Broadcast Scheduling Software Market Key Insights:

Get More Information on Broadcast Scheduling Software Market - Request Sample Report

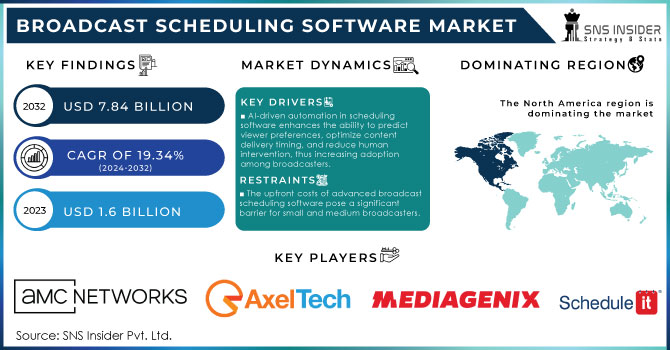

The Broadcast Scheduling Software Market Size was valued at USD 1.6 Billion in 2023 and is expected to reach USD 7.84 Billion by 2032, growing at a CAGR of 19.34% over the forecast period 2024-2032.

The global broadcast scheduling software market is growing substantially due to the enhanced digitization of broadcast operations and the overall increase in demand for more efficient programming management and efficiency. Governments around the world have been playing significant roles in shaping the broadcast industry their efforts are more apparent through demands for greater standards of programming and content delivery. For instance, the U.S. Federal Communications Commission (FCC) reported a 7% rise in the number of broadcast channels from 2021 to 2023, driven by advancements in digital broadcasting. In India, the Ministry of Information and Broadcasting announced new guidelines and targets for conversion by 2022, setting the goal to transform all remaining analog broadcasts to digital no later than 2025. Digital TV and Radio channels were recorded to increase by 12% in the European Union between 2020 and 2023. The broadcast distribution efficiency and impact on consumer satisfaction are issued by governments globally to shape their industries, and these factors are only expected to grow in importance in the upcoming years.

The increasing complexity of broadcast media planning and the rising adoption of cloud-based solutions are key drivers of market growth. Additionally, the popularity of smart devices and multimedia streaming applications further boosts the demand for broadcast scheduling software. This software provides broadcast management teams with features such as flexibility, efficiency, automation, content categorization, and remote access. Recent technological advancements in broadcasting have enabled service providers to enhance their offerings, contributing to overall market growth. However, the shift from traditional TV and radio to online sources, driven by smartphone usage, poses challenges. Despite this, growing investments in media technology are expected to create new opportunities for market players in the coming years.

Market Dynamics

Drivers

-

The increasing demand for streaming and video-on-demand services across multiple platforms (smart TVs, mobile, OTT services) is driving broadcasters to adopt scheduling software to manage complex distribution schedules effectively.

-

AI-driven automation in scheduling software enhances the ability to predict viewer preferences, optimize content delivery timing, and reduce human intervention, thus increasing adoption among broadcasters.

-

The shift toward cloud-based broadcast scheduling solutions offers scalability, flexibility, and cost-efficiency, making it easier for broadcasters to manage content without heavy infrastructure investment.

One of the significant drivers of the broadcast scheduling software market is the rise of multiplatform content distribution. As the consumption of media shifts towards on-demand and streaming services, broadcasters are compelled to deliver their content through various platforms, including traditional television, mobile devices, and over-the-top services. In the U.S. in 2023, streaming accounted for 36% of the total TV viewing time, marking a “dramatic shift toward digital consumption”.

This transition creates a need for advanced scheduling solutions capable of managing complex content delivery across various formats and devices. For instance, Netflix and Disney+ use scheduling software to time the release of their shows and movies and ensure that they reach the desired audience at the appropriate time. An additional example is the implementation of an advanced scheduling system by the BBC to synchronize the traditional television schedule of one of its airings with the online streaming release to improve viewer engagement and retention. As the audience continues to seek personalized, on-demand, and mobile viewing experiences, the ability to schedule and distribute content becomes essential. The growth of multiplatform delivery pushes broadcasters to invest in the software that would not only help them comply with the legal requirements but also maximize viewer satisfaction and engagement. The trend toward streaming is expected to continue growing, and the companies that would be able to navigate and capitalize on the complexity of multiplatform distribution would be best positioned to gain a competitive edge in the media landscape.

Restraints:

-

The upfront costs associated with implementing advanced broadcast scheduling software, particularly for small and medium broadcasters, can be a significant barrier.

-

As broadcast scheduling software increasingly relies on cloud and AI-based solutions, concerns over data privacy and cybersecurity risks can hinder widespread adoption.

One of the major constraints for the broadcast scheduling software market is the high initial investments that are required to implement advanced solutions. Although these tools provide multiple benefits, such as higher efficiency and better content management, the costs could be prohibitive for many small and medium-sized broadcasters. In many cases, it could be difficult or impossible for organizations to allocate proper budgets for new technology. The costs include obtaining software licenses, updating the hardware, and training the staff to use the new solutions. Moreover, it should be noted that additional investment in IT resources would be required for a successful change. The need for significant investments could lead to a situation in which many competitors decide to postpone the adoption of the updated scheduling software. As a result, they would become less competitive in a situation of a rapidly changing media landscape. To a large extent, the high initial costs prevent smaller companies from growing and adopting broadcast scheduling software.

Market Segmentation Analysis

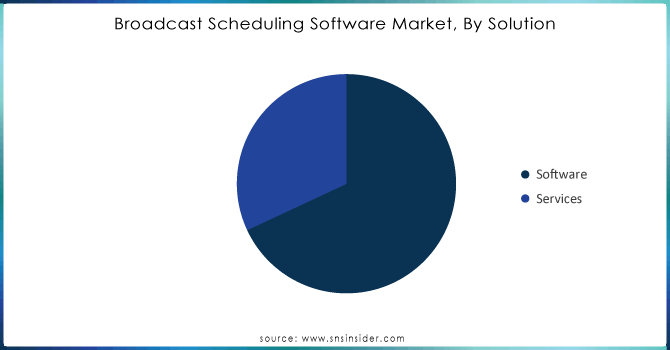

By Solution Segment

The software segment accounted for the largest revenue share of 62% in 2023. The growth of this segment is due to the rising need for modern software systems. These systems help in the automation of programming as well as in the nodes to place the ads, thereby reducing human error and enhancing operational efficiency. Many broadcasters are transitioning from manual scheduling processes to software-based solutions, as these tools offer real-time updates and easy integration with other broadcasting systems, including content management systems (CMS) and customer relationship management (CRM) tools.

On the other hand, the services segment is projected to grow with the fastest CAGR in the forecast period. This acceleration is due to the growing need for training, consulting and software-as-a-service SaaS model adoption. Broadcasters are using these models to lessen the upfront costs. Besides, the governments have provided tax incentives and subsidies to foster digital adoption. For instance, in 2023, Japan’s government has announced that it is offering subsidies in the tune of more than $500 million to broadcasters who will adopt SaaS platforms and cloud-based apps. This financial support makes the service segment more attractive to both large networks and small-scale broadcasters who seek to modernize their infrastructure with minimal capital investment.

Need Any Customization Research On Broadcast Scheduling Software Market - Inquiry Now

By Deployment

The on-premise segment held the largest revenue share of 51.8% in 2023. Broadcasters prefer on-premise solutions since they have direct control over their software infrastructure, the data is more secure, as well as independent from providers. Many broadcasters, especially large-scale networks, prefer to have control of their systems since the data and operations are their proprietary content. The U.S. Department of Commerce reported in the 2023 broadcasting infrastructure survey that close to 60% of US broadcasters still use on-premise solutions. The local broadcasters in the US prefer using the on-premise system due to the need to have greater control of the system and customization of the programs. This trend is prevalent in Europe as well, where regulatory bodies enforce stringent data protection laws such as the General Data Protection Regulation (GDPR), which makes cloud solutions less appealing for broadcasters handling sensitive or proprietary content. Despite the dominance of on-premise solutions, cloud-based deployments are gaining traction, particularly among smaller broadcasters and media companies. Cloud-based systems offer scalability and reduce the need for costly hardware maintenance. However, regulatory barriers and concerns over cloud security have kept on-premise solutions in the lead.

By Application

The TV segment accounted for the largest revenue share of 45% in the broadcast scheduling software market in 2023. Increasing pressure on television broadcasters to handle complex programming schedules and ad inventory has come from greater competition between digital and traditional media platforms. A report by the U.K.'s Office of Communications (Ofcom) traditional TV networks added over 200 new channels over the last three years, requiring sophisticated scheduling tools to manage simultaneous broadcasts across multiple regions. TV stations, especially in regions with high demand for local programming, are turning to broadcast scheduling software to streamline operations. Due to their strict advertising regulations, government statistics show that public broadcasters of countries such as Canada, Germany, and Australia have been mandated to maintain high-quality programming while adhering to stringent advertising regulations, further boosting the need for these tools.

Region Analysis

In 2023, North America dominated the global broadcast scheduling software market, accounting for the largest market share of 38.5%. The reasons for this dominance are largely because the region is highly advanced and boasts wide development in the broadcasting sector, technological advancement, and encouraging government measures towards the adoption of digital broadcasting solutions. As per the U.S. Federal Communications Commission, beyond the 90% of U.S. TV networks switching to all-digital broadcasting in the course of the last year into 2022 respectively, thus increasing the demand for scheduling software, and government-backed projects like Digital Video Broadcasting, launched in Canada, and ongoing in the U.S. in a bid to enhance the broadcasting infrastructure and fuel market growth accordingly.

On the other hand, the Asia-Pacific region is projected to register the fastest CAGR during the forecast period, primarily on account of rapid growth in digital broadcasting in countries such as India, China, and Japan. All of the Indian broadcast networks are expected to be digitized by the year 2025. The "Digital India" initiative launched by the Indian government is definitely going to attain its goal. A report released by India's Ministry of Information and Broadcasting cites an increase by 25% in digital TV subscriptions for 2023. It goes without saying that the rising demand for broadcast scheduling software reflects this rise. Digital innovation by the Japanese government through its "Society 5.0" initiative will spur growth in the market as broadcasters will embrace advanced scheduling solutions to manage more and more channels and platforms.

Recent Developments

-

In January 2023, The U.S. Federal Communications Commission (FCC) introduced new regulations mandating broadcasters to adopt more efficient scheduling solutions to ensure compliance with updated content and advertising standards. These regulations have prompted several major broadcasters to invest in advanced broadcast scheduling software systems.

-

In April 2023, WideOrbit partnered with Telos Alliance to provide broadcasters with a more efficient solution that minimizes the need for on-premises equipment. This collaboration allows all WO Automation for Radio server components and the Axia Altus virtual mixing console to be installed on Amazon Web Services (AWS), enabling the delivery of remotely contributed and on-air audio via the cloud.

Key Players

Key Software Developers or Service Providers

-

Advanced Broadcast Services Limited (ABSVision, ABSTraffic)

-

AMC Networks Inc. (AMC Scheduling Tool, AMC Distribution System)

-

AxelTech (AxelCast, AxelFlow)

-

MEDIAGENIX (WHATS'ON, WHATS'ON Workflow)

-

Marketron Broadcast Solutions (Marketron Traffic, Marketron Revenue)

-

Schedule it Ltd. (Schedule it! Scheduler, Schedule it! Planner)

-

WideOrbit (WideOrbit Traffic, WideOrbit Scheduling)

-

Imagine Communications (Selenio, Nexio)

-

Chetu Inc. (Broadcast Management Software, Scheduling Software Solutions)

-

BroadView Software Inc. (BroadView Traffic, BroadView Scheduler)

Users of Services/Products

-

BBC

-

NBCUniversal

-

ViacomCBS

-

Disney

-

Sky Group

-

Fox Networks

-

HBO

-

TelevisaUnivision

-

Discovery Inc.

-

RTVE

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.6 Billion |

| Market Size by 2032 | USD 7.84 Billion |

| CAGR | CAGR of 19.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Software, Services {Professional Services, Managed Services}) • By Deployment (On-Premises, Cloud, Hybrid) • By Application (TV, Radio, Digital Platforms) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Broadcast Services Limited, AMC Networks Inc., AxelTech, MEDIAGENIX, Marketron Broadcast Solutions, Schedule it Ltd., WideOrbit, Imagine Communications, Chetu Inc., BroadView Software Inc. |

| Key Drivers | • The increasing demand for streaming and video-on-demand services across multiple platforms (smart TVs, mobile, OTT services) is driving broadcasters to adopt scheduling software to manage complex distribution schedules effectively. |

| RESTRAINTS | • The upfront costs associated with implementing advanced broadcast scheduling software, particularly for small and medium broadcasters, can be a significant barrier. |