Adipic Acid Market Report Scope & Overview:

The Adipic Acid Market was valued at USD 5.98 billion in 2025E and is expected to reach USD 8.24 billion by 2033, growing at a CAGR of 4.09% from 2026-2033.

Get E-PDF Sample Report on Adipic Acid Market - Request Sample Report

The adipic acid market growth is driven primarily by its extensive use in the production of nylon 6,6, polyurethane foams, and plasticizers. Adipic acid is a versatile compound, valued for its role in improving durability, flexibility, and performance in various applications. Key industries fueling its demand include automotive, textiles, packaging, and construction. A significant trend in the market is the growing emphasis on sustainability. With rising environmental concerns, manufacturers are increasingly focusing on bio-based adipic acid production methods to reduce carbon emissions and dependency on fossil fuels.

Adipic Acid Market Size and Forecast

-

Market Size in 2025E: USD 5.98 Billion

-

Market Size by 2033: USD 8.24 Billion

-

CAGR: 4.09% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Adipic Acid Market Trends

-

Rising demand from the automotive, packaging, and textile industries is driving the adipic acid market.

-

Growing use in nylon 6,6 production for fibers, engineering plastics, and automotive components is boosting growth.

-

Expansion of coatings, resins, and polyurethane applications is fueling market adoption.

-

Advancements in sustainable and bio-based production methods are shaping market trends.

-

Increasing industrialization and infrastructure development in emerging economies are supporting demand.

-

Focus on regulatory compliance and environmental standards is influencing production and supply chains.

-

Collaborations between chemical manufacturers, end-use industries, and technology providers are accelerating innovation and global market expansion.

Adipic Acid Market Growth Drivers:

-

Adipic acid is essential for producing nylon 6,6, with rising demand driven by its widespread use in automotive, textile, and industrial applications.

Adipic acid serves as a vital raw material in the production of nylon 6,6, a versatile polymer extensively utilized in various industries. The automotive sector relies on nylon 6,6 for manufacturing lightweight, durable components such as air intake manifolds, radiator end tanks, and fuel system parts, contributing to improved vehicle efficiency and performance. Simultaneously, the textile industry employs nylon 6,6 in producing high-strength fibers for garments, upholstery, and industrial fabrics. The growing demand for durable, lightweight materials in automotive applications and the increasing consumer preference for high-quality textiles are key factors driving the demand for nylon 6,6. This, in turn, propels the adipic acid market, as it is indispensable in the polymer’s production process.

Adipic Acid Market Restraints:

-

Adipic acid production emits nitrous oxide, a potent greenhouse gas, posing environmental challenges and driving the need for sustainable alternatives.

The conventional production of adipic acid, primarily through the oxidation of cyclohexane, generates significant emissions of nitrous oxide (N₂O), a greenhouse gas with a global warming potential approximately 300 times greater than carbon dioxide (CO₂). This has raised substantial environmental concerns, as N₂O emissions contribute to climate change and ozone layer depletion. Regulatory authorities worldwide are increasingly imposing strict environmental regulations to limit these emissions, creating challenges for manufacturers to comply while maintaining cost-effectiveness. Additionally, the growing emphasis on sustainability has led to mounting pressure on the chemical industry to adopt cleaner, greener production methods.

Adipic Acid Market Segment Analysis

By Product, Nylon 6,6 Fiber segment dominated the Market and is also the fastest-growing segment

Nylon 6,6 Fiber segment dominated with the market share over 54% in 2025, which holds the largest market share, driven by its high demand in industries such as automotive and textiles. This segment is also the fastest-growing due to the increasing need for durable and lightweight materials. The Nylon 6,6 Resin segment also holds a significant share, with applications in engineering plastics and automotive components. While other segments, such as Adipate Esters and Polyurethane, contribute to the market, the growth and dominance of the Nylon 6,6 Fiber segment are the most notable in the adipic acid market.

By End-user Industry, Automotive segment dominated the Market in 2025

The automotive segment significantly drives the demand for adipic acid, primarily used in producing nylon 66, a strong and durable polymer. Nylon 66 is crucial for automotive applications such as tire cords, airbags, and engine components due to its resistance to abrasion and high-performance characteristics. The growing demand for lightweight, durable materials in vehicles further accelerates adipic acid consumption in this sector. As automotive manufacturers continue to focus on enhancing vehicle safety, fuel efficiency, and performance, adipic acid's role in producing essential components, such as airbags and tire cords, continues to grow, reinforcing its importance in the industry.

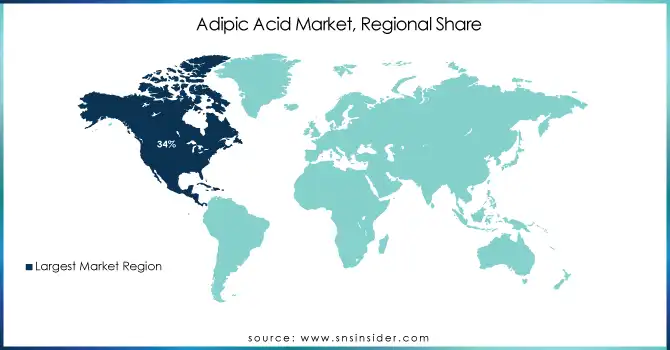

Adipic Acid Market Regional Analysis

North America Adipic Acid Market Insights

North America region dominated with the market share over 34% in 2025. This market leadership can be attributed to the region’s robust manufacturing infrastructure, which allows for the efficient production of adipic acid to meet increasing demand across various industries. The region’s commitment to research and development (R&D) plays a crucial role in its market dominance, as significant investments in technological innovations and advanced manufacturing processes have resulted in higher production efficiency and improved product quality. North America’s focus on sustainable and cost-effective production methods also enhances its competitive edge. Additionally, the presence of key players in the automotive, textile, and chemical sectors further strengthens the region's position.

Asia Pacific Adipic Acid Market Insights

The Asia Pacific region is expected to witness significant growth in the Adipic Acid Market during the forecast period. This growth is primarily driven by rapid urbanization, an expanding population, and a significant rise in the demand for consumer goods. As economies in this region continue to develop, there is an increasing need for textiles, automotive components, and packaging materials key sectors that rely heavily on adipic acid. The chemical is a critical raw material in the production of nylon, polyester, and polyurethane, all of which are used extensively in these industries. The growing demand for these materials in both established and emerging markets, coupled with the region’s manufacturing capabilities, is propelling the demand for adipic acid.

Europe Adipic Acid Market Insights

The Europe Adipic Acid Market is witnessing steady growth driven by rising demand for nylon, polyamides, and specialty polymers across automotive, textile, and industrial sectors. Increasing adoption of bio-based and eco-friendly adipic acid solutions supports sustainability initiatives. Growing investments in high-performance plastics and engineering polymers, coupled with expanding end-use industries, are fueling market expansion. Regulatory emphasis on environmental compliance further accelerates the shift toward greener production methods.

Middle East & Africa and Latin America Adipic Acid Market Insights

The Middle East & Africa and Latin America Adipic Acid Market is growing steadily due to rising demand for nylon, polyamides, and performance polymers in automotive, construction, and textile industries. Increasing industrialization, infrastructure development, and chemical manufacturing investments are driving market adoption. Growing focus on sustainable and bio-based adipic acid production, coupled with expanding end-use applications, supports market expansion across both regions, enhancing production efficiency and meeting environmental compliance requirements.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Adipic Acid Market Competitive Landscape:

LANXESS

LANXESS is a specialty chemicals company headquartered in Germany, producing high-performance chemicals and intermediates for automotive, construction, and industrial applications. The company emphasizes innovation in sustainable chemistry, efficient production processes, and market-driven solutions. Its portfolio spans polymers, specialty additives, and advanced intermediates, supporting global industrial supply chains. LANXESS focuses on balancing profitability with environmental responsibility, adapting to raw-material fluctuations, and maintaining a competitive edge in key chemical markets.

-

2024: LANXESS announced a global adipic acid price increase of €250 per metric ton due to significant raw-material cost rises.

BASF SE

BASF SE, headquartered in Ludwigshafen, Germany, is the world’s largest chemical company, offering products across chemicals, materials, agricultural solutions, and performance products. The company focuses on sustainable innovation, digital transformation, and value chain optimization. BASF invests in renewable feedstocks, circular economy initiatives, and efficiency-driven production processes to reduce emissions and costs while strengthening global competitiveness. Its vertical integration in polymers, intermediates, and specialty chemicals supports diversified industrial markets worldwide.

-

2024: BASF announced structural adjustments at its Ludwigshafen site, including the closure of adipic acid production by the end of 2025 to improve profitability under changing market conditions.

-

2025: BASF moved to acquire DOMO Chemicals’ 49% share in the Alsachimie JV, enhancing its vertical integration in adipic acid and PA 6,6 precursor production.

Ascend Performance Materials

Ascend Performance Materials is a global manufacturer of nylon 6,6, polyamide intermediates, and performance chemicals. Headquartered in the U.S., the company focuses on sustainable materials, low-carbon production, and innovative chemical processes for automotive, electronics, and industrial applications. Ascend invests in bio-circular feedstocks, emissions reduction technologies, and energy efficiency to advance green chemistry. Its vertically integrated approach ensures quality, scalability, and sustainability across the nylon 6,6 supply chain.

-

2023: Ascend started operating a thermal reduction unit (TRU) at its Pensacola plant, cutting over 98% of GHG emissions in adipic acid production.

-

2024: Ascend produced bio-circular adipic acid from used cooking oil, reducing the carbon footprint of its nylon 6,6 precursor.

INVISTA

INVISTA, a subsidiary of Koch Industries, is a global leader in polymers and fibers, including nylon, spandex, and polyester. The company emphasizes sustainable production, responsible sourcing, and innovation in high-performance materials for apparel, automotive, and industrial markets. INVISTA invests in certification programs, bio-feedstocks, and process efficiency to ensure environmentally responsible operations while meeting the growing demand for performance polymers and intermediates. Its global footprint supports flexible manufacturing and market access.

-

2025: INVISTA expanded its ISCC PLUS certification program, confirming its adipic acid production sites (Kingston, Victoria) for sustainable, mass-balance bio-feedstocks.

Solvay

Solvay is a Belgian-based advanced materials and specialty chemicals company serving automotive, aerospace, electronics, and consumer markets. It emphasizes sustainable chemistry, innovation in high-performance polymers, and carbon-neutral solutions. Solvay’s portfolio includes materials for mobility, energy transition, and industrial applications, with a focus on minimizing environmental impact. The company develops carbon-neutral and circular chemical solutions, ensuring product quality, regulatory compliance, and alignment with global sustainability targets.

-

2023: Solvay’s Rhodia business introduced a carbon-neutral adipic acid under the Rhodia brand, showcased at ABRAFATI 2023 in Brazil.

Key Players

Some of the Adipic Acid Market Companies

- LANXESS (High-performance plastics, nylon intermediates)

- BASF SE (Adipic acid for polyamide production, resins, and coatings)

- Ascend Performance Materials (Nylon 6,6 polymers, adipic acid for industrial applications)

- INVISTA (Adipic acid for polymers, engineering resins)

- Asahi Kasei Corporation (Adipic acid for polyamides, textiles, and synthetic rubbers)

- Radici Partecipazioni S.p.A. (Adipic acid for technical fibers, resins)

- DOMO Chemicals (Adipic acid for polyamide intermediates, performance polymers)

- Solvay (Adipic acid for eco-friendly polyamides, advanced materials)

- Sumitomo Chemical Co., Ltd. (Adipic acid for plastics, fibers, and chemical intermediates)

- Liaoyang Tianhua Chemical Co., Ltd. (Adipic acid for polyamides and coatings)

- Rennovia Inc. (Bio-based adipic acid production technologies)

- RadiciGroup (Adipic acid for synthetic fibers and engineering polymers)

- Shandong Haili Chemical Industry Co., Ltd. (Adipic acid for nylon and industrial chemicals)

- Invista Performance Technologies (IPT) (Advanced nylon intermediates)

- DuPont (Adipic acid for polymers, elastomers, and fibers)

- Arkema (Adipic acid-based resins and intermediates)

- Evonik Industries (Adipic acid for specialty chemicals)

- Toray Industries (Adipic acid for high-performance materials)

- DSM Engineering Materials (Adipic acid for sustainable nylon production)

- OCI Nitrogen (Adipic acid for industrial applications and fertilizers)

Suppliers for (wholesale distribution of a wide variety of chemicals, including adipic acid, with a focus on high-purity) on Adipic Acid Market

- Ascend Performance Materials

- BASF SE

- INVISTA

- Shandong Haili Chemical Industry Co., Ltd.

- Chongqing Huafon Chemical Co., Ltd.

- Meru Chem Private Limited

- Paramount Chemical & Acid Corporation

- JPM Pharma & Chemicals Pvt. Ltd.

- RCI Chemsol

- Pearl Chemicals

| Report Attributes | Details |

| Market Size in 2025 | USD 5.20 billion |

| Market Size by 2033 | USD 7.46 billion |

| CAGR | CAGR of 4.09% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Nylon 6, 6 Resin, Nylon 6, 6 Fiber, Adipate Esters, Polyurethane, and Others), • By Application (Plasticizers, Wet Paper Resins, Unsaturated Polyester Resins, Food Additives, Synthetic Lubricants, Coatings, and Other Applications) • By End-user Industry (Food and Beverage, Personal Care, Electrical and Electronics, Textiles, Pharmaceuticals, Automotive, Packaging, Consumer Goods, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LANXESS, BASF SE, Ascend Performance Materials, INVISTA, Asahi Kasei Corporation, Radici Partecipazioni S.p.A., DOMO Chemicals, Solvay, Sumitomo Chemical Co., Ltd., Liaoyang Tianhua Chemical Co., Ltd., Rennovia Inc., RadiciGroup, Shandong Haili Chemical Industry Co., Ltd., Invista Performance Technologies (IPT), DuPont, Arkema, Evonik Industries, Toray Industries, DSM Engineering Materials, OCI Nitrogen. |