GCC in the Retail and Consumer Goods Market Report Scope & Overview:

The Global Capabilities Centre in the Retail and Consumer Goods Market Size was valued at USD 19.1 Billion in 2023. It is expected to grow to USD 76.9 Billion by 2032 and grow at a CAGR of 15.1% over the forecast period of 2024-2032.

Get More Information on Global Capabilities Centre in the Retail and Consumer Goods Market - Request Sample Report

Automation and AI technologies are revolutionizing operations in various segments and retail and consumer goods are one of the sectors that significantly enhance the efficiency and accuracy of various processes. AI-driven algorithms in inventory management forecast customer demand patterns, optimize stock levels, and eliminate excess inventory to ensure that retail companies can address consumers’ needs promptly and at the lowest possible costs. In customer service, chatbots offer immediate and round-the-clock support, support to all clients, answer inquiries, and complete transactions with no human involvement. This ensures that no client’s needs are left unaddressed, and frees human resources to perform more high-priority jobs. In addition, robotic process automation is employed for quick and effortless processing of orders, maintaining, and handling invoices. This results in reduced turnaround times and lower error rates. Thus, employing these technologies can help RCG companies attain an agile and flexible operational framework while ensuring that overall customer satisfaction continues to be the topmost priority in a demanding and rapidly changing market.

For instance, in October 2024, Accenture acquired Joshua Tree Group to enhance its distribution center performance. It will help Accenture to enhance productivity and efficiency for its retail, consumer goods, and other product-based industry clients' distribution centers. It also enhances Accenture's ability to design and create increasingly autonomous supply chains in which AI-powered systems drive greater labor productivity, inventory optimization, and customer order fulfillment.

GCC in the Retail and Consumer Goods (RCG) sector is sitting at the point of a pattern shift, with data-driven decision-making as one of their cornerstones, consumer insights being significant, and supply chain optimization an imperative. Utilizing advanced data analytics, GCCs can have in-depth insights into consumer behavior and preferences and design marketing campaigns directed toward specific audience segments. This data-driven model allows companies to maximize their product portfolio in terms of real consumer demand and provide consumers with an improved experience, leading to the improvement of satisfaction & brand loyalty. Such proactive management helps organizations to sidestep stock out and excess inventory opportunities, ultimately reducing costs, and resulting in operational efficiencies. Real-time supply chain data analytics also allow businesses to better prepare themselves against disruption or changes in consumer demand, furthering resilience and contributing to sustained growth and competitiveness in an ever-changing market.

According to the U.S. Census Bureau, e-commerce sales in the United States grew by 14.2% in 2021, highlighting the importance of understanding consumer preferences in a digital-first environment.

GCC in the Retail and Consumer Goods Market Dynamics

Drivers

-

Prioritizing R&D in GCCs enables rapid adaptation to market changes and consumer preferences drives the market growth.

-

GCCs implement digital solutions that facilitate seamless omnichannel integration driving market growth.

Global Capability Centers (GCCs) for digital solutions are positioned to react and enable seamless omnichannel integration. 2. GCCs utilize AI, data analytics, and the cloud to provide consistent customer experiences across online, mobile, and in-store channels. This allows businesses to provide consistent and personalized on-message interactions that improve customer satisfaction and loyalty. GCCs can be better equipped to react to customer needs and preferences instantaneously, by streamlining operations as well as communications between different touchpoints. Along with that, the tracking of data across channels enables organizations to identify areas for effective inventory and service delivery optimization, enhancing decision-making capabilities, improving productivity, and increasing revenue. The adaptability of GCCs and the ease of digital solutions have become an essential part of coping with these demands, thereby facilitating overall market growth along with increasing consumer expectations for a seamless shopping experience.

A recent report from NASSCOM of Global Capability Centers (GCCs) in India, showcased their shift from traditional back-office functions to advanced roles in innovation and technology adoption. As of 2022, India is home to over 1,300 GCCs, employing more than 1.3 million professionals and contributing approximately 1% of the country's GDP. These centers are pivotal in driving customer-centricity by leveraging technology to enhance product development, customer insights, and overall user experience.

| Digital Solution | Functionality | Impact on Market Growth |

|---|---|---|

| Customer Relationship Management (CRM) | Centralizes customer data, enabling personalized marketing and sales efforts. | Increases customer retention and satisfaction, leading to higher sales. |

| Data Analytics Platforms | Analyzes customer behavior and preferences across channels. | Provides actionable insights, enabling businesses to tailor offerings effectively. |

| Enterprise Resource Planning (ERP) | Integrates all business processes, providing a unified view of operations. | Enhances efficiency, reduces costs, and improves inventory management. |

| Supply Chain Management (SCM) Systems | Streamlines logistics and inventory management across channels. | Improves responsiveness to demand fluctuations, reducing stockouts and overstock situations. |

| E-commerce Platforms | Facilitates online sales and integrates with physical store operations. | Expands market reach and increases sales opportunities through online channels. |

| Mobile Applications | Offers personalized shopping experiences and services via mobile devices. | Enhances customer engagement and convenience, driving higher sales conversions. |

| Artificial Intelligence (AI) Tools | Enables personalized recommendations and customer service automation. | Improves customer experience, leading to increased loyalty and repeat purchases. |

| Content Management Systems (CMS) | Manages digital content across various channels. | Ensures consistent messaging and branding, enhancing customer trust and recognition. |

| Social Media Integration Tools | Connects various social media platforms for cohesive marketing campaigns. | Expands brand visibility and drives traffic to e-commerce platforms, boosting sales. |

| Chatbots and Virtual Assistants | Provides instant customer support and product recommendations. | Increases customer satisfaction and engagement, leading to higher conversion rates. |

Restraint

-

Integration Challenges may hamper market growth.

One of the bigger pain points for Global Capability Centers (GCCs) is integration challenges; to integrate the new operations with existing business processes and systems. Not only does there need to be technology compatibility, but the corporate cultures as well as the corporate strategy also need to come together for a smooth transition. If GCCs fail to harmonize their functions with the overall objectives of the enterprise, this can result in workflow inefficiencies and communication dissonances between teams. But that seldom leads to an increased speed of reactiveness to changes in the market, which is by definition a huge negative in the converging and technologically driven retail and consumer goods space. However, if a GCC develops some cutting-edge solutions or insights and these are not communicated with other departments or stakeholders or integrated into their decision-making frameworks, then prime opportunities are lost to improve customer experience and drive operational efficiency. To sum up, GCCs that are not integrated into the organization will end as islands where they do not ensure optimal performance and competitiveness for the company.

| Trend | Opportunity |

|---|---|

| E-commerce Growth | Building robust e-commerce platforms, digital marketing expertise, and omnichannel strategies. |

| Supply Chain Disruptions | Implementing resilient supply chain management, risk mitigation strategies, and advanced analytics. |

| Sustainability and Ethical Sourcing | Developing sustainable sourcing practices, carbon footprint reduction initiatives, and ethical supply chain management. |

| Data-Driven Insights | Leveraging data analytics and AI to optimize inventory management, personalize customer experiences, and improve demand forecasting. |

| Emerging Technologies | Exploring opportunities in areas like blockchain, IoT, and augmented reality to enhance customer experiences and operational efficiency. |

| Customer Experience | Focusing on customer-centric initiatives, personalization, and seamless omnichannel experiences. |

| Talent Acquisition and Development | Building a skilled workforce with expertise in digital technologies, data analytics, and supply chain management. |

GCC in the Retail and Consumer Goods Market Segmentation Overview

By Industry Verticals

Food & Beverage held the largest market share around 48 % in 2023. The reason is the sheer size and palpitating demand in the food and beverage industry. Emerging domains like this, which require continuous supply chain management, customer service operations, digital marketing, and analytics drive the demand for GCC services in such sectors. Food and Beverage companies are also keen on achieving operational efficiencies and the entire digital transformation journey, so they have been early adopters of Global Capabilities Centres.

Fashion & Apparel and Home Goods are also strongly represented but typically command smaller market shares in the GCC landscape, more design-driven supply chain logistics, and consumer engagement strategies.

By Customer Segment

Large Enterprises held the largest market share around 32% in 2023. The Global Capabilities Centre (GCC) segment in Retail and Consumer Goods is largely led by large enterprises with a wide range of operations, a worldwide presence covering diverse geography, and a complicated supply chain. Multinational retailer’s consumer goods companies and even local enterprises need to have a rigorous support system that can handle a whole spectrum of processes including customer service, supply chain management, IT services, data analytics, and digital marketing. Their operation scale requires advanced capabilities and resources that GCCs provide at scale through more efficient processes, cost efficiencies, and skilled specialized labor across various regions of the globe. Large enterprises are also known to lead the digital transformation journey, leveraging GCCs for innovation, and customer experience and remaining competitive in the changing market. Due to their high budgets and the requirement for resetting optimization, they are trendsetter users of GCC support in way in the retail and consumer goods domain.

By Service

Supply Chain Management held the largest market share 38% in 2023. This is due to this most critical component of ensuring products are moved seamlessly between manufacturers and consumers. Given that the entire automotive industry is built around squeezing more juice from higher inventory turnover, lower cost of ownership, and faster door-to-door delivery, supply chain management will be crucial to retaining competitiveness. GCCs facilitate greater control over the end-to-end supply chain, with real-time tracking, demand forecasting, procurement; inventory management, and distribution on a global basis.

Retail and consumer goods organizations have a complex supply network and often run across countries' markets that require coordination in multiple regions. For such companies, GCCs promise greater operating efficiencies, cost savings, and agility to address a world with rapidly fluctuating consumer demand and evolving market conditions. There has been an increased usage of digital technologies like artificial intelligence (AI), machine learning (ML), and data analytics in supply chain processes linked with the demand for specialized GCC services.

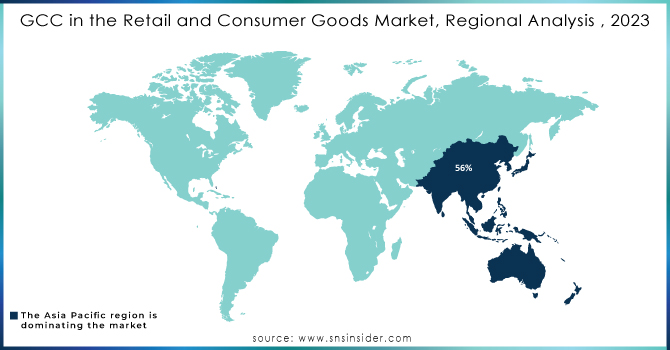

GCC in the Retail and Consumer Goods Market Regional Analysis

Asia Pacific held the largest market share around 56% in 2023. The GCC market in Retail and Consumer Goods is the highest share of the global market active in the Asia-Pacific region, as it consistently offers cost advantages along with a skilled workforce and strong infrastructure. Due to a significant chunk of the English-speaking workforce and the comparatively lower operational costs, GCCs are primarily located in nations such as India and the Philippines. As per the report by the Ministry of Electronics & Information Technology (2023), India has more than 1400 GCCs which contribute over USD 35 billion to the economy and growing at 11% YoY. Furthermore, rapid digitalization in the Asia-Pacific region improves operational efficiencies for global enterprises. The incentivization provided by the governments like the GCC 2.0 initiative of India focused on high-value services, and by the Philippines in the form of tax during setting-up centers make their dominance. Its scalability and cost-effectiveness have made the region the location of choice for multinationals to set up or grow their GCC.

Need Any Customization Research On GCC in the Retail and Consumer Goods Market- Inquiry Now

Key Players in GCC in the Retail and Consumer Goods Market

-

Accenture

-

Wipro

-

Infosys

-

IBM

-

Capgemini

-

Deloitte

-

Cognizant

-

HCL Technologies

-

Genpact

-

Tech Mahindra

-

Oracle

-

SAP

-

Atos

-

Cognizant Softvision

-

NTT Data

-

EPAM Systems

-

L&T Infotech (LTI)

-

KPMG

Key Users

-

Amazon (Amazon Prime, Amazon Fresh)

-

Walmart (Walmart Marketplace, Walmart Grocery)

-

Procter & Gamble (P&G Everyday)

-

Unilever (Unilever Sustainable Living Plan)

-

Coca-Cola (Coca-Cola Freestyle)

-

PepsiCo (PepsiCo Foods, Gatorade)

-

Nestlé (Nestlé Health Science)

-

Target (Target App, Target Circle)

-

L'Oréal (L'Oréal Professional Products)

-

Johnson & Johnson (Johnson's Baby, Neutrogena)

-

IKEA (IKEA Place App, IKEA Family)

-

Adidas (Adidas App, Confirmed)

-

Nike (Nike App, Nike Training Club)

-

Zara (Zara Online, Zara App)

-

H&M (H&M Online Store, H&M App)

-

Costco (Costco Online, Costco App)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 19.1 Billion |

| Market Size by 2032 | US$ 76.9 Billion |

| CAGR | CAGR of 15.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Industry Verticals (Food and Beverage, Fashion and Apparel, Home Goods) • By Customer segment (Large Enterprises, Small and Medium Enterprises) • By Service (R&D Supply Chain Management, IT Service, Customer Support Services, Finance and Accounting, Marketing and Sales) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Tata Consultancy Services (TCS), Wipro, Infosys, IBM, Capgemini, Deloitte, Cognizant, HCL Technologies, Genpact, Tech Mahindra, Oracle, SAP, DXC Technology, Atos, Cognizant Softvision, NTT Data, EPAM Systems, L&T Infotech (LTI), KPMG, and Others |

| Key Drivers | • GCCs implement digital solutions that facilitate seamless omnichannel integration driving market growth |

| RESTRAINTS | • Integration Challenges may hamper market growth. |