AI in Computer Vision Market Size & Trends Analysis:

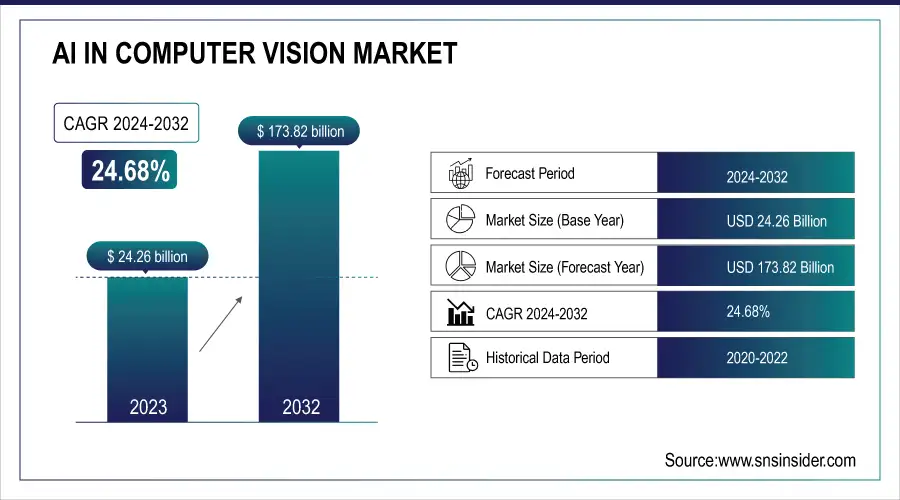

The AI in Computer Vision Market stood at USD 24.26 billion in 2023 and is likely to grow up to USD 173.82 billion by the end of 2032, with a CAGR of 24.68 % between 2024 and 2032. AI in the Computer Vision market is emerging very speedily owing to growing needs of automation, face recognition, and smart surveillance. Deep learning and imaging technology advancements are broadening uses in healthcare, automotive, and retail industries. North America and Asia-Pacific show the highest adoption, with a boost coming from robust technological infrastructure and innovation programs.

To Get more information on AI in Computer Vision Market - Request Free Sample Report

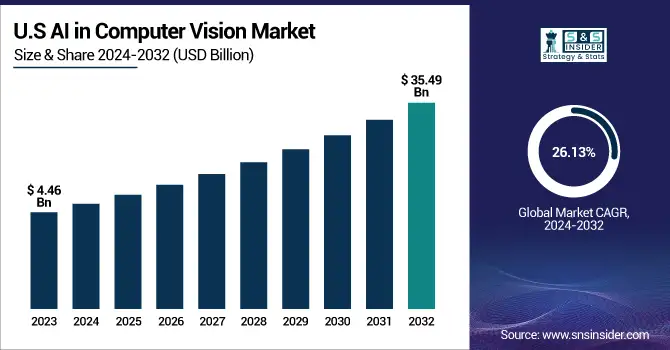

In the United States, the market for AI in Computer Vision was worth USD 4.46 billion in 2023 and is expected to grow to USD 35.49 billion by 2032, with a CAGR of 26.13 %. This is driven by the rising adoption of AI technology in major industries like healthcare, automotive, retail, and security. The U.S. is supported by a well-established tech ecosystem, good research infrastructure, and ample funding for computer vision and machine learning startups. The growth of applications such as self-driving cars, medical diagnostics, and intelligent surveillance systems is also fueling the demand for sophisticated visual processing technology in the country.

AI in Computer Vision Market Dynamics

Key Drivers:

-

Growing Integration of AI-Powered Vision Systems Across Healthcare and Automotive Industries Accelerates The AI in Computer Vision Market Growth.

The speedy adoption of AI-enabled vision systems in major industries such as healthcare and automotive is profoundly propelling the AI in Computer Vision Market. In the healthcare sector, AI-powered imaging solutions help detect diseases early, aid in diagnostics, and facilitate treatment planning, leading to better patient outcomes. In the automotive sector as well, advanced driver assistance systems (ADAS) and autonomous vehicles hugely depend on computer vision to perceive the environment, maintain safety, and make instantaneous decisions. The continued trend of digitization and automation across industries, combined with growing investment in AI R&D, further drives adoption. As these applications expand, demand for advanced computer vision solutions continues to grow.

Restrain:

-

High Initial Costs of AI-enabled computer Vision Infrastructure restrain the AI in Computer Vision Market Expansion Potential.

Owing to robust expansion, the Computer Vision Market's AI is restrained by the financial burden of up-front implementation expense. The fact that adoption would require powerful GPUs, custom-built hardware, deep learning libraries, and large labeled datasets renders implementation expensive, especially for small- and medium-scale businesses. Another reason is the heavy computational infrastructure and expertise that AI model training demands, making it a substantial additional cost. These cost-related hurdles can hinder deployment, restrict access in developing areas, and decelerate ROI, ultimately constraining wider market growth. Absent scaling costs being lowered or mitigated by scaling solutions, adoption will likely remain focused on more substantial corporations with larger budgets.

Opportunity:

-

Expanding Application of AI Vision Technologies in Smart Retail and Surveillance Offers Lucrative Opportunities for AI in the computer Vision Market.

The growth of AI vision technology to smart retail and surveillance creates massive market development potential. Within retail, AI-powered systems automate real-time stock management, marketing at the customer's level of detail, and checkout without a cashier, elevating customer experience and operational optimization. At the same time, in surveillance, AI vision elevates facial recognition, anomaly detection, and monitoring public safety in real time. It becomes essential infrastructure for both government and private sector security. With urban growth, innovative city development, and digitalization picking up speed in the world, these industries will be creating large demand. Companies investing in niche, scalable AI vision solutions stand to gain greatly from this fast-growing opportunity.

Challenges:

-

Limited Availability of Quality Datasets and Annotation Accuracy Challenges The AI in Computer Vision Market Development.

One of the most pressing problems in the AI in Computer Vision Market is the scarcity of high-quality, annotated datasets against which to train models. Computer vision applications depend significantly on large, correctly labeled datasets upon which to operate well in diverse applications. Acquiring and annotating such data, however, is labor-intensive, costly, and open to human bias, particularly for sophisticated tasks such as object detection in changing environments. In addition, biased or truncated datasets may create model inaccuracies and ethical issues. This limitation hinders model scalability and functionality, particularly in sectors such as healthcare and defense, where reliability and accuracy cannot be compromised.

AI in Computer Vision Market Segment Analysis

By Function

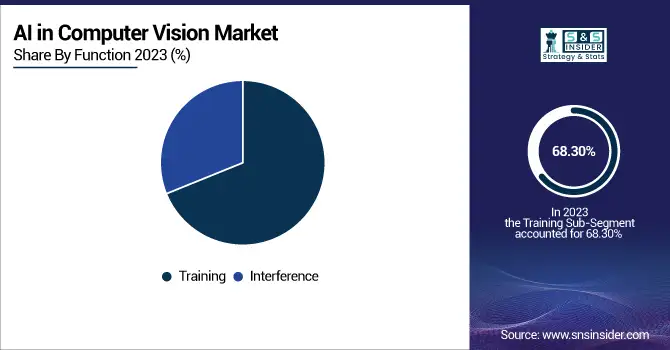

In 2023, the Training segment led the AI in the computer vision market and generated 68.30% of the revenue. This dominance is fueled by the high level of computational resources needed to train and optimize AI models, and hence, strong training datasets and heavy processing capabilities are required. Firms such as Microsoft have played a major role in this industry; in March 2023, Microsoft declared a computer vision AI renaissance with its Florence foundation model, which was trained on billions of text-image pairs and incorporated as affordable, production-ready computer vision services in Azure Cognitive Service for Vision. Such developments highlight the importance of end-to-end training in improving AI model accuracy and performance, thus driving market growth.

The Inference segment is anticipated to witness the highest Compound Annual Growth Rate (CAGR) of 26.75 % over the forecast period. The growth is driven by the rising use of AI models in real-time use cases across industries, which require efficient and timely inference capabilities. In February 2024, Assert AI announced its no-code computer vision platform, Pratham, patented for its unique methodology of democratizing computer vision and artificial intelligence. With Pratham, customers can unleash the power of Vision AI technology without any coding or AI skills, which is a key milestone in computer vision technology. Such developments underscore the increasing focus on making inference processes more efficient to ensure smoother adoption of AI models into real-world applications and drive market growth.

By End-use

In 2023, the Consumer Electronics segment headed the AI in computer vision market with a 32.60% share of revenue due to the implementation of AI-driven vision technology in products such as smartphones, laptops, and home automation systems. This increase has been supported by firms like Meta Platforms; in June 2023, Meta announced I-JEPA, an AI model capable of analyzing and completing images in a human-like manner, to improve experiences in consumer electronics. This trend reflects the growing demand for vision-enabled smart devices, reaffirming the dominance of AI in the computer vision market by the consumer electronics sector.

The Auto segment is anticipated to witness a 28.05 % CAGR over the forecast period due to growth in AI-powered computer vision for autonomous driving and driver assist systems. In January 2024, NVIDIA announced the DRIVE Thor platform, which is a centralized AI computer for cars that combines features such as autonomous driving and driver monitoring. Furthermore, firms such as Ambarella have created AI-enabled image signal processors for improving vehicle safety and performance. These innovations underscore the automotive industry's pursuit of integrating AI in computer vision, making it a fast-developing sector in the market.

By Application

In 2023, the Non-Industrial sector dominated AI in the computer vision market with a 53.60% revenue share. This is fueled by the extensive use of AI-enabled computer vision solutions across industries like retail, healthcare, and consumer electronics. For example, in May 2024, OpenAI unveiled GPT-4o, a multimodal AI model with the ability to process audio, vision, and text in real time, adding value to virtual assistant and customer service platform applications. Such advances highlight the increased use of AI in non-industrial applications, driving market growth.

The Industrial sector is expected to witness the highest Compound Annual Growth Rate (CAGR) of 26.15 % over the forecast period. This is due to the growing adoption of AI-based computer vision solutions in manufacturing and automation applications. Organizations such as Zivid and Mech-Mind Robotics have created sophisticated 3D vision systems and software to improve robotic guidance and quality inspection in industries. These developments emphasize the key position of AI in streamlining industrial processes, thus contributing to high growth in the AI in computer vision market.

By Component

In 2023, the Software segment was at the helm of the AI in computer vision market, capturing 62.40% of the revenue. The leadership is due to the rising demand for sophisticated software and algorithms that allow machines to effectively process and interpret visual data. Organizations such as OpenAI have played a key role in this expansion; in May 2024, OpenAI released GPT-4o, a multimodal AI that performs real-time reasoning across audio, vision, and text and can better improve applications across industries. Such advancements highlight the importance of software in pushing AI-based computer vision technology and its acceptance across industries.

The Hardware segment is expected to witness the maximum Compound Annual Growth Rate (CAGR) of 26.36 % over the forecast period. This is driven by the innovation of customized processors and chips that are tailored to maximize AI calculations for computer vision use cases. For example, in April 2024, Hailo Technologies added $120 million more to its Series C funding and introduced Hailo-10, a Generative AI acceleration module for edge devices that improves on-device AI processing capability. Such innovation reflects the growing focus on hardware breakthroughs to enable the growing needs of AI in computer vision, thus propelling market growth.

AI in Computer Vision Market Regional Insights

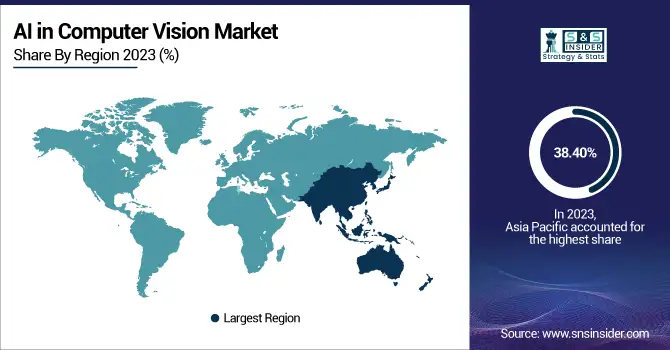

In 2023, the Asia Pacific region was the market leader in the AI in computer vision market, earning a 38.40% revenue share. This is fueled by quick technology development and heavy investments in AI in countries such as China, Japan, and South Korea. Businesses like SenseTime, one of the top Chinese AI companies, have played a pivotal role in this development. SenseTime launched SenseRobotGo, a robot that plays the Chinese game Go interactively, in December 2023, demonstrating technological advancements in AI-powered robots. These innovations reaffirm the commitment of the region to adopting AI in multiple applications, reinforcing its leading role in the AI in computer vision market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is expected to witness the highest Compound Annual Growth Rate (CAGR) of 26.84 % during 2022-2030 in the AI in computer vision market. The growth is driven by the growing adoption of AI technologies in industries like automotive, retail, and healthcare. For example, in April 2024, Cognex launched the In-Sight L38 3D Vision System, the first 3D vision solution with AI, which improves inspection and measurement applications. Furthermore, companies such as Ocrolus in New York are utilizing AI computer vision for the analysis of financial data, thereby fueling further market growth. These advancements showcase North America's rapid growth and innovation in the AI in computer vision market.

Key Players Listed in the AI in Computer Vision Market are:

-

NVIDIA Corporation ( Jetson AGX Orin, DeepStream SDK )

-

Intel Corporation – ( OpenVINO Toolkit, Intel RealSense )

-

Facebook –( DeepFace, DINOv2 )

-

Microsoft Corporation –( Azure Computer Vision, Seeing AI )

-

Qualcomm ( Snapdragon Neural Processing Engine, Vision Intelligence Platform)

-

AWS – ( Amazon Rekognition, AWS Panorama )

-

Xilinx –( Kria Vision AI Starter Kit, Zynq UltraScale+ MPSoC )

-

BASLER AG – ( Basler ace 2 Cameras, Basler pylon SDK )

-

IBM Corporation ( IBM Maximo Visual Inspection, IBM Watson Visual Recognition )

-

Google – ( Google Cloud Vision API, MediaPipe )

Recent Development

-

In December 2024, NVIDIA introduced CV-CUDA, an open-source library designed to accelerate end-to-end computer vision and image processing pipelines, enhancing efficiency for cloud applications.

-

In January 2025, Intel announced plans to spin off its RealSense computer vision division into an independent company, aiming to expand AI-powered technologies in stereo vision, robotics, and biometrics AI software and hardware.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.26 Billion |

| Market Size by 2032 | USD 173.82 Billion |

| CAGR | CAGR of 24.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component-( Hardware , Software) • By Application- ( Industrial , Non-industrial ) • By Function- ( Training, Interference ) • By End-use- ( Automotive, Healthcare, Retail Security And Surveillance, Robotics And Machines, Consumer Electronics ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation, Intel Corporation, Facebook, Microsoft Corporation, Qualcomm, AWS, Xilinx, BASLER AG, IBM Corporation, Google. |