Botulinum Toxin Market Report Scope & Overview:

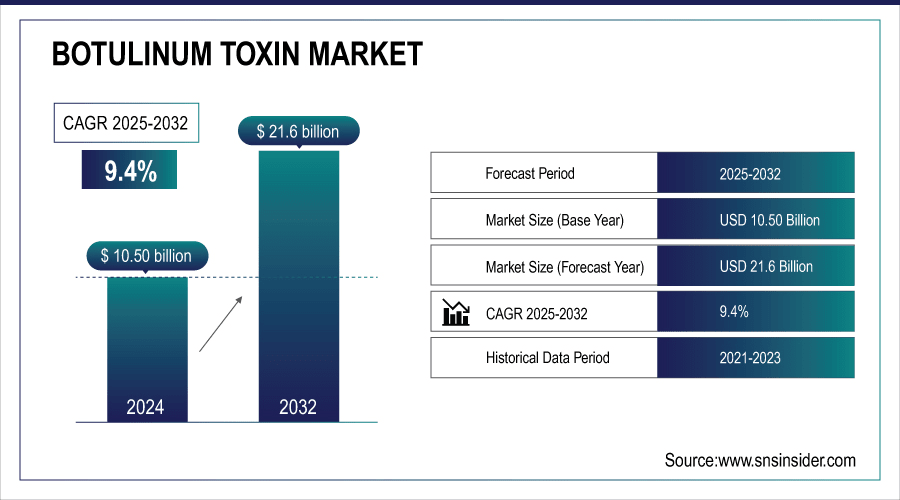

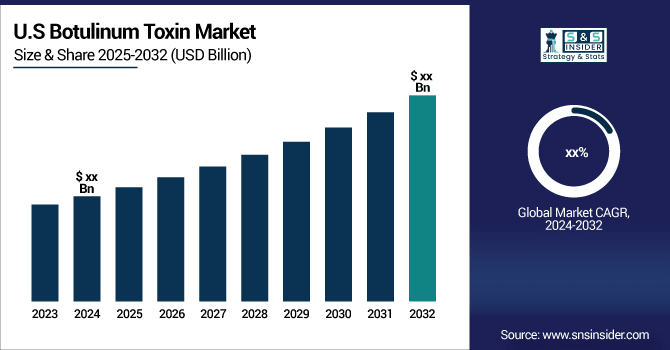

The Botulinum Toxin Market Size was valued at USD 10.50 billion in 2024 and is expected to be worth around USD 21.6 billion by 2032 growing at a remarkable CAGR of 9.4% over the forecast period 2025-2032.

The dynamic pattern in growth is observed within the botulinum toxin market, and it is determined by many interrelated trends showing changes in consumer preferences, various technological innovations, and an increasing awareness of aesthetic procedures. In the first place, there is an inclination from invasive to minimally invasive treatment. As patients are looking for effective but less traumatic options, botulinum toxin has become extremely popular for cosmetic enhancements. Examples of procedures that comprise wrinkle reduction or facial contouring with botulinum toxin have a shorter recovery time, less pain, and a lower complication rate compared with traditional surgery; in line with the general consumer demand for quicker, more time-efficient solutions to fit in with fast-paced lifestyles.

Procedural trends aside, variety in botulinum toxin products also leads to market growth. Brands including Botox, Dysport, and Xeomin have been continually advancing with increasing new product offerings to cater to a broad aesthetic need. This once more creates greater appeal to a broad client base to extend their attraction and thus increase the scope for wider accessibility. Hence, this kind of diversity not only allows the practicing physicians to climb competitive dynamics for this usage but also further helps them to better tailor the treatments based on the actual requirements of every patient. In this manner, the chances of repeat visits, growing manifold.

To Get More Information On Botulinum Toxin Market - Request Free Sample Report

Botulinum Toxin Market Highlights

-

The variety of botulinum toxin products including Botox, Dysport, and Xeomin is fueling market expansion, as diverse formulations allow physicians to tailor treatments for individual patient needs, enhancing accessibility and increasing repeat procedures.

-

Digital marketing and social media trends are reshaping the botulinum toxin market, with leading players leveraging Instagram, Facebook, and influencer endorsements to showcase treatment outcomes and build stronger consumer engagement.

-

Shifting cultural perceptions and increased acceptance of cosmetic enhancements among men and younger demographics are reducing stigmas, leading to broader adoption of botulinum toxin procedures worldwide.

-

R&D investment is expanding beyond aesthetics to therapeutic applications such as spasticity, cervical dystonia, and chronic migraines, reinforcing botulinum toxin’s position as a multi-purpose product.

-

The demand for non-invasive procedures continues to accelerate, with over 9 million botulinum toxin procedures performed in 2022, reflecting growing consumer preference for pain-free alternatives to traditional cosmetic surgeries.

-

Counterfeit products remain a restraint, with rising availability of unregulated alternatives posing risks to patient safety, brand reputation, and overall market growth.

Botulinum Toxin Market Drivers

-

Demand for Non-Invasive Procedures and Expanding Therapeutic Applications

The rising demand for minimally and non-invasive procedures is one of the primary factors driving the growth of the market of botulinum toxin. ISAPS 2022 stated that about 18,857,311 nonsurgical procedures were performed worldwide in the year 2021 wherein Botulinum Toxin, Hyaluronic Acid, and Laser Hair Removal represented about 7.2% of the total procedures. The botulinum toxin treatments which skyrocketed up to 9,221,419 procedures in 2022 have reflected an upward trend towards easier, pain-free options for those who wish to see youthful and healthy looks without the complications related to invasive cosmetic surgeries. The increasing consumer demand has forced manufacturers and suppliers to go aggressively in terms of advanced non-invasive cosmetic technologies.

More research and development (R&D) initiatives are expanding the growth of the market. The dual purposes of botulinum toxin, which include therapeutic and aesthetic use, expand its uses amongst the public populace. Increasing cases of chronic conditions such as spasticity, cervical dystonia, and chronic migraines stimulate demand for botulinum toxin products. According to the NIH in 2023, a relevant study established the high rate of spasticity occurrence in patients who present with brainstem hemorrhages, underscoring the need for the therapeutic scope.

Now, key pharmaceutical companies are expanding their R&D efforts to market effective treatments for these critical diseases while searching for aesthetic approvals. In addition to aesthetic applications, they will also be looking for regulatory approvals-for example, forehead lines, crow's feet, and frown lines. Clinical trials towards the use of botulinum toxin to enhance its aesthetic applications in existing products will be drivers for further development of the dynamic market.

Botulinum Toxin Market Restraints

-

Increasing Availability and Accessibility of Counterfeit Products Impede Market Growth

Botulinum Toxin Market Segments Analysis

By Type

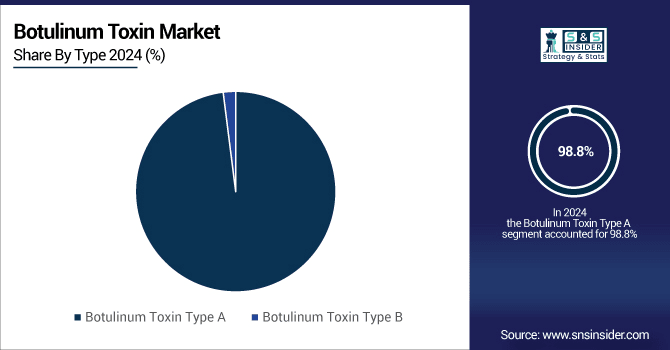

Botulinum toxin type-A segment accounted for the largest revenue share of 98.8% in 2024. The segment is expected to exhibit significant growth due to increased customer preference caused by various benefits, including minimal pain, no blood loss, and no scarring while undergoing procedures. The use of botulinum toxin type-A increased significantly as an alternative treatment for chronic migraines, tension-type headaches, and many other primary neurological disorders.

The aesthetic products of the botulinum toxin type-A segment will be used both for aesthetic and therapeutic purposes, and a greater demand for aesthetic enhancements will be expected to fuel this segment's growth in the future. The botulinum toxin market is segmented into type-A and type-B products. Specifically, most of the products belonging to the botulinum toxin type-A category, such as Botox and Dysport, have been experimented with clinically and used as treatment over long periods with minimal adverse effects.

By Application

The botulinum toxin market is segmented based on application into aesthetic and therapeutic segments. The aesthetic segment is expected to witness an aggressive compound annual growth rate of 10.2% during the forecast period. The bacterially manufactured neurotoxin, botulinum toxin (BoNT), has established itself as the foundation of cosmetology. As there is a growing consciousness of aesthetic appeal, along with technological advancements in both developed and developing nations, cosmetic surgery has seen a rise.

The therapeutic application segment contributes significantly to a market share of 43.0%. Botulinum toxin is the most potent biological neurotoxin and has shown good promise in treatment for a wide range of medical conditions. Therapeutic applications of botulinum toxin have increased with advancing researchers' insights into the mechanisms of action and interaction at the molecular level. Its application today is currently expansive for a range of therapeutic and preventive treatments. Examples include chronic migraines, hyperhidrosis, overactive bladder, and many more.

By End-User

The market is segmented based on end-use into hospitals, dermatology clinics, and spas & cosmetic clinics. Cosmetic centers and medspas accounted for the largest share of 44.5% in 2024. Factors driving the growth of this segment include increasing demand for aesthetic procedures in these facilities. This trend is likely to grow at a CAGR of 10.2% in the forecast period. Both plastic surgeons and owners of medical spas are experiencing increased clients. This market is growing as a result of the increasing numbers of medical cosmetic centers and medspas, especially in the Asia Pacific region.

In 2023, it is estimated that more than 43.4% of the revenue shall be fetched by the hospital segment. The sector witnesses growth owing to the presence of high-end hospitals with modern care and facilities in developed as well as developing countries and the explosion of aesthetic procedures. Hospital settings remain the primary venue for most treatments, including dystonia, spasticity, chronic migraines, and many others.

Botulinum Toxin Market Regional Insights

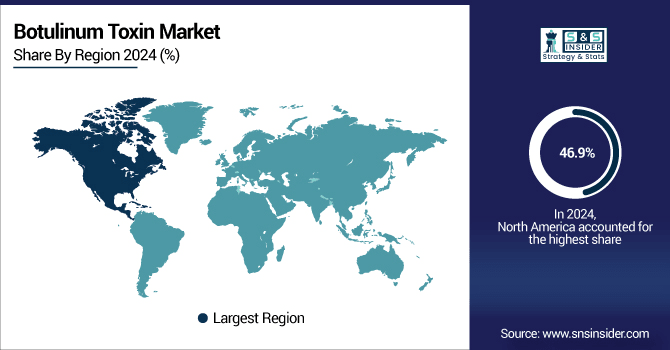

North America Botulinum Toxin Market Share

In 2024, the region-wise share of revenue in North America was around 46.9%. This is primarily attributed to the growth in disposable incomes and rising cosmetic procedures. About 1.3 million surgeries with botulinum toxin products were reported to the American Society of Plastic Surgeons (ASPS) in 2019. The growing use of botulinum toxin across various cosmetic applications will fuel the growth of the botulinum toxin industry in North America even more.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Botulinum Toxin Market Growth

Meanwhile, the Asia Pacific region is likely to be the largest market share contributor with an estimated growth rate of 11.1% in the forecast period. Such growth is further supported by easy reimbursements and a large patient population, among other things. Also, advanced healthcare facilities are available across many countries, meaning these nations demonstrate more beauty awareness or aesthetic consciousness, as the case may be, and such could also contribute to the growth of the market. The sharp rise in the number of medical spas and cosmetic centers in countries such as Thailand, Singapore, and Malaysia further supports the increase in the area of botulinum toxin market.

Botulinum Toxin Market Key Players

-

Allergen, Inc.

-

Merz Pharma

-

US Worldmeds

-

Galderma

-

Lanzhou Institute of Biological Products

-

AbbVie Inc.

-

Medytox

-

HUGEL, Inc.

-

Evolus, Inc.

-

Revance Therapeutics, Inc.

-

Supernus Pharmaceuticals, Inc.

-

Eisai Co., Ltd.

-

Hugh Source International Ltd

-

Daewoong Pharmaceutical

-

Huons Global

-

Chong Kun Dang Pharma

-

Alphaeon Corporation

-

Huadong Medicine

Botulinum Toxin Market Competitve Landscape

Hugel America, Inc. is the U.S. subsidiary of Hugel, Inc., a leading South Korea–based biopharmaceutical company specializing in medical aesthetics. The company offers a strong portfolio of botulinum toxin products and dermal fillers, addressing the rising demand for non-invasive cosmetic treatments in North America. Hugel America leverages its parent company’s global expertise and robust R&D to expand regulatory approvals and bring innovative products to the U.S. market. With increasing consumer awareness of anti-aging solutions and a surge in aesthetic clinics and medical spas, Hugel America is strategically positioned to strengthen its presence in both aesthetic and therapeutic applications.

-

In March 2024, Hugel America, Inc., a subsidiary of Hugel Inc., a global leader in the medical aesthetics industry, announced that the FDA has approved Letybo, a neurotoxin designed to treat moderate-to-severe glabellar (frown) lines in adults. Hugel plans to launch this product to aesthetic clinicians in the coming months, accelerating its transition to approved medical use. The FDA's approval is supported by positive results from three completed phase III trials involving over 1,000 participants in the U.S. and Europe. For seven consecutive years, this type A botulinum toxin has been the leading neurotoxic brand in South Korea recognized as one of the most dynamic aesthetic markets worldwide.

AbbVie Inc. is a leading global biopharmaceutical company headquartered in North Chicago, Illinois, USA, known for its innovative portfolio in immunology, oncology, neuroscience, and aesthetics. In the aesthetics market, AbbVie holds a dominant position with its flagship product Botox, widely used for both therapeutic and cosmetic applications. The company also owns Juvederm dermal fillers, further strengthening its presence in the medical aesthetics industry. Through strong R&D investments, strategic acquisitions, and regulatory approvals, AbbVie continues to expand its reach in the botulinum toxin and facial aesthetics market, meeting the rising global demand for non-invasive cosmetic procedures and anti-aging solutions.

-

In November 2023: AbbVie announced that new and existing members of Allē, the Allergan Aesthetics loyalty program, can take advantage of this year’s BOTOX Cosmetic Day offers, allowing them to buy, earn, and win rewards.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.50 billion |

| Market Size by 2032 | US$ 21.6 billion |

| CAGR | CAGR of 9.4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Application (Therapeutic {Chronic Migraine, Spasticity, Overactive Bladder, Cervical Dystonia, Blepharospasm, And Aesthetics), By Type (Botulinum Toxin Type A And Botulinum Toxin Type B), By End-User (Specialty & Dermatology Clinics, Hospitals & Clinics, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Ipsen Group, Allergan, Inc., Metabiologics, Merz Pharma, US WorldMeds, Galderma, Lanzhou Institute of Biological Products, AbbVie Inc., Medytox, HUGEL, Inc., Evolus, Inc., Revance Therapeutics, Inc., Supernus Pharmaceuticals, Inc., Eisai Co., Ltd., Hugh Source International Ltd, Daewoong Pharmaceutical, Huons Global, Chong Kun Dang Pharma, Alphaeon Corporation, Huadong Medicine |