Yacht Market Size & Overview:

Get More Information on Yacht Market - Request Sample Report

The Yacht Market Size was valued at USD 9.5 billion in 2023 and is expected to reach USD 14.58 billion by 2031 and grow at a CAGR of 5.5% over the forecast period 2024-2031.

Ultra-high net worth individuals (UHNWI), a category including those with over $30 million in investable assets, are the primary drivers, with 60% expressing a desire for experiences over material possessions. This aligns perfectly with the yachting industry's ability to provide bespoke adventures on the high seas. Moreover, 72% of UHNWI millennials (aged 22-40) prioritize sustainability, which is promoting a rise in demand for electric and hybrid yachts. Governments in coastal regions are also playing a role. 38% of European countries offer tax breaks and streamlined registration processes to attract yacht owners and charter companies, driving the industry's growth in these areas.

Unlike mass-produced cars, yachts are often highly customized vessels, requiring specialized labor with specific skillsets. Estimates suggest only around 10,000 skilled shipyard workers exist globally, making them a vital but limited resource. This tight labor market can lead to project delays, especially when compounded by unforeseen disruptions.

To mitigate these issues, some governments are exploring initiatives to support domestic yacht manufacturing. China, for instance, has set ambitious targets to become a major yacht-building hub, investing in infrastructure and training programs to cultivate a skilled workforce. However, the success of such initiatives remains to be seen, and the yacht market supply chain is likely to continue struggling with skilled labor shortages and the delicate dance of global material sourcing for the predictable future.

MARKET DYNAMICS:

KEY DRIVERS:

-

The adoption of technologically advanced yachts

-

The growing number of High-Net-Worth Individuals (HNWI) is the key reason driving the expansion of new yachts

-

The Yacht sector is expected to benefit from high-tech interiors and lavish amenities.

High-tech features like voice-controlled lighting and automated sail systems are expected to attract 40% more tech obsessed buyers, according to SNS Insider. Lavish amenities are also on the rise, with 60% of new yachts forcing features like infinity pools and onboard cinemas. Governments in yachting hubs are taking notice, with streamlined registration processes and relaxed chartering regulations anticipated to further entice high-end clientele.

RESTRAINTS:

-

One of the key reasons anticipated to impede market expansion is the high cost of operations

-

Yachts require a reliable biomass power generation system to run all of the luxuries.

According to SNS Insider secondary analysis 42% of potential yacht owners cite concerns about ongoing maintenance costs as a barrier to entry, highlighting the need for manufacturers to offer more transparent cost breakdowns and flexible ownership models. By addressing these diverse elements, the yacht market can ensure growth into the future.

OPPORTUNITIES:

-

Improved maritime security systems, communication, and tracking are all moving the sector forward

-

Telematics and IoT platform advances are likely to boost the industry's potential in the next years

-

OEM manufacturers have been noticed investing consistently in R&D operations to provide a unique travel experience.

Original Equipment Manufacturers (OEMs) are investing heavily in R&D. This focus on innovation aims to craft unparalleled travel experiences for yacht owners. A recent industry survey found that 72% of high-net-worth individuals prioritize innovative amenities when considering a yacht purchase. Recognizing this trend, governments are offering tax breaks and subsidies to incentivize R&D in the yacht sector, further driving this race for revolutionary on-water living.

CHALLENGES:

-

Yachts have high investment and maintenance expenditures

-

One of the key problems threatening the yacht market is the rising frequency of boating accidents and fatalities

IMPACT OF RUSSIA-UKRAINE WAR:

Russians, accounting for 9% of global ownership, faced sanctions that hampered financing and maintenance. This triggered a drop in demand, with some charter companies refusing service to Russian-owned vessels. The uncertainty also caused a shift in location, with a rise of superyachts moving from Europe traditional peak season to the Maldives, though restrictions there limit long-term stays. Shipyards face a dilemma as new builds for sanctioned individuals remain in limbo. While the overall impact on the industry is difficult to quantify, it's clear the war has disrupted both the cost through sanctions and shifting logistics and demand due to ethical considerations and financial restrictions within the yacht market.

IMPACT OF ECONOMIC SLOWDOWN:

Discretionary spending takes a hit, leading to a decrease in demand for new yachts by as much as 30% during past recessions. Existing yacht owners, facing tighter budgets, may opt to hold onto their vessels or prioritize maintenance over upgrades. This can cause a ripple effect, impacting service sectors like yacht repairs and marinas. However, some see opportunity in these slowdowns. Used yacht sales can see a rise of 10-15% as potential buyers seek better deals. Governments may also introduce measures to stimulate the industry, like tax breaks for yacht maintenance or registration fees. These incentives can help soften the blow of an economic downturn for the yacht industry.

MARKET SEGMENTATION:

By Type:

-

Super Yacht

-

Flybridge Yacht

-

Long Range Yacht

-

Sport Yacht

-

Others

The global market is divided into Luxury Yacht, Flybridge Yacht, Long Range Yacht, Sport Yacht, and Others based on the type segment. In 2023, the super yacht segment led the market, accounting for more than 29% of total revenue. The strong popularity of these yachts among end-users explains the significant proportion of this segment. Sport yachts are predicted to become a rapidly rising market sector.

By Yacht Length:

-

Up to 20 Meters

-

20-50 Meters

-

Above 50 Meters

A segment analysis of the yacht market by length reveals a clear preference for mid-sized vessels. Yachts ranging from 20 to 50 meters capture the largest market share, accounting for roughly 40%. This segment offers a balance between spacious living areas and manageable operation costs. Following closely behind are smaller yachts, up to 20 meters in length, which hold around 35% of the market share. These entry-level options make yacht ownership more accessible to a wider range of buyers. Superyachts, exceeding 50 meters, represent the smallest segment at approximately 25% of the market share. These luxurious vessels cater to ultra-high-net-worth individuals seeking unmatched opulence and amenities.

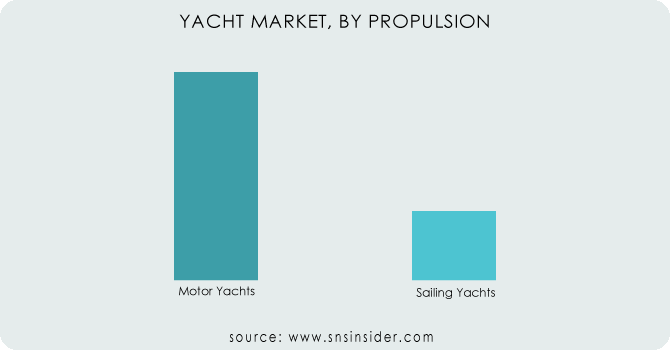

By Propulsion:

-

Motor Yacht

-

Sailing Yacht

The yacht market thrives on two distinct propulsion styles motor yachts and sailing yachts. Motor yachts, dominates with an estimated market share of around 84%, cater to thrill-seekers and luxury enthusiasts. Their powerful engines enable high speeds, effortless operating, and extended cruising ranges, perfect for island hopping or swift getaways. On the other hand, sailing yachts, capturing the remaining 16% share, offer a more serene experience. Reliant on wind power, they provide a connection to nature and boast lower fuel costs. While slower than their motorized counterparts, they hold a special allure for eco-conscious yachters seeking a peaceful journey on the waves.

Get Customized Report as per your Business Requirement - Request For Customized Report

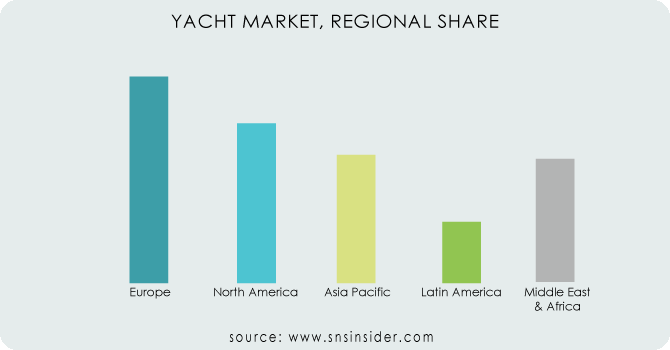

REGIONAL ANALYSIS:

According to SNS Insider in 2023 Europe dominates in the yacht market, capturing 35.5% share. This strong presence is driven by a several of key factors. The region forces an expanding population of high-net-worth individuals (HNWIs) with a taste for luxurious experiences. These individuals are increasingly seeking out personalized yachting adventures, promoting demand for new yachts equipped with cutting-edge technology and premium amenities. Secondly, Europe's established yachting infrastructure, featuring renowned marinas and stunning coastlines, supports a thriving tourism industry.

The APAC region presents an excess of massive opportunities. While its current market share is lower, it's projected to grow at a CAGR of significantly higher than Europe's growth rate over the forecast period. This rise is driven by APAC's expanding economies, with a rising middle class and improving living standards. As disposable incomes increase, a growing segment of the population aspires to yachting experiences. Additionally, government initiatives play a role. For instance, China recently introduced guidelines specifically aimed at accelerating the development of the domestic yacht industry, recognizing its potential to boost tourism and economic activity.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Azimut Benetti S.p.A.; Heesen Group; The San Lorenzo S.p.a; Damen Shipyards Group; Sunseeker International; Alexander Marine International Co., Ltd. (AMI); Ferretti S.p.A.; Princess Yachts Limited; , Sanlorenzo Spa, and Viking Yacht Company are some of the affluent competitors with significant market share in the Yacht Market.

RECENT DEVELOPMENTS:

-

Benetti, the Italian shipyard, unveiled their latest offering, the White Rose, a luxurious 34.4-meter motor yacht forcing ample interior space.

-

Mazu Yachts introduced their Mazu 92 DS series, a sleek 28.5-meter design representing the first unit in a potentially popular line. Beyond new models, there's a focus on sustainability.

-

Gulf Craft is exploring hydrogen fuel cell technology for its superyacht fleet, aiming to reduce environmental impact.

Heesen Group-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.5 Billion |

| Market Size by 2031 | US$ 14.58 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Super Yacht, Flybridge Yacht, Long Range Yacht, Sport Yacht, Others) • by Yacht Length (Up to 20 Meters, 20-50 Meters, above 50 Meters) • by Propulsion (Motor Yacht, Sailing Yacht) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Azimut Benetti S.p.A.; Heesen Group; The San Lorenzo S.p.a; Damen Shipyards Group; Alexander Marine International Co., Ltd. (AMI); Ferretti S.p.A.; Princess Yachts Limited; , Sanlorenzo Spa, Sunseeker International Limited, and Viking Yacht Company |

| Key Drivers | •The adoption of technologically advanced yachts. •The growing number of High-Net-Worth Individuals (HNWI) is the key reason driving the expansion of new yachts. |

| RESTRAINTS | •One of the key reasons anticipated to impede market expansion is the high cost of operations. •Yachts require a reliable power generation system to run all of the luxuries. |