Cancer Vaccine Market & Trends:

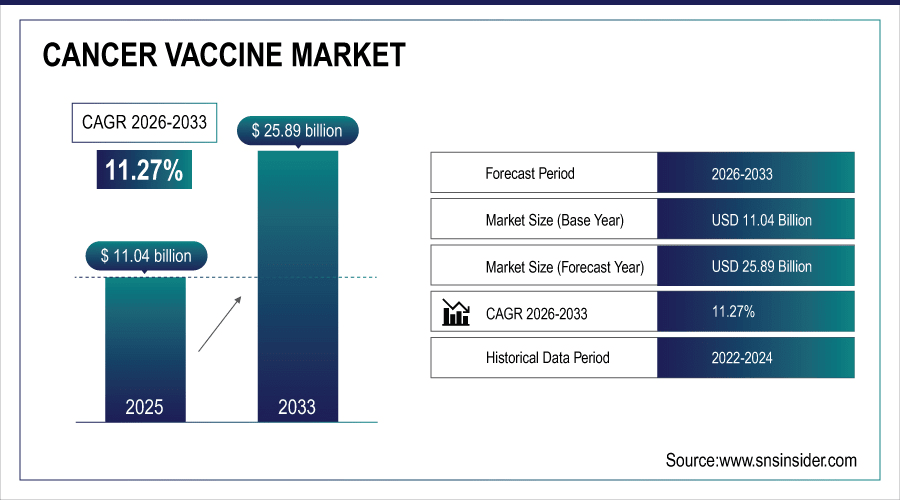

The Cancer Vaccine Market size was valued at USD 11.04 billion in 2025 and is projected to reach USD 25.89 billion by 2033, growing at a CAGR of 11.27% during 2026-2033.

The global cancer vaccines market is predominantly fuelled by vaccine technology developments, including the advent of neoantigen, DNA, and mRNA-based platforms that allow more personalized and efficacious treatments. Other innovative therapies are also being applied, including AI, biomarkers, and combinations are increasing results and also increasing adoption. Meanwhile, the mounting clinical pipelines and increasing approvals are driving the commercialization at a greater pace, laying a new ground for preventive and therapeutic cancer vaccines in the dynamic healthcare industry.

For instance, in June 2024, Inovio announced positive Phase II results for its DNA-based cervical cancer vaccine (VGX-3100), reinforcing pipeline strength and boosting confidence in therapeutic cancer vaccines.

To Get More Information On Cancer Vaccine Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 11.04 billion

-

Market Size by 2033: USD 25.89 billion

-

CAGR: 11.27% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cancer Vaccine Market Trends

-

The growing global incidence of cancer cases and high mortality rates are generating the demand of widely preventive (HPV, hepatitis) and therapeutic vaccines against cancer.

-

Personalized and neoantigen vaccine correlates for cancer vaccines are progressing, with the platforms of both mRNA and DNA vaccines facilitating tailored therapies.

-

Combination approaches, including combining cancer vaccines with checkpoint inhibitors and immunotherapies, are demonstrating better patient survival and clinical acceptance.

-

The rise of government-funded immunization programs and public advertising is expanding vaccine coverage in the developed as well as developing markets.

-

Growth in clinical trial pipelines and in regulatory fast-track designations is increasing the speed of product approval and market launch.

-

Growing pharma, biotech, and academic partnerships are increasing innovation for the discovery of cancer vaccines.

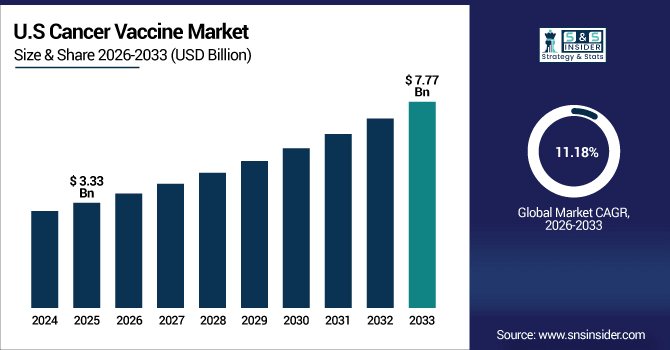

The U.S. Cancer Vaccine Market size was valued at USD 3.33 billion in 2025 and is projected to reach USD 7.77 billion by 2033, growing at a CAGR of 11.18% during 2026-2033. Cancer Vaccines Market Analysis shows that the US continues to lead in this space due to its high incidence of cancer, with substantial prevalence of lung, breast, prostate, and HPV-related cancers. With a large base of demand for both preventive (prophylactic) and therapeutic (therapeutic) vaccines, the US is the largest center for acceptance and development of advanced oncology vaccine products.

Cancer Vaccine Market Dynamics

Cancer Vaccine Market Growth Drivers:

-

Advancements in Vaccine Technology Driving Cancer Vaccine Consumption Growth

Outsourcing to Government & Organization Supply is a major driver of the cancer vaccine market. Pharmaceutical and biotechnology companies increasingly rely on CROs for preclinical ADME/Tox studies to reduce costs, access specialized expertise, and accelerate development timelines. This trend allows companies to focus on core research while ensuring high-quality, regulatory-compliant testing, fueling global market growth.

For instance, in May 2024, CureVac reported its second-generation mRNA cancer vaccine improved antigen expression efficiency by 50% in preclinical studies, advancing the personalization and effectiveness of immunotherapy.

Cancer Vaccine Market Restraints:

-

Lengthy and Uncertain Regulatory Pathways Limit Market Expansion Globally

A major factor hindering the cancer vaccines market is the time-consuming and uncertain regulatory process. Cancer vaccines need to go through several different clinical phases to demonstrate their safety, efficacy, and durability of response, a process that can take years. Regulatory authorities set high bars, and hundreds of potential vaccines never make it through trials due to weak immune responses or safety concerns. This unpredictability slows down approvals, drives up development costs, and makes smaller biotech companies afraid to press ahead very hard with cancer vaccine innovation.

Cancer Vaccine Market Opportunities:

-

Personalized & Neoantigen-Based Vaccines Create Growth Opportunities for the Cancer Vaccine Market

In the cancer vaccine market, personalized and neoantigen-based vaccines represent a significant opportunity. These treatments are matched to a patient’s tumor profile, providing patients with personalized, targeted therapy designed to attack only cancer cells with limited to no off-target toxicities. Tailored vaccines may stimulate a better immune response, improve the response to treatment, and target types of cancer that remain resistant to existing treatments. Increased focus on R&D and advancement in genomics and immunology have also facilitated the personalized approaches’ commercial viability.

For instance, in October 2024, BioNTech’s neoantigen-based personalized cancer vaccine elicited strong T-cell responses in over 80% of colorectal cancer patients, highlighting precision therapy potential.

Cancer Vaccine Market Segmentation Analysis

-

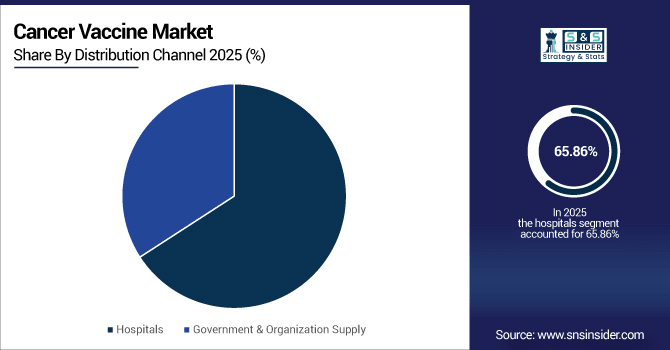

By distribution channel, hospitals held a 65.86%share in 2025e, while government & organization supply is growing the fastest with a CAGR of 11.55%.

-

By type, preventive cancer vaccines led the cancer vaccine market with a 55.82% share in 2025e, while therapeutic cancer vaccines are the fastest-growing segment with a CAGR of 11.99%.

-

By indication, the cervical cancer dominated the market with a 29.96% share in 2025e, whereas the bladder cancer segment is expected to grow fastest with a CAGR of 12.46%.

-

By technology, recombinant cancer vaccines led the market with a 56.87% share in 2025e, while viral vector and DNA cancer vaccine platforms are registering the fastest growth with a CAGR of 12.43%.

By Distribution Channel, Hospitals Lead While Government & Organization Supply Grow Fastest

The hospitals segment accounted for the largest share of the cancer vaccine market at around 65.86%in 2025E, as they are the main epicenters of vaccine delivery, oncology care, and patient follow-up, and because of their existing infrastructure, skilled personnel, and connections with the systems for the prevention and treatment of cancer. The Government & Organization Supply segment will have the highest CAGR of nearly 11.55% during 2026–2033, as the public immunization program, funding programs, and vaccination campaigns advance, so will accessibility to cancer vaccines, particularly in prophylactic programs including HPV and hepatitis.

By Type, Preventive Cancer Vaccines Lead Market While Therapeutic Cancer Vaccines Register Fastest Growth

The preventive cancer vaccines segment dominated the cancer vaccine market with a revenue share of about 55.82% in 2025E, owing to the large acceptance in public health programs for early diagnosis and increasing prevalence for cancer prevention is a major factor behind the demand and reduced cancer cases across the globe, leading to sustained market growth. The therapeutic cancer vaccines segment will grow at the highest CAGR of nearly 11.99% CAGR between 2026 and 2033, as a result of the rise of personalized mRNA, DNA, and neoantigen-based vaccines, combination treatments, and rising numbers of clinical trials against the treatment of established cancers.

By Indication, Cervical Cancer Dominates While Bladder Cancer Shows Rapid Growth

The cervical cancer segment was estimated to be the largest revenue generator with an approximate 29.96% of the total market share in 2025E, owing to massive HPV vaccination programs, the highest incidence of Cervical cancer globally, strong governmental support, and awareness promotions to Stress prevention, thereby fueling the adoption and continual expansion of the market globally. For instance, the bladder cancer segment is anticipated to be the fastest growing with a CAGR of around 12.46%, by 2026-2033, owing to growing incidence, development of efficacious therapeutic vaccines, and rising adoption of immunotherapy for the treatment of bladder tumors, thereby fueling market growth.

By Technology, Recombinant Cancer Vaccines Lead, While Viral Vector and DNA Cancer Vaccines Platforms Register Fastest Growth

The recombinant cancer vaccines segment accounted for the highest share of revenues in the cancer vaccine market at 56.87% in the year 2025E, owing to their established effectiveness, safety, and use for preventive vaccines like HPV and hepatitis B, and supported by robust government programs and patient acceptance globally. While the viral vector and DNA cancer vaccines platforms segment is expected to achieve the fastest CAGR of approximately 12.43% during the predicted period from 2026-2033, as a result of developments in gene-based technologies, personalised treatment applications, and a growing number of clinical trials with powerful immune responses, they are pushing into therapeutic cancer treatments.

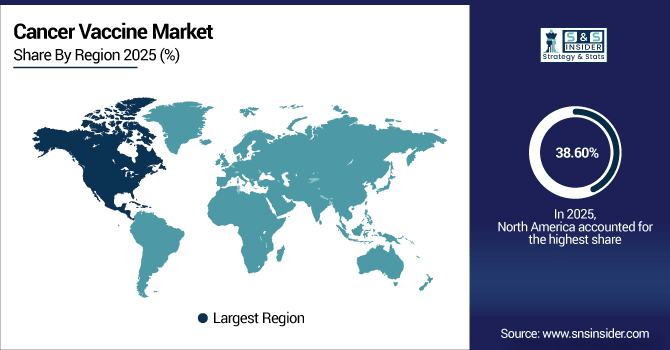

Regional Analysis:

North America Cancer Vaccine Market Insights

North America dominates the cancer vaccine market with a market share of 38.60% 2025E, owing to the high cancer prevalence, mature medical systems, and robust R&D expertise. Pharma and biotech giants companies including Merck, Moderna, and Pfizer, push innovation with mRNA, DNA, and neoantigen vaccines. Supportive regulatory landscape in terms of fast-track and breakthrough applications, generous government funding, and supportive reimbursement policies further expedite adoption and commercialization, making the US the largest and most significant market globally.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Cancer Vaccine Market Insights

The U.S. leads the North American cancer vaccines owing to high incidences, developed healthcare infrastructure, robust R&D network, large bioscience firms, benefits from regulators, and favorable reimbursement policies promoting easy adoption and inventions of prophylactic and therapeutic cancer vaccines.

Asia-Pacific Cancer Vaccine Market Insights

Asia-Pacific is the fastest-growing region in the cancer vaccine market, registering a CAGR of 12.20% over the forecast period, due to increasing prevalence of cancer, growing healthcare infrastructure, and government initiatives to promote vaccination programs. Rising knowledge about preventive health care, higher availability of innovative treatments, and a rise in discretionary incomes are contributing to adoption. Furthermore, new biotech entities, partnerships with international vaccine manufacturers, and increased clinical trial deployments are accelerating market progress. The favorable regulatory framework and growing demand for preventive and therapeutic cancer vaccines are also fueling the growth in the region.

China Cancer Vaccine Market Insights

The Asia-Pacific market growth is being led by China on account of increasing patient pool, increasing incidence of cancer, increasing healthcare infrastructure, government vaccination programs, rise in domestic biotech innovation and reforms in the regulatory framework. China dominates the Asia-Pacific cancer vaccines market and is expected to it will continue to do so during the forecast period.

Europe Cancer Vaccine Market Insights

Europe is expanding significantly in the cancer vaccines market on account of growing preventive healthcare awareness, rising applications of HPV and hepatitis B vaccines, and a high focus on therapeutic cancer vaccines. Government support, favorable reimbursement schemes, and well-established healthcare infrastructure are encouraging uptake. Rising R&D activities, collaborations between pharmaceutical and biotech companies, and an increasing number of clinical trials in key countries, including Germany, France, and the UK, will further boost the strong growth of the market.

Germany Cancer Vaccine Market Insights

Germany is the leading market in the European cancer vaccines market as Germany is one of the most developed countries for health care infrastructure, high prevalence of cancer, high government spending on vaccination programs, and support the development of new drugs and therapies.

Latin America (LATAM) and Middle East & Africa (MEA) Cancer Vaccine Market Insights

The Middle East & Africa and Latin America are developing regions in the cancer vaccines industry as a result of increasing cancer patients, improving healthcare facilities, and growing awareness of preventive healthcare measures. Government programs, rising healthcare spending, and growing immunization campaigns, especially for the vaccination against HPV and hepatitis B, are propelling the uptake. Moreover, partnerships with international vaccine companies, positive regulatory reforms, and improving accessibility in metropolitan areas continue to bolster market growth in both regions.

Competitive Landscape:

Merck & Co., Inc. – Headquartered in Kenilworth, New Jersey, USA, and founded in 1891, Merck is a global pharmaceutical leader. Its cancer vaccine portfolio includes the HPV vaccine Gardasil, widely used for cervical cancer prevention, and it is actively developing therapeutic vaccines in oncology through advanced R&D and collaborations.

-

In February 2025, Merck and Moderna reported that their mRNA-4157 personalized cancer vaccine combined with Keytruda reduced recurrence or death risk by 44% in melanoma patients, marking a significant advancement in therapeutic oncology vaccines.

GlaxoSmithKline plc (GSK) – Based in Brentford, United Kingdom, and established in 2000 (merger of Glaxo Wellcome and SmithKline Beecham), GSK is a major player in preventive oncology. Its Cervarix HPV vaccine and ongoing therapeutic vaccine programs position it prominently in the cancer vaccines market.

-

In October 2024, GSK expanded its Cervarix HPV vaccination program in several emerging markets, aiming to increase preventive vaccine coverage and reduce cervical cancer incidence globally.

Pfizer Inc. – Headquartered in New York City, USA, and founded in 1849, Pfizer is a leading global biopharmaceutical company. It focuses on both preventive and therapeutic cancer vaccines, leveraging partnerships and mRNA technology to develop next-generation oncology vaccines targeting multiple cancer types.

-

In January 2025, Pfizer announced a collaboration with BioNTech to advance mRNA-based personalized cancer vaccines, focusing on solid tumors, leveraging clinical trial progress to accelerate commercialization and regulatory approvals.

Cancer Vaccine Market Companies

Some of the key players in cancer vaccine market are:

-

CureVac N.V.

-

ImmunoGen, Inc.

-

Inovio Pharmaceuticals, Inc.

-

Roche Holding AG

-

Bristol-Myers Squibb

-

Transgene S.A.

-

Oncothyreon, Inc.

-

Advaxis, Inc.

-

Immunocore Ltd.

-

Vaxil Bio Ltd.

-

Argos Therapeutics, Inc.

-

NEOImmuneTech

-

STING Therapeutics

-

Fujifilm Diosynth Biotechnologies

-

Geneos Therapeutics.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 11.04 Billion |

| Market Size by 2033 | USD 25.89 Billion |

| CAGR | CAGR of 11.27 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Preventive Cancer Vaccines, Therapeutic Cancer Vaccines, Others) • By Indication (Prostate Cancer, Bladder Cancer, Melanoma, Cervical Cancer) • By Technology (Recombinant Cancer Vaccines, Whole-cell Cancer Vaccines, Viral Vector and DNA Cancer Vaccines, Other Technologies) • By Distribution Channel (Hospitals, Government & Organization Supply) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Merck & Co., Inc., GlaxoSmithKline plc, Pfizer Inc., Moderna, Inc., BioNTech SE, CureVac N.V., ImmunoGen, Inc., Inovio Pharmaceuticals, Inc., Roche Holding AG, Bristol-Myers, Squibb, Transgene S.A., Oncothyreon, Inc., Advaxis, Inc., Immunocore Ltd., Vaxil Bio Ltd., Argos Therapeutics, Inc., NEOImmuneTech, STING Therapeutics, Fujifilm Diosynth Biotechnologies, Geneos Therapeutics and other players. |