AI Infrastructure Market Size & Trends:

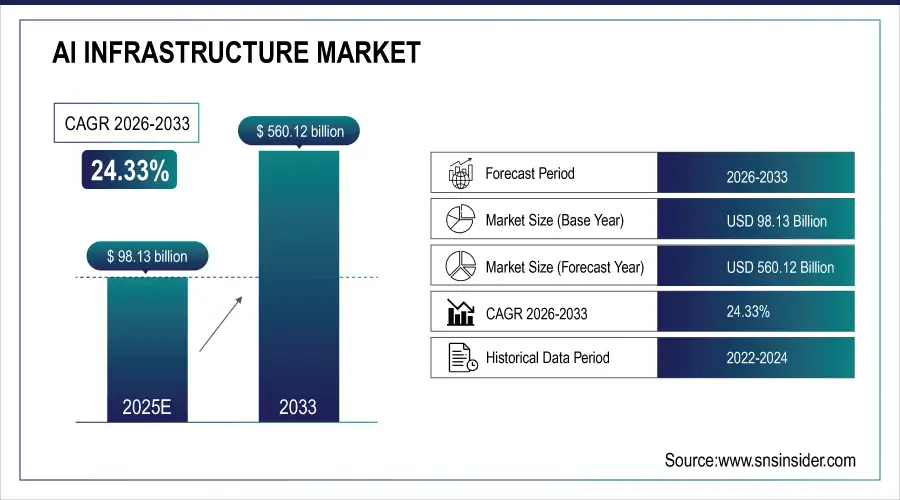

The AI Infrastructure Market Size is estimated at USD 98.13 Billion in 2025E and is projected to reach USD 560.12 Billion by 2033, growing at a CAGR of 24.33% during 2026–2033.

The Artificial Intelligence (AI) Infrastructure Market analysis gives a full picture of the developments in computer hardware, software platforms, deployment architectures, and AI workload enablement that are making it easier for businesses to use AI on a big scale. During the forecast period, there will be a steady demand for high-performance processors, accelerated computing systems, memory, storage, and AI-optimized software platforms. This is because generative AI, foundation models, hyperscale data centers, and enterprise AI transformation programs are all growing quickly.

AI infrastructure is expected to support over 78% of enterprise AI workloads globally by 2026, driven by increasing deployment of large language models (LLMs), computer vision, predictive analytics, and real-time inference systems across industries.

Artificial Intelligence Infrastructure Market Size and Growth Projection:

-

Market Size in 2025: USD 98.13 Billion

-

Market Size by 2033: USD 560.12 Billion

-

CAGR: 24.33% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on AI Infrastructure Market - Request Free Sample Report

AI Infrastructure Market Trends:

-

Growth of generative AI and foundation models is accelerating demand for GPUs and AI accelerators, with over 70% of hyperscalers increasing AI infrastructure spending.

-

Adoption of hybrid and multi-cloud AI is rising, as more than 60% of enterprises deploy AI workloads across multiple cloud platforms.

-

Expansion of edge AI and real-time inference is driving demand for low-latency processors, with deployments growing at a CAGR of over 20%.

-

Use of AI-optimized networking and interconnects is improving data movement efficiency by 30–40% in large AI clusters.

-

Focus on AI software stacks and MLOps is increasing, with over 65% of enterprises investing in AI workload optimization tools.

-

Emphasis on energy efficiency is boosting adoption of liquid cooling and power-efficient accelerators, reducing AI data center energy use by 20–25%.

U.S. AI Infrastructure Market Analysis:

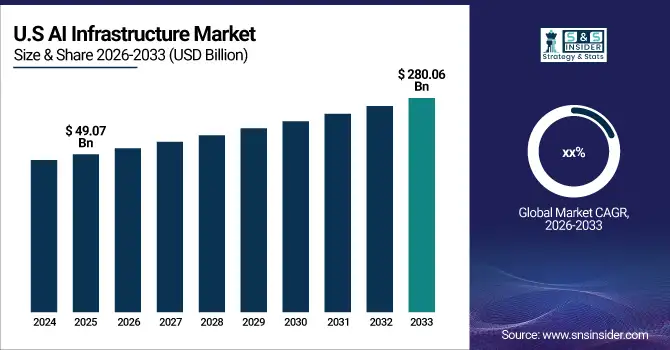

The U.S. AI Infrastructure Market size is estimated at USD 49.07 Billion in 2025E and is projected to reach USD 280.06 Billion by 2033. Rapid growth of hyperscale data centers, leadership in AI chip design, broad use of AI in businesses, and big investments in generative AI platforms are all driving the market growth. The U.S. market is even more dominant since the government gives a lot of money to AI research, cloud-native AI deployment, and the need for AI-driven automation is growing.

AI Infrastructure Market Growth Drivers:

-

Surging Adoption of Generative AI and Large-Scale AI Models to Boost Market Growth Globally

The growing use of generative AI and large-scale AI models is a major factor in the expansion of the AI Infrastructure Market. Businesses and cloud service providers are using more and more complicated models that need a lot of parallel computing, high-bandwidth memory, and distributed storage. Training and inference of LLMs, multimodal models, and AI copilots require faster technology, software frameworks that interact well with AI, and infrastructure designs that can grow.

AI infrastructure makes it possible to train models faster, have better inference latency, and use resources more efficiently. Hyperscalers and businesses are putting more money into AI clusters, GPU farms, and networking solutions that are unique to AI. This is helping the market grow steadily. Global investments in AI infrastructure are expected to rise by more than 18% each year until 2027. This is because AI workloads are growing and compute needs are rising.

AI Infrastructure Market Restraints:

-

High Capital Expenditure and Infrastructure Complexity May Hamper Market Expansion

High capital costs and complicated infrastructure are still big problems for the AI Infrastructure Market. To build advanced AI infrastructure, high investments is required for GPUs, accelerators, high-capacity memory, and specialist networking equipment. It takes a lot of skill, advanced software stacks, and constant tuning to set up and run AI clusters.

Operational challenges related to power consumption, cooling, and system integration further increase total cost of ownership. Smaller enterprises and government organizations may face adoption barriers due to financial constraints, slowing widespread deployment despite strong AI demand.

AI Infrastructure Market Opportunities:

-

Expansion of Hybrid Cloud and AI-as-a-Service Models Can Provide Better Growth Opportunities

The market for AI infrastructure has a lot of room to grow as hybrid cloud and AI-as-a-Service (AIaaS) models expand. Flexible deployment methods that strike a balance between cost effectiveness, security, and performance are becoming more and more popular among organizations. Businesses can use cloud scalability for training and inference while deploying sensitive workloads on-premises due to hybrid architectures.

AI infrastructure providers can capitalize on this shift by delivering modular, scalable, and cloud-integrated solutions. Growing demand for managed AI infrastructure, model hosting, and AI platform services is expected to drive long-term market growth. Hybrid and cloud-based AI infrastructure deployments are expected to account for over 61% of total installations by 2026.

AI Infrastructure Market Segmentation Analysis:

-

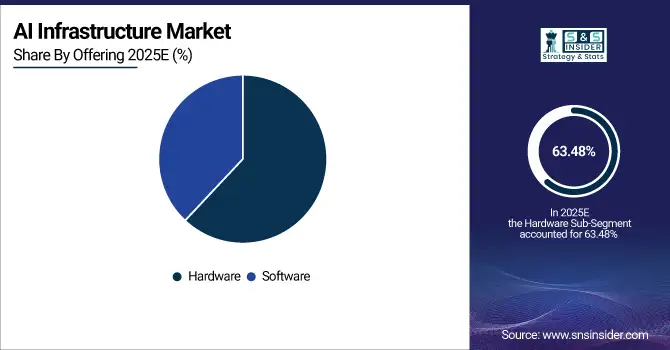

By Offering, Hardware held the largest market share of 63.48% in 2025, while Software is expected to grow at the fastest CAGR of 15.67% during 2026–2033.

-

By Deployment, Cloud dominated with a 52.36% share in 2025, while Hybrid is projected to expand at the fastest CAGR of 16.21% during the forecast period.

-

By Technology, Machine Learning accounted for the largest share of 58.94% in 2025, while Deep Learning is expected to grow at the fastest CAGR of 16.88% through 2033.

-

By End Use, Cloud Service Providers held the largest share of 44.72% in 2025, while Enterprise adoption is projected to expand at the fastest CAGR of 15.43% during 2026–2033.

By Offering, Hardware Dominates While Software Expands Rapidly in the Market

Hardware segment dominated the market due to its critical role in AI model training and inference. Processors, accelerators, memory, and storage systems form the foundation of AI infrastructure. In 2025, over 72% of AI workloads relied on GPU-accelerated hardware, highlighting the importance of high-performance compute platforms.

Software is the fastest-growing segment, driven by demand for AI frameworks, orchestration tools, MLOps platforms, and infrastructure management solutions. In 2025, AI infrastructure software adoption expanded across over 9,500 enterprise deployments, enabling efficient model lifecycle management and workload optimization.

By Deployment, Cloud Dominates While Hybrid Expands Rapidly in the Market

Cloud deployment dominated the market as hyperscalers offer scalable, on-demand AI infrastructure with reduced upfront costs. Cloud platforms support rapid experimentation, model training, and global deployment. In 2025, more than 60% of AI training workloads were executed in cloud environments.

Hybrid deployment is the fastest-growing segment, driven by regulatory requirements, data sovereignty concerns, and performance optimization needs. In 2025, over 4,200 organizations adopted hybrid AI infrastructure to balance flexibility, security, and cost efficiency.

By Technology, Machine Learning Dominates While Deep Learning Segment to Witness Fastest Growth Globally

Machine Learning dominated the market due to its widespread use in predictive analytics, recommendation systems, and automation applications. Over 65% of enterprise AI use cases relied on machine learning infrastructure in 2025.

Deep Learning is the fastest-growing segment, driven by increasing adoption of computer vision, natural language processing, and generative AI. In 2025, deep learning workloads accounted for over 48% of total AI compute consumption, reflecting their intensive infrastructure requirements.

By End-Use, Cloud Service Providers Dominate While Enterprises to Witness Fast Expansion Globally

Cloud Service Providers dominated the market as they operate large-scale AI clusters to support AI services, model training, and inference for global customers. In 2025, hyperscalers accounted for over 45% of global AI infrastructure spending.

Enterprise segment is the fastest-growing, driven by digital transformation initiatives, AI-driven automation, and data-driven decision-making. Over 58% of large enterprises deployed dedicated AI infrastructure in 2025 to support internal AI workloads.

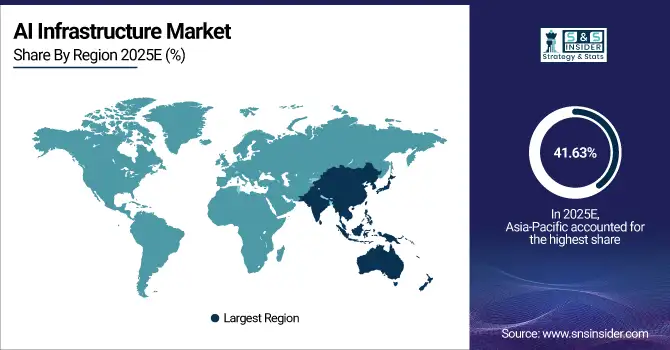

AI Infrastructure Market Regional Analysis:

Asia Pacific AI Infrastructure Market Insights:

In 2025, Asia Pacific held the dominant share of the AI Infrastructure Market, with over 41.63% of the global market. Rapid digitalization, the growth of hyperscale data centers, and substantial government funding for AI development in China, South Korea, Japan, and India are all driving growth. More money is going into AI accelerators, cloud platforms, and national AI agendas. This makes Asia-Pacific a major center for deploying large-scale AI infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China AI Infrastructure Market Insights:

China is the biggest spender on AI infrastructure in the Asia Pacific area, making up more than half of the total. The market is being pushed by high AI adoption, construction of data centers, and government-backed AI projects. Fast deployment of GPUs, AI accelerators, cloud platforms, and full-stack AI software makes it possible for AI workloads to handle a lot of data in industrial, surveillance, banking, and smart city applications.

North America AI Infrastructure Market Insights:

The North American market is expected to increase at a CAGR of more than 17% from 2026 to 2033, making it the fastest-growing regional market. Advanced AI research, the growth of hyperscale cloud computing, and the significant use of AI in businesses are all driving growth. North America is a world leader in AI infrastructure innovation and commercialization as it has made big investments in AI processors, fast networking, and AI software platforms.

-

U.S. AI Infrastructure Market Insights:

The U.S. dominates North America, contributing nearly 70% of regional revenue. The growth is driven by its leadership in AI hardware design, hyperscale cloud computing, and mature AI software ecosystems. Surging investments in generative AI, defense and aerospace AI, and enterprise automation are driving sustained demand for high-performance computing infrastructure and AI-optimized data centers.

Europe AI Infrastructure Market Insights:

The AI infrastructure market in Europe is growing as more and more businesses are using AI in areas including industrial automation, automotive, healthcare, and financial services. The region has around 22% of the global market share, due to solid rules, coordinated AI research programs, and rising expenditures in both cloud-based and on-premises AI infrastructure. This allows the market to grow steadily and in a controlled way.

-

Germany AI Infrastructure Market Insights:

Germany is the biggest contributor in Europe, making up almost 25% of the European market. Adoption of advanced industrial AI, strong data center infrastructure, and big investments in AI-enabled manufacturing, robotics, and automotive technologies all help growth. Germany's key role in the European market is strengthened by the deployment of AI infrastructure in Industry 4.0 projects.

Latin America AI Infrastructure Market Insights:

The market in Latin America is growing steadily, with a compound annual growth rate (CAGR) of about 13%. This increase is being driven by more people using the cloud, national digital transformation programs, and more AI being used in the financial services, telecommunications, and e-commerce industries. Brazil and Mexico are the top countries in the area for investments, owing to the growing need for scalable cloud and AI-ready data center infrastructure.

Middle East & Africa AI Infrastructure Market Insights

The Middle East and Africa AI Infrastructure Market is rising due to the government-led AI plans, smart city megaprojects, and more money going into cloud and data center infrastructure. Over 60% of spending in the region comes from GCC countries. AI infrastructure is being used more and more to support public services, energy optimization, transportation, and national digital economy projects.

AI Infrastructure Market Competitive Landscape:

AIBrain is an artificial intelligence business, established in 2014 and based in Palo Alto, California. Its main areas of concentration are autonomous learning, natural language comprehension, and conversational AI platforms. The company makes AI solutions for robots, business apps, and smart assistants that people use, using its own reinforcement learning and knowledge graph technology to mimic how people think and make decisions.

-

In 2024, AIBrain expanded its enterprise AI platform with advanced multimodal reasoning capabilities to support complex decision automation.

Founded in 2017 and based in Cambridge, Massachusetts, ConcertAI is one of the top healthcare AI companies. It focuses on using real-world data to help with life sciences and cancer research. The company combines clinical data, AI-driven insights, and research-grade analytics to speed up drug discovery, clinical trials, and precision medicine projects for biopharmaceutical and healthcare organizations.

-

In 2024, ConcertAI enhanced its CARA AI platform by incorporating generative AI models to improve oncology trial design and patient cohort identification.

Oracle Corporation is a global leader in corporate technology. It was founded in 1977 and is based in Austin, Texas. It makes database software, cloud infrastructure, AI-powered analytics, and enterprise apps. Oracle's AI features are built into all of its cloud services, which lets big businesses and governments throughout the world automate tasks, use predictive analytics, and run their businesses more intelligently.

-

In 2024, Oracle introduced new generative AI services within Oracle Cloud Infrastructure to strengthen enterprise-scale AI deployment and data security.

Salesforce, Inc. is a global leader in cloud-based customer relationship management (CRM) and enterprise AI solutions. It was formed in 1999 and is based in San Francisco, California. The company uses AI in its sales, service, marketing, and analytics platforms to improve customer interaction, personalization, and workflow automation in all industries.

-

In 2024, Salesforce expanded its Einstein AI and Data Cloud capabilities with generative AI copilots to deliver real-time, context-aware customer insights.

AI Infrastructure Companies are:

-

Nvidia Corporation

-

IBM Corporation

-

ConcertAI

-

Oracle Corporation

-

Amazon.com, Inc.

-

Google LLC (Alphabet Inc.)

-

Super Micro Computer, Inc.

-

Intel Corporation

-

Microsoft

-

Baidu

-

Huawei Technologies

-

Samsung Electronics

List of companies that provide raw materials and components for the AI infrastructure market:

-

TSMC

-

AMD

-

Micron Technology

-

Broadcom

-

Samsung Electronics

-

Intel Corporation

-

Nvidia Corporation

-

Qualcomm

-

SK Hynix

-

Texas Instruments

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 98.13 Billion |

| Market Size by 2033 | USD 560.12 Billion |

| CAGR | CAGR of 24.33 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware [Processor, Storage, Memory], Software) • By Deployment (On-Premises, Cloud, Hybrid) • By Technology (Machine Learning, Deep Learning) • By End Use (Enterprise, Government Organization, Cloud Services Providers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nvidia Corporation (U.S.), AIBrain (U.S.), IBM Corporation (U.S.), ConcertAI (U.S.), Oracle Corporation (U.S.), Salesforce, Inc. (U.S.), Amazon.com, Inc. (U.S.), Google LLC (U.S.), Super Micro Computers, Inc. (U.S.), Intel Corporation (U.S.), Microsoft (U.S.), Baidu (China), Huawei Technologies (China), and Samsung Electronics (South Korea) are key players in the AI infrastructure market, offering a range of AI solutions spanning hardware, software, cloud, and analytics. |