AI-Generated 3D Asset Market Report Scope & Overview:

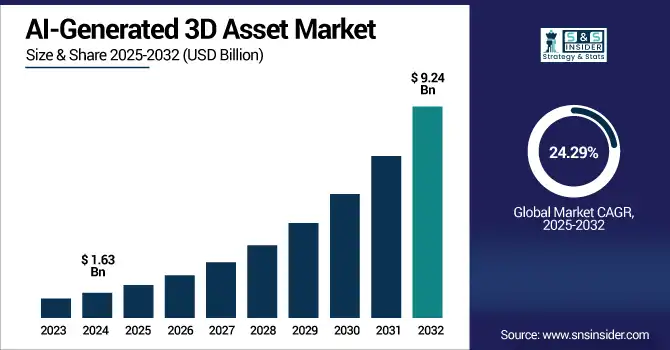

The AI-Generated 3D Asset Market size was valued at USD 1.63 billion in 2024 and is expected to reach USD 9.24 billion by 2032, growing at a CAGR of 24.29% over 2025-2032.

The AI-Generated 3D Asset Market growth due to the rising demand for high-quality and scalable 3D content across gaming, film, architecture, and e-commerce sectors. The integration of generative AI tools enables rapid asset creation, reducing production time and costs.

-

For instance, Stability AI’s “Stable Fast 3D” model generates high-quality, UV-unwrapped 3D assets in just 0.5 seconds from a single image, a dramatic improvement from the ~10 minutes required by its earlier SV3D model.

-

Additionally, automotive-grade AI technologies are building precise 3D environmental models for ADAS and autonomous driving, with over 170 patent applications supporting sensor fusion and perception systems.

Advancements in AR/VR technologies, coupled with the expansion of the metaverse and virtual experiences, are fueling adoption. Cloud deployment, increased automation, and growing investments in digital content creation further support market expansion. The surge in demand from educational platforms and virtual simulations also contributes significantly to growth, making AI-generated 3D assets a critical component of the digital ecosystem.

To Get more information on AI-Generated 3D Asset Market - Request Free Sample Report

The U.S. AI-Generated 3D Asset Market size was valued at USD 0.46 billion in 2024 and is expected to reach USD 2.56 billion by 2032, growing at a CAGR of 23.99% over 2025-2032.

Growth in the U.S. AI-Generated 3D Asset Market is driven by high adoption of advanced design tools, rising demand in gaming and film, strong investment in generative AI, and increasing use of immersive technologies across entertainment, retail, and education sector.

AI-Generated 3D Asset Market Dynamics

Drivers

-

Rising Demand for Real-Time 3D Content in Gaming, Metaverse, and AR/VR Applications is Significantly Accelerating AI-Generated 3D Asset Adoption

The rapid rise of immersive digital experiences is driving demand for real-time 3D content leveraging gaming, metaverse and AR/VR platforms. Developers need large amounts of high-fidelity content but the way content is currently generated is expensive and time consuming. AI-based 3D models help automate and speed up asset production on any given renovation and development phase, while maintaining immersive, visually-rich experiences. Escalating global demand for places that are nearly identical to reality means that studios are turning to AI for optimized, textured, and rigged assets realizing that AI generated 3D content is critical in the adoption for the next gen of interactive media creation.

-

According to Unity, 62% of game studios reported actively using AI to improve workflows especially around content creation and animation and 71% of those said AI boosted delivery and operations. Unity’s AI tools aim to make creators up to 10× more productive, enhancing both workflows and runtime interactivity for real-time 3D experiences.

Restraints:

-

Lack of Standardized Formats and Interoperability Between AI-generated Models and Mainstream 3D Software Tools Slows Integration into Production Pipelines

While strides in AI created 3D content are in focus, dealing with interoperability with applications, such as Blender, Unity, and Autodesk is an issue yet-to-be-solved. Bad texture mapping, rigging, and inconsistent mesh quality, make it hard to integrate models into standard pipelines. File formats that are non-compatible and defective animation layers require a human fix leading to inefficiency. These gaps represent a roadblock to adoption for studios that depend on streamlined workflows. The automation of 3D asset generation relies on a standardized post-processing pipeline that AI-generated assets currently lack, and the outputs are often far from ideal and require substantial manual work before they can be used as assets for exports.

Opportunities

-

Integration of AI-generated 3D Asset Tools with Low-Code/No-Code Platforms Opens Up New User Bases Beyond Traditional 3D Designers

The rise of low-code and no-code platforms are emerging to enable even non-technical users, such as marketers, educators, even small businesses or DIY able end users to use 3D tools generated by AI. Such interfaces that are easy to use let us create 3D assets through text prompts, sketches, or even voice commands. This has opened access to a larger pool of people beyond professional designers, creating new markets and demand for models that are smart, interoperable and deployable. The strength of code-free ecosystems to boost the growth of 3D asset market driven by trends in creative workflow integration of AI, independent creator enablement and training is shown.

-

NVIDIA introduced NIM microservices for RTX AI PCs, enabling low-code GUIs such as AnythingLLM, ComfyUI, and Langflow to access generative AI including 3D creation via simple graphical interfaces. Yahaha Studios, a no-code 3D game development platform, now supports immersive content creation with over 100,000 developers and more than 200,000 registered users.

Challenges:

-

Concerns Over Copyright, Originality, and Intellectual Property Rights of AI-Generated Assets Pose Regulatory and Legal Uncertainties

The rise of 3D content generated by AI has important legal implications regarding ownership, originality, and potential copyright infringement. As AI models rely on large datasets for training, they risk unintentionally reproducing protected designs, which can lead to litigation if used commercially. However, machines are corralled by emblematic intellectual property laws that merely peripherally elucidate what should happen with outputs they generate, leaving creators, AI purveyors, and patrons out on a limb. Attribution and licensing disputes are an extra layer of complication. Without comprehensive global laws, these issues will not only remain, but prevent the widespread, commercial, and creative use of AI-generated 3D assets on a large scale.

AI-Generated 3D Asset Market Segmentation Analysis:

By Component

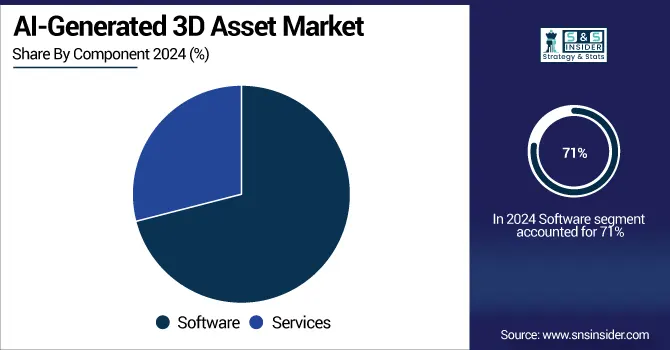

Software segment dominated the AI-Generated 3D Asset Market with the highest revenue share of about 71% in 2024 due to its essential role in asset creation, customization, and integration into design workflows. The rise of generative AI platforms and plug-ins has driven wide adoption among developers, studios, and designers, enabling scalable and automated production of high-quality 3D models across gaming, AR/VR, and animation pipelines.

Services segment is expected to grow at the fastest CAGR of about 25.68% over 2025–2032, fueled by rising demand for asset customization, integration support, and cloud-based rendering services. As more businesses adopt AI-generated 3D solutions, the need for consulting, training, and model optimization services has grown significantly. Outsourcing asset development and real-time support further accelerates the expansion of service-based offerings in this market.

By Application

Gaming segment dominated the AI-Generated 3D Asset Market with the highest revenue share of about 34% in 2024 due to its high consumption of 3D characters, props and environments. AI becomes an indispensable tool for game developers aiming to create scalable, high-quality, immersive, and cost-effective open-world and mobile game content at scale, which leads to enhanced productivity and shorter development windows within the AAA, Indie, and mobile game ecosystems.

Augmented Reality segment is expected to grow at the fastest CAGR of about 28.12% over 2025–2032, owing to the increasing adoption of AR in training, retail, healthcare, and social media. As AR devices require lightweight and real-time 3D models, AI-generated assets are indispensable. Artificial Intelligence is allowing for quick asset creation and customization, which is enabling dynamic AR content delivery on smartphones, wearables, and headsets.

By End-User

Media & Entertainment segment dominated the AI-Generated 3D Asset Market with the highest revenue share of about 32% in 2024 due to its continuous demand for animated characters, cinematic environments, and visual effects. Studios and content creators leverage AI to streamline production pipelines, reduce post-production costs, and generate hyper-realistic 3D elements, supporting films, streaming content, and virtual production workflows.

E-commerce segment is expected to grow at the fastest CAGR of about 28.52% over 2025–2032, owing to the growing employment of 3D product visualization, AR try-ons, and virtual showrooms. Still, for retailers, AI-generated assets help digitize their huge catalogues at Jet-speed, improve the online shopping experience while assisting in reducing product returns.

By Asset Type

Characters segment dominated the AI-Generated 3D Asset Market share of about 33% in 2024 owing to its extensive usage in games, films, and simulations. Characters are central to story and gameplay for games and interactive media, and AI enables the rapid generation of diverse, expressive, avatar characters that are ready for animation. The popularity of AI-character assets remains robust as demand for virtual influencers, NPCs, and digital humans continues.

Environments segment is expected to grow at the fastest CAGR of about 26.16% over 2025–2032, owing to the high demand for procedurally generated landscapes, cityscapes, and interiors across gaming, simulations, and virtual worlds. This allows for effortlessly scaling up in complex environments maintaining a consistent style and level of detail, creating an immersive experience for the user while saving on manual resources in metaverse, training, and architectural applications.

AI-Generated 3D Asset Market Regional Outlook:

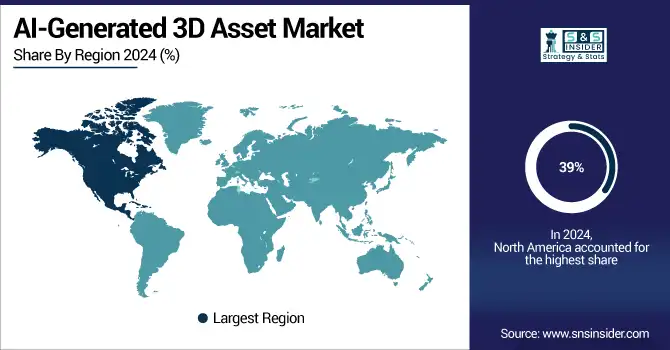

North America dominated the AI-Generated 3D Asset Market with the highest revenue share of about 39% in 2024, owing to the strong presence of several leading tech companies, gaming studios, and media producers. High investment in AI R&D, an early adopter mentality to advanced 3D tools and a matured digital infrastructure helps the region drive the rapid integration of AI-generated content across the entertainment, simulation, and virtual production industries.

The U.S. is dominating the AI-generated 3D asset market due to its advanced tech ecosystem, major industry players, and high AI investment levels.

Asia Pacific is expected to grow at the fastest CAGR of about 26.26% over 2025–2032, driven by rapid regional digitization and increasing applications of 3D technologies in education and retail. The investment in AI innovation, development of 3D content by the creation of immersive content in various countries, such as China, Japan, South Korea, and India, and a growing base of creators and mobile-first users are escalating demand for automated 3D asset generation.

China is dominating the AI-generated 3D asset market in Asia Pacific due to its massive gaming industry, strong AI innovation, and government-backed digital initiatives.

Europe is emerging as a significant player in the AI-generated 3D asset market, driven by advancements in gaming, automotive design, and virtual production. Countries such as Germany, France, and the U.K. are investing in Artificial Intelligence (AI) to enhance creative and industrial applications.

Germany is dominating the AI-generated 3D asset market in Europe due to its strong industrial base, advanced R&D, and robust digital transformation initiatives.

AI-generated 3D asset market trends in the Middle East & Africa and Latin America show rising demand driven by digital economy growth, gaming adoption, and immersive tech investments, with local startups embracing generative AI for accessible, regionally tailored 3D content creation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

AI-Generated 3D Asset Market companies are Epic Games (Unreal Engine), Unity Technologies, Adobe (Substance 3D, Mixamo), Autodesk, NVIDIA, OpenAI, Google (Google Research, DeepMind), Meta (Facebook Reality Labs), Microsoft (Azure AI, Microsoft Mesh), Alibaba DAMO Academy, Luma AI, Kaedim, Sloyd, Scenario, Promethean AI, Reallusion, CGTrader, TurboSquid (by Shutterstock), Meshy, and Didimo.

Recent Developments:

-

2025: NVIDIA at COMPUTEX unveiled an Omniverse Blueprint for AI factory digital twins supporting OpenUSD schemas for simulating AI‑factory assets integrating power, cooling, networking in digital twins.

-

2024: Autodesk unveiled Project Bernini (May 2024), an experimental generative AI model that creates multiple functional 3D shapes from inputs such as images, text, voxels, and point clouds.

-

2023: Unity introduced a dedicated AI Marketplace within the Unity Asset Store, centralizing curated AI tools and assets that accelerate AI‑driven game development and real‑time 3D workflows

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.63 Billion |

| Market Size by 2032 | USD 9.24 Billion |

| CAGR | CAGR of 24.29% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Asset Type (Characters, Environments, Props, Textures, Others) • By Application (Gaming, Film & Animation, Architecture, E-commerce, Virtual Reality, Augmented Reality, Others) • By Deployment Mode (Cloud, On-Premises) • By End-User (Media & Entertainment, Gaming, Architecture & Design, E-commerce, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Epic Games (Unreal Engine), Unity Technologies, Adobe (Substance 3D, Mixamo), Autodesk, NVIDIA, OpenAI, Google (Google Research, DeepMind), Meta (Facebook Reality Labs), Microsoft (Azure AI, Microsoft Mesh), Alibaba DAMO Academy, Luma AI, Kaedim, Sloyd, Scenario, Promethean AI, Reallusion, CGTrader, TurboSquid (by Shutterstock), Meshy, Didimo |