Mobile Learning Market Report Scope & Overview:

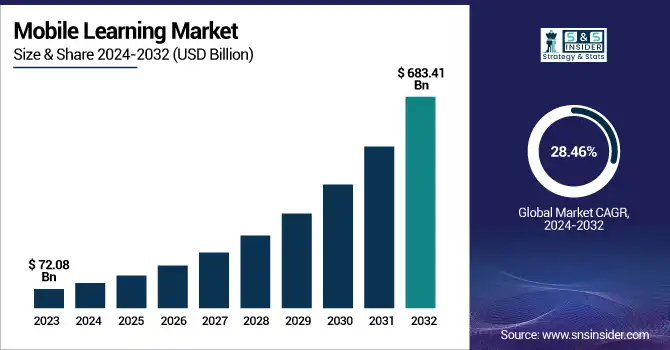

The Mobile Learning Market was valued at USD 72.08 billion in 2023 and is expected to reach USD 683.41 billion by 2032, growing at a CAGR of 28.46% from 2024-2032.

To Get more information on Mobile Learning Market - Request Free Sample Report

This report includes in-depth insights across key dimensions such as content and platform statistics, learning outcomes and efficacy, user journey and personalization, app performance and technology metrics, as well as localization and cultural adaptation. The market is experiencing exponential growth driven by the rising demand for flexible, on-the-go education, especially among corporate users. Advancements in mobile technology, AI-driven personalization, and the expansion of cloud-based platforms are transforming user engagement and learning retention. Additionally, regional localization and culturally adaptive content are playing a vital role in enhancing user experience and expanding global reach. The report offers a comprehensive view of evolving learner behavior, technological trends, and performance indicators shaping the mobile learning ecosystem.

U.S. Mobile Learning Market was valued at USD 20.41 billion in 2023 and is expected to reach USD 190.82 billion by 2032, growing at a CAGR of 28.20% from 2024-2032.

This growth is primarily fueled by the increasing adoption of digital learning solutions across educational institutions and corporate environments. The widespread use of smartphones, high-speed internet, and the growing need for remote learning have significantly boosted mobile learning uptake. Additionally, the integration of AI and machine learning for personalized learning paths, along with gamified and interactive content, is enhancing user engagement and learning outcomes. The corporate sector’s focus on continuous upskilling and compliance training further supports the rapid expansion of mobile learning platforms across the U.S.

Mobile Learning Market Dynamics

Drivers

-

Increased smartphone accessibility and affordability are significantly boosting the growth and adoption of mobile learning platforms worldwide

Smartphones are becoming more accessible and affordable across the globe, directly contributing to the widespread growth of mobile learning platforms. With rising smartphone penetration in both urban and rural areas, users are now empowered to access educational content anytime and anywhere. This convenience allows learners to integrate education into their daily routines, which boosts engagement and improves knowledge retention. Mobile learning also supports multimedia formats like videos, podcasts, and interactive quizzes, which make the learning experience more dynamic. Furthermore, it removes geographical barriers, enabling even remote learners to benefit from quality education. Educational institutions and corporates alike are adopting mobile learning as a scalable and flexible solution. The growing reliance on mobile devices for everyday activities ensures that mobile learning will continue to thrive in the evolving education ecosystem.

Restraints

-

Poor internet connectivity and digital infrastructure continue to hinder mobile learning accessibility in many developing and remote global regions

Limited access to stable internet connections remains a major challenge for the mobile learning market, especially in developing and rural regions. In many areas, internet infrastructure is either non-existent or unreliable, making it difficult for users to engage with online content effectively. Even if smartphones are available, mobile learning becomes impractical without consistent connectivity. Data costs also pose a significant barrier, discouraging users from streaming videos or downloading large educational files. These constraints disproportionately affect students in underserved communities, limiting their access to equal learning opportunities. Additionally, intermittent internet access disrupts the continuity and flow of education, leading to reduced engagement and poor learning outcomes. To ensure equitable access, investments in broadband infrastructure and affordable mobile data plans are critical for the mobile learning market’s sustained and inclusive growth.

Opportunities

-

AI, AR, and other advanced technologies are creating new interactive and immersive possibilities within the mobile learning market ecosystem

Technological advancements, especially in AI, AR, and machine learning, are opening new doors for innovation in the mobile learning market. AI enables personalized learning paths by analyzing user behavior, providing real-time feedback, and recommending content suited to each learner’s needs. Augmented and virtual reality introduce immersive simulations and hands-on learning experiences, making education more interactive and engaging. These technologies are especially valuable in fields like healthcare, engineering, and technical training, where practical understanding is essential. Additionally, gamification and voice assistants enhance user engagement and retention. Mobile learning apps integrating these technologies offer a richer, more customized experience. As development costs decrease and adoption grows, the integration of smart technologies is expected to become a defining factor in mobile learning success, leading to broader market acceptance and rapid global expansion.

Challenges

-

Maintaining high-quality and consistent educational content remains a major issue for mobile learning platforms targeting diverse global audiences

Ensuring high-quality content across mobile learning platforms presents a significant challenge due to the diverse user base and varied learning needs. While accessibility has improved, content quality often lacks standardization, especially on user-generated or open platforms. Poorly structured courses, outdated materials, or non-accredited content can hinder learner progress and reduce platform credibility. Furthermore, inconsistency in language, pedagogy, and cultural relevance can alienate certain user groups. Learners expect reliable, engaging, and well-researched material that aligns with curriculum standards or industry requirements. Without consistent quality control, mobile learning platforms may fail to deliver desired outcomes. To address this, providers must invest in expert-led content creation, regular updates, and robust review systems. Collaborating with educational institutions and industry experts ensures accuracy and relevance, maintaining user trust and improving educational value over time.

Mobile Learning Market Segment Analysis

By Application

Corporate learning led the mobile learning market in 2023 with the highest revenue share of approximately 40%. This dominance is primarily due to the rising adoption of mobile platforms for upskilling and continuous professional development among employees. Companies are increasingly investing in flexible, cost-effective learning solutions to improve workforce productivity and performance. Mobile learning supports on-demand access to training materials, enabling learners to engage at their own pace and convenience. Moreover, organizations value mobile learning for its scalability, making it ideal for geographically dispersed teams and remote workforces.

Online on-the-job training is projected to grow at the fastest CAGR of around 30.16% from 2024 to 2032. This growth is driven by its ability to deliver real-time, contextual learning experiences directly in the workflow. Employees gain practical skills and knowledge while actively performing their tasks, which enhances learning retention and job performance. The increasing emphasis on experiential learning, coupled with the growing integration of mobile technologies and AI-driven training tools, further supports the rapid expansion of this segment. Additionally, the flexibility and personalization of mobile-based on-the-job training make it highly appealing across industries seeking agile talent development solutions.

By Software solution

Video-based courseware dominated the mobile learning market in 2023, capturing the highest revenue share of approximately 40%. Its popularity stems from the engaging, visually rich content format that enhances knowledge retention and caters to various learning styles. With widespread smartphone usage and faster internet connectivity, learners can access high-quality video lessons anytime and anywhere. Video content is particularly effective for demonstrating complex concepts, fostering higher learner engagement. Enterprises and educators increasingly favor video-based modules for their scalability, consistency in delivery, and ability to integrate animations, voiceovers, and subtitles, making learning more inclusive and interactive.

Interactive assessment is anticipated to grow at the fastest CAGR of about 30.09% between 2024 and 2032. This growth is fueled by the increasing need for personalized learning experiences and real-time performance feedback. Interactive assessments allow learners to actively engage with the material through quizzes, simulations, and scenario-based evaluations. These methods enhance comprehension and motivation while allowing educators and trainers to measure progress and adapt content dynamically. The rise of gamification and adaptive learning technologies further supports the expansion of this segment, as organizations and institutions seek more effective and responsive mobile learning tools.

By End-User

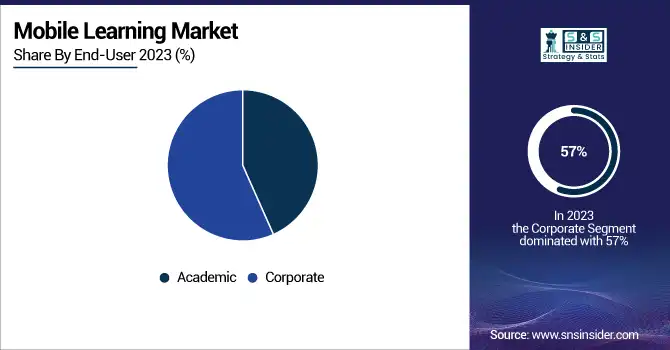

The corporate segment held the largest share of the mobile learning market in 2023, accounting for approximately 57% of total revenue. This dominance is attributed to the increasing demand for scalable, cost-effective training solutions across enterprises. Mobile learning empowers organizations to deliver consistent, flexible training programs to employees regardless of location, aligning well with the global shift toward remote and hybrid work environments. It supports real-time learning, rapid onboarding, leadership development, and compliance training. Corporates also favor mobile platforms for their ability to track performance metrics and customize content based on employee roles and needs. These advantages make mobile learning a strategic tool in workforce development.

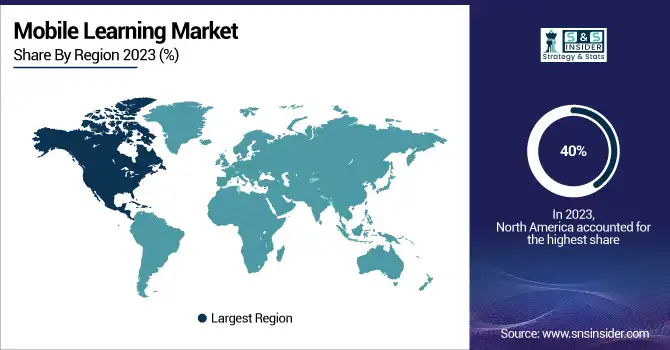

Regional Analysis

North America dominated the mobile learning market in 2023 with a revenue share of approximately 40%, primarily due to its advanced technological infrastructure and high smartphone and internet penetration. The presence of key market players, significant investments in digital education, and widespread adoption of e-learning platforms across educational institutions and corporations further propelled growth. Additionally, government initiatives promoting digital literacy and continuous learning programs contributed to the region's dominance in the mobile learning space, establishing it as a mature and lucrative market.

Asia Pacific is projected to witness the fastest CAGR of about 29.94% from 2024 to 2032, driven by rising smartphone usage, increasing internet accessibility, and a growing young population eager for flexible learning solutions. Government support for digital education, expanding edtech startups, and a focus on improving rural education are accelerating mobile learning adoption. The region's large population base and demand for affordable, scalable educational tools make it a prime environment for rapid market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Adobe Inc. (Adobe Captivate, Adobe Learning Manager)

-

Allen Communication Learning Services, Inc. (DesignJot, Allen Learning Portal)

-

AT&T Inc. (AT&T Workforce Manager, AT&T Mobile Forms)

-

Business Training Library LLC (BizLibrary) (BizLibrary Collection, BizSkills)

-

Cisco Systems, Inc. (Cisco Webex, Cisco Networking Academy)

-

Citrix Systems, Inc. (Citrix Workspace, Citrix Content Collaboration)

-

Dell Inc. (Dell Mobile Workspace, Dell Technologies Education Services)

-

El Design Pvt. Ltd. (ELD LMS, ELD Mobile Learning Modules)

-

IBM Corporation (Watson Learning Assistant, IBM Talent Management Solutions)

-

Integra Software Services Pvt. Ltd. (Integra eLearning, Integra Classroom Solutions)

-

NetDimensions (NetDimensions Talent Suite, NetDimensions Learning)

-

Promethean (ActivPanel, ClassFlow)

-

SAP AG (SAP Litmos, SAP SuccessFactors)

-

Skillsoft (Percipio, Skillsoft Leadership Development Program)

-

Upside Learning (UpsideLMS, Plethora Learning Platform)

Recent Developments:

-

In February 2025, Integra Software Services launched an Accessibility Microsite to assist publishers, educational institutions, and businesses in creating accessible digital content. The platform offers solutions for compliance with WCAG, ADA, and Section 508 standards, enhancing user experience.

-

In November 2024, Adobe Learning Manager introduced an AI-powered search feature that combines lexical and semantic analysis to deliver smarter, context-aware results, enhancing mobile learning experiences for users.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 72.08 Billion |

| Market Size by 2032 | US$ 683.41 Billion |

| CAGR | CAGR of 28.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software Solution (E-Books, Interactive Assessment, Video-Based Courseware, Others) • By Application (Corporate Learning, In-class Learning, Simulation-Based Learning, Online On-the-Job Training) • By End-User (Academic, Corporate) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adobe Inc., Allen Communication Learning Services, Inc., AT&T Inc., Business Training Library LLC (BizLibrary), Cisco Systems, Inc., Citrix Systems, Inc., Dell Inc., El Design Pvt. Ltd., IBM Corporation, Integra Software Services Pvt. Ltd., NetDimensions, Promethean, SAP AG, Skillsoft, Upside Learning. |