Decentralized Identity Market Report Scope & Overview:

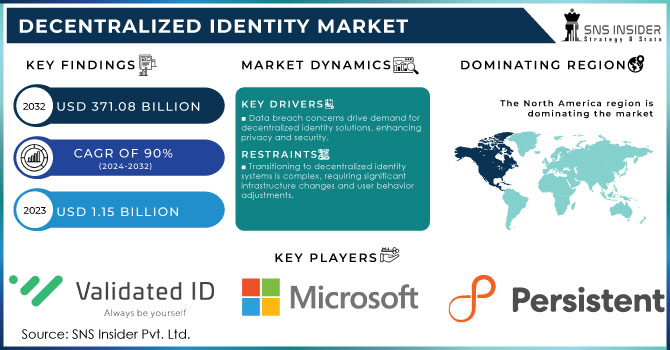

Decentralized Identity Market size was valued at USD 1.15 Billion in 2023. It is expected to Reach USD 371.08 Billion by 2032 and grow at a CAGR of 90% over the forecast period of 2024-2032.

Get More Information on Decentralized Identity Market - Request Sample Report

The growing demand for seamless user experiences is driving the global acceptance of decentralized Identity. Decentralized Identity (ID) solutions fully compliant with the blockchain technology offering a transparent and unchangeable ledger, decentralized ID is enabled by storing user identification information on the blockchain while verifying it without a median regulator or third-party authentication under clear mandates. Approximately 45% of enterprises globally are expected to adopt some form of decentralized identity solution by 2024. Traditional verification processes will require various usernames, passwords, and authentication methods are cumbersome. Decentralized ID simplifies this by providing a single, portable identity verifiable across various platforms. In response to regulatory requirements (e.g. CCPA, GDPR), which have increased focus on responsible data handling and individual control over identity information - organizations are being pushed more directly into decentralized ID solutions. There are now over 1,000 active decentralized identity projects to early 2024 and most of them use blockchain technology on platforms such as Ethereum or Hyperledger. In 2023, around 25% of internet users are expected to be using some form of decentralized identity solution at an increasing growing trend toward digital identity management.

Decentralized IDs are becoming popular among industries like finance, healthcare, and e-commerce that require reliable Identity Management that is built for transaction validation which deters frauds or identity thefts as an added layer of cyber-security. Their widespread adoption is countered by infrastructure changes and transplantation between platforms. Collaboration among technology providers, industry associations, and regulatory bodies is crucial to establishing common frameworks and open standards for decentralized identity. Investment in decentralized identity startups reached $1.5 billion in 2023, highlighting significant venture capital interest in this technology. 85% of businesses will be affected by privacy regulation changes, adapting how they authenticate their identity with GDPR and CCPA regulations by 2025. Around the world, airlines and airports have taken up decentralized identity technologies introducing facial recognition check-in as well as contactless travel to numerous points in their travels.

Market Dynamics

Drivers

-

Growing concerns over data breaches and unauthorized access in centralized identity systems are driving the demand for decentralized identity solutions. These solutions provide individuals with more control over their data, enhancing privacy and security.

-

Sectors such as finance, healthcare, and e-commerce require robust identity verification processes to ensure secure transactions and protect sensitive data. The increasing digitalization of these industries drives the demand for reliable decentralized identity solutions.

Growing demand for data privacy and security is a major growth factor in the decentralized identity market. With data breaches and unauthorized access rising, individuals as well as organizations need to look for enhanced protection. Businesses using a decentralized identity solution have seen an overall 40% in fraud cases as regards identity theft compared to traditional identification management systems. More than 70% of consumers are willing to switch to services offering decentralized identity solutions due to increased concerns about data privacy and control.

Decentralized identity solutions provide a key advantage by allowing users to retain control over their data. This model reduces reliance on centralized databases, which are often targeted by hackers. For instance, in 2022, the average cost of a data breach was approximately $4.35 million, as reported by the Ponemon Institute. By implementing decentralized identity systems, organizations can mitigate such costs through improved security protocols and reduced risk of data compromise. Furthermore, our recent study indicates that 75% of consumers are increasingly concerned about how their data is managed and protected. This rising awareness drives the adoption of decentralized identity technologies, which offer a more secure way to manage and verify identity without exposing sensitive information to potential breaches. This shift towards enhanced data privacy solutions reflects the broader trend of prioritizing security in digital interactions. The Federal Trade Commission (FTC) has forecast a 45% increase in global fraud and identity theft losses. The rapid evolution of technology, including machine learning, results in a high rate of cyberattacks - attackers can generate new aggressive code versions daily. Cyber threat protection needed for business growth This has accelerated the building and adoption of decentralized identity solutions as businesses are now looking to leverage Decentralized Identity for secure & safeguard against security gaps, and DDoS attacks.

Restraints

-

Shifting from traditional centralized identity systems to decentralized models can be complex and requires significant changes in infrastructure and user behaviour.

-

Implementing decentralized identity solutions can involve substantial initial costs, including the need for new technology, training, and changes to existing systems.

Interoperability is a major challenge for the decentralized identity market and it remains as one of its most significant restraints. The decentralized identity systems function on various standards and protocols that can result in compatibility-related issues between different platforms. For example, there are many decentralized identity frameworks (e.g., Sovrin, uPort, and Veres One) with different technology licensing. This lack of uniformity can hinder the seamless exchange of identity information across different systems, which is crucial for broad adoption. A recent survey in 2023 revealed around 60% of organizations were experiencing interoperability problems with decentralized identity solutions. It also can be expensive to rectify these interoperability problems. The average organization might need to spend as much as 30% more on extra technology and integrations just so it will be able to support the different decentralized identity systems someone may join. This complexity and associated costs can delay the adoption of decentralized identity solutions and deter smaller organizations from making the switch. Overcoming this restrain, there needs to be industry-wide collaboration to establish common standards and protocols that enable decentralized identity systems that can interact seamlessly with each other.

Segment analysis

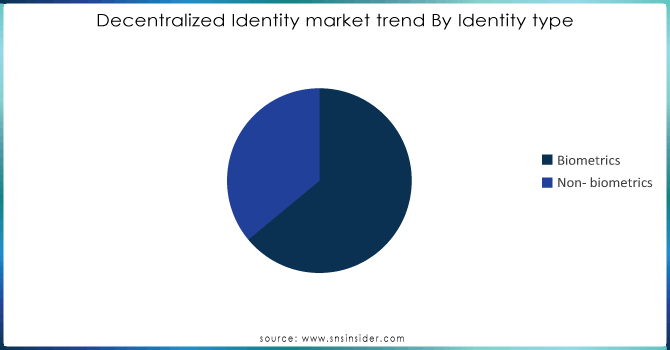

By Identity Type

The biometric segment led the market by identity type in 2023, accounting for over 64.0% of market revenue share Because the increase in precision in Biometric identifiers like fingerprints, face recognition and voice recognition, these methods provide a strong level of verification that is difficult to forge or replicate, ensuring reliable digital interactions. Biometric identity verification can enhance user convenience, who will surely appreciate the fact they can verify their own identities without any hassle. This eliminates the need for passwords or other traditional forms of authentication, which can be easily forgotten, stolen, or compromised. Non-biometrics is estimated to be the fastest growing in the coming years. The rise in the utilization rate of the consumer for non-biometric identity solutions on account of their portability and ease is anticipated to drive this sector's growth. Moreover, while biometric password-free security is on the rise it will likely drive a growing need for non-biometric authentication as backup.

Do You Need any Customization Research on Decentralized Identity Market - Enquire Now

By End-user

The enterprise segment accounted for the largest revenue share of over 64.0% in 2023 due to its need to mitigate business risks. A decentralized identity framework enables a platform to maintain an independent record of users' identities of the identity issuer, eliminating the need collect and store personal data.

The individual segment is expected to witness the highest compound annual growth rate (CAGR) of 91.6% during the period. This is being driven by individual adoption of decentralized identity solutions and self-management. These solutions allow people to do identification in many processes like loan application, bank account opening and another KYC-based processes where a human has to do the person. The potential use cases of decentralized identity, such as those for individual users will continue to create opportunities for the segment throughout the forecast years.

By organization Size

Large enterprises accounted for over 67.0% revenue share of the market in 2023, as the growing adoption of decentralized identity solutions to eliminate identity risks continues among these organizations. One such example that took place in August 2022 was Litentry, the multi-chain identity aggregation protocol partnered with blockchain infrastructure provider Node Real. At the same time, this partnership will bring the MegaNode of NodeReal to Litentry enterprise ecosystem for providing real-time and historical data indexing on Ethereum and Binance Chain networks. The SMEs segment is expected to grow with the fastest CAGR of 89.5% during the forecast period. Small and medium-scale businesses are slowly adopting digital services to provide better customer experience. Small and medium enterprises are increasingly turning to the use of blockchain for identity management over issues such as privacy, transparency between parties, and securing sensitive information. Furthermore, these offerings provide SMEs with improved product and service functionality, supply chain management capabilities, and opportunities for blockchain- driven business model innovation. This benefits are expected to drive the rapid adoption of decentralized identity solutions in the small and medium enterprise (SME) segment.

By Vertical

The BFSI segment dominated the market and accounted for a significant revenue share of over 18%. This sector, encompassing banking, financial services, and insurance, plays an important role in ensuring customer trust and security. Banks are mandated to conduct Know Your Customer (KYC) checks to verify the identity of their customers and safeguard against any involvement in illicit activities like bribery or money laundering. Moreover, it is noteworthy that the United States allocates a staggering USD 24 billion towards Anti-Money Laundering (AML) compliance measures. This substantial investment underscores the nation's commitment to combatting financial crimes and maintaining the integrity of its financial systems.

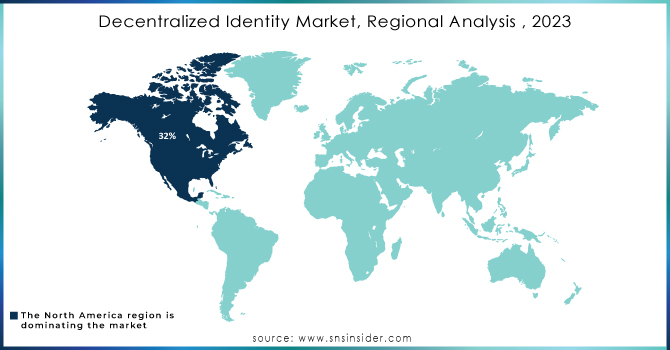

Regional analysis

North American region dominated the global market in 2023 with held revenue share of more than 32% in 2023, This region has diverse industries Including financial services, healthcare, and government to e-commerce all of which can take advantage of decentralized identity solutions. The increasing need for secure and reliable identity authentication, data exchange, and user identification in these respective sectors have accelerated the adoption of decentralized systems. Moreover, the tech-savvy population in North America is becoming more specific toward data privacy and digital security which propels the demand for market growth in the region

The Asia Pacific region is expected to grow at the fastest annual growth rate (CAGR) of 92% over the forecast period. This increase is attributed to growing awareness about cybersecurity in India, China, and Japan. In the Asia Pacific, several groups have been established to enforce consumer identity protection and are expected to strengthen market development in this region as well. In April 2021, The Commons Project Foundation and Affinidi (a Temasek identity startup) announced that they would empower individuals navigating the complexities of international travel during the pandemic era with a safe path to share their digital health records. They add to the region's reputation for robust cybersecurity and identity protection measures that help accelerated market expansion.

Key Players:

The major players are Validated ID, Persistent, Microsoft, Wipro, Dragonchain, SecureKey Technologies, Accenture, R3, Avast, Datarella, Serto, Ping Identity, NuID, SelfKey, Nuggets, Finema, Civic Technologies, Affinidy, Hu-manity, 1Kosmos, and others in final report.

Recent development

-

December 16, Quadrata Boosts DeFi Security in 2023 Web3 identity solution quadrata partnered with nine leading trusted defy protocols (Archblock, Truefi) to deliver secure and privacy-first user ID verification in San Francisco, This partnership seeks to introduce innovation designed with DeFi safety in mind and create trust within the industry.

-

Microsoft Enters to Decentralized ID, in 2022, MS relaunched its identity and access product and took the Entra Verified ID which appears to it will be their step into the decentralized identity space.

-

Tech-focused Information Security News, DailyAbout Menu In 2023 Avast Acquires for Digital ID Expansion Cybersecurity giant secures customer base and technology in the burgeoning field of decentralized digital IDs by Lucian Constantin June 28, Share As part.... The move also indicates Avast's dedication to the niche market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.15 Billion |

| Market Size by 2032 | USD 371.08 Billion |

| CAGR | CAGR of 90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Identity Type (Non- Biometrics, Biometrics) • By Organization Size (Large Enterprises, SMEs) • By End User (Enterprises, Individual) • By Verticals (BFSI, Government, Healthcare And Life Sciences, Telecom And IT, Retail & E-Commerce, Transport And Logistics, Real Estate, Media And Entertainment, Travel And Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Validated ID, Persistent, Microsoft, Wipro, Dragonchain, SecureKey Technologies, Accenture, R3, Avast, Datarella, Serto, Ping Identity, NuID, SelfKey, Nuggets, Finema, Civic Technologies, Affinidy, Hu-manity, 1Kosmos |

| Key Drivers | • Growing concerns over data breaches and unauthorized access in centralized identity systems are driving the demand for decentralized identity solutions. These solutions provide individuals with more control over their data, enhancing privacy and security. |

| RESTRAINTS | • Shifting from traditional centralized identity systems to decentralized models can be complex and requires significant changes in infrastructure and user behaviour. |