Industrial Cable Market Size Analysis:

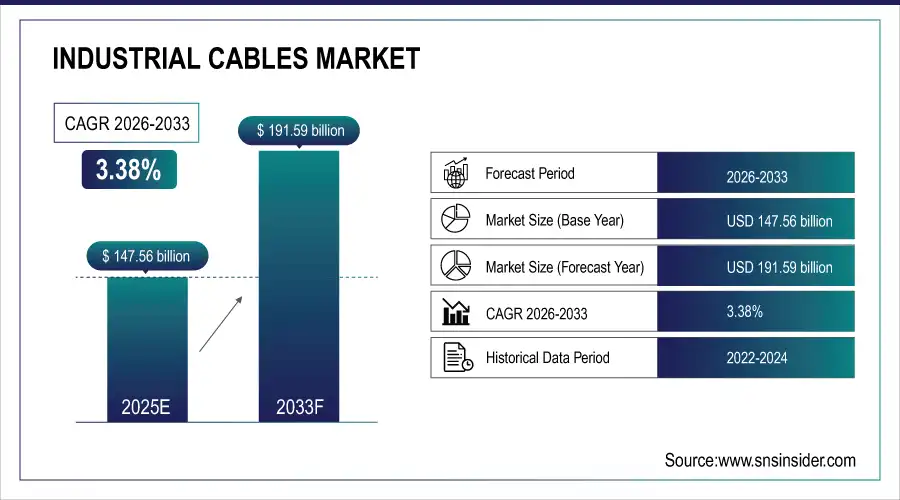

The Industrial Cable Market Size was valued at USD 147.56 billion in 2025E and is expected to reach USD 191.59 billion by 2033 and grow at a CAGR of 3.38% over the forecast period 2025-2032.

The global Industrial Cable Market is witnessing substantial growth due to increasing investments in the smart infrastructure and industrial automation in several industries. With the advent of the digital age, interconnection is the future, and the demand for high-capacity cabling solutions is growing.

According to research, over 60% of global manufacturers are integrating automation solutions, driving massive demand for sensor cables, data cables, and power transmission systems.

Industrial Cable Market Size and Forecast:

-

Market Size in 2025: USD 147.56 Billion

-

Market Size by 2033: USD 191.59 Billion

-

CAGR: 3.38% from 2026 to 2033

-

Base Year: 2024

-

Forecast Period: 2026–2033

-

Historical Data: 2021–2023

To Get more information On Industrial Cable Market - Request Free Sample Report

Key Trends in the Industrial Cable Market:

• Increasing deployment of industrial automation boosting demand for high-performance cables.

• Expansion of smart factories driving adoption of Ethernet and data transmission cables.

• Growing implementation of Industry 4.0 technologies requiring advanced connectivity solutions.

• Rising investments in renewable energy projects supporting high-voltage power cable usage.

• Increased utilization of robotics and machinery in manufacturing fueling cable demand.

• Shift toward flame-retardant, heat-resistant, and eco-friendly cable materials.

• Strategic partnerships among cable manufacturers and automation technology providers.

• Upgrading aging electrical infrastructure in developing economies accelerating market growth.

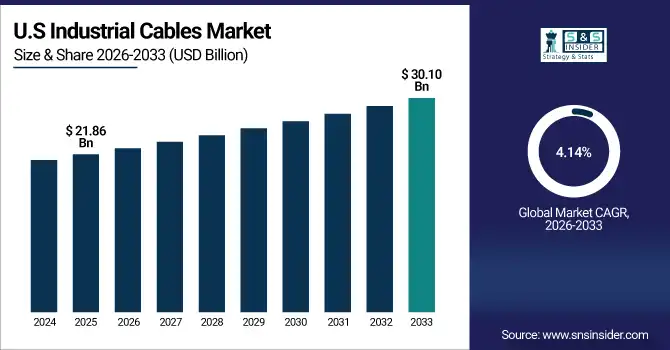

The U.S. Industrial Cable Market size was USD 21.86 billion in 2025E and is expected to reach USD 30.10 billion by 2033, growing at a CAGR of 4.14% over the forecast period of 2026–2033. The US Industrial Cable Market growth is essentially a result of the growing industrial automation, increasing spending on energy-efficient infrastructure, and upgradation of utility network. Increasing need for high performance connectivity solutions such as manufacturing, oil & gas, and smart grid technologies in industrial vertical are some of the key factors driving the growth of this market.

According to research, the U.S. hosts over 33% of the world’s data centers, requiring continuous investment in high-capacity cabling and power infrastructure.

Industrial Cable Market Drivers:

-

Rising adoption of Industry 4.0 and automation accelerates demand for advanced industrial cabling systems across all manufacturing sectors globally.

The increased implementation of Industry 4.0 technologies, such as smart factories, IIoT devices, and AI-based systems, requires seamless and high-speed connectivity, driving the demand for advanced industrial cables. Automated machinery and connected devices rely heavily on stable and interference-free data transmission, which fiber optics and high-performance cables enable. As manufacturers pursue operational efficiency, predictive maintenance, and intelligent control systems, the need for robust and reliable industrial cabling solutions becomes paramount, positioning the cable industry as an essential enabler of industrial digital transformation.

According to research, up to 40% of automation system costs in modern factories are attributed to connectivity infrastructure, including cabling, sensors, and network interfaces.

Industrial Cable Market Restrain:

-

Supply chain disruptions and raw material volatility impact cable production timelines and profitability.

The Industrial Cable Market is highly dependent on consistent access to raw materials such as copper, aluminum, and polymers. Any fluctuation in their prices or disruptions in the global supply chain, as seen during recent geopolitical conflicts or pandemics, can delay manufacturing and delivery schedules. This volatility directly affects cable manufacturers’ profit margins and may lead to project slowdowns or cancellations. Dependency on imported materials further intensifies the challenge, limiting market growth and investor confidence.

Industrial Cable Market Opportunities:

-

Rapid expansion of data centers and 5G networks presents vast opportunities for high-speed cable installations.

The global rise of cloud computing, edge data centers, and 5G deployment requires robust infrastructure with ultra-fast connectivity. Fiber optic industrial cables are vital for achieving the necessary data transmission speeds and bandwidth. As businesses digitize operations and expand cloud-based services, the demand for cabling solutions that support uninterrupted, high-capacity communication networks continues to grow. This scenario opens up substantial opportunities for industrial cable providers to cater to the evolving needs of the telecommunications and IT sectors.

According to research, nearly 60% of 5G private networks are being deployed in industrial facilities by 2025, requiring rugged, interference-resistant cable systems for real-time automation and control.

Industrial Cable Market Challenges:

-

Rising competition from wireless technologies threatens the long-term demand for traditional industrial cabling.

As wireless communication technologies such as 5G, Wi-Fi 6, and Li-Fi advance rapidly, industries are exploring these as viable alternatives to physical cables for certain applications. Wireless networks offer flexibility, mobility, and reduced installation efforts. In environments where cabling may be cumbersome, wireless solutions can be more appealing. This shift may reduce the dependency on traditional wired systems, posing a potential threat to the cable market, particularly for short-range and non-critical data transmission uses.

Industrial Cable Market Segmentation Analysis:

By Cable Type, Fiber Optics Lead, Medium Voltage Cables to Surge

The Fiber Optic Cable segment dominated the highest revenue share of around 43.87% in 2025E due to its superior bandwidth capacity, high-speed data transmission, and immunity to electromagnetic interference. These characteristics make it the preferred choice in data-intensive and critical industrial applications. Companies like Prysmian Group have played a key role in expanding global fiber optic infrastructure, catering to demands in industrial automation and telecommunication. Its durability and long-distance performance further support widespread industry adoption.

The Medium Voltage Cable segment is projected to grow at the fastest CAGR of approximately 4.97% from 2026 to 2033, primarily due to the rising need for reliable power distribution across industrial zones and renewable energy installations. Nexans S.A. is actively innovating in this space, offering medium voltage solutions tailored for smart grids and energy-efficient systems. These cables meet the growing electrification needs of urban and rural areas and support large-scale infrastructure upgrades around the globe.

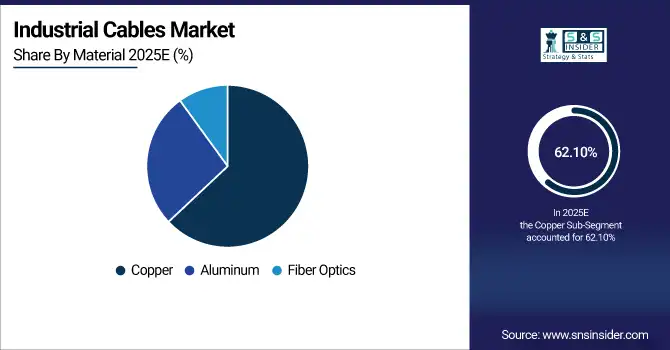

By Material, Copper Dominates While Fiber Optics Gain Momentum

The Copper segment led the Industrial Cable Market in 2025E with a dominant revenue share of 62.10%, owing to its excellent electrical conductivity and mechanical strength. These qualities make copper a core material in various power and data transmission setups. Southwire Company, LLC has been a major provider of copper-based industrial cables, enabling safe and efficient energy distribution in critical sectors. Its reliability and proven performance under harsh conditions have made it the material of choice across industries.

The Fiber Optics segment is expected to register the fastest CAGR of 4.74% from 2026 to 2033 due to the increasing demand for high-speed and high-capacity industrial networks. This growth is supported by rising integration of connected technologies. Corning Incorporated, a leader in fiber optics, continues to deliver cutting-edge cable solutions that support rapid data communication in smart factories and automated systems. Its innovation and global presence are accelerating industrial digital transformation.

By Application, Power Distribution Leads, Telecom to Expand Rapidly

The Power Distribution segment dominated the market with a revenue share of about 39.23% in 2025E, driven by its essential function in safely transmitting electricity across industrial operations. General Cable, a brand under Prysmian Group, offers a comprehensive range of power distribution cables used in construction, mining, and energy sectors. These systems are vital for maintaining operational continuity, reducing energy loss, and enabling scalable infrastructure growth in diverse industrial setups.

The Telecommunication segment is projected to grow at the fastest CAGR of 4.64% from 2026 to 2033, propelled by industrial digitalization and expansion of 5G infrastructure. Industrial cables companies such as Furukawa Electric Co., Ltd. has been at the forefront of deploying telecom cable solutions, enhancing communication capabilities in industrial settings. As industries depend increasingly on fast and reliable data transmission, telecom cables are becoming indispensable for efficiency and automation, especially in high-tech and logistics environments.

By End Use Industry, Energy & Utilities Dominate, Automotive Poised for Fastest Growth

The Energy and Utilities segment dominated the Industrial Cable Market share of about 43.06% in 2025E, largely due to its central role in powering industrial and public infrastructure. With extensive cable needs in generation, distribution, and smart grid management, LS Cable & System has been instrumental in supplying robust solutions. Its cables are designed to ensure stability, efficiency, and resilience in demanding environments, supporting global electrification and renewable integration trends.

The Automotive segment is forecasted to grow at the fastest CAGR of approximately 4.78% between 2026 and 2033, driven by the surge in electric vehicle production and autonomous technologies. Sumitomo Electric Industries, Ltd. is a leading player providing automotive cable systems tailored for EVs and ADAS integration. As the industry pivots toward lightweight, high-efficiency, and data-capable cables, companies like Sumitomo are helping accelerate this evolution through continuous innovation.

Asia Pacific Leads the Global Industrial Cable Market in 2025

Asia Pacific led the global market with a 37.11% revenue share in 2025E, underpinned by rapid industrialization, infrastructure development, and strong growth in manufacturing sectors across China, India, Japan, and Southeast Asia. Government initiatives supporting smart cities, power grid upgrades, and digital infrastructure have significantly boosted cable demand. The region's cost-competitive production and large-scale deployment across industries continue to solidify its market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Dominates Regional Growth with Large-Scale Industrial Expansion

China dominates the Asia Pacific market, driven by rapid industrialization, large-scale infrastructure development, and government-backed initiatives like “Made in China 2025” that boost demand for high-performance industrial cables in construction, energy, telecom, and transportation sectors.

North America Set for Fastest Growth Driven by Automation and Clean Energy Investments

North America is expected to witness the fastest CAGR of 5.06% from 2026 to 2033, driven by large-scale investments in automation, electrification, and clean energy. The modernization of existing industrial and power infrastructure, along with increased adoption of smart manufacturing practices, is creating robust demand for advanced industrial cable systems. Growing focus on grid reliability, cybersecurity, and data-driven industrial processes further supports the region’s strong growth outlook.

United States Leads North American Market with Advanced Industrial Adoption

The U.S. leads the North American Industrial Cable Market due to its advanced manufacturing base, early adoption of smart technologies, and significant investments in grid modernization, renewable energy, and automation across sectors like automotive, aerospace, and data centers.

Europe Maintains Strong Market Presence with Sustainability and Automation Focus

Europe holds a substantial share in the Industrial Cable Market due to stringent energy efficiency regulations, widespread automation, and strong emphasis on sustainability. Countries like Germany, France, and the UK are investing in smart grids, electric mobility, and green infrastructure, driving demand for innovative, durable, and eco-friendly cable solutions across industrial sectors.

Germany Dominates Europe with Industry 4.0 and Advanced Manufacturing Leadership

Germany dominates the European Industrial Cable Market due to its strong manufacturing sector, early adoption of Industry 4.0, and leadership in automation and automotive production. Investments in smart grids, renewable energy, and digital infrastructure further strengthen its position in the region.

Saudi Arabia and Brazil Drive Growth in Middle East & Africa and Latin America

The Middle East & Africa region is led by Saudi Arabia, driven by massive investments in energy infrastructure, smart city projects, and industrial diversification. In Latin America, Brazil dominates due to its strong manufacturing base and growing demand for industrial cables in renewable energy, oil and gas, and infrastructure development sectors.

Key Industrial Cables Companies are:

-

Nexans

-

NKT A/S

-

LS Cable & System Ltd.

-

Sumitomo Electric Industries Ltd.

-

Fujikura Ltd.

-

Southwire Company, LLC

-

Belden Inc.

-

Tele-Fonika Kable S.A.

-

Taihan Electric Wire Co., Ltd.

-

Brugg Cable Group

-

Caledonian Cables Ltd.

-

Top Cable Corp.

-

Riyadh Cables Group of Companies

-

KEI Industries Ltd.

-

Elsewedy Electric Co.

-

Kabelwerke Brugg AG

-

Encore Wire Corporation

-

Leoni AG

Competitive Landscape for Industrial Cable Market:

Prysmian Group

Prysmian Group is the world’s largest manufacturer of industrial and energy cables, delivering comprehensive cable and connectivity solutions across power transmission, telecom, industrial automation, and renewable infrastructure sectors. With advanced R&D capabilities and a global production network, the company specializes in high-voltage submarine cables, fiber optic cables, and specialty industrial wiring designed for high performance and durability. Prysmian plays a crucial role in enabling global electrification and digital transformation, supplying critical cabling systems that support smart grids, offshore wind farms, and industrial modernization projects across multiple regions.

-

In May 2025, Prysmian Group expanded its industrial cable production capacity to support accelerating demand from renewable power and smart grid infrastructure upgrades across international markets.

Nexans

Nexans is a prominent global provider of cable systems focused on advancing sustainable electrification and industrial connectivity. The company offers a diverse portfolio including energy distribution cables, data and fiber optic cables, and specialized industrial cabling for transportation, utilities, and automation. With strong expertise in high-voltage subsea cable networks, Nexans supports major offshore wind developments and modernization of energy infrastructure. Its strategic transformation into an “Electrification Pure Player” reinforces its role in enhancing operational safety, efficiency, and resilience in industrial environments.

-

In January 2025, Nexans launched new industrial cable solutions designed to improve sustainability and energy efficiency, aligning with increasing electrification and carbon reduction initiatives.

NKT A/S

NKT A/S is a European leader in power cable manufacturing, delivering high-performance cable systems for industrial power networks, offshore energy projects, and utility grid development. The company focuses on advanced high-voltage and medium-voltage solutions engineered to support long-distance energy transmission and harsh industrial environments. NKT plays a vital role in enabling renewable integration and infrastructure reliability across global markets, emphasizing precision engineering and environmentally responsible production.

-

In March 2025, NKT upgraded its cable manufacturing capabilities to support large-scale renewable energy transmission projects, strengthening its position in the industrial and utility sectors.

LS Cable & System Ltd.

LS Cable & System Ltd. is a major global manufacturer of power, industrial, and communication cables, serving key sectors including energy, transportation, manufacturing, and telecom. With strong technological expertise in extra-high-voltage cables, subsea systems, and industrial fiber optics, the company enables broad advancements in smart grids, factory automation, and electrified infrastructure. LS Cable & System is widely recognized for its innovation, reliability, and ability to deliver tailored cabling solutions for complex industrial requirements across international markets.

-

In February 2025, LS Cable & System expanded its industrial cable portfolio to support automation-driven manufacturing and renewable energy projects, reinforcing its leadership in energy-efficient connectivity solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 147.56 Billion |

| Market Size by 2033 | USD 191.59 Billion |

| CAGR | CAGR of 3.38% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Cable Type (Low Voltage Cable, Medium Voltage Cable, High Voltage Cable, Fiber Optic Cable) • By Material (Copper, Aluminum, Fiber Optics) • By Application (Power Distribution, Telecommunication, Construction, Manufacturing) • By End Use Industry (Energy and Utilities, Telecommunications, Construction, Automotive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Prysmian Group, Nexans, NKT A/S, LS Cable & System Ltd., Sumitomo Electric Industries Ltd., Fujikura Ltd., Southwire Company, LLC, Belden Inc., ABB Ltd., Tele-Fonika Kable S.A., Taihan Electric Wire Co., Ltd., Brugg Cable Group, Caledonian Cables Ltd., Top Cable Corp., Riyadh Cables Group of Companies, KEI Industries Ltd., Elsewedy Electric Co., Kabelwerke Brugg AG, Encore Wire Corporation, Leoni AG |