Data Center Liquid Cooling Market Size & Overview:

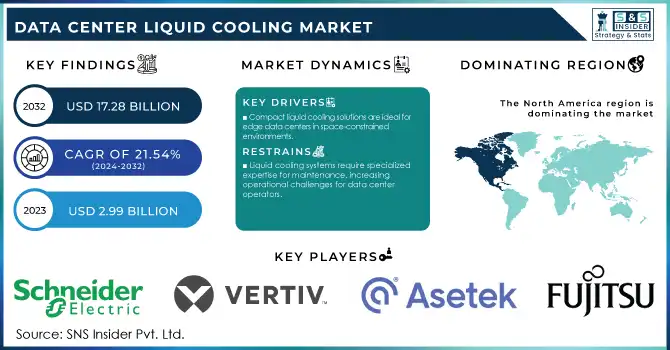

Data Center Liquid Cooling Market was valued at USD 3.63 Billion in 2024 and is expected to reach USD 17.28 Billion by 2032, growing at a CAGR of 21.54% from 2025-2032.

The data center liquid cooling market is experiencing rapid growth driven by the increasing need for efficient and sustainable cooling solutions. With the surge in data generation, the expansion of AI workloads, and the widespread adoption of cloud computing, traditional air-cooling systems often fall short of meeting the thermal management demands of high-density servers. Liquid cooling systems, known for their superior heat dissipation and energy efficiency, have become the preferred choice. These systems significantly reduce power consumption, enable higher server density, and lower carbon emissions. For example, hyper scale data centers operated by leading technology companies like Microsoft and Google have adopted liquid cooling to effectively manage the intense heat produced by their AI and machine learning workloads.

Get more information on Data Center Liquid Cooling Market - Request Sample Report

As the industry continues to evolve, advancements in materials, system designs, and hybrid cooling technologies are expected to further drive the adoption of liquid cooling solutions. While challenges such as high upfront costs and specialized maintenance requirements remain, the long-term operational savings and environmental benefits solidify liquid cooling as a critical technology for the future of data center operations.

Key Growth Drivers and Challenges in the Data Center Liquid Cooling Market

-

Rising focus on data center sustainability and energy efficiency drives adoption of liquid cooling to reduce energy usage and improve Power Usage Effectiveness (PUE).

-

Growing demand from AI, machine learning, and high-performance computing workloads fuels the need for advanced cooling solutions.

-

Expansion of edge data centers accelerates deployment of compact liquid cooling systems for real-time processing.

-

Increasing adoption of immersion cooling and direct-to-chip solutions enhances efficiency in high-density environments.

-

5G and telecom operators leverage liquid cooling to manage large-scale local data processing.

-

High retrofitting costs and infrastructure challenges limit adoption in legacy data centers.

-

Future innovations in hybrid and modular liquid cooling systems are expected to simplify integration and reduce costs.

Data Center Liquid Cooling Market Drivers

-

The rise in data-intensive applications and AI training demands require efficient cooling for high-performance servers.

-

Traditional air-cooling struggles with high-density server setups, driving the shift to liquid cooling for superior heat management.

-

Compact liquid cooling solutions are ideal for edge data centers in space-constrained environments.

Smart liquid cooling is becoming more critical for the edge data center for space-constrained applications in urban centers, remote sites, or industrial areas. Edge facilities, are all about processing the data closer to its source, which in turn means less latency and thus real-time analytics—a hallmark of an edge infrastructure compared to a traditional data center. Nonetheless, the limited footprint at such facilities presents a huge problem domain for conventional air-cooling solutions that rely on large fans and airflow systems. Liquid cooling addresses these challenges, providing a more effective and space-efficient solution. These systems use fluids with high thermal conductivity to transfer heat away directly from servers, removing the need for large air-cooling infrastructure. Due to their modular and scalable attributes, they are perfectly suited for the constrained footprints of edge facilities. An example is immersion cooling, in which servers are placed within non-conductive liquids to keep them cool, using little footprint. In addition, edge data centers run in harsher conditions, such as areas with extreme ambient temperatures or stringent power capabilities. These are exactly the situations where liquid cooling systems are ideal, as they are much less impacted by outside temperatures and require dramatically less power than conventional air cooling. This can increase reliability and even help with low power usage effectiveness (PUE) which is a key KPI for energy-efficient edge operations.

As industries—from telecommunications to healthcare to autonomous vehicles—start to adopt edge computing, they continue to drive the need for compact liquid cooling. As an example, telecom operators implementing 5G networks leverage edge data centers due to their ability to locally process large amounts of data. Liquid cooling systems save space in these facilities, allowing them to maintain optimum performance even when concerns about space and power become too much.

Liquid cooling essentially will emerge as a fundamental technology for supporting high-performance and sustainable operations in edge data centers as the demand for edge computing technologies continues to grow and require efficient cooling that will be space-constrained.

Data Center Liquid Cooling Market Restraints

-

Liquid cooling systems require specialized expertise for maintenance, increasing operational challenges for data center operators.

-

The possibility of leaks in liquid cooling systems can pose a threat to sensitive server equipment, deterring some operators from adoption.

-

Retrofitting existing data centers with liquid cooling systems can be challenging and costly due to infrastructure incompatibilities.

Upgrading existing data centers with liquid cooling systems presents significant challenges and costs due to inherent infrastructure incompatibilities. Most traditional data centers are designed for air-based cooling, with layouts, server racks, and airflow systems tailored for fans and HVAC setups. Transitioning to liquid cooling often requires extensive modifications, such as installing specialized cooling loops, pipes, pumps, and reservoirs to manage the liquid coolant. These adjustments necessitate substantial redesigns, causing operational disruptions, potential downtime, and additional expenses for data center operators.

Moreover, liquid cooling systems demand specific structural modifications for proper installation and functionality. For instance, immersion cooling may require customized server racks to accommodate hardware submerged in non-conductive liquids, while direct-to-chip cooling involves altering server components for effective heat transfer. Retrofitting such systems into legacy facilities often means dismantling existing setups and reconfiguring server layouts, which significantly drives up costs and extends project timelines. Compatibility issues with existing IT hardware further complicate retrofits. Many servers and components in traditional data centers are not built to support liquid cooling, necessitating upgrades or replacements that add to the financial burden. Additionally, operators must ensure that new systems comply with safety regulations and environmental standards, particularly regarding the handling of liquid coolants. This often requires specialized training and certifications for staff, further increasing complexity. Retrofitting also brings operational risks, such as potential fluid leaks that could damage sensitive equipment. These risks, combined with the high capital investment and technical expertise required, make many operators cautious about adopting liquid cooling in older facilities.

Despite these obstacles, the long-term advantages of liquid cooling—such as improved energy efficiency, increased server density, and reduced operational costs—continue to drive interest in retrofit solutions. To address these challenges, companies are innovating modular and hybrid liquid cooling systems that integrate more seamlessly into existing data centers, offering a more practical and cost-effective approach to retrofitting in the future.

Data Center Liquid Cooling Market Segment Analysis

-

By Component

The Solution segment dominated the data center liquid cooling market with a significant revenue share of 58.23% in 2023, owing to the rise in demand for cutting-edge technologies, like direct-to-chip and immersion cooling systems. It is propelled by an increasing need for advanced thermal management in hyperscale and colocation data centers driven by the likes of Google and Microsoft. This trend has been further expedited by the growing need for more energy-efficient, sustainable, cooling solutions to help reduce power consumption and minimize carbon footprints. With the increasing applications of liquid cooling in high-performance computing and AI workloads, we expect the Solution segment to retain its dominance with the high-efficiency level and better heat dissipation capability.

The Services segment is expected to grow at the highest CAGR due to increasing demand for specialized services for deployment, support services, and consulting for liquid cooling systems. In such a system with ever-rise difficulties triggered by complexity, there is an increasing demand for expertise, such as system design, system retrospectives, and performance tuning. Outsourcing of maintenance activities to maintain the smooth functioning of operations is also contributing to the segment growth. With the rising adoption of sophisticated cooling technologies and the growing installation of edge and hyperscale data centers that require improved fluid management, system maintenance, and regulatory compliance, the Services segment will witness robust growth.

-

By Data Center Type

Hyperscale data centers dominated the liquid cooling market and represented a significant revenue share of 42.78% in 2023. They utilize advanced cooling technology to handle substantial heat loads while providing energy savings and minimizing the carbon footprint. Hyperscale infrastructure will be seamlessly integrated into global cloud solutions with Google, Microsoft, and Amazon among the leading tech companies investing significantly to accelerate the transition to liquid cooling to improve performance and sustainability. Hyperscale data centers will continue to dominate the market as AI-powered applications, cloud services, and 5G develop further. Liquid cooling provides energy-efficient solutions enabling high-density operations that align well with sustainability goals globally while helping to optimize energy efficiency and reduce carbon emissions.

The colocation data centers are anticipated to witness the highest CAGR due to the growing need from small and medium enterprises (SMEs) for affordable IT infrastructure services. Liquid cooling enables the colocation providers to accommodate multiple customer requirements, maintain higher server densities, and comply with energy efficiency standards. This trend is being supplemented by a renewed emphasis on green IT and sustainability, which is also promoting liquid cooling in this area. Moreover, the rapid development of edge computing and IoT are also pushing colocation facility growth as businesses demand scalable and energy-efficient solutions. Liquid cooling is set to be important in improving both the eco-efficiency and the ecological sustainability of colocation data centers, allowing for significant expansion of this segment into the next few years.

Data Center Liquid Cooling Market Regional Analysis

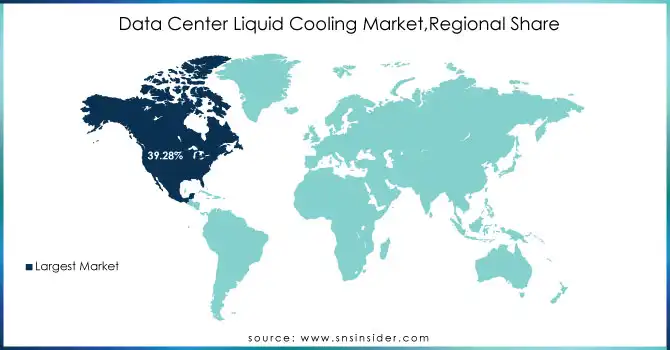

North America Data Center Liquid Cooling Market Leadership

North America dominated the data center liquid cooling market and accounted for a revenue share more than of 39.28% owing to the presence of some of the key hyperscale operators like Google, Microsoft, and Amazon Web Services (AWS) Due to the large amount of AI, cloud computing and big data workloads that happen in the region, which also translates to higher server densities, there is a rising demand for advanced cooling technologies to manage these workloads. Moreover, government schemes encouraging energy-efficient technologies and sustainability are enhancing the adoption of liquid cooling solutions. Growth of Hyperscale data centers, demand driven by AI, and 5G is likely to strengthen North America as the market leader. Moreover, growing investments in green IT, along with the integration of renewable energy will permit the region to combat environmental issues and improve the energy efficiency of mega data centers.

Asia-Pacific Data Center Liquid Cooling Market Growth Opportunities

Asia-Pacific is expected to register the highest CAGR during the forecast period, due to the proliferation of digitalization efforts alongside growing cloud service adoption, and future investment in hyperscale and colocation data centers. With growing data traffic across IoT, 5G rollouts, and edge computing, nations including China, India, and Japan require improved cooling solutions. Liquid cooling adoption is further fueled by supportive government policies that highlight energy efficiency and sustainability in the region. The data center market in Asia-Pacific is poised for strong growth as enterprises and cloud providers strengthen their foothold in the region. Liquid cooling will continue to witness rapid growth due to increased demand for edge computing and heightened awareness regarding energy-efficient technologies, which will further be supported by large-scale investments by global and regional players.

Need any customization on Data Center Liquid Cooling Market - Enquiry Now

Data Center Liquid Cooling Market Key Players

The major key players along with their products are

-

Vertiv Group

-

CoolIT Systems

-

Rittal GmbH

-

Fujitsu Limited

-

Submer

-

Iceotope Technologies

-

Nortek Air Solutions

-

Midas Green Technologies

-

Green Revolution Cooling (GRC)

-

Chilldyne

-

Huawei Technologies

-

Dell Technologies

-

Supermicro

-

Lenovo

-

LiquidStack

-

IBM Corporation

-

Advanced Cooling Technologies, Inc. (ACT)

-

Alfa Laval

Data Center Liquid Cooling Market Competitive Landscape

Perstorp Holding AB, headquartered in Sweden, is a leading global specialty chemicals company recognized for its expertise in sustainable and high-performance solutions. The company focuses on advanced polymers, coatings, resins, adhesives, and animal nutrition, catering to industries such as construction, automotive, agriculture, and packaging. Perstorp has a strong market presence in Europe, North America, and Asia, with an increasing emphasis on bio-based and circular chemical solutions. With growing demand for sustainable materials and low-carbon innovations, Perstorp is strategically expanding its portfolio to support green transformation, positioning itself as a key player in specialty chemicals and advanced material markets.

-

June 2024 – Perstorp partnered with Intel’s Open IP Advanced Liquid Cooling team to develop a new synthetic thermal management fluid for immersion cooling. This advanced solution uses Intel’s SuperFluid technology to boost cooling capacity from 500W to 800W per chip

STULZ Modular, a division of STULZ GmbH, is a global leader in modular data center solutions and precision cooling systems. The company specializes in scalable and energy-efficient modular data centers that cater to hyperscale operators, colocation providers, enterprises, and edge computing applications. With growing demand for AI, cloud computing, and 5G infrastructure, STULZ Modular is positioned strongly in the market by offering customized, prefabricated solutions that reduce deployment time and enhance sustainability. Leveraging its expertise in data center cooling and modular infrastructure, STULZ Modular is expanding across North America, Europe, and Asia-Pacific to meet rising digitalization and green IT initiatives.

-

May 2024 – STULZ Modular, a subsidiary of STULZ GmbH, collaborated with Asperitas to explore the potential of immersion cooling technologies in high-density data centers. Their focus is on a modular data center concept utilizing immersion cooling for both indoor and outdoor deployments

| Report Attributes | Details |

| Market Size in 2024 | USD 3.63 Billion |

| Market Size by 2032 | USD 17.28 Billion |

| CAGR | CAGR of 21.54% from 2025-2032. |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2022-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Solution and Service) • by Type of Cooling (Room-Based Cooling, Rack-Based Cooling, and Row-Based Cooling) • by Type of Data Center (Enterprise Data Center, Colocation Data Center, Wholesale Data Center, Hyperscale Data Center, and Others) • by Industry Vertical (BFSI, Manufacturing, IT & Telecom, Media & Entertainment, Retail, Government & Defense, Healthcare, Energy, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric, Vertiv Group, Asetek, CoolIT Systems, Rittal GmbH, Fujitsu Limited, Submer, Iceotope Technologies, Nortek Air Solutions, Midas Green Technologies, Green Revolution Cooling (GRC), Chilldyne, Huawei Technologies, Dell Technologies, Supermicro, Lenovo, LiquidStack, IBM Corporation |