Submarine Cable Systems Market Size

Get more information on Submarine Cable Systems Market - Request Sample Report

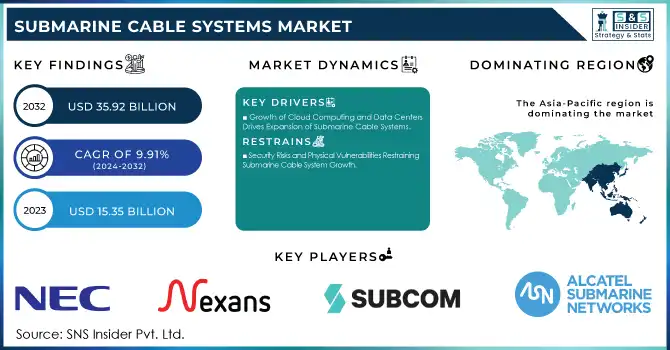

The Submarine Cable Systems Market Size was valued at USD 15.35 billion in 2023 and is expected to reach USD 35.92 billion by 2032, growing at a CAGR of 9.91% over the forecast period 2024-2032.

The growing demand for data traffic and bandwidth is driving the expansion of the submarine cable systems market, with internet usage, smart devices, streaming services, and cloud computing all contributing to the need for high-bandwidth, low-latency communication. Submarine cables, which carry over 99% of global intercontinental data traffic, are essential to meeting this demand. For example, the Asia Direct Cable (ADC), spanning 10,000km and connecting countries like China, Japan, and the Philippines, has a capacity of over 160 Tbps, significantly boosting data traffic diversity in the region. Similarly, the Jupiter submarine cable, completed in 2020, connects Asia and the US, spanning over 14,000km with a capacity of 60 terabits per second to support the massive data requirements of tech giants like Facebook, Amazon, Google, and Microsoft. The increasing participation of internet content providers in submarine cable projects is evident, with these companies engaging in about 16 separate cabling ventures across the Pacific, Atlantic, and Asia. submarine cable networks are evolving to support emerging technologies like 5G, which will further drive data consumption. However, despite this rapid growth, only 36% of Sub-Saharan Africa is connected to the internet, underlining the need for continued investment in submarine cable systems to support global connectivity. As these developments continue, the submarine cable systems market is poised for significant growth, driven by high-capacity cables, evolving technologies, and an increasing demand for reliable, high-speed global communication, with a critical need for enhanced security, especially in regions like the Indo-Pacific.

Submarine Cable Systems Market Dynamics

Drivers

-

Growth of Cloud Computing and Data Centers Drives Expansion of Submarine Cable Systems

The rapid growth of cloud computing services and data centers is a key driver for the submarine cable systems market, as these sectors require high-capacity cables for reliable data transmission. The demand for high-speed connectivity to support cloud-based applications, services, and data storage has accelerated the expansion of submarine cable networks. For example, the ADC , engineered by S.B. Submarine Systems (SBSS) and spanning 7,740 kilometers, addresses the bandwidth needs of cloud computing and AI, enhancing stability and redundancy in the Asia-Pacific region. China Telecom, with over 50 international submarine cable resources and 254 overseas Points of Presence (PoP), continues to expand its systems to support technologies like 5G, AI, and IoT. Additionally, the 2Africa Pearl submarine cable, the world’s longest subsea network, spans 45,000 km and offers 180 terabits per second of capacity, improving connectivity from Bahrain to Africa and Europe. This infrastructure supports Bahrain’s Vision 2030, helping develop energy-efficient data centers with a 60MW IT load capacity, highlighting the increasing reliance on submarine cables for digital connectivity.

Restraints

-

Security Risks and Physical Vulnerabilities Restraining Submarine Cable System Growth

Submarine cables, integral to global data transmission, face substantial physical and cyber threats that act as key restraints on the growth of the submarine cable systems market. These cables are essential for transmitting around 99% of intercontinental internet traffic, handling critical communications for financial markets, government, and military operations. However, they are highly vulnerable to natural disasters, such as earthquakes and tsunamis, and human activities like fishing, anchoring, and sabotage. Physical damage to these cables can lead to extended service outages, severely disrupting global communication and data transfer across multiple industries. Moreover, the escalating risks of cyberattacks, including espionage and sabotage, driven by geopolitical tensions, further expose these vital infrastructures. Submarine cables have become targets in hybrid warfare scenarios, with incidents like the 2022 Nord Stream pipeline attack and Houthi-led cable damage in the Red Sea raising alarms about their security. These vulnerabilities not only jeopardize the stability of global communications but also deter investment in new cable infrastructure due to the high costs of reinforcing security measures. The growing risks have also led to a slowdown in cable system deployment, as companies and governments must allocate significant resources to protect cables from both physical and cyber threats. With over 529 active cable systems and a network extending across 745,000 miles of ocean, the demand for high-capacity, secure submarine cables continues to rise. However, the threat of disruptions and the financial burden of ensuring safety pose major challenges to the market.

Submarine Cable Systems Market Segment Analysis

By Component

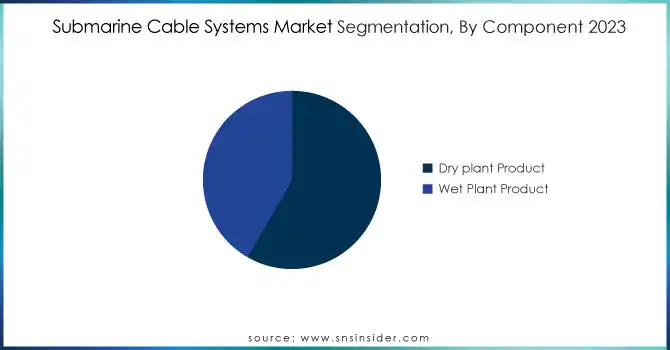

In 2023, the Dry Plant product segment accounted for the largest share of the Submarine Cable System Market, capturing around 59% of the revenue. The Dry Plant segment plays a crucial role in submarine cable systems, comprising key infrastructure components such as amplifiers, repeaters, branching units, and terminal stations. These components are vital for maintaining signal strength, amplifying data transmission over long distances, and ensuring reliable communication. Amplifiers and repeaters help extend the range of data signals, while branching units enable connections between different cable networks or landing stations. Additionally, terminal stations are essential for connecting submarine cables to terrestrial networks, facilitating seamless data transfer.

By Deployment

In 2023, the Deep Water segment captured the largest share of the Submarine Cable Systems Market, accounting for approximately 69% of the revenue. This segment refers to submarine cable installations in ocean depths beyond 200 meters, where the cables are typically laid on the ocean floor or buried for protection. The deep-water installation is crucial for connecting distant international locations, enabling high capacity, long-distance communication networks. Cables in deep-water areas are designed to withstand extreme environmental conditions, such as high pressure and potential natural hazards like undersea landslides or earthquakes. The demand for deep-water cables is increasing due to the growing need for robust global connectivity, particularly to support cloud services, international data transfer, and emerging technologies like 5G.

Submarine Cable Systems Market Regional Outlook

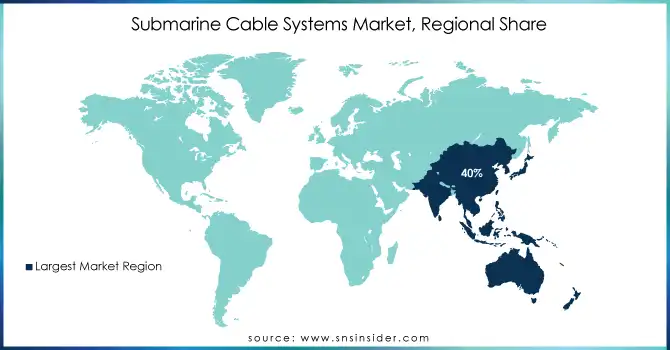

In 2023, Asia-Pacific dominated the Submarine Cable Systems Market, capturing approximately 40% of the revenue share. This region’s leadership is largely driven by the robust digital transformation and technological advancements in key countries such as China, Japan, India, and South Korea. China, with its rapid expansion of data centers and investments in cloud infrastructure, is a major contributor to this growth, leveraging initiatives like the Belt and Road Initiative to enhance global connectivity. Japan and South Korea, as technology hubs, are pivotal in submarine cable system deployment, supporting regional and intercontinental data transfer. India, with its growing internet penetration and rising demand for data, is increasingly investing in submarine cable systems to boost connectivity within Asia and globally. The region’s strategic location facilitates global data exchange, making it a critical junction for both regional and international communications. Additionally, government-backed projects such as the Asia-Africa-Europe-1 (AAE-1) and the Southeast Asia-Japan Cable (SJC) further solidify the region's dominance. The rise of emerging technologies like 5G, AI, and IoT, particularly in China and India, is driving demand for high-capacity submarine cables, making Asia-Pacific a significant player in the global submarine cable market.

North America is the fastest-growing region in the Submarine Cable Systems Market over the forecast period 2024-2032. The growth is driven by increasing demand for high-speed internet and cloud services, along with significant investments in digital infrastructure. The U.S. and Canada are at the forefront of this development, with major projects aimed at strengthening submarine cable networks. The U.S. has seen large-scale deployments like the MAREA and Dunant cables, connecting to Europe and Asia, significantly enhancing transatlantic and transpacific data transmission. The government’s emphasis on cybersecurity and network resilience also boosts market growth. Canada, with its emerging data centers in cities like Toronto and Vancouver, is positioning itself as a key player in global data exchanges. Rising data consumption, advancements in 5G, AI, and the cloud drive the demand for reliable, high-capacity submarine cables, further accelerating market growth in North America.

Need any customization research on Submarine Cable Systems Market - Enquiry Now

KEY PLAYERS:

Some of the major players in Submarine Cable Systems Market with their product:

-

Alcatel Submarine Networks: (Submarine optical fiber cable systems, repeaters, and branching units)

-

SubCom, LLC: (Repeatered submarine cables, submarine cable installation services)

-

NEC Corporation: (Optical submarine cable systems, repeaters, terminal equipment)

-

Nexans SA: (Submarine high-voltage cables, fiber optic submarine cables)

-

Prysmian Group: (High-voltage submarine power cables, optical fiber cables)

-

Hengtong Group Co., Ltd.: (Submarine fiber optic cables, accessories for marine communication)

-

ZTT Group: (Submarine power and optical fiber cables, offshore cable systems)

-

NKT A/S: (High-voltage submarine power cable systems)

-

Corning Incorporated: (Optical fiber and cables for submarine communication networks)

-

Hellenic Cables: (Submarine power transmission and telecommunication cables)

-

Sumitomo Electric Industries, Ltd.: (Submarine optical fiber cables, connectors)

-

Apar Industries: (Submarine communication and power cables)

-

AFL: (Fiber optic cables, cable assemblies for submarine applications)

-

TFKable: (Submarine energy cables, telecom cables)

-

Hexatronic Group: (Submarine fiber optic systems and cables)

-

SSGCABLE: (Submarine high-voltage power cables, optical cables)

-

OCC Corporation: (Submarine optical fiber cables, subsea cable protection systems)

-

1X Technologies LLC: (Custom-designed submarine power and optical cables)

-

Tratos: (High-voltage submarine power cables, submarine telecom cables)

-

Huawei Marine Networks: (Submarine communication cable systems, undersea network solutions)

List of Suppliers of raw materials and components for the submarine cable systems market:

-

Dow Inc.

-

BASF

-

Avery Dennison

-

3M

-

Sumitomo Chemical

-

Draka (Prysmian Group)

-

Corning Incorporated

-

Hengtong Group

-

AFL

-

Nexans

-

Prysmian Group

-

ZTT Group

-

Southwire

-

General Cable

-

Schneider Electric

-

LS Cable & System

-

SABIC

-

TE Connectivity

-

Cablex

-

Beijing Tianyishun Cable Co. Ltd.

Recent Trends

-

On June 27, 2024, Nokia announced it will sell Alcatel Submarine Networks (ASN) to the French state for €350 million (USD 374 million). This move will streamline Nokia’s Network Infrastructure division, focusing on growth in fixed, IP, and optical networks while increasing its operating profit margin by 100-150 basis points.

-

On December 22, 2024, NEC Corp. completed the Asia Direct Cable (ADC), a high-capacity submarine cable system connecting China, Japan, the Philippines, Singapore, Thailand, and Vietnam. This project enhances digital connectivity and supports bandwidth-heavy applications like 5G and AI.

-

On August 7, 2024, Prysmian successfully completed sea trial tests for a 500 kV HVDC submarine cable at a record-breaking depth of 2,150 meters. This achievement sets new standards in cable installation for ultra-deep waters.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.35 Billion |

| Market Size by 2032 | USD 35.92 Billion |

| CAGR | CAGR of 9.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Dry Plant Product, Wet Plant Product) • By Offering (Cable Installation, Cable Maintenance & Repair, Upgrade) • By Deployment (Shallow Water, Deep Water) • By Application ( Submarine power cables, Submarine communication cables) • By End User (Offshore wind power generation, Inter country & island connection, Offshore oil & gas) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alcatel Submarine Networks, SubCom LLC, NEC Corporation, Nexans SA, Prysmian Group, Hengtong Group Co., Ltd., ZTT Group, NKT A/S, Corning Incorporated, Hellenic Cables, Sumitomo Electric Industries, Ltd., Apar Industries, AFL, TFKable, Hexatronic Group, SSGCABLE, OCC Corporation, 1X Technologies LLC, Tratos, Huawei Marine Networks. |

| Key Drivers | • Growth of Cloud Computing and Data Centers Drives Expansion of Submarine Cable Systems |

| Restraints | • Security Risks and Physical Vulnerabilities Restraining Submarine Cable System Growth |