Zoom Lens Market Size & Growth:

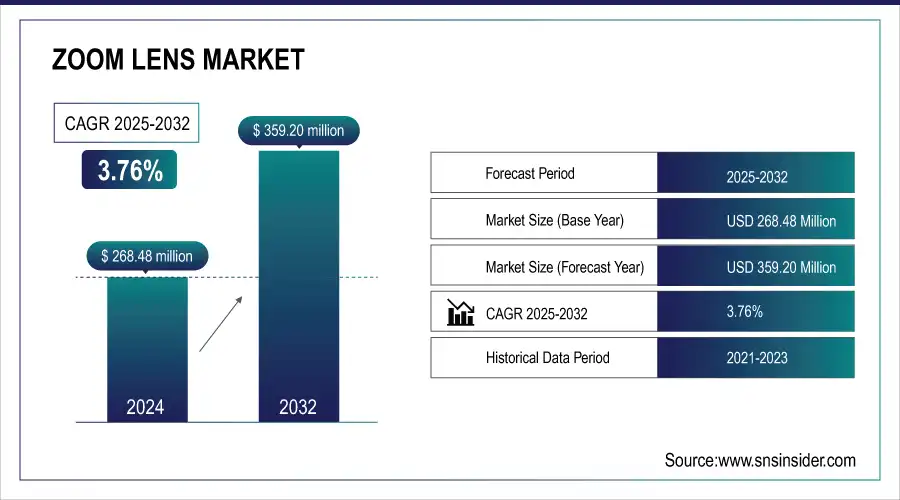

The Zoom Lens Market Size was valued at USD 268.48 million in 2024 and is expected to reach USD 359.20 million by 2032 and grow at a CAGR of 3.76% over the forecast period 2025-2032.

To Get more information on Zoom Lens Market - Request Free Sample Report

The worldwide Zoom Lens Market is growing steadily due to rising demand across applications including surveillance, medical imaging, industrial automation, and transport. The major drivers of market growth include technology advancements, incorporation into IoT systems, and growth in smart infrastructure. Higher imaging accuracy and flexibility are turning zoom lenses indispensable across consumer as well as industrial markets.

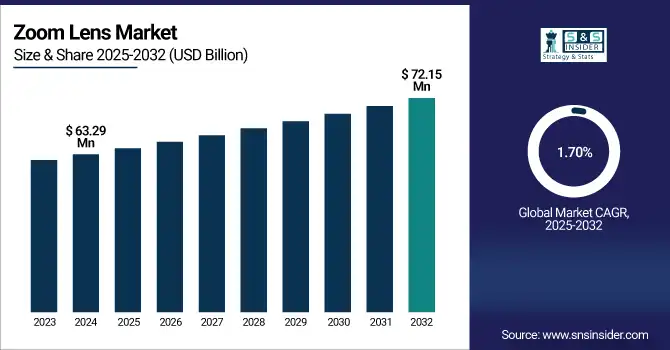

The U.S. Zoom Lens Market size was USD 63.29 million in 2024 and is expected to reach USD 72.15 million by 2032, growing at a CAGR of 1.70% over the forecast period of 2025–2032.

The U.S. Market is experiencing moderate growth, driven by consistent adoption across security monitoring, healthcare imaging, and industrial automation. Ongoing investments in intelligent surveillance systems and innovations in optical technology are growth enablers. The market also gains from increasing integration of zoom lenses in IoT-enabled products, improving functionality across a wide range of high-precision applications.

Zoom Lens Market Dynamics

Key Drivers:

-

Rising Integration of IoT and Smart Technologies in Surveillance Applications Accelerates the Growth of the Market.

Growing integration of IoT and AI technology into surveillance equipment is strongly driving demand for high-performance zoom lenses. These zoom lenses facilitate real-time tracking, facial recognition, and remote surveillance, making security systems more efficient. Government investment in smart city initiatives and smart infrastructure is also adding to the demand. As smart surveillance is becoming an urgent requirement in both urban and industrial environments, the demand for smart zoom lenses keeps growing steadily.

According to research, In 2023 Dubai’s AI-driven traffic surveillance using advanced zoom lenses cut accidents by 25%, showcasing the growing importance of zoom lenses in smart transportation and urban safety systems.

Restrain:

-

Limited Compatibility of Zoom Lenses with Legacy Systems Restrains Adoption Across Traditional Industrial and Surveillance Infrastructures.

Many sectors and public services are still using legacy systems that do not have the digital interfaces or processing capacity to handle modernzoom lenses. This compatibility issue provides a barrier for perfect integration of newest zoom lenses, especially the ones with electric or IoT features. Replacing entire systems to support a new lenses is expensive and time-consuming, which can be a barrier to adoption. Thereby, potential users hesitate or refrain from investment into state of the art zoom lens technology, which hinders the market expansion.

Opportunities:

-

Emerging Demand for Advanced Imaging Solutions in Healthcare and Industrial Automation Creates Lucrative Opportunities for the Market.

In health care and industrial automation applications, the use of sophisticated imaging technologies is becoming more prevalent for applications such as diagnostics, real time process monitoring and quality control applications. In this regard, IoT compliant zoom lenses are beneficial, capable of providing improved image quality, accurate focus control, and remote control. These capabilities enhance productivity and enhance the decision-making ability in clinical and industrial fields. The increasing prevalence of telemedicine, robotic surgeries, and automated manufacturing systems have created the need for high-performance optical components. This canny shift of the market speaks directly to manufacturers who believe that offering a high-resolution, tunable zoom lens with the capacity for customization, that addresses the specific demands of these rapidly changing and high demand application sectors, offers a unique and profitable market opportunity.

A notable example is the 2023 launch of the NeuroExplorer, an ultra-high-performance, brain-dedicated PET/CT developed by United Imaging in collaboration with Yale University and UC Davis—demonstrating the market’s shift toward highly specialized imaging.

Challenges:

-

Data Security and Privacy Concerns Pose a Major Challenge to Widespread Adoption of IoT-Enabled Zoom Lens Technologies.

The migration of zoom lenses into IoT applications leads to serious issues concerning data privacy, unauthorized accesses, and cyber security risks. In sensitive domains such as surveillance and memory care, video data is constantly collected, streamed and stored, and a leakage therein can result in serious implications. Meeting strict security standards such as those for data protection, encryption, secure communication and system verification. Such additional complications not only drive up the cost doing business but lengthen the process of purchasing decisions – particularly in government and public sector projects. Consequently, the cyber-security is significant challenge for the popularity of the smart zoom lens technology in IoT applications.

Zoom Lens Market Segment Analysis:

By Product Type

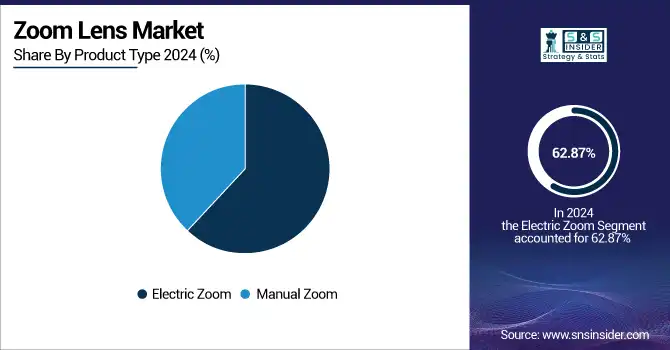

The Electric Zoom segment dominated the Zoom Lens Market share revenue by a 62.87% in 2024, prompted by need for high-technology imaging in application areas of surveillance, broadcast, and commercial photography. Mention-worthy product announcements involve Sony FE 70-200mm F4 Macro G OSS II zoom lens and Canon's RF100-300mm f/2.8L IS USM, both products catering to high-end professionals desiring high-configuration optics. These developments emphasize the segment's supremacy, as it mirrors a zoom lens market trends towards precision, automation, and integration with IoT-enabled products.

the Manual Zoom segment is expected to grow at the fastest rate of CAGR of 5.29% from 2025 to 2032. The growth is triggered by increasing adoption by photography hobbyists, small production houses, and schools and universities that prioritize manual control and affordability. Unlike electric zooms, manual zoom lenses provide physical precision and increased user control, which are preferred by creative users. Firms such as Tamron and Sigma have developed compact, lightweight manual zoom lenses, e.g., Tamron's 20-40mm F2.8 Di III VXD, which are optimized for mirrorless systems. Such innovations are consistent with the increased need for multifunctional and cost-effective optical solutions, particularly in developing economies, thus contributing immensely to the overall zoom lens market growth.

By Application

Security Monitoring segment is dominated in the highest share in the Market in 2024, at 32.82%, based on increasing need for high-resolution surveillance applications in commercial and public safety applications. Motorized zoom lenses supporting remote focal control and AI incorporation are gaining more popularity. Marketers such as Canon and Hikvision introduced next-generation zoom lenses with increased low-light performance and image stabilization. These technologies facilitate real-time monitoring, facial recognition, and object tracking, and thus are essential for contemporary surveillance systems. With increasing smart city projects and investments in infrastructure security across the world, this segment is leading the Market with robust product development momentum.

The industrial automation segment is witness the fastest CAGR growth of 5.22% by 2032 attributable to increase in application use of zoom lenses in the machine vision, Robotics and quality inspection system. Zoom optics provide flexibility for different object sizes and distances, improving automation throughput. But it’s a long time between concept and the final product. zoom lens companies, including Tamron, have already launched deformable industrial imaging lenses like the M117FM-RG series for small industrial systems, and OMRON’s AI-powered FH Series Vision System increases defect detection even when there’s no training data available. These advancements are in line with growing needs for flexible, smart optical systems under Industry 4.0 and are fueling strong growth in the industrial segment of the Market.

Zoom Lens Market Regional Analysis:

North America dominated the market in 2024 with a 38.65% revenue share, fueled by strong demand in applications such as security surveillance, broadcasting, and industrial automation. The high share of the region is attributed to technological advancements and the presence of major manufacturers that have introduced high-performance products. These technologies serve professionals in different industries, making the region stronger. Leadership in North America in the Market is also guaranteed by ongoing investments in security infrastructure and consumer electronics, guaranteeing long-term growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The United States holds the largest share in the North American Market as the country has a highly competitive and well-developed telecommunication and technological setup, high demand for security and surveillance systems, and is leading in sectors such as broadcasting, consumer electronics, and industrial automation among others, which always lead to innovations and growth in the market.

Asia Pacific is anticipated to grow at the fastest CAGR of 4.81% between 2025 to 2032. This development is attributed to rise in the uptake of zoom lenses in consumer electronics, security systems, and industrial automation. The area is infused with the rapid progress of technology, of which some are focused on enhancing imaging quality and user experience. With countries such as China, Japan, and India pushing the development of smart cities and manufacturing, the need for all-purpose and affordable zoom lenses is anticipated to increase and contribute to the further growth of the market.

-

China leads the Asia Pacific Market because of its robust manufacturing strength, fast adoption of high-technology applications in consumer electronics, surveillance, and industrial automation, and huge investments in smart city infrastructure, fueling high demand for innovative zoom lens technologies.

The Europe Zoom Lens Market is steadily rising due to improvements in imaging technology and application demand in segments such as surveillance, industrial automation, and consumer electronics. Technological advancements, such as high definition and motorized lenses, are driven by improved imaging capabilities with Europe having a high share owing to dominant manufacturers and consumer demand.

-

Germany leads the European Zoom Lens Market because of its robust industry base, precision engineering, and location of world-renowned players such as Zeiss and Leica. Technological advancements of the country and quality production stimulate huge demand, solidifying the country's position at the forefront of the market.

The Middle East & Africa (MEA) and Latin America regions are lesser in proportion, are experiencing substantial increase in the Zoom Lens Market. Rising integration of advanced imaging solutions by governments of countries such as the UAE, Brazil, and Saudi Arabia in the infrastructure, smart cities, and security segments is continuing to fuel the demand.

Key Players:

Major Key Players in Zoom Lens Market are Young Optics, Fujifilm Holdings Corporation, IOT Lenses, Canon, Nikon, SONY, Tamron, CBC, Kenko, Kowa and others.

Recent Development:

-

February 2024, Sony launched a compact full-frame E-mount lens offering constant F2.8 aperture, designed for portability and high-performance imaging.

-

November 2024, Nikon has improved version of the Z50, featuring enhanced autofocus and 4K video recording capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 268.48 Million |

| Market Size by 2032 | USD 359.20 Million |

| CAGR | CAGR of 3.76% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Electric Zoom, Manual Zoom) •By Application Field (Security Monitoring, Medical Industry, Transportation Industry, Environmental Monitoring Industry, Industrial Automation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Young Optics, Fujifilm Holdings Corporation, IOT Lenses, Canon, Nikon, SONY, Tamron, CBC, Kenko, Kowa |