High-Frequency Transformer Market Size Analysis:

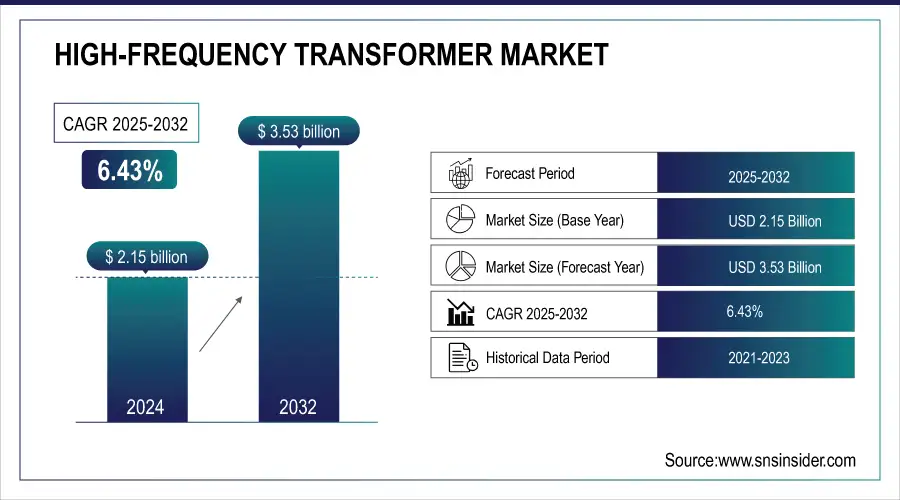

The High-Frequency Transformer Market Size was valued at USD 2.15 billion in 2024 and expected to reach USD 3.53 billion by 2032, and grow at a CAGR of 6.43% over the forecast period 2025-2032.

The high-frequency transformer market is experiencing robust growth, driven by key trends such as the expansion of renewable energy, increasing demand for electric vehicles (EVs), and technological advancements in energy efficiency. Renewable energy systems, including solar and wind power, require efficient power conversion, and high-frequency transformers are integral to these applications due to their ability to minimize energy loss and support compact designs. As more renewable energy sources are integrated into the global grid, particularly in countries like India, the need for high-frequency transformers to maintain grid stability and manage power conversion will rise significantly. For instance, India's grid is projected to face challenges as the share of on-grid renewables surpasses 50% by 2040, increasing the demand for high-frequency transformers. Additionally, the increasing adoption of electric vehicles (EVs) is further propelling the market, with high-frequency transformers being crucial for EV power systems, as automakers push for more efficient and sustainable energy solutions.

Get more information on High-Frequency Transformer Market - Request Sample Report

In the context of the European and North American markets, the rapid growth of the EV sector and renewable energy infrastructure is expected to sustain the demand for these transformers, bolstering their role in both the energy and automotive sectors. Governments worldwide are investing in smart grids, which require efficient transformers for energy management, creating further opportunities for market expansion. Furthermore, the renewable energy penetration in countries like Ireland is expected to increase wind generation by 10% with the use of smart transformers (STs) in grid applications. These developments, combined with the drive for energy efficiency and power conversion, will sustain the high-frequency transformer market’s growth trajectory over the next decade.

High-Frequency Transformer Market Report Trends:

-

Growing demand for energy-efficient transformers drives adoption in renewable energy, electric vehicles, power grids, and smart grids.

-

High-frequency transformers (HFTs) offer superior efficiency, compact design, and advanced thermal management for modern power systems.

-

Innovations in materials and design optimization, including multi-objective genetic algorithms, improve performance, power density, and energy conversion efficiency.

-

HFTs support integration of renewable energy sources and enhance grid stability, aligning with sustainability and carbon reduction goals.

-

Electromagnetic interference (EMI) from high switching frequencies poses challenges, requiring shielding, grounding, and compliance with EMC standards.

-

EMI mitigation increases design complexity and cost, potentially limiting adoption in price-sensitive or stringent industries like automotive, aerospace, and telecommunications.

High-Frequency Transformer Market Drivers:

-

Energy Efficiency and Sustainability Driving the High-Frequency Transformer Market

As global awareness about energy conservation increases, the demand for HFTs, which offer superior efficiency over traditional transformers, is expanding. These transformers minimize power loss, enhance energy performance, and reduce overall consumption, making them crucial in sectors like renewable energy, electric vehicles (EVs), and power grids. Their compact design and high-performance capabilities meet the stringent requirements of modern power systems, particularly in renewable energy applications, such as solar and wind power. In addition, their ability to manage thermal challenges in high-power systems further contributes to their adoption. Innovations in HFT design, including advanced materials and optimization techniques, have significantly improved energy efficiency, reducing environmental impacts. Moreover, the focus on sustainability is fueling the development of smart grid infrastructure, energy-efficient transportation systems, and power electronics, all of which require high-frequency transformers. These transformers play an integral role in enabling the integration of renewable energy sources and enhancing grid stability, which is increasingly important in the face of stricter regulations aimed at reducing carbon emissions. Furthermore, the design and operational characteristics of HFTs are becoming more advanced, with techniques like multi-objective genetic algorithms improving performance. For instance, a 1 kV, 50 kVA HFT has been successfully designed to achieve a power density of 24 kW/dm3 and an efficiency of 99.76%, making it highly efficient in energy conversion and operation. Additionally, these transformers have been shown to handle high-frequency harmonics, reducing eddy losses and improving system longevity. Overall, the demand for energy-efficient solutions in various industries is expected to continue driving the high-frequency transformer market.

High-Frequency Transformer Market Restraints:

-

Impact of Electromagnetic Interference on High-Frequency Transformer Market Growth

Electromagnetic Interference (EMI) is a significant restraint in the high-frequency transformer market due to the higher levels of electromagnetic emissions these transformers generate, especially with their high switching frequencies, typically between 2kHz and 9kHz. The operation of these transformers, particularly in power converters and inverters, results in EMI that can disrupt nearby electronic systems, including communication equipment, sensors, and other sensitive devices. This interference creates noise and signal distortion, reducing the overall performance of these systems. To counter this, manufacturers must incorporate shielding and mitigation strategies, which can significantly increase the complexity and cost of the transformer. The requirement for EMI shielding and grounding techniques, while essential, adds both financial and engineering challenges, requiring the use of special materials and precise construction methods. Additionally, high-frequency transformers must comply with strict electromagnetic compatibility (EMC) standards such as IEC 61000-4-3, which limit the permissible levels of EMI and mandate that transformers undergo rigorous testing to ensure compliance. If these standards are not met, the use of high-frequency transformers could be restricted in certain markets, such as telecommunications, automotive, and aerospace, where stringent performance and reliability requirements exist. These compliance demands can make it more difficult for manufacturers to enter or expand in such industries. Moreover, the increased costs of compliance—through the inclusion of EMI filters, advanced materials and precise design—could deter adoption in price-sensitive applications. Despite these challenges, ongoing advancements in EMI mitigation technologies, such as improved transformer designs and better shielding materials, continue to help overcome these barriers, although they do impact market dynamics and growth potential.

High-Frequency Transformer Market Segment Analysis:

By Power Output

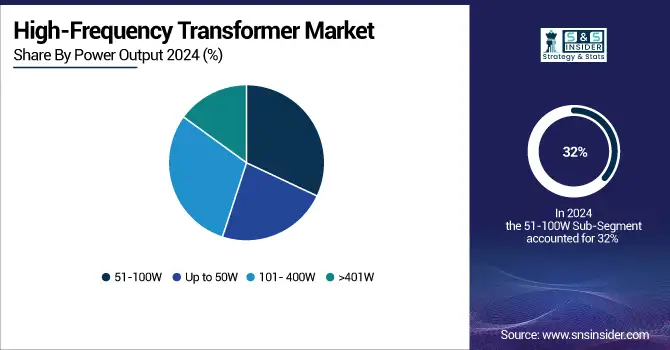

In 2024, the 51-100W power output segment dominated the high-frequency transformer market, accounting for approximately 32% of the market share. This segment’s dominance is driven by its widespread application in a variety of industries, including telecommunications, automotive, and industrial power supplies. High-frequency transformers in this power range are essential for energy-efficient systems, providing reliable power conversion in compact designs. Their ability to deliver moderate power while maintaining efficiency and minimizing energy loss aligns with growing demand for sustainable solutions in sectors like electric vehicles (EVs) and renewable energy integration. The increasing reliance on compact, high-efficiency transformers for power distribution and electronic devices further bolsters the market growth within this segment. As industries continue to prioritize energy efficiency and sustainability, the demand for 51-100W high-frequency transformers is expected to rise, solidifying its position in the market.

By Industry Vertical

In 2024, the industrial segment led the high-frequency transformer market, accounting for approximately 23% of the market share. This dominance is primarily driven by the increasing adoption of high-frequency transformers in industrial applications, where energy efficiency, compact design, and reliable power conversion are essential. Industries such as manufacturing, automation, and robotics benefit from the superior power handling capabilities of high-frequency transformers, ensuring optimal performance in machinery and equipment. These transformers are crucial in systems like power supplies for automation controls, variable speed drives, and electrical grids. As industries focus on enhancing operational efficiency and reducing energy consumption, the demand for high-frequency transformers in the industrial sector continues to grow. This segment’s growth is further supported by innovations in transformer design, ensuring high performance in challenging industrial environments while meeting sustainability goals.

High-Frequency Transformer Market Regional Analysis:

North America High-Frequency Transformer Market Trends:

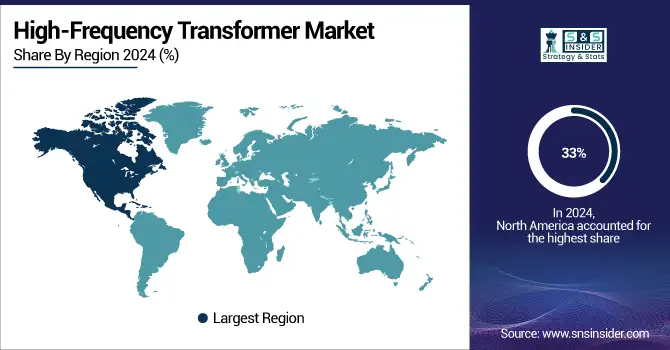

In 2024, North America emerged as the dominant region in the high-frequency transformer market, holding a significant share of approximately 33%. The region’s leadership is driven by the growing demand for energy-efficient power solutions across various industries, including automotive, telecommunications, and renewable energy. North America’s well-established industrial infrastructure and a strong focus on sustainability further fuel the adoption of high-frequency transformers. Additionally, the region’s advanced technological landscape and increasing investments in smart grid systems and electric vehicles (EVs) contribute to market growth. The presence of key players, along with favorable government regulations promoting green energy solutions, ensures North America’s continued dominance in the high-frequency transformer market, positioning it for further expansion in the coming years.

Need any customization research on Electric Vehicle Market - Enquiry Now

Asia Pacific High-Frequency Transformer Market Trends

Asia-Pacific is poised to be the fastest-growing region in the high-frequency transformer market from 2024 to 2032. This growth is primarily driven by rapid industrialization, urbanization, and the increasing adoption of renewable energy solutions in countries like China, India, Japan, and South Korea. China, being the largest manufacturing hub, plays a critical role in driving demand for energy-efficient transformers, especially in sectors such as telecommunications, automotive, and renewable energy. India’s growing emphasis on infrastructure development and the rise of electric vehicles further boost the demand for high-frequency transformers. Additionally, Japan’s advanced technological innovation in power electronics and energy systems supports market growth. The region is also witnessing significant investments in smart grids, power electronics, and electric vehicle charging infrastructure, all of which require high-frequency transformers. Furthermore, the push towards reducing carbon emissions and transitioning to cleaner energy sources in the region is expected to increase the adoption of efficient transformers. With supportive government policies and an expanding industrial base, Asia-Pacific is expected to lead the high-frequency transformer market’s expansion over the forecast period.

Europe High-Frequency Transformer Market Trends

Europe is witnessing steady growth in high-frequency transformers due to strong adoption of renewable energy, smart grid modernization, and energy-efficient industrial solutions. Government incentives for green energy, rising EV infrastructure, and advanced technological capabilities in Germany, France, and the UK support market expansion and increased transformer demand.

Latin America High-Frequency Transformer Market Trends

Latin America is experiencing moderate growth, led by industrial electrification, renewable energy initiatives, and rising EV adoption. Brazil, Mexico, and Argentina are key contributors, supported by infrastructure upgrades, government incentives for energy efficiency, and increasing demand for smart energy solutions, boosting the high-frequency transformer market.

Middle East & Africa High-Frequency Transformer Market Trends

The Middle East & Africa market is expanding gradually, driven by investments in energy infrastructure, renewable power projects, and industrial modernization. Rising demand for energy-efficient solutions in the UAE, Saudi Arabia, and South Africa, coupled with supportive policies and growing smart grid deployment, fuels high-frequency transformer adoption.

Key High-Frequency Transformer Companies are:

-

TDK Corporation (High-frequency inductors, transformers)

-

Tabuchi Electric Co., Ltd. (Power transformers, high-frequency transformers)

-

Taiyo Yuden Co. Ltd. (High-frequency transformers, inductors)

-

Bel Fuse Inc. (Power transformers, current transformers, magnetic components)

-

Murata Manufacturing Co., Ltd. (High-frequency transformers, inductors)

-

Vishay Intertechnology, Inc. (Transformers, inductors, power management components)

-

Coilcraft Inc. (Inductors, high-frequency transformers)

-

GCI Technologies (Magnetic components, high-frequency transformers)

-

Falco Electronics (Custom transformers, high-frequency transformers)

-

Delta Electronics Inc. (Power transformers, inductors, converters)

-

ABC Taiwan Electronics Corp. (High-frequency transformers, inductors)

-

Sumida Corporation (Transformers, inductors, high-frequency magnetic components)

-

Panasonic Corp. (High-frequency transformers, inductors, power management components)

-

Samsung Electro-Mechanics (Inductors, transformers, power supplies)

-

TT Electronics plc (Transformers, power management components)

-

Würth Elektronik GmbH & Co. KG (Transformers, inductors, magnetic components)

-

Bourns, Inc. (Magnetic components, high-frequency transformers)

-

Infineon Technologies AG (High-frequency transformers, power modules, semiconductors)

-

Eaton Corporation (Power transformers, electronic components, energy management solutions)

-

Schaffner Holding AG (Magnetic components, high-frequency transformers, EMC filters)

List of Suppliers in High Frequency Transformer Market who that provide raw materials and components for the high-frequency transformer market:

-

Laird Performance Materials

-

Hubbell Inc.

-

Toray Industries, Inc.

-

Hitachi Metals Ltd.

-

3M Company

-

Mitsubishi Materials Corporation

-

Amphenol Corporation

-

Vishay Intertechnology, Inc.

-

KEMET Corporation

-

Nitto Denko Corporation

High-Frequency Transformer Market Competitive Landscape:

TDK Ventures, the corporate venture arm of TDK Corporation, invests in early-stage startups focused on materials, energy, and cleantech innovations. By supporting technologies like solid-state transformers, it advances energy-efficient, compact, and high-performance high-frequency transformer solutions, enabling improved grid resilience, EV charging infrastructure, and renewable energy integration globally.

-

February 7, 2024 – TDK Ventures invested in Singapore-based Amperesand, pioneering solid-state transformer (SST) technology to enhance global electrification and support EV charging infrastructure with efficient, resilient, and adaptable solutions.

Vitesco Technologies, established in 2019 as a spin-off from Continental AG and headquartered in Germany, specializes in electrification and powertrain solutions. By advancing power electronics for electric and hybrid vehicles, the company enhances the efficiency, performance, and integration of high-frequency transformers, supporting sustainable mobility and energy-efficient power systems globally.

-

9 August 2024 – Vitesco Technologies has selected Infineon’s CoolGaN 650V transistors to enhance power efficiency in its Gen5+ GaN Air DC–DC converters, setting new benchmarks in power density (over 96% efficiency) and sustainability for power grids and electric vehicle systems.

Mitsubishi Electric is a global leader in electrical and electronic equipment, specializing in power systems, automation, and energy-efficient technologies. The company develops high-frequency devices, including GaN HEMTs and MMICs, for applications in mobile communication base transceiver stations and satellite communication earth stations. These innovations contribute to the advancement of high-speed, large-capacity communication systems

-

June 14, 2024 – Mitsubishi Electric will begin shipping 8W and 14W GaN MMIC power amplifiers for Ka-band satellite communications starting July 1, aimed at enhancing power efficiency and miniaturization for high-capacity earth stations.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.15 Billion |

| Market Size by 2032 | USD 3.53 Billion |

| CAGR | CAGR of 6.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Output (Up To 50W, 51- 100W, 101- 400W, > 401W) • By Industry Vertical (Industrial, Automotive, Military & Defense, RF & Telecommunications, Consumer Electronics, Transmission & Distribution, Healthcare) • By Application (Power Supplies, Alternative Energy Inverters, Electronic Switching Devices, LED Lighting, Plasma Generation, Personal Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | TDK Corporation, Tabuchi Electric Co., Ltd., Taiyo Yuden Co. Ltd., Bel Fuse Inc., Murata Manufacturing Co., Ltd., Vishay Intertechnology, Inc., Coilcraft Inc., GCI Technologies, Falco Electronics, Delta Electronics Inc., ABC Taiwan Electronics Corp., Sumida Corporation, Panasonic Corp., Samsung Electro-Mechanics, TT Electronics plc, Würth Elektronik GmbH & Co. KG, Bourns, Inc., Infineon Technologies AG, Eaton Corporation, Schaffner Holding AG. |