Polyetheramine Market Analysis & Overview

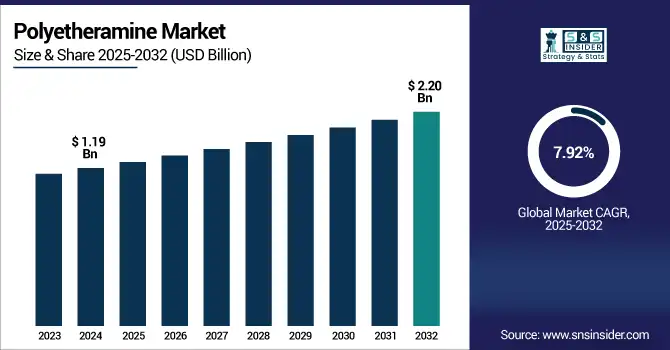

The Polyetheramine Market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 2.20 billion by 2032, growing at a CAGR of 7.92% over the forecast period of 2025-2032.

Polyetheramine Market Analysis highlights the rising use in epoxy coatings as one of the major driving factors for the market growth. Polyetheramines are commonly used as epoxy curing agents and are known for enhanced adhesion, flexibility, chemical resistance, and mechanical strength. These characteristics make them extremely useful as protective coatings for industrial flooring, marine, and anticorrosive structures. Polyetheramines are also increasingly used as a crosslinker in underlying coatings as the need for durable, high-performance coatings increases across construction, automotive, and infrastructure sectors. Also, the increasing trend of green and solvent-free composition complements the market growth of polyetheramine-based epoxy coatings, on account of which the growth of this market is further drives the Polyetheramine market growth.

To Get more information on Polyetheramine Market - Request Free Sample Report

The U.S. Environmental Protection Agency (EPA) restricts the VOC content of industrial maintenance coatings to 100g/L under the National Volatile Organic Compound Emission Standards for Architectural Coatings (Rule 1113). It is this regulation that has propelled the rapid adoption of low-VOC, water-based epoxy coatings, which are also cured by polyetheramines.

Polyetheramine Market Drivers:

-

Increasing Application in Adhesives and Sealants Drives the Market Growth

The growth of polyetheramines market is attributed to increasing application in adhesives and sealants as they are used to enhance bonding strength, flexibility, and durability on a wide variety of surfaces and materials. Polyetheramines are known for usefulness in advanced adhesive and sealant systems for construction, automotive, aerospace, and electronics applications. With great chemical resistance, thermal stability, and compatibility with different polymers, they are suitable for high-performance applications where long-term reliability is essential. Polyetheramine-based adhesives and sealants are witnessing increased usage for bonding lightweight and high-strength materials in various structural components and assembly process, owing to increasing demand for light-weighting and high-strength solutions. Further, the low-VOC and eco-friendly properties supporting formulation against stringent environmental regulation also contribute the market growth.

Polyetheramine Market Restraints:

-

Technical Complexity in Formulation May Hamper the Market Growth

The market growth of polyetheramines can be hindered by technical complexity in formulation, as they may need to be incorporated into high-end systems that require specialized knowledge, accurate conditions, and controlled processing environments. Polyetheramines differ from traditional additives in that they need a delicate equilibrium with other chemical components to provide the target properties, such as adhesion, flexibility, or curing speed. However, this complex nature can also be a roadblock, especially for small and mid-sized manufacturers who do not possess the technical know-how or infrastructure for formulation optimization. Also, incorrect usage or incompatibility with other ingredients could result in performance failures, costs increase, or safety concerns that might limit adoption.

Polyetheramine Market Opportunities:

-

Increasing in 3D Printing Materials Creates an Opportunity in The Market

The increasing use of 3D printing materials provides an opportunity for the polyetheramine market because demand for high-performance, customizable polymers is continuously increasing in various end-use industries, including aerospace, automotive, healthcare, and consumer goods. The elasticity, chemical resistance, and capacity to improve mechanical properties of polyetheramines make them promising candidates as additives and modifiers for 3D printing resins and thermoset formulations. Such improvements in layer adhesion, increased impact resistance, and overall durability make them great for functional prototypes and end-use parts. The gradual transition from prototyping to full-scale production of additive manufacturing opens the door to a significantly larger market for sophisticated materials, such as polyetheramines that enable complex designs and performance requirements, which drives the Polyetheramine market trends.

In June 2023, Huntsman Corporation acquired a producer of bio-based polyetheramine a part of its green chemistry portfolio. This acquisition strengthens Huntsman's position in sustainable epoxy and adhesive formulations, the key ingredient for wind energy, and 3D printing composites applications.

Polyetheramine Market Segmentation Analysis:

By Product

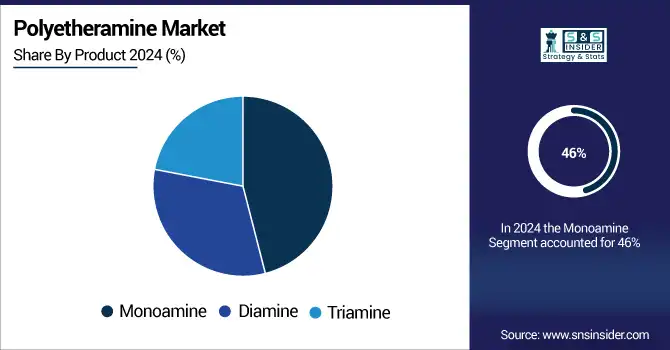

Monoamine held the largest polyetheramine market share, around 46%, in 2024 due to originating predominantly from various applications, such as epoxy coating, adhesives, sealants, and fuel additives. As they contain only a single active amine group, monoamines are both highly reactive and compatible with most polymers, which renders them excellent curing agents for epoxy resins widely used in protective coatings and composites. Their lower viscosity and friendliness for handling add value in industrial and construction applications. Furthermore, the increasing need for durable and corrosion-resistant coatings in the automotive and infrastructure allied industries has stimulated a higher consumption of polyetheramines based on monoamines.

Diamine held a significant Polyetheramine market share. It is owing to the presence of superior crosslinking capacity and mechanical strength to withstand aggressive end-use applications, including polyurea coatings, high-performance adhesives, and composite materials. Diamine-based polyetheramines contain 2 reactive amine groups, which provide better efficiency and durability compared to epoxy systems commonly used in industrial flooring, protective linings, and structural composites. Their increasing use in industries, such as automotive, aerospace, and wind energy, which require lightweight, high-strength, and chemical-resistant materials, has fueled their strong market position.

By Applications

The epoxy coatings held the largest market share, around in the polyetheramine applications segment 38%, in 2024. The growth is driven by the widespread use of polyetheramines as curing agents in epoxy systems, and their high adhesion, chemical resistance, flexibility, and mechanical strength. Epoxy coatings, often installed in industrial flooring, marine, infrastructure protection, and automotive parts, are based on the concept of extended durability with long-term performance. Such properties can be improved by the addition of polyetheramines to the cured epoxy systems, resulting in increased toughness and thermal stability of the materials. Demand for corrosion-resistant and solvent-free coatings, due to the increasing environmental regulations globally and infrastructure development, has also driven the growth of the polyetheramine industry.

Adhesives & Sealants holds a significant share in the Polyetheramine market owing to the growth in applications in various end-use industries, such as construction, automotive, electronics, and aerospace. Polyetheramines are known to offer high-performance adhesive and sealant formulations due to their high bonding strength, high durability, and high chemical resistance. They are well fitted for use in the structural bonding and sealing of indoor and outdoor materials due to their ability to increase flexibility, thermal stability, and weathering resistance. The growing imperative for lightweight materials and energy-efficient designs (especially for electric vehicles and modern infrastructure projects) drives the need for adhesive systems technology.

Polyetheramine Market Regional Outlook:

Asia Pacific Polyetheramine market held the largest market share, around 47.23%, in 2024. It is owing to rapid industrialization, increasing infrastructure projects, and an upsurge in demand of principal end-use sectors including construction, automotive, electronics, and wind energy. In Asia Pacific, nations, such as China, India, South Korea, and Japan are currently seeing high opportunities in coatings, adhesives, and composites applications, which are all key applications for polyetheramines. Additionally, large-scale manufacturing is facilitated by leading chemical manufacturers, with lower production costs supported by low-cost raw material availability in the region. Furthermore, the growing government investments in renewable energy and smart infrastructure, and the increasing awareness towards sustainable and high-performance materials, have majorly driven the growth of the polyetheramine market in Asia Pacific.

In June 2024, Huntsman Corporation opened a new plant name JEFFAMINE polyetheramine plant on Jurong Island, Singapore. This plant has an annual capacity of 16,000 tonnes, and it is the first plant in the Asia Pacific region.

North America Polyetheramine market held a significant share and is the fastest-growing segment over the forecast period. The growth is driven by the established manufacturing ecosystem, R&D infrastructure, and environmental regulations leading to higher adoption of polyetheramines, which have low-VOC high-performance, and are endogenous to the area. They are widely used in epoxy coatings, adhesives, sealants, and fuel additives, and continue to grow consistently as a result of rising infrastructure growth, clean energy projects, and automotive developments. The raw end of the North America polyetheramine market is left by the presence of top-notch chemical manufacturers like Huntsman Corporation and Dow Chemical, amongst others, along with new investment follies in green technologies and green materials, which further buttress this regional segment's key position on the global scene.

The U.S Polyetheramine market size was USD 215.74 million in 2024 and is expected to reach USD 432.24 million by 2032 and grow at a CAGR of 9.07% over the forecast period of 2025-2032. The growth is driven by the presence of established industrial base, strong demand for high-performance materials in a wide range of applications, and strong focus on sustainability and innovation. Polyetheramines are widely used in these applications in epoxy coatings, adhesives, sealants, and fuel additives in refined construction, automotive, aerospace, and energy sectors of the country. Given the need for durability, chemical resistance, and environmental compliance, these sectors rely on the benefits of polyetheramines. Furthermore, the increasing U.S. governmental focus on minimizing VOC emissions and promoting lower toxicity alternatives has also spurred growth in applications consuming polyetheramines.

Europe held a significant market share during the forecast period owing to the growing attention toward sustainability, energy efficiency, and innovation in materials science in the region. The continued market growth can mainly be attributed to the increasing use of polyetheramines in epoxy coatings, adhesives, sealants, and composites in various application segments, particularly automotive, construction, and wind energy. The shift toward polyetheramine-based formulations has been further accelerated by European regulations that favor low-VOC and environmentally friendly chemicals, such as REACH and the EU Green Deal. Moreover, key manufacturers near the region, coupled with continued investments into research and production capabilities, have reinforced the region's importance for the supply chain of high-performance sustainable materials as well. The convergence of regulatory, industry, and environmental priorities has ensured Europe's leadership position in the global polyetheramine market over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Polyetheramine Market Companies are:

The major Polyetheramines companies are Huntsman Corporation, BASF SE, Clariant AG, Wuxi Acryl Technology Co., Ltd., Yangzhou Chenhua New Materials Co., Ltd., Yantai Minsheng Chemicals Co., Ltd., IRO Group Inc., The Aurora Chemical Co., Ltd., Yantai Dasteck Chemicals Co., Ltd., and Zibo Dexin Lianbang Chemical Industry Co., Ltd.

Recent Developments:

-

In August 2024, Shandong Longhua New Materials Co. accomplished the polyether and polyetheramine upgrading/transformation project to 1milliont/y of polyether product capacity with polyetheramine as a major product.

-

In December 2023, BASF SE finalized a capacity expansion for specialty amines, including polyetheramines (Baxxodur) and amine catalysts (Lupragen) at its Geismar, Louisiana, facility to support North America markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.19 Billion |

| Market Size by 2032 | USD 2.20 Billion |

| CAGR | CAGR of 7.92% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Monoamine, Diamine, and Triamine) •By Applications (Polyurea, Fuel Additives, Composites, Epoxy Coatings, Adhesives & Sealants, and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Huntsman Corporation, BASF SE, Clariant AG, Wuxi Acryl Technology Co., Ltd., Yangzhou Chenhua New Materials Co., Ltd., Yantai Minsheng Chemicals Co., Ltd., IRO Group Inc., The Aurora Chemical Co. Ltd., Yantai Dasteck Chemicals Co., Ltd., Zibo Dexin Lianbang Chemical Industry Co., Ltd. |