Acetylene Black Market Report Scope & Overview:

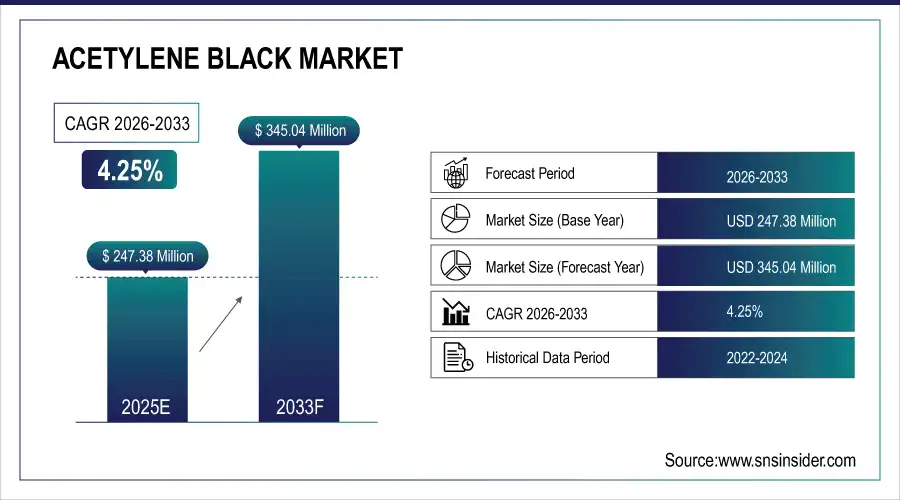

The Acetylene Black Market Size was valued at USD 247.38 Million in 2025E and is expected to reach USD 345.04 Million by 2033, growing at a CAGR of 4.25% over the forecast period of 2026-2033.

The Acetylene Black Market is witnessing significant growth, fueled by increasing demand for high-performance batteries, conductive materials, and rubber applications. Rising adoption in electric vehicles, energy storage systems, adhesives, coatings, and cosmetics is driving market expansion. Technological advancements in purity, conductivity, and particle size enhance product efficiency across industrial and consumer applications.

Market Size and Forecast:

-

Acetylene Black Market Size in 2025E: USD 247.38 Million

-

Acetylene Black Market Size by 2033: USD 345.04 Million

-

CAGR: 4.25% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Acetylene Black Market - Request Free Sample Report

Key Acetylene Black Market Trends

-

Rising demand for lithium-ion and solid-state batteries in electric vehicles and consumer electronics.

-

Increasing adoption in rubber, adhesives, and coatings for improved conductivity and durability.

-

Growth in energy storage systems boosting high-purity acetylene black consumption.

-

Technological advancements in particle size control and conductivity optimization.

-

Expansion of industrial applications in cosmetics, greases, and specialty chemicals.

-

Focus on sustainable and low-carbon production processes due to environmental regulations.

-

Rising Asia-Pacific dominance, driven by China, Japan, and South Korea industrial growth.

U.S. Acetylene Black Market Insights

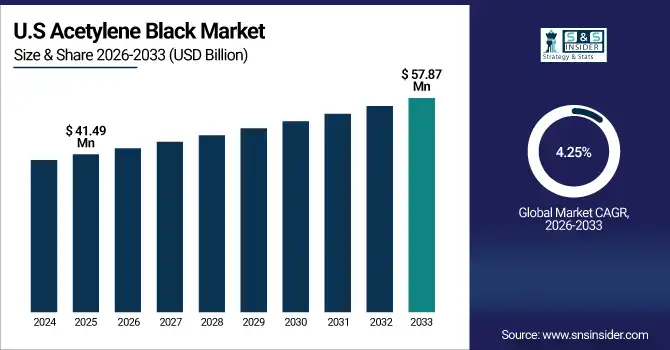

The U.S. Acetylene Black Market size was USD 41.49 million in 2025 and is expected to reach USD 57.87 million by 2033 growing at a CAGR of 4.25% over the forecast period of 2026-2033. The growth is fueled by rising demand for high-performance batteries and conductive materials, which drives the adoption in electronics, EVs, and industrial applications. Increasing usage in adhesives, coatings, and rubber enhances material efficiency, while technological advancements in particle size and conductivity improve product performance. Expansion in energy storage systems and industrial manufacturing further supports market growth.

Acetylene Black Market Growth Driver

-

Growing Demand for High-Performance Batteries and Conductive Materials Drives Acetylene Black Market Expansion Globally

The growth of the Acetylene Black Market is primarily driven by the increasing demand for high-performance batteries and conductive materials, which are essential in electric vehicles, energy storage systems, and advanced electronics. As industries strive for better energy efficiency, lighter-weight solutions, and enhanced conductivity, acetylene black provides an ideal material, facilitating improved battery life, higher charge capacity, and superior electrical performance. Consequently, manufacturers are ramping up production to meet this rising need, which also encourages investment in research and technological improvements in particle size control, purity, and conductivity, further accelerating market growth. Moreover, the integration of acetylene black in adhesives, coatings, and rubber applications enhances product durability and reliability, creating additional demand across industrial and consumer sectors.

For instance, In April 2025, Denka Company Limited expanded its production facility in Japan to increase high-purity acetylene black output for EV battery manufacturers, directly addressing the surging demand for energy-efficient, conductive materials.

Acetylene Black Market Restraint

-

High Production Costs and Raw Material Price Volatility Restrict Growth of Acetylene Black Market Worldwide

The growth of the Acetylene Black Market is restrained by high production costs and fluctuating raw material prices, particularly acetylene gas and energy inputs, which constitute a significant portion of overall manufacturing expenses. Price volatility creates uncertainty for manufacturers, affecting profitability and limiting large-scale production expansions. Consequently, some smaller producers are unable to compete, slowing market penetration in emerging regions. Additionally, the requirement for advanced processing equipment and stringent quality control measures further increases capital expenditure, discouraging new entrants and delaying market growth despite increasing demand. Regulatory compliance related to environmental and emission standards adds another layer of cost and complexity, influencing production strategies and long-term investment decisions.

In June 2024, a mid-sized manufacturer in China suspended expansion plans due to the rising cost of acetylene feedstock and energy, directly impacting its market participation and production schedules.

Acetylene Black Market Opportunity

-

Rising Adoption of Electric Vehicles and Renewable Energy Storage Solutions Presents Significant Growth Opportunity for Acetylene Black Market

The increasing global adoption of electric vehicles and renewable energy storage solutions offers a substantial growth opportunity for the Acetylene Black Market. As automakers and energy companies seek lightweight, high-conductivity materials to enhance battery efficiency, acetylene black is being prioritized for its superior performance in lithium-ion and solid-state batteries. This trend encourages manufacturers to develop ultra-pure, battery-grade products, improving market penetration and technological innovation. Governments supporting EV adoption and renewable energy initiatives further incentivize industry investments, leading to expanded production capacity and strategic collaborations. Consequently, acetylene black finds increasing application in energy storage systems, electronics, and high-performance industrial products, positioning the market for long-term growth.

For instance, In March 2025, Orion Engineered Carbons launched a new high-conductivity acetylene black variant for EV batteries, capitalizing on rising energy storage demand and providing a competitive advantage in North America and Europe.

Acetylene Black Market Segment Highlights:

-

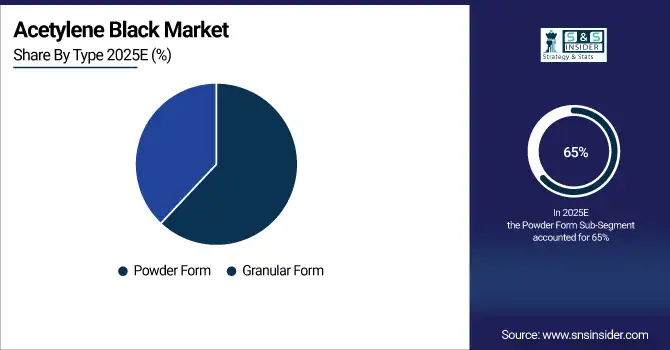

By Type: Powder Form – 65% (largest), Granular Form – 35%

-

By Application: Batteries – 45% (largest), Adhesives/Sealants/Coatings – 20%, Rubber – 15%, Greases – 8%, Cosmetics & Personal Care – 7%, Others – 5%

Acetylene Black Market Segment Analysis

By Type

The Powder Form segment dominates the market with a 65% share, driven by its extensive use in high-performance batteries, conductive polymers, and industrial adhesives requiring superior conductivity and fine particle size. Granular Form, holding 35%, is widely adopted in rubber, coatings, and grease applications, providing ease of handling and controlled dispersion. Growth is further supported by increasing demand for energy-efficient applications, lightweight conductive materials, and enhanced electrical performance across automotive, electronics, and industrial sectors.

By Application

The Batteries segment leads the market with a 45% share, owing to rising adoption in electric vehicles, energy storage systems, and consumer electronics. Adhesives/Sealants/Coatings, accounting for 20%, benefit from acetylene black’s conductivity and stability in industrial and construction materials. Rubber, with 15%, enhances durability and performance in tires and industrial products. Greases (8%) and Cosmetics & Personal Care (7%) leverage functional and conductive properties, while Others (5%) cater to niche applications. Segment growth is driven by technological advancements, rising industrialization, and increased adoption of high-performance materials.

Acetylene Black Market Regional Analysis

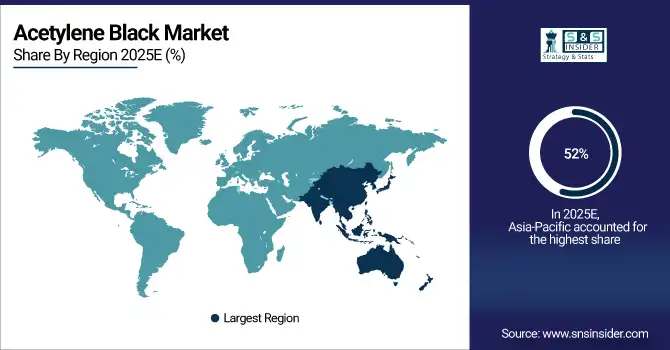

Asia-Pacific Acetylene Black Market Insights

Asia-Pacific accounts for 52% of the market in 2025 and is the fastest-growing region due to rapid electronics manufacturing, automotive production, and renewable energy storage expansion. China, Japan, South Korea, and India are key contributors, driven by rising demand for battery-grade acetylene black, conductive materials, and high-performance industrial applications. Government support for industrial modernization, R&D incentives, and investment in advanced materials accelerate adoption. Collaborations between local manufacturers and global suppliers enhance technology transfer, product quality, and cost-efficient production, establishing Asia-Pacific as a dominant hub for acetylene black deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Acetylene Black Market Insights

North America holds 22% of the market in 2025, supported by strong electronics, automotive, and aerospace sectors. The U.S. leads adoption due to advanced R&D infrastructure, stringent quality standards, and growing use in energy storage, EV batteries, and high-performance insulating materials. Increasing investments in industrial automation, EV manufacturing, and aerospace projects accelerate market growth. Partnerships between material suppliers and OEMs promote product innovation, reliability, and application-specific customization, establishing North America as a key hub for acetylene black technologies.

Europe Acetylene Black Market Insights

Europe accounts for 17% of the market in 2025, driven by electronics, automotive, and aerospace industries. Germany, France, and the U.K. are major contributors, focusing on lightweight, high-conductivity materials and flexible circuits. Regulatory incentives for energy efficiency, sustainability, and high-performance materials encourage innovation. Growth in labelling, specialty films, and industrial applications supports adoption. Collaborations between European polyimide and conductive material suppliers with industrial clients foster advanced product development and compliance with environmental and performance standards.

Latin America and Middle East & Africa (MEA) Acetylene Black Market Insights

Latin America holds 4% and MEA 5% of the market in 2025. Brazil, Mexico, UAE, and Saudi Arabia are investing in electronics, automotive, aerospace, and energy storage applications, along with high-performance conductive materials. Growing industrial infrastructure, awareness of advanced polymer solutions, and government initiatives drive adoption. Public-private partnerships and collaborations with international suppliers enhance local production capabilities. Steady growth in niche applications, such as specialty fabricated products and labelling, is expected across both regions, supported by technology adoption and industrial expansion.

Competitive Landscape for Acetylene Black Market:

Denka Company Limited

Denka Company Limited is a leading manufacturer of high-purity Acetylene Blacks, serving battery, electronics, automotive, and industrial applications.

-

In April 2025, Denka expanded its Chiba Plant production capacity to meet growing demand for high-purity acetylene black used in electric vehicle lithium-ion batteries.

Orion Engineered Carbons S.A.

Orion Engineered Carbons develops advanced acetylene-based conductive additives for batteries, electronics, and industrial applications, emphasizing sustainability and high conductivity.

-

In October 2025, Orion inaugurated a new production facility in La Porte, Texas, for the PRINTEX Kappa 100 battery-grade conductive carbon additive, expected to begin production.

Cabot Corporation

Cabot Corporation specializes in high-performance carbon blacks for tires, coatings, batteries, and energy storage solutions.

-

In February 2024, Cabot partnered with a leading tire manufacturer to co-develop ultra-low rolling resistance carbon black compounds, improving fuel efficiency and supporting electric vehicle mobility.

Birla Carbon

Birla Carbon provides high-quality carbon blacks for tires, rubber, coatings, and specialty industrial applications.

-

In October 2024, Birla Carbon introduced Continua, a sustainable carbonaceous material reclaiming carbon black from post-consumer tires for reuse in new tires and other industrial applications.

Acetylene Black Market Key Players

Some of the ACETYLENE BLACK Companies

-

Denka Company Limited

-

Hexing Chemical Industry Co. Ltd.

-

Ebory Chemical Co. Ltd.

-

Xuguang Chemical Co. Ltd.

-

Jinhua Chemical Co. Ltd.

-

Zhengning New Material Technology Co. Ltd.

-

Xinglongtai Chemical Products

-

Orion Engineered Carbons S.A.

-

Soltex Inc.

-

Sun Petrochemicals

-

Cabot Corporation

-

Phillips Carbon Black Limited (PCBL)

-

Tokai Carbon Co. Ltd.

-

Birla Carbon

-

Mitsubishi Chemical Corporation

-

China Synthetic Rubber Corporation (CSRC)

-

Imerys Graphite & Carbon

-

Asbury Carbons

-

Continental Carbon Company

-

Shanxi Fulihua Chemical Materials Co. Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 247.38 Million |

| Market Size by 2033 | USD 345.04 Million |

| CAGR | CAGR of4.25% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Powder Form, Granular Form) • By Application: (Adhesives/Sealants/Coatings, Batteries, Rubber, Greases, Cosmetics & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Denka Company Limited, Hexing Chemical Industry Co. Ltd., Ebory Chemical Co. Ltd., Xuguang Chemical Co. Ltd., Jinhua Chemical Co. Ltd., Zhengning New Material Technology Co. Ltd., Xinglongtai Chemical Products, Orion Engineered Carbons S.A., Soltex Inc., Sun Petrochemicals, Cabot Corporation, Phillips Carbon Black Limited (PCBL), Tokai Carbon Co. Ltd., Birla Carbon, Mitsubishi Chemical Corporation, China Synthetic Rubber Corporation (CSRC), Imerys Graphite & Carbon, Asbury Carbons, Continental Carbon Company, Shanxi Fulihua Chemical Materials Co. Ltd. |