Autonomous Mobile Manipulator Robots Market Size Analysis:

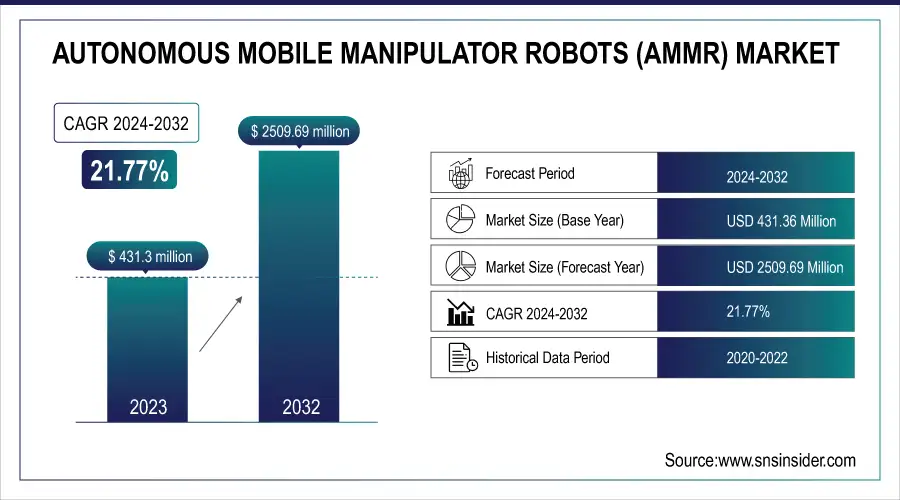

The Autonomous Mobile Manipulator Robots (AMMR) Market was valued at USD 431.36 million in 2023 and is projected to reach USD 2,509.69 million by 2032, growing at a robust CAGR of 21.77% from 2024 to 2032.

This expansion is primarily driven by the growing demand for advanced automation technologies across various industries, including logistics, automotive, electronics, and healthcare. AMMRs bring together the capabilities of mobile platforms and robotic arms to perform activities such as material transportation, assembly, and inventory management with greater efficiency. As businesses concentrate on increasing productivity and minimizing operational expenses, the use of AMMRs will see massive growth.

To Get more information on Autonomous Mobile Manipulator Robots (AMMR) Market - Request Free Sample Report

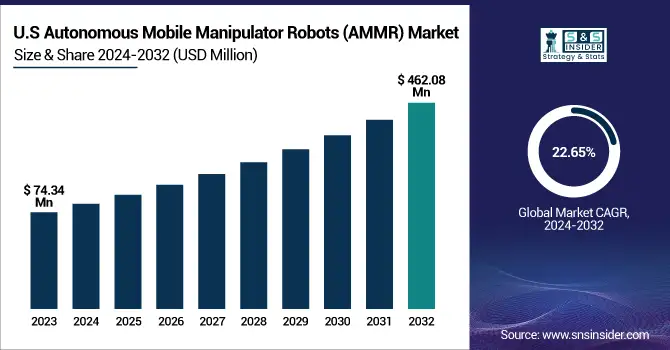

The U.S. Autonomous Mobile Manipulator Robots Market size was USD 74.34 million in 2023 and is expected to reach USD 462.08 million by 2032, growing at a CAGR of 22.65% over the forecast period of 2024–2032. This massive growth is driven by the widespread adoption of automation technologies by industries like logistics, manufacturing, healthcare, and retail. AMMRs play a more and more significant role in optimizing warehouse operations, improving manufacturing efficiency, and saving labor costs. The U.S. market enjoys a robust technological foundation, early robot adoption, and considerable investments in AI and automation. With the rising demand for adaptable, smart robotic systems, the U.S. is likely to retain its position as the market leader in the global AMMR market through the forecast period.

AMMR Market Dynamics

Key Drivers:

-

Rising Integration of Automation and Robotics in Industrial Workflows Accelerates the Autonomous Mobile Manipulator Robots Market Growth.

The growing interconnection of automation technologies across various sectors is heavily promoting the use of Autonomous Mobile Manipulator Robots (AMMRs). Sectors like automotive, electronics, logistics, and manufacturing are constantly being pushed to enhance efficiency, lower costs, and minimize the chances of human errors. AMMRs provide a smart solution by integrating autonomous mobility and robotic manipulation, enabling them to carry out intricate tasks like picking, placing, handling, and assembling with great accuracy. This not only increases productivity but also facilitates flexible manufacturing and lean operations. Since more companies invest in smart factories and Industry 4.0, the demand for AMMRs is increasing continually. Since they can adjust to changing environments and perform various tasks, they are a major driver of industrial automation expansion.

Restrain:

-

High Initial Investment and Complex Deployment Limits the Growth of Autonomous Mobile Manipulator Robots Market.

The huge upfront investment and deployment complexity are major impediments to market growth. Acquiring sophisticated robotic systems is a high capital investment, particularly for SMEs that may be operating with limited budgets. Moreover, adopting AMMRs into existing infrastructures involves customization, technical skill, and downtime for installation and testing, disrupting continuous operations. The requirement of skilled personnel for operating and maintaining these systems increases operational costs even further.Additionally, in sectors where processes are not yet completely digitized, the shift to autonomous systems could be viewed as unnecessary or risky. Such obstacles can slow down adoption, especially in emerging economies or price-sensitive industries, limiting overall market growth.

Opportunities:

-

Growing Adoption of AMMRs in E-Commerce Warehouses Offers Significant Market Expansion Opportunities.

Online stores are increasingly spending money on automation to manage bulk order fulfillment, particularly during holiday seasons. AMMRs are perfectly suited to automate repetitive and manpower-intensive operations such as sorting, moving, and inventory management within large warehouses. Their capability to move around in dynamic warehouse spaces and collaborate with human workers makes them a good investment in order accuracy and speed improvement. As the demand for speedy delivery increases among consumers, businesses are looking to cutting-edge robot technology to streamline supply chains. With increasing labor shortages and the requirement for scalability in operations, AMMRs are an effective and practical solution, setting themselves up as a disruptive technology for e-commerce logistics over the next few years.

Challenges:

-

Lack of Standardization in AMMR Technology and Safety Regulations Poses a Major Challenge to Market Growth.

The absence of standardization in technology and safety regulations. With increasingly sophisticated and autonomous AMMRs, their safe operation in dynamic, human-oriented environments become more challenging. There is no single global standard for the design, deployment, or performance criteria of these robots. This creates interoperability problems between systems and suppliers, making integration across facilities more difficult. Additionally, a lack of well-defined regulatory frameworks can hinder adoption based on fears related to liability, employee safety, and compliance. Firms might be reluctant to automate processes entirely in the absence of established guidelines. These issues need to be addressed through concerted efforts between governments, manufacturers, and industry associations in setting standards that enable innovation while maintaining safety and compatibility.

Autonomous Mobile Manipulator Robots Market Segments Analysis:

By System Type

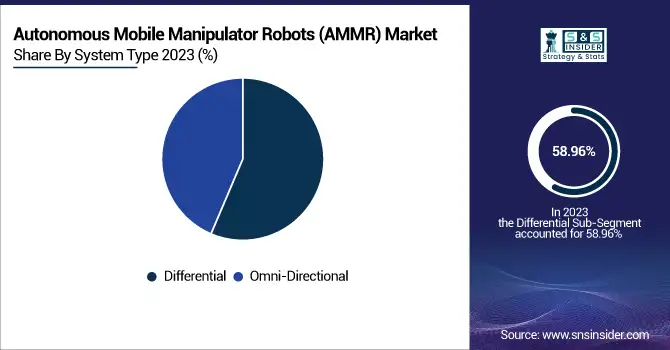

In 2023, the differential system segment at a revenue share of 58.96%. A differential drive system is popular for its uncomplicated mechanics and low cost of operations and is therefore used extensively in industrial settings for linear, precise movement. Firms like OTTO Motors and OMRON have improved this segment through models like OTTO 600 and MD-900, better suited for the transportation of material and autonomous driving. These new developments have been improving operational efficacy and reliability and further solidifying the leadership role of the segment. This increase is directly contributed to by rising industrial automation requirements driving the global growth of the AMMR market.

The omnidirectional segment is recording the fastest expansion in the AMMR market at a projected CAGR of 23.21% through 2024–2032. This system type allows free, 360-degree movement suitable for dynamic, space-restricted spaces like e-commerce warehouses and medical facilities.

The latest technologies, such as Hello Robot's Stretch 3 and Cobot's omnidirectional robots, introduced in early 2024, provide better maneuverability and smart navigation features. The technologies facilitate flexible logistics and adaptive operations, which are extremely appealing for next-generation automation. With the increasing demand for adaptable robotic solutions, the omnidirectional segment is expected to be the key driver of the future development of the AMMR market.

By Application

In 2023, the assembly segment dominated the Autonomous Mobile Manipulator Robots market with a revenue share of 37.64%. This is due to mounting automation in manufacturing operations, wherein AMMRs heighten precision, efficiency, and safety. Firms such as Robotnik have come up with the RB-ROBOUT+, an autonomous mobile manipulator with a 20 kg arm load capacity, tailored for automating handling operations and tool work within big industrial areas. Likewise, Xiaomi Automobile Co. incorporated 94 autonomous mobile robots into its assembly factory, executing more than 100 material-handling and assembly operations. These advancements highlight the pivotal position of AMMRs in simplifying intricate assembly processes, thus driving the overall development of the AMMR market.

The sorting segment is expected to advance at the fastest CAGR of 23.90% through the forecast period, driven by the fast growth of e-commerce and the demand for effective order fulfilment. AMMRs are being used more and more in warehouses and distribution centres to automate sorting operations, improving speed and accuracy. Firms such as Locus Robotics have diversified product lines with solutions such as Locus Vector and Locus Max, supporting different sorting applications.

Moreover, Addverb Technologies has come up with Automated sortation systems coupled with AMMRs, enhancing warehouse operations. Such developments play a central role in addressing the rising demand for quick and accurate sorting solutions, which in turn is a key factor driving the growth of the AMMR market.

By Payload

In 2023, the 10–20 kg payload segment dominated the Autonomous Mobile Manipulator Robots market with a revenue share of 38.90%. The reason for this dominance is that the segment provides the best possible balance between payload and maneuverability, making it perfect for applications such as assembly, material handling, and packaging. Robotnik's introduction of the RB-ROBOUT+, which has a UR20 arm that can handle a maximum of 20 kg, is one such development in this segment. These developments serve industries that need efficient but adaptable automation solutions. The sector's visibility reflects its critical position in optimizing operational efficiency across sectors, hence making a huge contribution to the growth of the AMMR market as a whole.

The over 20 kg payload segment is expected to expand at the fastest CAGR of 23.23% through the forecast period, led by growing demand for managing heavier loads in sectors such as automotive and logistics. Doosan Robotics' launch of the P-series, which is used for palletizing operations with a payload capacity of 30 kg, reflects the development of the segment. These heavy-duty AMMRs respond to the demand for strong automation technologies that can handle large amounts of materials. The segment's rapid expansion is a reflection of an overall trend toward automating heavy-duty applications, making it one of the growth drivers in the expanding AMMR market.

By End-use

In 2023, the logistics sector dominated the Autonomous Mobile Manipulator Robots market, accounting for 33.12% of the revenue. The reason for its dominance lies in the growing application of robotics and automation across logistics and supply chain processes. AMMRs make warehouse processes more efficient, precise, and speedy by independently moving around, picking, packing, and delivering goods, thus decreasing manual effort and optimizing processes. As e-commerce grows exponentially, AMMRs are important to streamline warehouse operations, control inventory, and support quicker order fulfillment to keep pace with increasing demand. Scalability and flexibility make them adaptable to shifting demand patterns, seasonal variation, and changing warehouse configurations, giving logistics businesses agility and operational resilience in dynamic environments.

The healthcare sector in the Autonomous Mobile Manipulator Robots market is expected to develop at a high growth rate, with the Fastest CAGR of 23.84% during the forecast period. This is because there is a growing demand for automation in hospitals to enhance the efficiency of operations, minimize labor costs, and provide better care to patients. AMMRs are used for applications like material handling, carrying medical supplies, and even assisting during surgeries. The use of AMMRs assists in solving labor shortages, enhancing speed and accuracy in operation, as well as minimizing the risk of human error. As the medical sector moves on to adopt more automation, the market for AMMRs for use in healthcare will significantly grow, making a contribution to increased growth in the AMMR sector as a whole.

Autonomous Mobile Manipulator Robots (AMMR) Market Regional Overview:

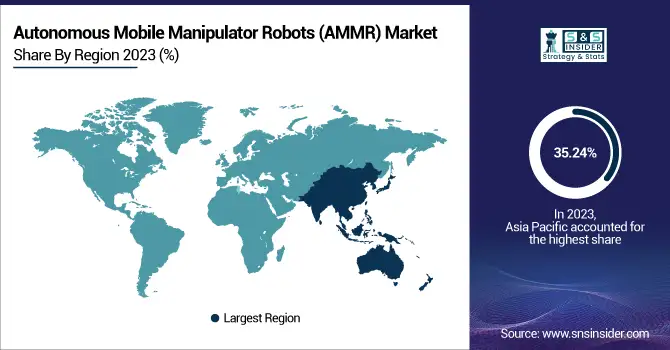

In 2023, the Asia Pacific dominated the Autonomous Mobile Manipulator Robots market with a 35.24% revenue share. This is because of strong government policies such as China's "Made in China 2025" plan that encourages intelligent manufacturing and automation. Advanced AMMRs have been introduced by firms like KUKA AG and OMRON that are customized for use in semiconductor manufacturing and healthcare sectors. For example, KUKA's mobile manipulator robot supports wafer handling in semiconductor manufacturing, whereas OMRON's solutions aid in healthcare environments. These advancements reflect the region's emphasis on bringing automation into different industries, fueling substantial growth in the AMMR market.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North American AMMR market is expected to expand at a CAGR of 23.50% from 2032. This is attributable to technological advancements in automation technologies and rising demand in industries such as healthcare, logistics, and manufacturing. Firms like OTTO Motors have introduced models such as the OTTO 600, which is intended for heavy-duty material handling, while ADLINK Technology launched an AMR with the SWARM CORE software platform for effective material handling in smart manufacturing plants. These developments reflect the region's emphasis on improving operational efficiency through automation, making it a global leader in the AMMR market.

Key Players in Autonomous Mobile Manipulator Robots Market along with their products:

-

ABB – (YuMi, ABB IRB 6700)

-

Boston Dynamics –( Stretch, Spot)

-

FANUC CORPORATION – (CR-35iA, M-20iA)

-

KUKA AG – (KUKA Robotics LBR iiwa, KUKA KMR iiwa)

-

OMRON Corporation – (LD-250, HD-1500)

-

Onward Robotics (Onward Mobile Manipulator, Onward Cobot)

-

PBA Group – (PBA Robot, PBA Collaborative Robot)

-

Robotnik – (RB-ROBOUT+, RB-KAIROS)

-

Stäubli International AG – (RX160, TS2-40)

-

YASKAWA Electric Corporation (Motoman MH24, Motoman MPL400)

Recent Development:

-

In November 2024, FANUC America introduced the M-950iA heavyweight robot, capable of handling payloads up to 500 kg, suitable for applications like welding, drilling, and riveting.

-

In February 2024, OMRON introduced the MD Series of autonomous mobile robots (AMRs), including the MD-650 and MD-900, designed for medium payload applications ranging from 650 to 900 kg.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 431.36 Million |

| Market Size by 2032 | USD 2509.69 Million |

| CAGR | CAGR of 21.77 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By System Type – (Differential, Omni-Directional) •By Application – (Sorting, Transportation, Assembly, Inventory Management, Others) •By Payload – (3-5 Kg, 5-10 Kg, 10-20 Kg, More than 20 Kg) • By End-use – (Automotive, Electronics, Logistics, FMCG, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Boston Dynamics., FANUC CORPORATION, KUKA AG, OMRON Corporation, Onward Robotics, PBA Group, Robotnik, Stäubli International AG, YASKAWA Electric Corporation. |