Ionic Liquids Market Key Insights:

The Ionic Liquids Market size was valued at USD 50.8 Million in 2023. It is expected to grow to USD 110.5 Million by 2032 and grow at a CAGR of 9.00% over the forecast period of 2024-2032.

The ionic liquids market is gaining a lot of popularity in different chemical processing applications as they are used in different fields which is increasing their market. In particular, their unique characteristics like low vapor pressure, high thermal stability, and tunable viscosity enable them to behave as solvents, catalysts, electrolytes, and reaction media for various applications. ILs were reported to increase the efficiency and yield of organic synthesis reactions by up to 30% over traditional solvents, according to a U.S. Department of Energy report.

Get more information on Ionic Liquids Marke - Request Sample Report

Ionic liquids are viewed as modern electrolytes in advanced battery systems, specifically in electrochemistry. With the U.S. Energy Information Administration (EIA) estimating that demand for advanced batteries will grow by 18% in 2030, these figures suggest a key role for ILs to help meet this burgeoning demand. In separation processes, ILs have proven to be particularly useful as extractive agents for target compounds.

Ionic liquids (ILs) have become popular in separation technology because of their great selectivity towards broad solutes and their extreme efficiency as solvents for a variety of separation and purification processes. These are ever more used for the extraction of precious metals mainly lithium and rare earth elements that obtained great importance for electronics and renewable energy technologies. For example, research shows an IL can recover over 90% of metal, which is a greener solution than traditional approaches. ILs also serve as effective desulfurization agents by more than 90%, thus meeting the strict environmental standards for reducing sulfur from fuels.

Such green strategies are essential in combating air pollution according to the U.S. Environmental Protection Agency (EPA). Additionally, ILs are also used to extract toxic substances from industrial waste streams thus improving waste management but with a lower environmental impact. The increasing industrial interest in ionic liquids for sustainable and efficient separation methods drives their development. With government-induced funding and handling of green technology projects, this trend is further solidified leading to innovation and adoption of ILs in multiple applications such as petrochemicals, mining, and wastewater treatment.

Market Dynamics

Drivers

-

Growing demand for renewable energy and electronics drives the market growth.

ionic liquids market is expected to see substantial growth owing to the increased use of renewables and improvements in electronics, particularly energy storage and electrochemical devices. The U.S. Department of Energy has ambitious goals to achieve a 100% clean electricity sector by 2035 as that is the course for global energy policies towards sustainability. Owing to their superior ionic conductivity and thermal stability, ionic liquids are being paid greater attention when used as electrolytes in batteries and supercapacitors which can improve the electrochemical performance of energy storage devices. One of the main causes of this increase is the incorporation of renewable energy, i.e., wind and solar power, that requires storage to balance intermittency on both sides of supply and demand.

Moreover, the electronics industry is also experiencing rapid growth the Consumer Technology Association projects that the global market for electronic devices will be USD 1.2 trillion by 2026. In electronics, the capability of ionic liquids from organic light-emitting diodes (OLEDs) to solar cells will continue to bolster their position in enabling the move towards a low-carbon economy.

Restraint

-

Thermal stability and decomposition issues may hamper the market growth.

Thermal stability is one of the key physical properties that can determine polymer ionic liquids (PILs) industrial feasibility, but the high-temperature thermal decomposition of some ILs limits this application. Although there are many ILs that can stand high temperatures, some formulations may decompose under thermal stress to emit VOC or other undesirable byproducts. Such decomposition can affect not only the stability of the ionic liquid but also an effective role in processes with massive temperature transportation as high-temperature reactions or energy storage systems. In catalysis or electrochemistry applications where temperature requires constant monitoring, the instability of certain ILs can adversely affect their application scope while also causing problems during operation. This means that parts of the industries that rely on high-temperature processing may take a more cautious approach toward the use of ionic liquids and will possibly seek more thermally stable alternatives.

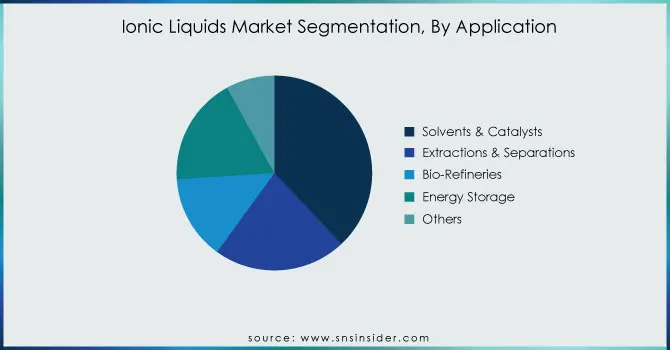

Market Segmentation Analysis

By Application

Solvents & Catalysts held the largest market share around 38% in 2023. This is due to the unique properties and versatile applications of ionic liquids to play such roles. Ionic liquids are particularly promising as solvents due to their near-zero vapor pressure, helping to mitigate emissions and improve safety in industrial processes. With tunable physicochemical properties, they can be engineered to serve a particular purpose; hence, formulating a solvent for miscellaneous organic/ inorganic compounds to dissolve in, as well as participating in or influencing the reactions and increasing yield. Ionic liquids function as effective mediums in catalysis, stabilizing reactive intermediates more selectively and often operating under milder conditions than standard solvents. These two factors, combined with their ability to solubilize both reactants and catalysts and provide a reaction environment that minimizes side reactions, make them fully dominate in this area.

|

Segment |

Description |

Key Applications |

|---|---|---|

|

Solvents |

Ionic liquids are used in extraction, purification, and synthesis. |

Chemical manufacturing, pharmaceuticals |

|

Catalysts |

Ionic liquids are utilized to enhance reaction rates and selectivity. |

Petrochemical refining, organic synthesis |

|

Electrolytes |

Ionic liquids are employed in batteries and fuel cells. |

Energy storage, electrochemical devices |

|

Other Applications |

Other niche uses in fields like lubricants and separation processes. |

Specialty chemicals, environmental applications |

Do You Need any Customization Research on Ionic Liquids Market - Inquire Now

Regional Analysis

North America region held the highest market share around 43% in 2023. The region has a setup of chemical industry which is continuously evolving its promotional profile by implementing innovative solutions to make things more resource-efficient and eco-friendly. The presence of several prominent academic and research institutions facilitates the collaboration between industry and academia, supporting new formulations as well as applications of ionic liquids in pharmaceuticals, energy storage, or catalysis. In addition, strict U.S. regulations for volatile organic compounds (VOCs) by the Environmental Protection Agency (EPA) are pushing the industry toward greener alternatives such as ionic liquids to meet safety and environmental regulations. The Biden administration, via the U.S. Department of Energy (DOE), hopes to see the nation have a 100% clean electricity sector nationwide by 2035 the government is going big on alternative energy solutions. As such, we expect these ionic liquids to continue growing in the North American region as the innovation capabilities of companies are complemented by this offshore regulatory environment.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (Basionic BC01, Basionic ST80)

-

Solvay S.A. (Cyphos IL 101, Cyphos IL 104)

-

Merck KGaA (EMIM BF4, BMIM PF6)

-

Ionic Liquids Technologies GmbH (IoLiTec) (IoLiLyte 101, IoLiLyte 110)

-

Proionic GmbH (Trihexyltetradecylphosphonium chloride, Ethylammonium nitrate)

-

Evonik Industries AG (TEGO IL X-101, TEGO IL K-102)

-

Strem Chemicals, Inc. (1-Butyl-3-methylimidazolium chloride, 1-Ethyl-3-methylimidazolium acetate)

-

The Chemours Company (Ionicool LTM-210, Ionicool LTM-300)

-

Tatva Chintan Pharma Chem Pvt. Ltd. (1-Butyl-3-methylimidazolium bis(trifluoromethylsulfonyl)imide, 1-Ethyl-3-methylimidazolium tetrafluoroborate)

-

Reinste Nano Ventures Pvt. Ltd. (1-Butyl-3-methylimidazolium bromide, 1-Ethyl-3-methylimidazolium trifluoromethanesulfonate)

-

Solvionic (EMIM OAc, BMIM Cl)

-

Scionix Ltd. (Choline Geranate, Choline Chloride)

-

Sigma-Aldrich Corporation (Merck Group) (1-Butyl-3-methylimidazolium tetrafluoroborate, 1-Hexyl-3-methylimidazolium hexafluorophosphate)

-

Tatvachintan Pharma Chem Pvt. Ltd. (1-Ethyl-3-methylimidazolium chloride, 1-Butyl-3-methylimidazolium methyl sulfate)

-

E-Ionic GmbH (Triethylammonium bis(trifluoromethylsulfonyl)imide, 1-Butyl-1-methylpyrrolidinium dicyanamide)

-

Emulsar Chemicals (BMIM BF4, BMIM Cl)

-

Zhejiang Lanke High-Purity Materials Co., Ltd. (LIPON IL-101, LIPON IL-103)

-

Green Performance Materials (GPM) Ltd. (BMIM TFSI, BMIM Ac)

-

Rhodia (Ammonium nitrate-based ILs, Phosphonium-based ILs)

-

Thermo Fisher Scientific (1-Ethyl-3-methylimidazolium ethyl sulfate, 1-Butyl-3-methylimidazolium hexafluorophosphate)

Recent Developments:

-

In 2023, BASF launched a new range of ionic liquids designed for use in sustainable and efficient processes, particularly in the field of green chemistry. This product line aims to provide solutions for chemical synthesis and separation processes, highlighting the company's commitment to sustainable innovation.

-

In 2022, Solvay introduced a novel ionic liquid platform that enhances the performance of lithium-ion batteries. This development focuses on improving the thermal stability and safety of electrolytes used in energy storage applications, addressing the growing demand for high-performance batteries in electric vehicles and renewable energy systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 50.8 Million |

| Market Size by 2032 | US$ 110.5 Million |

| CAGR | CAGR of 9.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Solvents & Catalysts, Extractions & Separations, Bio-Refineries, Energy Storage, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Solvay S.A., Merck KGaA, Ionic Liquids Technologies GmbH (IoLiTec), Proionic GmbH, Evonik Industries AG, Strem Chemicals, Inc., The Chemours Company, Tatva Chintan Pharma Chem Pvt. Ltd., Reinste Nano Ventures Pvt. Ltd., Solvionic, Scionix Ltd., Sigma-Aldrich Corporation (Merck Group), Tatvachintan Pharma Chem Pvt. Ltd., E-Ionic GmbH, Emulsar Chemicals, Zhejiang Lanke High-Purity Materials Co., Ltd., Green Performance Materials (GPM) Ltd., Rhodia, Thermo Fisher Scientific. Others |

| Key Drivers | •Growing demand in renewable energy and electronics drives the market growth. |

| Restraints | •Thermal stability and decomposition issues may hamper the market growth. |