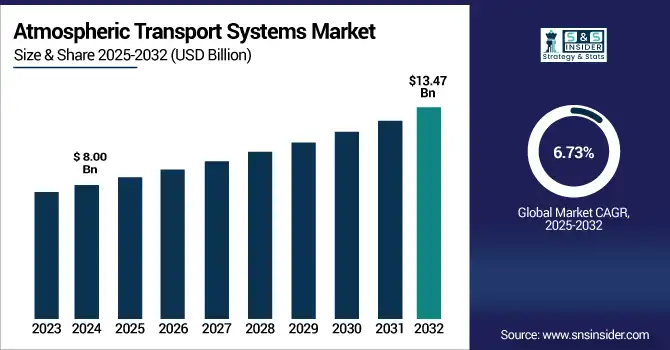

Atmospheric Transport Systems Market Size & Growth Analysis:

The Atmospheric Transport Systems Market size was valued at USD 8.00 Billion in 2024 and is projected to reach USD 13.47 Billion by 2032, growing at a CAGR of 6.73% during 2025-2032.

To Get more information on Atmospheric Transport Systems Market - Request Free Sample Report

The Atmospheric Transport Systems market is gaining momentum, with an increasing demand for accurate and long-term environmental surveillance. These systems monitor shifts in the composition of the air while contributing to the study of climate change, and the response to it. Increased interest in remote and environmentally sensitive regions, such as Polar Regions, is contributing to the need for state-of-the-art observing systems. Businesses and governments are embracing technologies that provide real-time data, highest accuracy and optimal performance. This is even reinforced with more rigorous environmental policies and a worldwide trend towards sustainability. The market is therefore, increasing its adoption rates in the research, industrial and environmental segments, with long-terms prospects for growth based on innovation and international collaboration.

China's first atmospheric observation site on Antarctic continent, at Larsmann Hills, put into use to support research of climate change on the continent by the constant monitoring of the change of Antarctic atmosphere. The move boosts China’s polar prowess, and supports international research into environmental changes in crucial climate-sensitive regions.

The U.S Atmospheric Transport Systems Market size was valued at USD 2.40 Billion in 2024 and is projected to reach USD 3.33 Billion by 2032, growing at a CAGR of 4.15% during 2025-2032, owing to increased stringent environmental regulations, growing expenditure on real time air quality monitoring and technological advancements. Rising demand for climate resilient and sustainable solutions, particularly in industries and research areas, are boosting continued Atmospheric Transport Systems market growth and investment prospects in the medium to long-term, within the public and private sectors.

Atmospheric Transport Systems Market Dynamics:

Drivers:

-

Rising Air Traffic Complexity Fuels Demand for Advanced Atmospheric Transport Systems

The growing complexity of air traffic and the need for enhanced flight safety are key drivers of the Atmospheric Transport Systems market. The systems report real-time weather conditions, visibility, air turbulence and air quality, all essential for maintaining safe and efficient air traffic and flight operations. As the global air traffic continues to grow and airspace becomes more crowded, authorities and airlines are seeking to incorporate modern atmospheric monitoring technologies to aid in smarter decision-making and minimize operational risk. Furthermore, improvements in sensor, data analytics, and automation capabilities have provided increases in the real-time and forecast atmospheric data, leading to increasing market demand. Focus on enhancing aviation safety and infrastructure by regulators is also driving the investments in these system in the commercial as well as defense sectors.

There is increasing concern about aviation safety in the U.S. after a fatal midair collision near Washington Reagan Airport and a near-miss at Chicago Midway. Although there is no assessed cause of the event, experts question deficiencies in air traffic control staffing and safety systems and raise concerns for federal scrutiny and NTSB investigations.

Restraints:

-

Shortage of Skilled Personnel Limits Effective Deployment of Atmospheric Transport Systems

The deployment and operation of advanced Atmospheric Transport Systems demand specialized technical expertise to ensure accuracy, maintenance, and seamless integration with existing infrastructure. However, there is a real current shortage in talent in this niche industry, which presents an enormous challenge to companies wishing to incorporate these technologies. If intelligent operators are not available, then intelligent performance of the system may decrease due to suboptimal calibration, such as extended troubleshooting events and ineffective data analysis. This talent gap lengthens time-to-market and drives up costs, constraining the overall prospects for market growth. Furthermore, the fast development of air quality monitoring technologies demands ongoing training which, however, many groups are not able to afford. Accordingly, the absence of such technical knowledge serves as a barrier to the general acceptance and effective use of Atmospheric Transport Systems for both military and civilian applications.

Opportunities:

-

Increased Demand for Real-Time Atmospheric Data Drives Growth in Atmospheric Transport Systems

The increasing deployment of next-generation inflight technologies and connected aircraft systems is creating demand for precise, up-to-the-minute atmospheric information, for the purpose of improving safety, performance, and passenger experience. Airlines and aviation authorities are increasingly pressured to optimize flight routes, minimize delays, and enhance decision making, and therefore require Advanced Atmospheric Transport Systems that can provide continuous monitoring of weather patterns, turbulence, and air quality. This growing need for accurate environmental data for improved navigation and personalization of inflight services, also indicates a huge opportunity for the atmospheric monitoring solutions market in both commercial and defense aviation. Advancements in sensor capabilities, cloud connectivity and data analytics are also driving market growth, providing quicker and more reliable atmospheric data.

Thales and Delta Air Lines unveiled the Delta SYNC seatback experience in partnership with the carrier, powered by FlytEDGE, the world's first cloud-native inflight entertainment system with a personalized experience and no operational constraints at refresh time. It transforms the travel experience with 4K displays, multi-language support and data-enabled features for a customized travel journey.

Challenges:

-

Technical Complexities and Data Integration Challenges Limit Growth of Atmospheric Transport Systems Market

The Atmospheric Transport Systems market faces significant challenges due to the technical complexities involved in deploying and maintaining advanced monitoring equipment. Limited availability of skilled personnel to operate sophisticated sensors and interpret atmospheric data hampers effective system utilization. Moreover, it is still a challenge to combine huge volumes of real-time data from variety sources into actionable information, leading to the slowdown of decision-making. Expensive advanced sensor technology and infrastructure investment also limits broad use, particularly among smaller operators. Additionally, the cloud-based nature of platforms gives rise to data security and data privacy issues that pose regulatory challenges. These collective factors limit scalability and efficacy of Atmosphere Transport Systems, thereby hindering appropriate penetration of market and growth in the market despite an increasing demand of accurate environmental monitoring in the aviation and allied industries.

Atmospheric Transport Systems Market Segmentation Analysis:

By Type

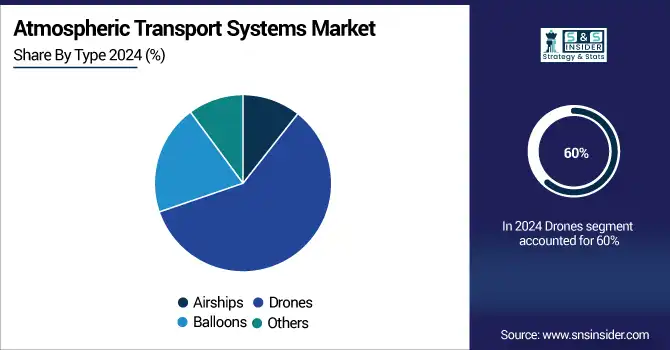

The Drones segment held a dominant Atmospheric Transport Systems Market share of around 60% in 2024, owing to their flexibility, cost-effectiveness and ability to offer accurate, real-time information from the atmosphere in areas which are hard-to-reach. Rising need for improved weather monitoring and real-time information gathering in aviation and environmental applications also propels the market in the Atmospheric Transport Systems market.

The Airships segment is expected to experience the fastest growth in the Atmospheric Transport Systems Market over 2025-2032 with a CAGR of 10.76%, as they are capable of transporting heavy loads to a greater distance with limited fuel consumption. The demand for these systems would be increased with the increasing use in environmental monitoring, disaster management, and remote atmospheric data collection which is driving the Atmospheric Transport Systems market.

By Application

The Surveillance segment held a dominant Atmospheric Transport Systems Market share of around 41% in 2024, owing to surge in demand for enhanced security and monitoring solutions. Increasing concerns for border security, protecting critical infrastructure and disaster response are encouraging the applications of the surveillance systems. Moreover, progress in sensor capabilities and real-time data analytics have made atmospheric systems more effective, further facilitating the market growth.

The Environmental Monitoring segment is expected to experience the fastest growth in the Atmospheric Transport Systems Market over 2025-2032 with a CAGR of 10.52%, as people are gaining awareness about climate change and environment protection. Investment in monitoring air quality, pollution, and natural disasters is also sweeping through governments and organizations. Rapid adoption of atmospheric transport systems for environmental uses is also being facilitated by progress in sensor technology and real-time data accumulations.

By End User

The Commercial segment held a dominant Atmospheric Transport Systems Market share of around 52% in 2024, and expected to be fastest growing during 2025-2032 with CAGR of 8.39%. This growth is driven by the increasing demand for efficient cargo transport and logistics solutions, especially due to the rapid expansion of e-commerce and urbanization. Innovations in atmospheric transport technologies, such as drones and airships, are reducing operational costs and improving delivery speeds. Additionally, governments and private sectors are investing in infrastructure to support commercial applications, further accelerating market growth.

Atmospheric Transport Systems Market Regional Insights:

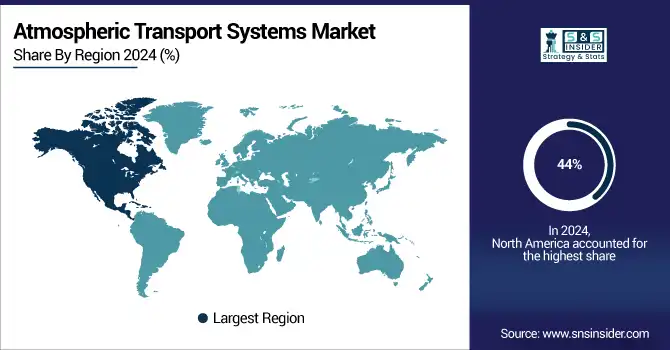

In 2024, the North America dominated the Atmospheric Transport Systems market and accounted for 44% of revenue share. This dominance is maintained by intensive technological innovation, long established industrial infrastructure, and substantial government investment in both the defense and the commercial sectors. Increasing demand for high-tech surveillance, cargo transport, and environmental monitoring solutions, growing support from government bodies and funding is driving market growth in the region.

The Atmospheric Transport Systems market in the U.S. is developing rapidly, owing to rising investments toward drone technology along with growing commercial applications and favorable government initiatives for promoting innovation and infrastructure development.

Asia-Pacific is projected to register the fastest CAGR of 8.40% during 2025-2032, as urbanization is on the rise and the number of e-commerce industries are growing at a fast pace, coupled with huge investment on advanced atmospheric transport technology. Beijing processes such a large share of the domestic drone market due to supportive government policies and the growing industrial infrastructure nationwide and increasing desire for effective cargo and surveillance drones, Fahey said, provide a strong market for drone innovation and adoption.

In 2024, Europe emerged as a promising region in the Atmospheric Transport Systems market, owing to the rising environment regulations, focus towards sustainable transport solutions and maximum investment made in the research and development of the Atmospheric Transport Systems. Increasing need for high-end surveillance and monitoring solutions also further propels the market in the region.

LATAM and MEA is experiencing steady growth in the Atmospheric Transport Systems market, is growing steadily owing to growing infrastructure in the regions and security concerns related to transportation and commercial expansion. Increasing government investments and collaborations to enhance surveillance and monitoring capabilities are also fueling market growth in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Atmospheric Transport Systems Companies are Airbus SE, Lockheed Martin Corporation, Boeing Company, Northrop Grumman Corporation, Thales Group, Alphabet Inc. (Loon Project/X), Raven Industries, Zephyr Aerospace, DJI, Textron Inc. and Others.

Recent Developments:

-

In May, 2025, Airbus delivered the first two NH90 MSPT helicopters to the Spanish Navy, enhancing amphibious transport capabilities under Spain's expanding National Helicopter Plan.

-

In May, 2025, AALTO announced its Zephyr HAPS completed a 67-day flight from Kenya to Australia, showcasing ultra-endurance and readiness for commercial deployment despite a controlled descent in the Indian Ocean.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.00 Billion |

| Market Size by 2032 | USD 13.47 Billion |

| CAGR | CAGR of 6.73% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Airships, Drones, Balloons, Others) • By Application (Cargo Transport, Surveillance, Environmental Monitoring, Others) • By End User (Commercial, Military, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Atmospheric Transport Systems market companies are Airbus SE, Lockheed Martin Corporation, Boeing Company, Northrop Grumman Corporation, Thales Group, Alphabet Inc. (Loon Project/X), Raven Industries, Zephyr Aerospace, DJI, Textron Inc. and Others. |