Advanced Elastomers Market Report Scope & Overview:

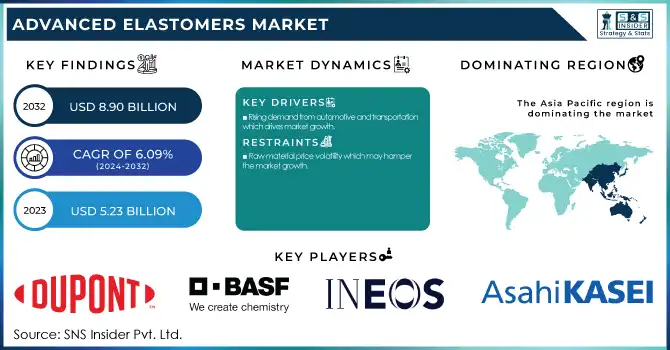

The Advanced Elastomers Market size was USD 5.23 Billion in 2023 and is expected to reach USD 8.90 Billion by 2032 and grow at a CAGR of 6.09 % over the forecast period of 2024-2032. This report provides comprehensive statistical insights and trends, covering global production capacity and utilization rates by type and region for 2023. It provides an in-depth analysis of raw material price fluctuations, supply chain dynamics, and the regulatory impact shaping the market across different countries. The report evaluates sustainability metrics, including carbon footprint, recycling initiatives, and waste management practices, highlighting the industry's shift toward eco-friendly solutions. Additionally, it examines innovation and R&D investments by key players, focusing on advancements in material performance and manufacturing technologies. The study also assesses market adoption across major end-use industries, identifying growth opportunities and regional demand variations. These insights equip stakeholders with a data-driven understanding of market trends, regulatory challenges, and competitive strategies.

To Get more information on Advanced Elastomers Market - Request Free Sample Report

Advanced Elastomers Market Dynamics

Drivers

-

Rising demand from automotive and transportation which drives market growth.

Increasing automotive and transportation demand is one of the major growth factors for the market of advanced elastomers. Specialized elastomers provided unique melting and highly flexible characteristics that made this component, and many others, better suited to function over time in the escalated demands of a vehicle. The automakers use elastomers in a variety of components, such as seals, gaskets, hoses, vibration control systems, and tires, due to their superior flexibility, strength, high-density cushion properties, and ability to retain a portion of elasticity at elevated and low ambient temperatures, as well as resistance to both industrial and automotive fluids. The transition to electric vehicles (EVs) and lightweight cars is driving the need for high-performance elastomers due to their contribution towards weight reduction, better fuel economy, and improved vehicle performance. Furthermore, the growing integration of sophisticated elastomers in noise, vibration & harshness (NVH) elimination applications also drive market growth. With governments around the world tightening emissions legislation, and manufacturers increasingly needing to achieve environmental compliance, elastomers that are sustainable and recyclable are gaining attention.

Restraint

-

Raw material price volatility which may hamper the market growth.

Fluctuation in prices of raw materials is a major factor that is expected to hinder the growth of the advanced elastomers market during the forecast period. Advanced elastomers are produced using a wide range of key essential raw materials which include raw synthetic rubber, specialty polymers, and petrochemical-based feedstocks and their prices change frequently. The cost and availability of these commodities are directly influenced by fluctuations in the price of crude oil, geopolitical crises, supply-chain constraints, and shifts in trade policies. Sudden increases in prices lead to increases in manufacturing costs making maintaining stable profit margins and competitive pricing difficult for producers. Price fluctuations also compel the manufacturers to look for different raw materials or amend their processes often resulting in delays or inconsistency in the quality of the end product.

Opportunity

-

Advancements in 3D printing & manufacturing technologies create an opportunity in the market.

The growing demand for advanced elastomers due to advancements in 3D Printing & manufacturing technologies 3D printing has allowed for the changing flexibility, durability, and precision in the performance of high-performance components, driving the market revenue. With the growing demand for customized lightweight solutions across automotive, healthcare, aerospace, and consumer electronics industries, this category is expected to significantly drive the demand for elastomer-based 3D printing materials. Thanking recent developments in additive manufacturing, the processing of thermoplastic elastomers (TPEs), liquid silicone rubber (LSR), and even other high-performance elastomers have become more beneficial, allowing the manufacturing of high-performance parts, functional prototypes, flexible seals, soft-touch components, and biomedical implants. Also, digital manufacturing innovations are increasingly ramping up production efficiency, enabling multi-material printing and developing UV-cured elastomer formulations, producing less waste, and reducing costs.

Challenges

-

Performance limitations in extreme conditions may challenge the market growth.

High-performance restrictions in adverse conditions are a major hindrance to the growth of the advanced elastomers market. Although these materials yield higher flexibility, durability, and chemical resistance than traditional forms of material, their performance may degrade under high temperature, high pressure, or aggressive chemical exposure conditions. As an example, certain elastomers have limited low-temperate properties and can lose their elasticity and be brittle, which limits their versatility for use in aerospace and cold-weather applications. On the other hand, too much heat leads to thermal degradation, which can lessen mechanical strength and shorten the service life in automotive and industrial manufacturing applications. Further, aggressive chemicals, UV radiation, and oxidative environments can cause material degradation that compromises reliability in industries such as healthcare and electronics.

Advanced Elastomers Market Segmentation Analysis

By Product Type

Thermoplastic elastomers held the largest market share around 34% in 2023. It is primarily due to the attractive combination of properties of rubber-like elasticity, the versatility of thermoplastics, the ability to be processed together with plastics, and the strength of most elastomers. Unlike conventional elastomers, TPE can be injected, and extruded, and its recycling eliminates ordering costs, which enhances their popularity in a wide range of industries. The ability to resist various chemicals, lightweight, and flexibility has led to the adoption in automotive, healthcare, and consumer and industrial applications. The Automotive sector is a major area where TPEs are replacing conventional rubber because of its contribution to fuel efficiency & super weather-resistant properties. The increasing focus on sustainability has driven insert materials like recyclables like TPEs and added fuel to the fire. As material innovation continues to improve, TPEs are poised to remain a top elastomer choice for the growing demand for high-performance, economical, and sustainable elastomers.

By Application

Insulation held the largest market share around 34% in 2023. It is due for automotive, construction, electrical, and industrial applications. High-performance elastomers have excellent thermal resistance, flexibility, and durability, making them perfect insulation for extreme environments. The automotive sector and construction sector use elastomer materials for insulation as they help in achieving high fuel efficiency and sound from vehicular to the outside environment low noise insulation elastomer materials for better sound attenuation and elastomer materials insulating products in low heat loss contribute to energy-efficient buildings. Balancing this, the development of electrification in cars and an increase in renewable energy infrastructure is bringing out a growing need for high-performance insulation materials. In addition, strict government regulations concerning energy conservation and fire safety standards are expected to propel the adoption level of advanced elastomeric insulation solutions.

By End User Industry

Industrial held the largest market share around 48% in 2023. It is owing to numerous applications in seals, gaskets, hoses, vibration dampers, and insulation materials in ultra-heavy-duty applications. Good abrasion resistance, chemical/ozone resistance, and flexibility make advanced elastomers critical materials in industrial machinery, manufacturing equipment, and process industries like oil & gas, chemical processing, and power generation. High-performance materials that can withstand extreme temperatures, pressure fluctuation & harsh chemical exposures have resulted in greater adoption of advanced elastomers in industrial applications. As a result, energy efficiency, improved operational safety and regulatory compliance have driven the use of elastomers in high-performance sealants and coatings. The industrial segment is anticipated to continue being the largest in terms of revenue share in the advanced elastomers market due to persistent industrial growth coupled with increasing demand for sustainability and longevity.

Advanced Elastomers Market Regional Outlook

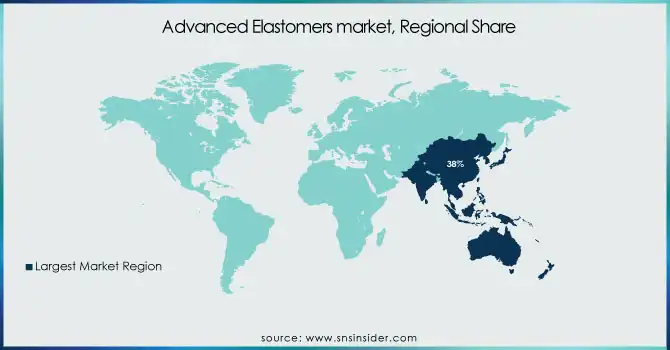

Asia Pacific held the largest market share around 38% in 2023. This is owing to its strong industrial base, rapid urbanization, and rising demand from the automotive, construction electronics, and healthcare industries. Key manufacturing hubs within the region include China, India, Japan, and South Korea, where, the large-scale production of automobiles, industrial equipment, and consumer electronics fuels the growth of the advanced elastomers market. Moreover, growth in the market has also been contributed by government initiatives providing support for infrastructure growth and expansion of industries. Increasing automotive production in the region combined with soaring progress towards EVs has led to an augmented consideration for advanced elastomers in seals, gaskets, and insulation applications. In addition to this, the Rising number of investments in medical implants, flexible electronics, and wearable devices also contributes to the growth of the healthcare sector in turn making the Asia-Pacific market high as well. A well-developed supply chain, cheap production and increasing investments in R&D are the major driving forces that will help this region maintain the leading position in the advanced elastomers market throughout the next decades.

North America held a significant market share in 2023. The rise of innovation and adoption of high-performance elastomers as a result of major manufacturers and R&D center presence in the U.S. and Canada Moreover, high regulatory standards for safety, emissions, and sustainability are driving the need for long lasting, rugged elastomers for automotive and industrial applications. Increasing emphasis on electric vehicles (EVs), renewable energy infrastructure, and advanced medical devices has further fueled the market growth. North America maintains a considerable share of the global advanced elastomers market; driven by technological innovation, high-quality manufacturing, and sustainability initiatives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

DuPont de Nemours, Inc. (Viton fluoroelastomers, Kalrez perfluoro elastomer parts)

-

BASF SE (Elastollan thermoplastic polyurethane elastomers, BUNA EP elastomers)

-

INEOS (SYNTHENE polybutadiene rubber, Keltan EPDM)

-

Asahi Kasei Corporation (Tufdene styrene-butadiene rubber, Asaflex thermoplastic elastomers)

-

LANXESS AG (Keltan EPDM, Therban HNBR)

-

Huntsman Corporation (IROGRAN TPU, AVALON TPU)

-

LG Chem (SEETEC polypropylene elastomers, LUPOY polycarbonate resins)

-

Mitsui Chemicals, Inc. (TAFMER polyolefin elastomers, MILASTOMER thermoplastic elastomers)

-

JSR BST Elastomer Co., Ltd (S-SBR rubber, E-SBR rubber)

-

Zeon Chemicals L.P. (Nipol nitrile rubber, HyTemp polyacrylate elastomers)

-

Kuraray Co., Ltd. (SEPTON styrene block copolymers, HYBRAR thermoplastic elastomers)

-

Wacker Chemie AG (ELASTOSIL silicone rubber, SILPURAN silicone elastomers)

-

ExxonMobil (Vistalon EPDM rubber, Santoprene TPV)

-

Arkema (Pebax thermoplastic elastomers, Kynar fluoropolymers)

-

Celanese Corporation (Forprene thermoplastic elastomers, Riteflex thermoplastic polyester elastomers)

-

Trinseo (SYNTHOS synthetic rubber, MAGNUM ABS resins)

-

SABIC (LEXAN polycarbonate resins, ULTEM polyetherimide resins)

-

Rogers Corporation (PORON polyurethane foams, BISCO silicone materials)

-

Hutchinson SA (Body sealing systems, Vibration control systems)

-

AGC Inc. (Fluon ETFE, AFLAS fluoroelastomers)

Recent Development:

-

In March 2024, Dow launched a new artificial leather made from polyolefin elastomers (POE). This innovation supports the automotive industry's move toward animal-free materials. The development aligns with sustainability trends and enhances vehicle interior options.

-

In May 2023, Borealis introduced a range of circular plastomers and elastomers derived from renewable feedstock. The portfolio includes Stelora, an innovative engineering polymer designed for advanced applications. This launch supports sustainability and high-performance material solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.23 Billion |

| Market Size by 2032 | US$ 8.90 Billion |

| CAGR | CAGR of 6.09 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Thermoplastic Elastomers, Silicon Elastomers, Fluorinated Elastomers, EPDM, Others) • By Application (Insulation, Implants, Flexible Circuits, Connectors, Others), • By End Use Industry (Industrial, Aerospace & Defense, Medical, Electronics & Electrical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGC Inc., AkzoNobel N.V., Shin-Etsu Chemical Co., Ltd., Gujarat Alkalies and Chemical Limited, Nouryon, Occidental Petroleum Corporation, KEM ONE, INEOS Group, Dow Chemical Company, Tokuyama Corporation, SRF Limited, Ercros, Jinling Group, Juhua Chemical, LUXI Chemical, Dongyue, Jiangsu Meilan Chemical, Lee & Man Chemical, Dahai-Group, CHC |