Acetone Market Report Scope & Overview:

The Acetone Market Size was valued at USD 6.1 billion in 2023, and is expected to reach USD 11.9 billion by 2032, and grow at a CAGR of 7.7% over the forecast period 2024-2032.

Get PDF Sample Copy of Acetone Market - Request Sample Report

The acetone market is reshaping dynamically by the combination of industry development, technology innovation, and shifting consumer trends. On the industrial and consumer applications side, this versatile solvent of acetone is applied in many industrial and consumer applications and is growing with great vigor, driven by some important factors. One of the chief drivers is the accelerating usage of acetone for making high-performance composites and polymers. This surge is most particularly noticeable in industries such as automotive and aerospace, which, with acetone able to find applications as a solvent in resin formulations and as a cleaning agent for composite materials, continue to push the boundaries of technological innovation. The demand for acetone, therefore, has been very high, as it has become an increasingly critical raw material for their manufacturing processes.

Recent developments in the acetone market underline that this industry has not stopped growing. For instance, in July 2023, Shell Chemicals was working on a next-generation acetone plant in Singapore. The new facility would help further increase the capacity of Shell with regards to the manufacture of high-quality acetone and supply the rising demand that comes from the Asia-Pacific region. The investment is very strategic in terms of increasing the presence of the firm in the acetone market and helps achieve higher-order sustainability goals by embedding advanced production technologies that lower the impact on the environment. In November 2023, BASF SE also announced a large investment in its acetone production capabilities in Ludwigshafen, Germany. The group is eyeing this investment to enhance production efficiency and meet rising demand for acetone in Europe. The step taken by BASF forms part of a broader strategy to upgrade its chemical manufacturing infrastructure by upgrading plants in order to enhance output and optimize environmental performance. It will further strengthen BASF's supply chain and create it as the largest acetone supplier.

Technological developments are also playing an important role in the acetone market. In March 2024, a joint venture of Dow Chemical and LG Chem announced a process technology breakthrough that would significantly cut energy use and generate significantly less waste in acetone production. This new technology uses state-of-the-art catalytic processes to enhance production effectiveness but with less damage to the environment. This story was yet another example of how the greener roadmap in methods of production was coming out of the industry.

Changing consumer and industrial preferences also drive demand for the acetone market. Green and sustainable products evoke research and development activity leading to bio-based acetone. The breakthrough achievement in January 2024 announced by Archer Daniels Midland included the capability to produce bio-acetone from renewable resources. This development falls in line with global trends toward sustainability and provides an alternate source to traditional acetone production processes, dependent on fossil fuels. The new bio-based acetone will serve the growing consumer preference for green products and offer a source of differentiation in the acetone market.

Acetone Market Dynamics:

Drivers:

- Increasing demand for acetone as a solvent in various industries

Growing demand for acetone as a solvent across various industries is the major driver shaping the trajectory of the market. The broad range of applications has rendered acetone a significant solvent and ensured maximum adoption across various industries. For instance, in March 2023, PPG Industries, a global coatings manufacturer, entered new markets with its comprehensive range of acetone-based solvents for high-performance coating applications in the automotive and industrial segments. The transfer emphasizes the reason acetone is vital in the designing of coatings that guarantee shine and high lifespan. Also, in June 2023, the pharmaceutical leader Pfizer also embraced acetone in manufacturing drugs that would enhance the solubility and stability of various drugs, a reason why the chemical is regarded as significant in the other relevant pharmaceutical industries. Further, in September 2023, Apple Inc. stated that the consumer electronics company used acetone during the production of electronic parts for cleaning and degreasing purposes before assembling these parts; this depicts its important role in ensuring the quality and precision of today's high-tech devices. Moreover, in November 2023, Henkel AG expanded its portfolio on acetone-based adhesives to help meet the already growing demand from the construction sector. These examples show the wide application of acetone as a solvent, driven by its distinctive properties, like rapid evaporation and effective dissolution capabilities that make it essential for a wide variety of industrial and consumer products.

- Rising demand for acetone in the production of polycarbonate resins

The rising demand for acetone in the production of polycarbonate resins is one of the major driving factors for the market. Polycarbonate resins have broader applicability in automobile parts, electronic devices, and building material owing to the strength and transparency they provide. For instance, in April 2023, Sabic—the worldwide leader in diversified chemicals—announced a significant capacity increment to manufacture polycarbonate resins from its facility based in Geleen, the Netherlands. Such growth was driven by the growing need for high-performance materials in industries like automotive and electronics, where impact resistance and optical clarity of polycarbonate resins apply. In August 2023, Covestro AG—leading in advanced high-tech polymer materials production released a line of polycarbonate resins for the production of the latest generation of electronic devices. The quality of acetone as a solvent for these resins plays a central role in ensuring the optimal performance and highest quality of polycarbonate products, which are by nature irreplaceable. In December 2023, Mitsubishi Chemical Corporation declared the development of high thermal stability of new polycarbonate resin which is further having improved mechanical properties; at the time of polymerization, acetone has been used as its major component. This escalating polycarbonate resin manufacturing trend underlines the growing dependence on acetone, propelled by the demand for materials that combine versatility and performance for high-tech and industrial applications.

Restraints:

- High level of flammability while posing low acute toxicity risks

The high degree of flammability associated with acetone, together with low acute toxicity risks, is a significant restraint to its market applications. The flammability problem requires strict safety measures and handling procedures, thereby increasing operation costs for manufacturers and users. For instance, in February 2024, the chemical giant Dow Inc. was under regulatory pressure over its acetone production facilities due to new safety rules governing fire hazards. These regulations compelled Dow to make an adequate investment in state-of-the-art safety systems, and updated its storage practices to bring them up to the improved standards of safety. In May 2024, BASF SE delayed an expansion of acetone production capacity at Ludwigshafen, Germany, over fire safety concerns and implementation of more safety infrastructure. The case points out how this acetone flammability feature may make things worse by burdening operation costs and increasing operational complexities, thus affecting the market dynamics.

Opportunities:

- Growing adoption of acetone in the healthcare industry

Increasing applications of acetone in the healthcare industry represent an opportunity for the market, as the material is being increasingly used in several medical and pharmaceutical applications. Because it's such a versatile and powerful cleaning agent as a solvent, acetone has become highly cherished in health facilities. For instance, in January 2024, Johnson & Johnson announced a new initiative to use acetone in its manufacturing processes of medical devices by taking advantage of the solvent property and its improved service in cleaning and sterilizing the complex surgical equipment. This foregrounds the inescapable role of acetone in maintaining hygiene standards and medical equipment functionalities. Besides, in the March of 2024, Pfizer continued the use of acetone in the pharmaceutical formulations for drug synthesis and purification works. This reflects the fact that acetone is highly recognizable as treatment to ensure the integrity and effectiveness of drugs. In July, 2024, Siemens Healthineers began using acetone in the imaging equipment during cleaning of sensitive parts and maintenance, for better performance under reliability. These are prominent examples of how the applications of acetone further expand within the health care sector by playing an efficient role in the upgradation of quality and safety of health products and services.

Challenges:

- Stringent regulations regarding the use and disposal of acetone

The stringent regulations placed, therefore, pose a huge challenge to the market on the use and disposal of acetone, as companies have to go through complex compliance requirements that may affect operational efficiency and costs. For example, in the United States, a new requirement on handling and disposal was set by the Environmental Protection Agency as a regulatory body in June 2024. Businesses will need to invest in innovative technologies for waste treatment to comply with ever-tightening environmental standards. This regulation altered major companies like Eastman Chemical Company, who were supposed to improve the safety features of their manufacturing units producing acetone and also the waste disposal methodology. By October 2024, operations in Europe were a pain for BASF SE because the European Union was making it very difficult to test and report on acetone emissions under the revised REACH regulations. Such compliance-oriented regulatory barriers needed modification at huge expenses for updating compliance protocols and operational processes, leading the continuous challenge to handle Acetone's environmental impact strictly under the Rule of Law.

Acetone Market Segments

By Grade

In 2023, the Technical Grade dominated in acetone market due to its large range of application across industries such as automotive, construction, and electronics. Technical Grade acetone is highly pure and finds very effective usage as a solvent in the industrial process; hence, it was preferred due to cost effectiveness and versatility. For instance, companies like Dow Chemical and Shell Chemical demonstrated rising demand for Technical Grade acetone in their production. It is hence projected that the share of Technical Grade acetone will be around 70% in 2023, considering that the massive diversified industrial uses the product finds are compared to the Specialty Grade acetone, which caters to more or less niche markets with higher purity and specific performance requirements.

By Application

The Solvents segment dominated the acetone market in 2023, as the acetone type of material is an extensively used one in both industrial and consumer applications. Because of its highly efficient performance as a solvent, it has been applied extensively for cleaning, degreasing, and in paint and coatings formulations. Some leading chemical companies, like BASF and PPG Industries, showed robust demand for the product in their solvent applications, citing its importance in product quality and performance. Volume-wise, the Solvents segment is expected to hold around 60% of the market share in 2023 and grow at a much faster rate than other applications such as Bisphenol A and Methyl Methacrylate, which find significant, albeit niche, applications in comparison.

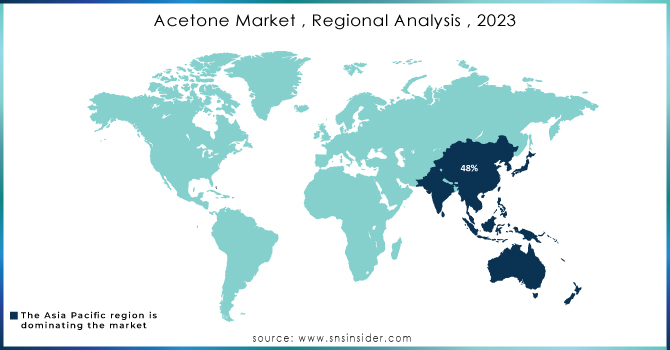

Acetone Market Regional Analysis

Asia Pacific dominated the acetone market, with a share of around 48% of the revenues in 2023, which is expected to grow further with a strong CAGR during the forecast period. The leading position of the Asia Pacific region in the acetone market is supported by its large, established, and rapidly growing chemical industry. This has encouraged large-scale production and circulation of acetone through the channels set up by the chemical manufacturers in the region. Also, enough raw materials, like propylene, increase the acetone production capacity of the region. Besides, huge growth in the manufacturing sector within the Asia Pacific region has been seen, which inflated the demand for acetone. It finds applications in a number of industries, ranging from automobile and construction to pharmaceutical and cosmetics industries. As these sectors proliferate in the region, there is a concomitant forecast that demands for acetone-based products such as solvents, adhesives, and coatings will grow accordingly.

Moreover, Europe emerged as the fastest-growing region, holding a CAGR of about 8.3% in the acetone market during the forecast period of 2024–2032. Strong industrialization in the region is supposed to play a major function from the automotive, construction, and pharmaceutical industries. It will also further give an up thrust to the demand for acetone. Besides, growing priorities for sustainable practices and restraining norms on the environment have significantly increased the demand for bio-based acetone in Europe. The product is used as an initiative to cut down on the carbon footprint created in the region and towards an easy adaptation of greener and more sustainable substitutes. This shape towards bio-based acetone derived from renewable resources such as biomass and waste materials is supposed to create growth opportunities in the Europe market.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players are INEOS Phenol GmbH, SABIC, The Dow Chemical Company, Domo Chemicals GmbH, Formosa Chemical and Fiber Corporation, Kumho P&B Chemicals, Royal Dutch Shell PLC, Honeywell Research Chemicals, Spectrum Chemical Mfg. Corp., Altivia Chemicals, and other key players mentioned in the final report.

Recent Development:

-

January 2024: Haldia Petrochemicals Ltd. inaugurated a mega phenol plant in Kolkata; the facility is expected to be operational by Q1 2026 and will produce 185 KTPA of acetone and 300 KTPA of phenol annually.

-

December 2023: A Thai company, PTT Global Chemical, said production of acetone and phenol would be restarted on a commercial operating basis in. It is focusing on the optimization of plant resource efficiency. Its production facility has a yearly capacity of 150,000 tons for acetone and 250,000 tons for phenol.

-

April 2023: KBR, Inc. and Wanhua Chemical Group Co., Ltd. announced the record completion of new technology for a 650 KTA acetone/phenol plant in Shandong Province, with start-up and high-quality product delivery in eight days.

-

June 2022: INEOS Phenol launched INVIRIDISTM, the first line of its bio-attributed products, with phenol, acetone, and alpha-methyl styrene (AMS) that are made without the use of fossil fuels.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.1 Bn |

| Market Size by 2032 | USD 11.9 Bn |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Technical Grade and Specialty Grade) •By Application (Solvents, Bisphenol A (BPA), Methyl Methacrylate (MMA), and Others) •By End-use (Agricultural Chemicals, Cosmetics & Personal Care, Automotive, Paints & Coatings, Plastics, Pharmaceuticals, Rubber Processing, Printing Ink, Polymer & Resin Processing, Adhesive, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | INEOS Phenol GmbH, SABIC, The Dow Chemical Company, Domo Chemicals GmbH, Formosa Chemical and Fiber Corporation, Kumho P&B Chemicals, Royal Dutch Shell PLC, Honeywell Research Chemicals, Spectrum Chemical Mfg. Corp., Altivia Chemicals |

| Key Drivers | •Increasing demand for acetone as a solvent in various industries •Rising demand for acetone in the production of polycarbonate resins •Growing popularity of acetone as a cleaning agent in the electronics industry |

| Market Restraints | •Fluctuating prices of crude oil •High level of flammability while posing low acute toxicity risks |