Consumer Network Attached Storage Market Size & Analysis:

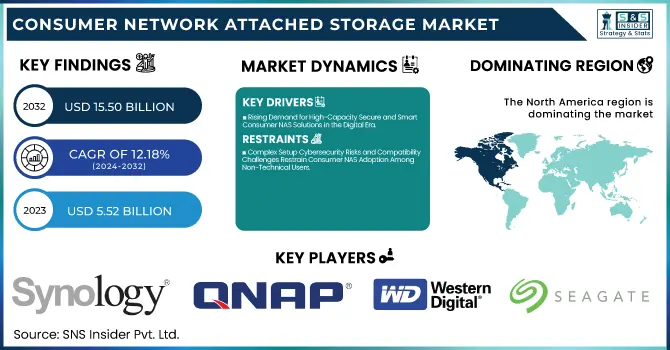

The Consumer Network Attached Storage Market Size was valued at USD 5.52 Billion in 2023 and is expected to reach USD 15.50 Billion by 2032 and grow at a CAGR of 12.18% over the forecast period 2024-2032. Software integration is reaching new levels, allowing for cloud sync, AI file sorting, and mobile apps within the Consumer Network Attached Storage (NAS market). On the Storage utilization side, NAS needs are set to soar due to increased personal data creation, particularly in high-capacity needs. You can tell that users prioritize experience and satisfaction, where they very quickly prefer features that allow for the following: the UX is intuitive and user-friendly, accessible remotely, and automated backups. Performance and reliability: still a top priority, especially with faster transfer speeds and concern for energy consumption and security (encryption, multi-factor authentication). The combined appeal of NAS' affordability, safety, and scalability is speeding up adoption as it becomes more user-friendly, faster, and fits right into the complete smart home experience.

To Get more information on Consumer Network Attached Storage Market - Request Free Sample Report

Consumer NAS Market Dynamics

Key Drivers:

-

Rising Demand for High-Capacity Secure and Smart Consumer NAS Solutions in the Digital Era

The demand for high-capacity, secure, and cost-effective personal and small business storage solutions are the factors leading to the growth of the Consumer Network Attached Storage (NAS) market. The growth of digital content, including 4K/8K videos, high-resolution images, and gaming data has caused an increase in NAS volume, resulting in a need for multiple bays. Moreover, growing applications of smart home devices, IoT applications, and home security systems are driving the need for continuous access, and dependable storage. Features like AI-based data management, automatic backups, and remote access have made consumer NAS solutions more attractive by far. In addition, the increasing worry about data privacy and security breaches in cloud storage services simply drives more and more users to choose local NAS storage as a safer alternative.

Restrain:

-

Complex Setup Cybersecurity Risks and Compatibility Challenges Restrain Consumer NAS Adoption Among Non-Technical Users

One of the biggest pain points in Consumer NAS is having a complicated setup and management process for non-technical users. NAS devices are comparatively involved; they need to be configured on a network, set up in RAID, and managed on an ongoing basis, which scares away many casual consumers who are used to plug-and-play external hard drives. Moreover, smooth use between various devices and operating systems is a moot point as end-users want them to be integrated as easily as possible with Windows, Mac, smartphones, and smart TVs. The vulnerability of NAS devices to various cybersecurity risks such as ransomware, data breaches, or unauthorized access when they are connected to the internet is an additional major restraint. Because most consumers do not know how to enforce firewall rules, hold encryption keys, or regularly update firmware, their NAS systems can be easily attacked.

Opportunity:

-

AI-powered SSD NAS Hybrid Cloud and Subscription Models Unlock Growth Opportunities in Consumer Storage

With SSD-based NAS, AI-based data optimization, and energy-efficient storage solutions, there are several market opportunities to explore here. We have also observed a rising trend in the hybrid cloud NAS solutions, which is a solution with both local and cloud storage and this one has a huge prospect for growth. Due to the rise in high-speed internet penetration and ongoing digital transformation programs, growing adoption will be expected from the emerging Asia-Pacific region. Further, the emergence of subscription-based NAS solutions and NAS-as-a-Service (NaaS) models provides another avenue for vendors to monetize, while decreasing costs for users looking at consumer NAS solutions.

Challenges:

-

Connectivity Limitations Scalability Issues and Low Awareness Hinder Consumer NAS Adoption and Market Growth

Limited high-speed connectivity options in some areas also make cloud-integrated NAS and remote-access NAS solutions less effective. Accessing their NAS remotely may cause lag or data transfer problems for users in places with slow broadband speeds or poor internet access. Limitations can also appear with storage scalability on entry-level NAS devices, as some low-end devices support neither drive expansion nor easy upgrades. Finally, the overall consumer mindset that has yet to consider the benefits of NAS over conventional storage solutions leads to limited market traction and significant education and marketing efforts needed by the vendor community.

Consumer Network Attached Storage (NAS) Market Segments Analysis

By Design

In 2023, the 4-Bays segment held the largest share of the Consumer Network Attached Storage (NAS) market at 26.6%, thanks to its well-rounded performance in storage capacity and price that suits home users and small businesses. Today it is still one of the most popular solutions for media streaming, data backup, and personal cloud storage.

The 2-Bays segment is expected to witness the fastest CAGR during 2024-2032, owing to high demand for budget-friendly, entry-level NAS platforms. This is attractive due to the simple RAID setup, small form factor, and rising usage of home users and freelancers, who want reliable local storage to replace cloud services.

By Mount Type

The standalone segment led the Consumer Network Attached Storage (NAS) market in 2023, capturing 63.6% of the market share, and is projected to grow at the fastest CAGR throughout 2024-2032. The growth is attributed to its user-friendliness, plug-n-play, and no-installation required features, making it a perfect fit for home users and small businesses. High, standalone NAS devices having high storage, remote access, and data security reduce dependency on the cloud. The growing consumption of digital content, increasing data privacy concerns, and growth in smart home and IoT applications are additional factors contributing to the high demand for standalone NAS solutions globally.

By Storage Type

The Consumer Network Attached Storage (NAS) market by storage type was led by the Hard Disk Drive (HDD) segment in 2023, accounting for 62.2% share by value during the year owing to their low cost, high storage capacity, and high availability. Although slower than SSD, HDD-powered NAS is a popular option for budget-oriented consumers and businesses that need mass data storage.

The hybrid segment is projected to grow at the fastest CAGR during 2024-2032, owing to surging demand for improved performance efficiency, reliability, and energy efficiency. Hybrid NAS mixes HDD and SSD performance, which best serves applications needing fast access and large storage size.

By Storage Capacity

The 1 TB to 20 TB segment had the largest market share of 60.6% in 2023 and is expected to witness the highest CAGR during the forecast period. This growth is attributed to the growing need for high-capacity and affordable storage solutions among home and small business users. Due to the increased use of 4K/8K videos, gaming data, and personal cloud storage, users gravitate toward NAS devices that can scale over time while also providing data backup protection. In addition, the tailwind of remote work, smart home use cases, and multimedia streaming continue to drive adoption for NAS solutions from 1TB to 20.

By Deployment

The On-Premise segment led the Consumer Network Attached Storage (NAS) market in 2023 with a 48.7% share, attributed to the growing requirement for high-performance and secure on-premise storage solutions. On-premise NAS offers several advantages that many users look for, such as data privacy, direct access speed, and less dependence on internet connection.

Hybrid segment to be the fastest growth by 2024-2032. The hybrid sector allows the public to have its cake and eat it too, offering both the safety and security of on-premise storage and the flexibility of cloud in one combined segment. This tends to be well received by consumers and businesses looking for remote access, automated backups, and greater scalability, and hybrid NAS continues to be a major driver for future market growth.

By End Use

In 2023, the Consumer Network Attached Storage (NAS) market was led by the Business segment, which accounted for a share of 57.3%, due to the increasing adoption of secure, scalable, and high-capacity storage solutions among small and medium enterprises (SMEs). Comparing all these usages NAS is used by businesses for data backup, file sharing, and collaboration tasks that ensure smooth data workflow.

The fastest CAGR from 2024-2032 is likely to be in the Residential segment, due to the growing digital content consumption and smart home integration followed by a significant rise in personal cloud storage. As public cloud services face growing criticism over data privacy, more homeowners are turning to NAS for private, affordable storage.

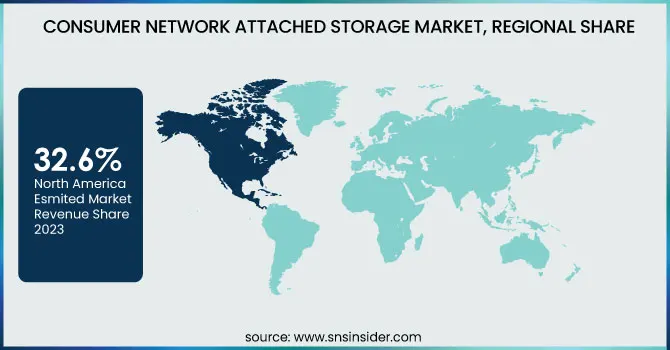

Consumer NAS Market Regional Outlook

In 2023, North America led the Consumer Network Attached Storage (NAS) market with a 32.6% share due to high adoption of advanced storage solutions, and heightened data security awareness, coupled with high penetration of key NAS vendors in the region. Growing smart home adoption, robust internet infrastructure, and increased need for data backup will further drive the regional market growth. In the U.S. and Canada, established brands such as Synology, Western Digital, and QNAP dominate the consumer landscape, supplying a diverse array of NAS solutions for home and commercial use. As an example, Synology DiskStation models are unbelievably popular amongst U.S. small businesses for secure file sharing, remote access, and data backup since they provide sensible storage solutions at a terrific price point the performances of such models make the concept of an integrated micro-SMB environment viable.

Asia Pacific is expected to grow at the fastest CAGR from 2024-2032, due to factors such as growing digitalization, increasing penetration of the internet, and rising implementation of NAS solutions among home users and small & medium enterprises (SMEs). The expansion of cloud services and local data storage needs is driving rapid growth in countries like China, Japan, and India. Demand for personal cloud and media streaming solutions in India has resulted in an increase in NAS adoption among home users, for example. Hybrid solutions are also gaining traction in China where many businesses need to comply with stringent data localization regulations without sacrificing seamless cloud integration.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Consumer Network Attached Storage Market are:

-

Synology (DiskStation DS220+, DiskStation DS920+)

-

QNAP Systems (TS-251D, TS-453D)

-

Western Digital (My Cloud Home, My Cloud EX2 Ultra)

-

Seagate Technology (Personal Cloud, IronWolf 110 SSD)

-

NETGEAR (ReadyNAS 424, ReadyNAS 214)

-

ASUSTOR (AS1002T, AS5304T)

-

Buffalo Technology (LinkStation 220, TeraStation 3210DN)

-

TerraMaster (F2-210, F5-422)

-

Drobo (5N2, B810n)

-

Apple Inc. (Time Capsule, AirPort Extreme)

-

Lenovo (EMC px2-300d, Iomega ix2)

-

HP Inc. (Media Vault mv2020, StorageWorks X500)

-

Dell Technologies (PowerVault NX400, PowerVault NX3240)

-

ASRock (NAS Killer 4.0, Rackmount 4U)

-

ZyXEL Communications (NAS326, NAS540)

Recent Trends

-

In January 2024, Synology launches BeeStation, a personal cloud storage solution with a built-in 4TB drive, AI-powered photo organization, and seamless remote access offering a secure, subscription-free alternative to traditional cloud services.

-

In January 2025, QNAP launches myQNAPcloud Storage, offering 16GB of free storage, seamless NAS integration, and cost-effective backup solutions with no data transmission fees.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.52 Billion |

| Market Size by 2032 | USD 15.50 Billion |

| CAGR | CAGR of 12.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design (1-Bay, 2-Bays, 4-Bays, 5-Bays, 6-Bays, Above 6-Bays) • By Mount Type (Standalone, Rackmount) • By Storage Type (Hard Disk Drive (HDD), Flash Storage, Hybrid) • By Storage Capacity (Less than 1 TB, 1 TB to 20 TB, More than 20 TB) • By Deployment (On-Premise, Cloud/ Remote, Hybrid) • By End Use (Residential, Business) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Synology, QNAP Systems, Western Digital, Seagate Technology, NETGEAR, ASUSTOR, Buffalo Technology, TerraMaster, Drobo, Apple Inc., Lenovo, HP Inc., Dell Technologies, ASRock, ZyXEL Communications. |