliance.

The highest CAGR throughout 2025 to 2032 is projected for in-line moisture analyzers. As industries are progressing towards automation and continuous production processes, the utilization of in-line analyzers is gaining momentum. Such systems provide continuous, real-time moisture monitoring which allows manufacturers to take immediate action. The rapid adoption of these sensors in high-volume industries including food processing, chemicals, and semiconductors (due to their ability to integrate seamlessly into production lines) is one of a few key factors that will propel this market even further.

By Technique, Karl Fischer Titration dominate the Market, Near-Infrared (NIR) technology is expected to grow fastest

Karl Fischer Titration held a 27.4% share of the moisture analyzer market in 2024. This method is still nowadays the gold standard for accurate laboratory-scale moisture content measurement, mainly in the pharmaceutical, chemical, and food sectors. Its precision and accuracy at low levels of moisture make it an integral component in some high-precision applications. It is well-accepted for its applicability among different sample types including solids, liquids, and gases; therefore, providing a greater market share for the method.

Near-infrared (NIR) technology is expected to experience the fastest growth in CAGR from 2025 to 2032. NIR eliminates the obstructions of many forms of testing: no human or artificial destruction, immediate assessment of the sample, and no chemicals or reagents are needed to quantify moisture contents. With industries moving towards process automation and continuous monitoring in real-time, NIR is gaining wider appeal to applications in the food and beverage, pharmaceuticals, and agriculture sectors. This growth in adoption will lead to significant market growth.

By Vertical, Food and Beverage dominates the Market, Semiconductors are expected to grow fastest

Food and Beverage was the leading application segment for the moisture analyzer market, accounting for a market share of 25.7%, in 2024. This is primarily due to the vital impact of moisture content on the quality, texture, shelf life, and safety of any food products. Moisture content is important for food standards compliance, as well as production optimization. The high requirement for accurate moisture testing across food processing, packaging, and storage has driven the bulk of market share in this particular sector.

Semiconductors to grow in the highest CAGR from 2025 to 2032 With the increase in the accuracy of semiconductor manufacturing processes, the moisture analysis process is also required to be accurate to prevent defects and increase the yield. The production of semiconductor materials is another application that benefits from moisture control because slight deviations in moisture content can compromise the resulting electronic components. The industry is adopting moisture analyzers in the industry due to increasing demand for small and efficient electronic equipment, scoring for compact space.

Moisture Analyzer Market Regional Analysis

North America Moisture Analyzer Market Insights

North America was the dominant regional segment with a share of 37.6% in 2024. The presence of major end-use industries needing accurate moisture analysis such as pharmaceuticals, food and beverage, chemicals, and semiconductors driving the market leadership in the region. In North America, companies such as Thermo Fisher Scientific and Mettler Toledo played an important role in the development of advanced moisture analyzers for these sectors. For instance, FDA regulations in the U.S. have strict moisture content testing for pharmaceutical products which makes moisture analyzers vital.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Moisture Analyzer Market Insights

The highest growth rate, from 2025 to 2032, is anticipated in Asia Pacific. Continents dominating manufacturing industries like China, India, and Japan along with industries like food processing, pharmaceuticals, and electronics driving moisture analyzers demand, contributing to moisture analyzers market growth. Firms such as Shanghai Lianheng are adopting advanced systems for moisture analysis in a range of sectors including food and chemicals in China operators. Additionally, moisture analyzers are increasingly being adopted by Japan's strong semiconductor industry, which is a major market for precise manufacturing.

Europe Moisture Analyzer Market Insights

Europe holds a significant share in the moisture analyzer market, driven by strong industrial automation, advanced manufacturing, and stringent quality standards across food, pharmaceutical, and chemical sectors. The region’s focus on precision testing and regulatory compliance boosts demand for high-performance analyzers. Additionally, technological innovation and increased adoption of inline and real-time moisture analysis systems enhance efficiency, supporting the market’s steady growth across key European industries.

Middle East & Africa and Latin America Moisture Analyzer Market Insights

The Moisture Analyzer market in the Middle East & Africa and Latin America is growing steadily, driven by industrial expansion and rising demand in food, pharmaceuticals, and chemicals. Adoption is supported by the need for quality control, regulatory compliance, and efficient production processes, with increasing awareness of advanced technologies like inline and non-destructive analyzers fueling regional market growth.

Moisture Analyzer Market Competitive Landscape:

Kett Electric Laboratory

Founded in 1944, Kett Electric Laboratory specializes in moisture, gas, and particle measurement instruments for industrial and laboratory applications. Its products are widely used in food processing, agriculture, and chemical industries to provide real-time, accurate analysis, supporting quality control, process optimization, and regulatory compliance. Kett emphasizes innovation in inline and laboratory measurement technologies to enhance productivity and product consistency.

-

July 2024: Kett launched the RX20 and RX30 Inline Moisture Meters, offering advanced real-time moisture analysis tailored for food processing and agricultural applications.

OHAUS Corporation

Established in 1907, OHAUS provides precision laboratory instruments, including balances and moisture analyzers, for education, research, and industrial applications. The company focuses on reliable, accurate, and user-friendly equipment to streamline testing and quality control processes across multiple sectors. OHAUS is recognized for combining innovation with practical functionality to meet evolving laboratory and industrial requirements.

-

2024: OHAUS introduced the next-generation moisture analyzers MB32, MB62, and MB92, designed for precise and reliable moisture testing across diverse industries.

Sartorius AG

Founded in 1870, Sartorius AG is a leading global provider of laboratory and biopharmaceutical equipment, specializing in precision balances and moisture analyzers. The company integrates advanced technologies to support rapid, accurate measurements, enabling laboratories and industrial facilities to improve quality control, productivity, and compliance.

-

News (2025): Sartorius launched the LMA200PM microwave-drying moisture analyzer, delivering moisture results in 40–120 seconds by combining microwave heating with integrated analytical weighing.

Mettler‑Toledo International Inc.

Founded in 1945, Mettler-Toledo International Inc. delivers high-precision instruments and analytical solutions for laboratories, industrial plants, and food retail operations. Its moisture analyzers, weighing instruments, and process analytics tools help ensure product quality, regulatory compliance, and operational efficiency across industries such as pharmaceuticals, chemicals, and food processing.

-

2024: Mettler-Toledo released updated datasheets for the HE53 and HC103 halogen-moisture-analyzer models, highlighting product availability and calibration support.

Moisture Analyzer Market Companies are:

-

Mettler-Toledo International Inc.

-

A&D Company, Limited

-

Thermo Fisher Scientific Inc.

-

AMETEK, Inc.

-

Metrohm AG

-

GE (General Electric Company)

-

Mitsubishi Chemical Holdings Corporation

-

Kett Electric Laboratory

-

Precisa Gravimetrics AG

-

PCE Instruments Ltd.

-

Adam Equipment Co. Ltd.

-

Arizona Instrument LLC

-

Sinar Technology

-

Gow-Mac Instrument Co.

-

U-Therm International (H.K.) Ltd.

-

Danaher Corporation

-

SpectraSensors Inc.

-

KERN & Sohn GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.40 Billion |

| Market Size by 2032 | USD 1.83 Billion |

| CAGR | CAGR of 3.41% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technique (Karl Fischer Titration, Loss-on-Drying, Capacitance, Microwave, Drying Oven, Near-infrared, Radio Frequency, Others) • By Equipment Type (Desktop-Mounted, Handheld, In-line) • By Vertical (Plastic and Polymer, Pharmaceuticals, Chemical and Petroleum, Food and Beverage, Wood, Paper, and Pulp, Research and Academics, Construction, Water Treatment and Biomass, Semiconductor, Metal and Mining) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mettler-Toledo International Inc., Sartorius AG, A&D Company, Limited, Shimadzu Corporation, Thermo Fisher Scientific Inc., AMETEK, Inc., Metrohm AG, GE (General Electric Company), Mitsubishi Chemical Holdings Corporation, Kett Electric Laboratory, Precisa Gravimetrics AG, PCE Instruments Ltd., Adam Equipment Co. Ltd., Arizona Instrument LLC, Sinar Technology, Gow-Mac Instrument Co., U-Therm International (H.K.) Ltd., Danaher Corporation, SpectraSensors Inc., KERN & Sohn GmbH |