Global Aesthetics Market Overview:

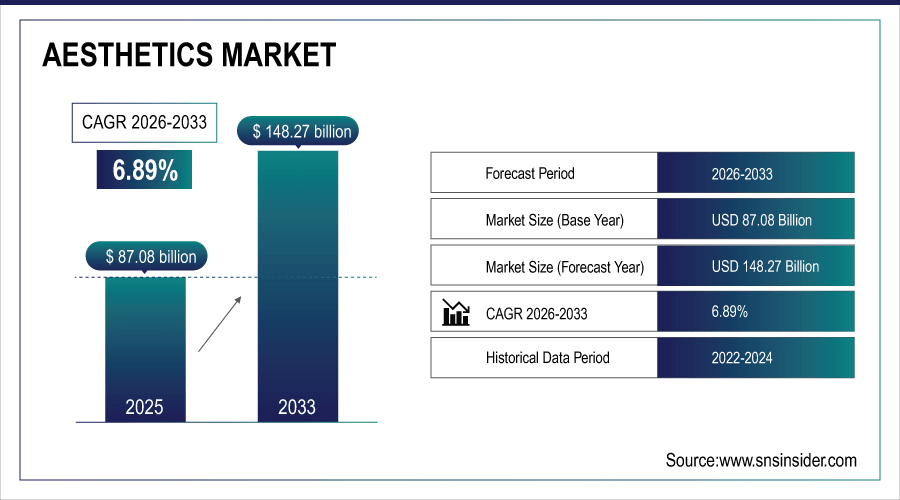

The Aesthetics Market size is valued at USD 87.08 Billion in 2025E and expected to reach USD 148.27 Billion by 2033, growing at a CAGR of 6.89% over the forecast period 2026-2033.

The Aesthetics Market growth is due to the rising demand for minimally invasive and non-invasive cosmetic procedures. Factors such as increasing awareness about physical appearance, advancements in aesthetic technologies, and the growing popularity of injectable treatments like botulinum toxins and dermal fillers are fueling market expansion. Moreover, the rise in medical tourism and the influence of social media and celebrity endorsements have significantly contributed to the adoption of aesthetic procedures, particularly among younger populations. According to study, Over 50% of new patients cite social media platforms and celebrity endorsements as key factors influencing their decision to undergo aesthetic procedures.

To Get More Information On Aesthetics Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 87.08 Billion

-

Market Size by 2033: USD 148.27 Billion

-

CAGR: 6.89% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Aesthetics Market Trends

-

Minimally invasive procedures gaining popularity due to faster recovery and lower risks.

-

Increasing adoption of injectables like botulinum toxins and dermal fillers globally.

-

Growing influence of social media and celebrities on aesthetic procedure decisions.

-

Expansion of aesthetic clinics and hospitals in emerging markets driving accessibility.

-

Rising disposable incomes in Asia-Pacific and Middle East boosting procedure affordability.

-

Medical tourism growth contributes to international demand for cost-effective aesthetic treatments.

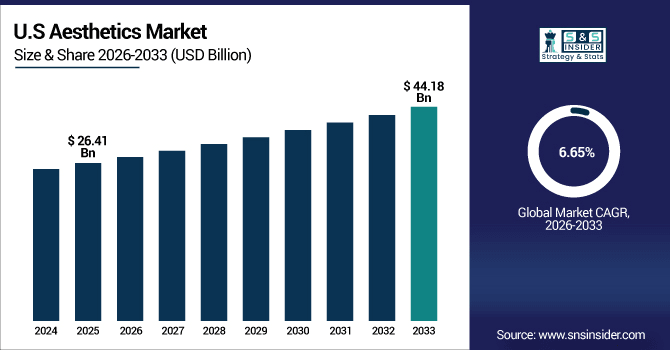

The U.S. Aesthetics Market size is valued at USD 26.41 Billion in 2025E and is expected to reach USD 44.18 Billion by 2033, growing at a CAGR of 6.65% over the forecast period of 2026-2033, driven by high consumer awareness, advanced technologies, widespread adoption of minimally invasive procedures, and strong presence of dermatology and beauty clinics, fostering continuous growth in cosmetic and non-surgical treatments.

Aesthetics Market Growth Drivers:

-

Rising Popularity of Minimally Invasive Procedures Fuels Market Expansion Globally

The increasing preference for minimally invasive and non-invasive aesthetic treatments is a major driver of market growth. Procedures such as botulinum toxin injections, dermal fillers, laser treatments, and body contouring require little to no downtime, lower risk of complications, and faster recovery compared to surgical interventions. Consumers are becoming more aware of the benefits of these procedures due to social media influence, celebrity endorsements, and growing aesthetic consciousness. Additionally, technological advancements have improved the safety, precision, and effectiveness of devices and treatments, further encouraging adoption. Clinics and hospitals are increasingly offering these procedures, expanding accessibility and fueling market growth globally.

Botulinum toxin injections and dermal fillers account for around 40% of total aesthetics market revenue.

Aesthetics Market Restraints:

-

High Costs of Advanced Aesthetic Treatments Limit Market Penetration

Despite the growing demand, the high cost of advanced aesthetic procedures remains a key market restraint. Surgical procedures, laser devices, and premium injectable treatments can be prohibitively expensive, especially in developing regions. The upfront investment required for energy-based devices and the recurring cost of consumables add to the financial burden for both clinics and patients. This limits adoption among price-sensitive segments and reduces the frequency of repeat procedures. Moreover, the lack of insurance coverage for cosmetic treatments in many countries further restricts market penetration, slowing overall growth in certain regions.

Aesthetics Market Opportunities:

-

Emerging Markets Offer Significant Growth Potential for Aesthetic Services

Emerging economies in Asia-Pacific, Latin America, and the Middle East present a significant growth opportunity for the aesthetics market. Rising disposable incomes, urbanization, and increasing awareness of aesthetic procedures are driving adoption in countries like India, China, Brazil, and the UAE. Additionally, medical tourism is becoming a major factor, as patients seek high-quality yet cost-effective treatments in these regions. By establishing clinics, expanding distribution of devices and products, and targeting younger demographics, companies can tap into untapped demand and accelerate market growth. Partnerships with local distributors and training programs for aesthetic professionals further enhance market potential.

India, China, Brazil, and UAE together account for ~25% of new procedure volumes in emerging markets.

Aesthetics Market Segmentation Analysis:

-

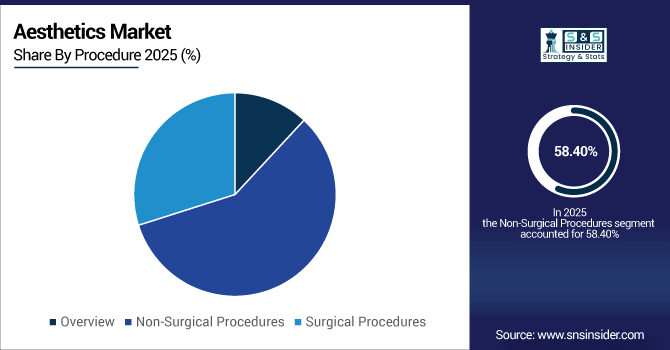

By Procedure: In 2025, Non-Surgical Procedures led the market with a share of 58.40%, while Surgical Procedures is the fastest-growing segment with a CAGR of 9.40%.

-

By Product: In 2025, Injectables led the market with a share of 40.06%, while Body Contouring Devices is the fastest-growing segment with a CAGR of 8.50%.

-

By Application: In 2025, Facial Aesthetics led the market with a share of 50.64%, while Body Aesthetics is the fastest-growing segment with a CAGR of 7.90%.

-

By End-User: In 2025, Dermatology Clinics led the market with a share of 45.20%, while Beauty Clinics is the fastest-growing segment with a CAGR of 8.80%.

By Procedure, Non-Surgical Procedures Leads Market and Surgical Procedures Fastest Growth

The Non-Surgical Procedures segment leads the Aesthetics Market, driven by increasing consumer preference for minimally invasive treatments such as injectables, laser therapies, and skin rejuvenation. These procedures offer benefits like reduced recovery time, lower risk of complications, and less discomfort compared to traditional surgical interventions, making them highly appealing to a broad range of patients. Growing awareness about aesthetic enhancements, social media influence, and advancements in medical technology have further encouraged adoption. Meanwhile, Surgical Procedures are emerging as the fastest-growing segment, fueled by rising demand for permanent aesthetic solutions such as facelifts, liposuction, and body contouring surgeries. Technological innovations, expanding surgical capabilities, and increasing availability of specialized clinics are driving their rapid market growth globally.

By Product, Injectables Leads Market and Body Contouring Devices Fastest Growth

The Injectables segment leads the Aesthetics Market, driven by the increasing popularity of botulinum toxins, dermal fillers, and other minimally invasive facial treatments. Consumers prefer injectables due to quick results, minimal downtime, and lower risk of complications compared to surgical procedures. Rising aesthetic awareness, social media influence, and advancements in treatment precision and safety have further fueled adoption. Meanwhile, Body Contouring Devices are the fastest-growing product segment, propelled by growing demand for non-invasive fat reduction and body sculpting procedures. Expansion of clinics offering these treatments, coupled with technological innovations in contouring devices, is encouraging market growth and opening new opportunities globally.

By Application, Facial Aesthetics Leads Market and Body Aesthetics Fastest Growth

The Facial Aesthetics segment dominates the Aesthetics Market, driven by the growing demand for anti-aging treatments, wrinkle reduction, and dermal fillers. Increasing consumer focus on appearance, rising awareness of minimally invasive procedures, and the influence of social media and celebrity endorsements have significantly boosted adoption in this segment. Additionally, technological advancements in injectables and laser treatments have enhanced treatment precision and safety, further encouraging uptake. Meanwhile, Body Aesthetics is emerging as the fastest-growing segment, fueled by the rising popularity of non-invasive fat reduction, body sculpting, and contouring procedures. Expansion of clinics offering body aesthetic solutions, coupled with innovative device technologies, is propelling rapid growth in this application segment globally.

By End-User, Dermatology Clinics Leads Market and Beauty Clinics Fastest Growth

The Dermatology Clinics segment leads the Aesthetics Market, owing to their specialization in skin and facial treatments, high patient trust, and established reputation for providing safe and effective aesthetic procedures. These clinics offer a wide range of services, including injectables, laser treatments, and skin rejuvenation, attracting a large and diverse patient base. Increasing awareness about minimally invasive treatments and the growing number of clinics in urban areas have further strengthened their market position. Meanwhile, Beauty Clinics are emerging as the fastest-growing end-user segment, driven by rising demand for convenient, non-surgical procedures, expanding wellness trends, and the adoption of advanced aesthetic devices. Rapid growth in this segment highlights significant market potential globally.

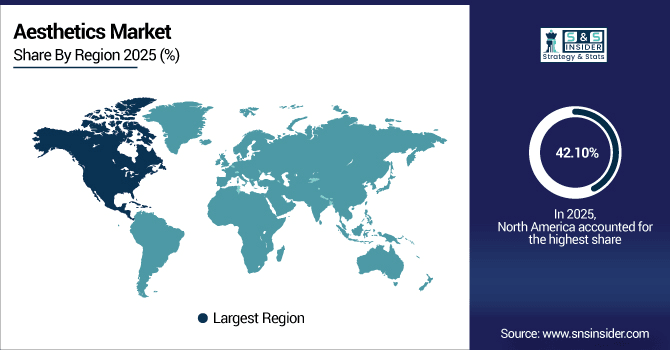

Aesthetics Market Regional Insights:

North America Market Insights:

The Aesthetics Market in North America held the largest share 42.10% in 2025, driven by high consumer awareness, advanced healthcare infrastructure, and growing demand for minimally invasive cosmetic procedures. The region benefits from technological advancements in injectables, laser treatments, and body contouring devices, which enhance treatment precision, safety, and effectiveness. Rising disposable incomes, social media influence, and increasing acceptance of aesthetic enhancements among younger populations further support market growth. Additionally, the presence of well-established dermatology and beauty clinics, along with expanding medical tourism and wellness trends, contributes to steady market expansion. North America continues to lead in innovation, procedure adoption, and overall market development globally.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Aesthetics Market with Advanced Technological Adoption

The U.S. leads the aesthetics market, driven by high adoption of advanced devices, minimally invasive procedures, and growing consumer awareness of cosmetic enhancements.

Asia-Pacific Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Aesthetics Market with a CAGR 8.01%, due by rising disposable incomes, increasing urbanization, and growing awareness of aesthetic treatments. The demand for minimally invasive procedures, including injectables, laser therapies, and body contouring, is rapidly increasing among younger populations. Expanding medical tourism and the adoption of advanced aesthetic technologies in clinics and hospitals further support market growth. Additionally, rising investments in healthcare infrastructure and the expansion of dermatology and beauty clinics are fueling accessibility. Social media influence and lifestyle trends also contribute to growing acceptance of aesthetic procedures, positioning Asia-Pacific as a high-potential growth region globally.

China and India Propel Rapid Growth in Aesthetics Market

China and India drive rapid Aesthetics Market growth, fueled by Rising disposable incomes, growing urban populations, and increasing awareness of minimally invasive cosmetic procedures are driving rapid adoption and expanding the aesthetics market in the region.

Europe Market Insights

Europe holds a significant position in the global Aesthetics Market, supported by advanced healthcare infrastructure, technological innovations, and increasing demand for minimally invasive and non-invasive procedures. Consumers are becoming more conscious of appearance and wellness, driving adoption of injectables, laser treatments, and body contouring services. The presence of well-established dermatology and beauty clinics, along with strong regulatory frameworks ensuring safety and efficacy, enhances market confidence. Additionally, lifestyle trends, growing aesthetic awareness, and expansion of aesthetic service providers across urban areas contribute to steady growth. Europe continues to be a key region for innovation, procedure adoption, and market development globally.

Germany and U.K. Lead Aesthetics Market Expansion Across Europe

High consumer awareness, advanced aesthetic technologies, and growing adoption of minimally invasive procedures are driving market growth and establishing Germany and the U.K. as key leaders.

Latin America (LATAM) and Middle East & Africa (MEA) Market Insights

The Aesthetics Market in Latin America (LATAM) and Middle East & Africa (MEA) are emerging as promising regions for the Aesthetics Market, driven by increasing disposable incomes, rising urbanization, and growing awareness of cosmetic and minimally invasive procedures. The adoption of injectables, laser treatments, and body contouring is accelerating as more clinics and hospitals expand their services across urban centers. Medical tourism is gaining momentum, with patients seeking high-quality yet cost-effective aesthetic procedures. Additionally, social media influence, lifestyle trends, and the increasing focus on personal appearance are boosting consumer interest. Investments in healthcare infrastructure, technological adoption, and professional training programs for aesthetic specialists are further enhancing market growth and regional potential.

Competitive Landscape

Alma Lasers is a key player in the aesthetics market, focusing on non-invasive and minimally invasive procedures. The company drives growth through innovative laser, body contouring, and skin rejuvenation devices. Its emphasis on technological advancements and expanding clinic networks positions it strongly in global aesthetic solutions.

-

In April 2025, Alma Lasers launched a special edition of the Soprano Titanium hair removal platform. This upgraded version features a breakthrough applicator that enhances treatment speed by 20%, enabling faster and more efficient hair removal sessions.

Cynosure is a leading provider of aesthetic laser and energy-based devices. The company specializes in picosecond, fractional, and hair removal lasers, catering to dermatology and cosmetic clinics. Continuous innovation, product portfolio expansion, and a focus on precision and safety help Cynosure strengthen its market presence worldwide.

-

In November 2014, Cynosure launched its PicoSure laser system, marking the introduction of the first and only aesthetic picosecond laser specifically designed for the effective and safe removal of tattoos and benign pigmented lesions.

AbbVie, through its Allergan Aesthetics portfolio, dominates the injectables segment with botulinum toxins and dermal fillers. The company leverages strong R&D, global distribution, and technological advancements to deliver effective, minimally invasive treatments, driving widespread adoption across dermatology clinics, beauty centers, and medical aesthetic practices globally.

-

In January 2025, Allergan Aesthetics unveiled the AA Signature Program at the IMCAS World Congress. This program aims to empower healthcare professionals to deliver holistic, personalized treatment plans, enhancing patient satisfaction and loyalty by addressing multiple areas of the face in a single treatment approach.

Aesthetics Market Key Players:

-

Merz Pharmaceuticals

-

Cynosure

-

Cutera Inc.

-

Alma Lasers

-

Johnson & Johnson

-

Lumenis Ltd.

-

Sientra, Inc.

-

Sinclair Pharma

-

Medytox Inc.

-

Lutronic

-

Fotona d.o.o.

-

Anika Therapeutics Inc.

-

Hugel Inc.

-

Hoahai Biological Technology

-

Revance Therapeutics

-

Venus Concept

-

Candela Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 87.08 Billion |

| Market Size by 2033 | USD 148.27 Billion |

| CAGR | CAGR of 6.89% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Injectables, Laser Devices, Skin Care Products, Hair Removal Devices, Body Contouring Devices) • By Procedure (Overview, Non-Surgical Procedures, Surgical Procedures) • By Application (Overview, Facial Aesthetics, Body Aesthetics, Hair Removal, Skin Rejuvenation) • By End-User (Overview, Dermatology Clinics, Beauty Clinics, Hospitals, Home Care Settings) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AbbVie Inc., Galderma, Bausch Health Companies Inc., Merz Pharmaceuticals, Cynosure, Cutera Inc., Alma Lasers, Johnson & Johnson, Lumenis Ltd., Sientra, Inc., Sinclair Pharma, Medytox Inc., Lutronic, Fotona d.o.o., Anika Therapeutics Inc., Hugel Inc., Hoahai Biological Technology, Revance Therapeutics, Venus Concept, Candela Corporation, and Others. |