Agriculture Robots Market Report Scope & Overview:

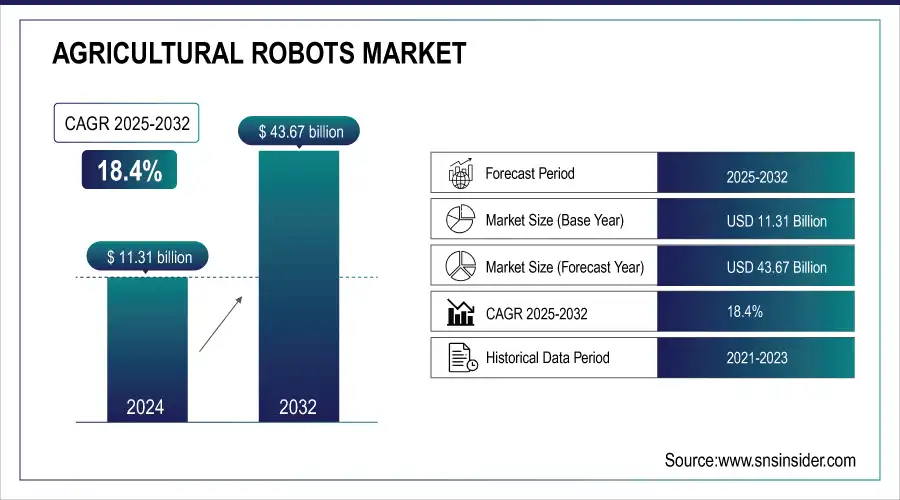

The Agricultural Robots Market Size was valued at USD 11.31 Billion in 2024 and is expected to reach USD 43.67 Billion by 2032 and grow at a CAGR of 18.4% over the forecast period 2025-2032.

To get more information on Agriculture Robots Market - Request Free Sample Report

The Market is driven by technological advancements, automation demand, and increased efficiency. Key metrics like adoption rates, investment trends, and labor replacement data provide insights into the sector’s growth. Robotics is transforming farming tasks such as planting, harvesting, and livestock management. As AI and automation technologies advance, agricultural robots are expected to play a vital role in improving sustainability, yield, and productivity. With government support for smart farming, the market is evolving to meet challenges like labor shortages and climate change, ultimately enhancing agricultural practices.

Agricultural Robots Market Size and Forecast:

- Market Size in 2024: USD 11.31 Billion

- Market Size by 2032: USD 43.67 Billion

- CAGR (2025–2032): 18.4%

- Base Year: 2024

- Forecast Period: 2025–2032

- Historical Data: 2021–2023

Agricultural Robots Market Highlights:

-

Deployment of AI-driven vision systems enabling precision crop monitoring, early disease spotting, and optimized harvesting cycles.

-

Expansion of autonomous drones for large-scale field mapping, irrigation scheduling, and soil nutrient assessment.

-

Advancement in swarm robotics to perform synchronized tasks like planting, weeding, and pesticide application with higher efficiency.

-

Integration of machine learning algorithms to enhance adaptability of robots across diverse terrains and climatic conditions.

-

Growing shift toward energy-efficient robotic platforms powered by solar and hybrid solutions for sustainable farming operations.

-

Adoption of robotic arms for delicate handling of fruits and vegetables to minimize post-harvest losses.

Agricultural Robots Market Growth Drivers:

-

Increasing Demand for Automation and Precision Farming Technologies Boosts the Agricultural Robots Market's Growth

The adoption of automation and precision farming technologies is one of the key drivers of the Agricultural Robots Market. These technologies enhance operational efficiency, reduce labor costs, and improve productivity. Robotics applications like harvesting, planting, and spraying offer higher accuracy and operational speed, making it easier to manage large-scale farms. As farmers continue to embrace these innovations to tackle labor shortages, climate change, and resource management challenges, the demand for agricultural robots continues to surge. Furthermore, the growing focus on sustainable farming practices and reducing environmental impacts further accelerates the adoption of robotic systems in agriculture.

Agricultural Robots Market Restraints:

-

High Initial Investment and Maintenance Costs Limit Widespread Adoption of Agricultural Robots

Despite the growing interest in agricultural robots, the high initial cost of acquiring and maintaining these technologies remains a major restraint. Small and medium-sized farms, in particular, may find it difficult to invest in robotic systems due to the substantial capital required for purchase, installation, and maintenance. Additionally, the need for specialized technicians and regular upgrades to ensure the systems remain efficient adds to the financial burden. As a result, many farmers hesitate to adopt these solutions, fearing the return on investment may not justify the high upfront costs, limiting the market’s expansion in certain regions.

Agricultural Robots Market Opportunities:

-

Government Support and Funding for Precision Agriculture Encourage Growth in Agricultural Robotics

Government initiatives and financial support for precision agriculture offer a significant opportunity for the Agricultural Robots Market. As the agricultural sector faces challenges related to sustainability, resource management, and labor shortages, governments around the world are introducing policies and programs to promote the adoption of advanced technologies like agricultural robots. These include subsidies, tax incentives, and research funding aimed at driving innovation and making automation more accessible to farmers. Such support encourages manufacturers to develop cost-effective and efficient solutions, making agricultural robots more attractive to a broader market and driving their widespread use.

Agricultural Robots Market Segment Analysis:

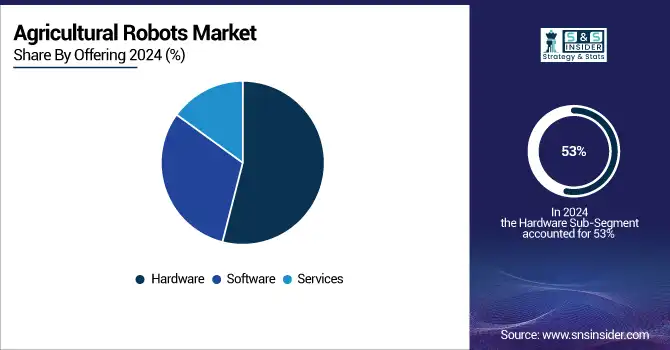

By Offering

The Hardware segment dominated the Agricultural Robots Market with a 53% revenue share in 2024, driven by advancements in robotics systems and machinery. Companies like John Deere and Trimble are continually enhancing their hardware offerings, such as John Deere’s autonomous tractors and Trimble’s robotic sprayers, to improve efficiency in planting, spraying, and harvesting. These hardware solutions are integral to the development of agricultural robots as they enable high-performance automation in diverse farming activities. The dominance of the hardware segment reflects the increasing need for robust and reliable machinery that supports precision agriculture, which continues to drive growth in the overall market.

The Software segment is expected to grow at the highest CAGR of 19.95% during the forecast period, as software solutions are key to enhancing the functionality of agricultural robots. Companies like Trimble and AG Leader are advancing their software platforms, such as Trimble Ag Software and AG Leader’s Integra Display, to integrate data analytics, GPS systems, and AI for precision farming. These software innovations enable real-time monitoring, optimization of resources, and better decision-making for farmers. As agricultural robots become more sophisticated, the software segment’s growth directly correlates with the broader market by providing essential tools for data-driven farming and automated operations.

By Application

The Milking segment in the Agricultural Robots Market held the largest share of revenue at 29% in 2024, reflecting the increasing demand for robotic milking systems in dairy farming. Lely introduced its Astronaut A5, enhancing automation in dairy farming. As automation technology evolves, robotic milking systems allow for 24/7 milking, precise monitoring of cow health, and consistent milk production, boosting dairy farm productivity. This growing adoption of Milking Robots directly correlates with the wider Agricultural Robots Market, highlighting a shift towards automation for improved efficiency and sustainability in farming.

The Planting & Seeding Management segment is expected to grow at the largest CAGR of 21.05% during the forecast period, fueled by the increasing demand for automated planting solutions. John Deere also launched its SeedStar 4HP system, providing farmers with a smart planting solution for precision agriculture. With technology improving, these systems contribute to more efficient use of seeds, reducing waste and increasing crop yield. As this segment grows, it contributes to the broader Agricultural Robots Market by optimizing planting operations and boosting agricultural productivity through automation.

By Type

The Dairy Robots segment dominated the Agricultural Robots Market in 2024 with a 37% share, driven by the increasing adoption of automated systems in dairy farming. These systems reduce labor costs, improve milk production efficiency, and enhance animal welfare. As automation continues to shape farming practices, the growth in dairy robots directly contributes to the overall expansion of the Agricultural Robots Market, offering more efficient, sustainable farming solutions.

The UAVs segment is growing at the largest CAGR of 19.72% within the forecast period, as these Unmanned Aerial Vehicles are increasingly used for crop monitoring, spraying, and precision farming. UAVs allow for efficient monitoring of large agricultural fields, reducing the need for manual labor while providing farmers with detailed insights into soil health, irrigation, and pest control. The expanding use of UAVs directly correlates with the growth of the Agricultural Robots Market by enhancing operational efficiency and sustainability in farming practices.

Agricultural Robots Market Regional Analysis:

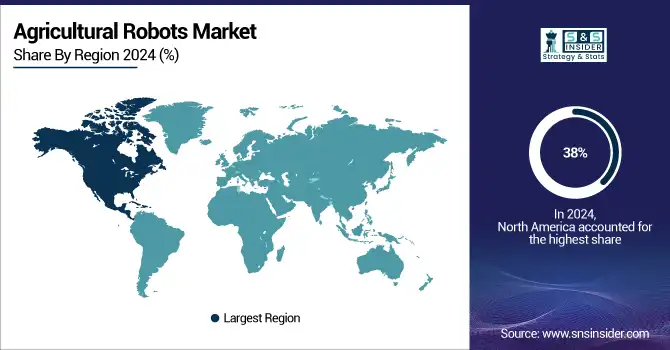

North America Agricultural Robots Market Insights

North America dominated the Agricultural Robots Market in 2024, with an estimated market share of around 38%. The region’s leadership is supported by advancements in precision agriculture, high adoption rates of robotics technologies, and strong investments in automation. Companies like John Deere and DeLaval are key players in this region, driving innovations in dairy and crop management robots. The presence of technologically advanced infrastructure and favorable government policies also bolsters market growth in North America.

Need any customization research on Agriculture Robots Market - Enquiry Now

Asia-Pacific Agricultural Robots Market Insights

The Asia Pacific region is the fastest-growing market for Agricultural Robots, with an estimated CAGR of 19.87% during the forecast period. This growth is attributed to the increasing need for automation in countries like China and India, where labor shortages and demand for higher agricultural productivity are significant drivers. Companies like Agrobot are expanding their presence in the region, offering cutting-edge robotic solutions for planting and harvesting, thereby driving regional market expansion.

Europe Agricultural Robots Market Insights

Europe represents a significant share of the Agricultural Robots Market, driven by the region’s focus on sustainable farming practices, labor efficiency, and advanced mechanization. Countries such as Germany, France, and the Netherlands are leading adopters of robotics in precision farming, dairy automation, and greenhouse management. Strong government support for digital agriculture, combined with funding initiatives for research and innovation, has accelerated the use of drones, autonomous tractors, and robotic harvesters. Leading companies like CLAAS and GEA Group play a key role in advancing agricultural automation, positioning Europe as a highly competitive region in this sector.

Middle East & Africa Agricultural Robots Market Insights

The Middle East & Africa Agricultural Robots Market is witnessing steady growth, fueled by the region’s need to address water scarcity, food security challenges, and reliance on imports. Countries like Saudi Arabia, the UAE, and South Africa are increasingly investing in agri-tech and robotics to enhance controlled-environment farming, greenhouse operations, and precision irrigation. With rising government initiatives to achieve self-sufficiency, robotic solutions for crop monitoring and vertical farming are gaining traction. The integration of drones and autonomous systems is transforming desert and arid land agriculture, supported by international collaborations.

Latin America Agricultural Robots Market Insights

Latin America is emerging as a promising region for the Agricultural Robots Market, supported by its vast arable land, large-scale commercial farming, and demand for higher productivity. Countries such as Brazil, Argentina, and Mexico are investing in robotic solutions for harvesting, spraying, and weeding to optimize agricultural efficiency. The adoption of automation is particularly strong in the sugarcane, coffee, and soybean sectors, where robotics addresses labor shortages and operational challenges. Increasing partnerships between local producers and global agri-robot companies are accelerating technological integration, making Latin America a rapidly growing contributor to the agricultural automation landscape.

Agricultural Robots Market Key Players:

-

Autonomous Solutions, Inc.

-

BouMatic

-

CNH Industrial N.V.

-

CLAAS KGaA mbH

-

GEA Group Aktiengesellschaft

-

Harvest Automation, Inc

-

Trimble, Inc.

-

Agrobot

-

Lely

-

DeLaval

-

John Deere

-

DJI Technology

-

Naïo Technologies

-

FarmWise

-

ecoRobotix

-

Bonsai Robotics

-

SwarmFarm Robotics

-

Verdant Robotics

Agricultural Robots Market Competitive Landscape:

AGCO Corporation, founded in 1990 and headquartered in Duluth, Georgia, USA, is a global leader in designing, manufacturing, and distributing agricultural equipment and solutions. The company offers tractors, combines, sprayers, and precision farming technologies, supporting farmers worldwide with innovative, sustainable, and productivity-enhancing machinery for modern agriculture.

-

August 2024: AGCO Corporation sold its grain division to focus on precision agriculture. The company aimed to sharpen its emphasis on smart farming technologies and autonomous solutions, boosting its position in the agricultural robotics market. This move reflects AGCO's dedication to sustainability, automation, and innovation within the farming industry.

Autonomous Solutions, Inc., founded in 2000 and headquartered in Petersboro, Utah, USA, specializes in robotics and automation technologies for agriculture, mining, defense, and industrial applications. The company develops advanced autonomous vehicle systems, enabling efficiency, safety, and precision through cutting-edge robotics, driving innovations in smart farming and off-road automation solutions.

-

September 2024: Autonomous Solutions, Inc. highlighted the growing role of AI and autonomous technology in agriculture. Their systems, including retrofitted tractors, were being used to tackle labor shortages, reduce operational costs, and improve crop yields. The use of AI, computer vision, and data analytics is revolutionizing farming practices for increased productivity and sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.31 Billion |

| Market Size by 2032 | USD 43.67 Billion |

| CAGR | CAGR of 18.4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Planting & Seeding Management, Spraying Management, Milking, Monitoring & Surveillance, Harvest Management, Livestock Monitoring, Others) • By Type (Driverless Tractors, UAVs, Dairy Robots, Material Management) • By Offering (Hardware, Software, Services) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles |

AGCO Corporation, Autonomous Solutions Inc., BouMatic, CNH Industrial N.V., CLAAS KGaA mbH, GEA Group Aktiengesellschaft, Harvest Automation Inc., Trimble Inc., Agrobot, Lely, DeLaval, John Deere, DJI Technology, Naïo Technologies, Carbon Robotics, FarmWise, ecoRobotix, Bonsai Robotics, SwarmFarm Robotics, Verdant Robotics |