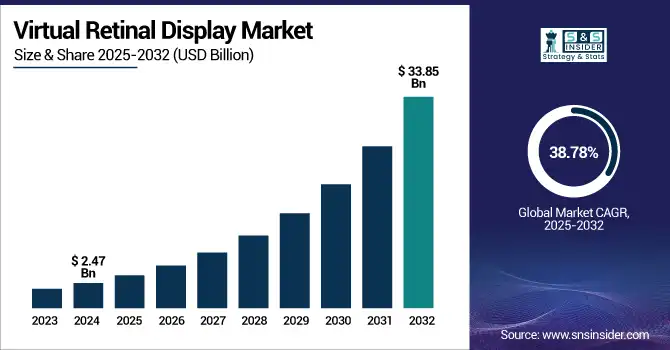

Virtual Retinal Display Market Size Analysis:

The Virtual Retinal Display Market Size was valued at USD 2.47 billion in 2024 and is expected to reach USD 33.85 billion by 2032 and grow at a CAGR of 38.78 % over the forecast period 2025-2032.

To Get more information on Virtual Retinal Display Market - Request Free Sample Report

The global market is driven by such large trends as detailed technology and application segmentation combined with at the same time highly different regionally developments. The growth is driven primarily by increasing demand in the gaming, health care and defense sectors, along with the continued rapid development of display technology. Competition and innovation are driving increasingly rapid adoption, making the virtual retinal display a key enabler of immersive, high-fidelity visual displays around the world.

According to research, over 35% of enterprises worldwide have begun integrating virtual retinal displays into training, simulation, and design workflows as of 2023.

The U.S. Virtual Retinal Display Market size was USD 0.59 billion in 2024 and is expected to reach USD 7.26 billion by 2032, growing at a CAGR of 36.80 % over the forecast period of 2025–2032.

The US virtual retinal display market growth due to increase in prevalence of advance AR and wearable devices, major investment in healthcare and military across the region. Rising consumer awareness and immersion technology adoption in gaming and entertainment industry also contribute to the market. Moreover, the ongoing strong R&D investment together with positive government policies encourage technological developments and market establishment.

According to research, Over 50% of U.S. consumers are now aware of and willing to adopt immersive technologies, including AR glasses and VRD-enabled wearables.

Virtual Retinal Display Market Dynamics

Key Drivers:

-

Growing Demand for Enhanced Visual Display in Healthcare and Military Applications

The need for high-end, precise, real-time imaging in medical and military creates a massive boom for the virtual retinal display market. In medicine, such displays assist by enabling minimally invasive surgeries and diagnostics that enable surgeon to have clear, hands-free images and which help to make them more accurate and faster. In the military domain, better situational awareness through retinal displays increases the efficiency of missions and enhances the safety of personnel during complex operations. These are serious use cases and as a result they are driving the development, investment and adoption of Virtual Retinal Display and the associated markets in these high-value sectors on a global scale.

According to research, Military personnel using retinal display systems report up to a 40% improvement in situational awareness during complex missions, reducing risk and enhancing decision-making.

Restrain:

-

High Cost of Virtual Retinal Display Technology Limits Widespread Adoption

High cost of manufacturing and developing virtual retinal displays is a key restraint to the market. They depend on complex optics, sophisticated light sources and high level of calibration, which lead to high cost for these technologies to be operated by final users. High prices limit penetration in cost-sensitive markets, such as in developing countries. The need for custom hardware and software adds to the cost burden, making most companies dis-incentivized to adopt such solutions, causing the growth of the market to be significantly suppressed. In addition, the total cost is higher based on the continuous maintenance and technical support factor besides preventing widespread adoption.

Opportunities:

-

Rising Adoption of Virtual Retinal Displays in Automotive and Smart Wearables Presents Growth Potential

Increasing adoption of virtual retinal display in automotive heads-up display (HUD) and smart wearable devices create significant growth opportunities. The lightweight and high resolution displays are desired in such areas to present real-time information to the user in a unobtrusive manner. Connection to smart glasses and helmets via navigation and communication are more user-friendly and safer. Connected consumer devices and smart technologies have become increasingly popular, and manufacturers have an exciting market opportunity to innovate and monetize new offerings. Moreover, progress in sensor technology and AI application make these equipment more and attractive in function.

According to research, Advances in AI and sensor integration have improved HUD accuracy and responsiveness by over 25%, enhancing navigation and communication in smart wearables.

Challenges:

-

Complexity in Integration with Existing Systems Hampers Adoption

The virtual retinal display technology has become difficult to incorporate into existing devices and platforms. Incompatibility with different hardware and software ecologies can impose a longer development cycle and a higher development cost. This complicates the introduction of VRD systems in domains such as automotive, healthcare, and consumer electronics. Furthermore, providing a seamless user experience in various applications needs to be constantly reinvented and seriously field tested, on long product launch time frame and market penetration. Also, a lack of consistent protocols creates interoperability issues and also makes it challenging for seam-less integration and scaling across sectors.

Virtual Retinal Display Market Segment Analysis:

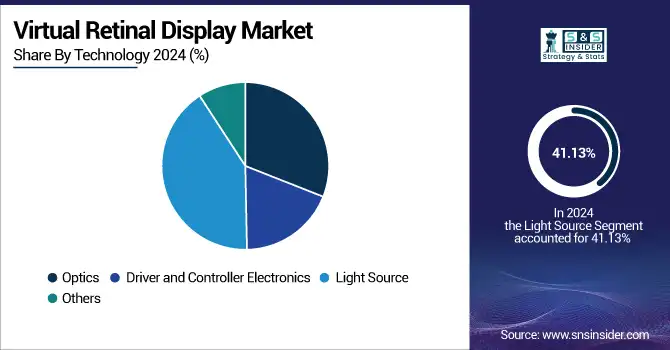

By Technology

The Light Source segment dominated the Virtual Retinal Display Market with the highest revenue share of about 41.13% in 2024, due to their important role in providing brightness, clarity, and image quality. Light sources like laser diode and LED play essential roles in VRD systems, which can help produce bright images via high efficiency and real display excellent images on retina. Virtual retinal displays companies such as MicroVision Inc. have been fostering the development of small, low-power light source tech, notably for AR/VR applications, bolstering the segment’s industry lead. The increasing use in automotive HUDs and wearable displays serves to increasingly establish its leading market position.

The Optics segment is expected to grow at the fastest CAGR of about 40.12% from 2025 to 2032, because of the growing requirement of miniaturized and high performance optical devices. The cutting-edge optics provide sharp, clear images for great objective clarity of the outdoor environment, and perfect optics rendering texture for the task, this is key to a UHD experience. Magic Leap, Inc. has been instrumental in developing some of the most advanced optics systems for lightweight and high-resolution AR wearables, expediting awareness. This development is driving innovation and explosive growth in consumer and enterprise display applications. Growing interest towards 3D visualization and advancing real time imaging is simultaneously increasing the requirement for the next gen optical modules.

By Application

The Gaming and Entertainment segment dominated the Virtual Retinal Display Market in 2024, capturing a 32.87% revenue share, fuelled by the increasing requirement for high-quality, high-definition visual experiences. Virtual retinal displays yields vibrant real world image with less eye strain effect over extended uses thus are perfect for gamers and multimedia users. Immersive gaming technologies, like Sony Group Corporation, are spending in large amount for the retinal display systems, which is being effectively integrated to some of the next generation gaming headsets and entertainment systems. Rising interest toward e-sports markets and AR-based interactive storytelling is augmenting global demand for VRD-enabled entertainment solutions.

The Medical segment is projected to grow at the fastest CAGR of about 40.46% from 2025 to 2032, because of increasing incorporation of VRD in diagnostics, surgical and therapeutic instruments. These are capable of providing high-resolution, real-time image viewing for better operative and teleconsultation precision. There are several groups including Thermo Fisher Scientific Inc., who are investigating retinal display-based modalities for clinical imaging and diagnostics. With the advancement of digital health solutions, VRDs are growing in relevance within hospitals, clinics, and telemedicine platforms. The increasing preferences for minimally invasive surgeries along with wearable health tech will certainly escalate the medical industry outlook.

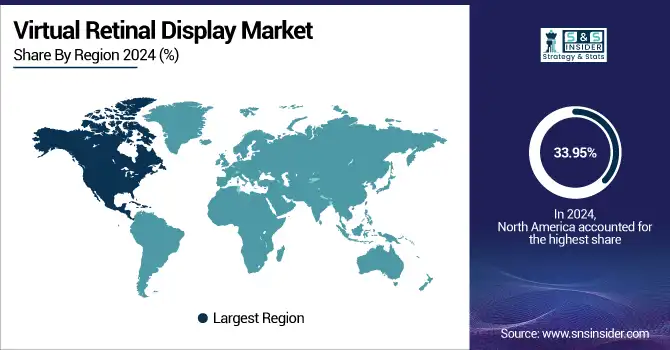

Virtual Retinal Display Market Regional Outlook:

North America dominated the highest Virtual Retinal Display Market share of about 33.95% in 2024, due to early adoption of new technologies and a developed consumer electronics industry. The region has strong research and development facilities, a high investment in digital innovation and extensive use of AR/VR across industries, including healthcare, military and gaming. Rising prevalence of favorable regulatory policies and growing preference for sensory experiences are also instigating NA to maintain its dominance in the virtual retinal displays market.

-

US dominated the North American Market due to the technological advanced infrastructure, the high penetration of AR/VR devices, strong ecosystem for research and development, dynamic applications in healthcare, defense and entertainment industry, accompanied with significant consumer and institution investment in various innovations within the country.

Asia Pacific is expected to grow at the fastest CAGR of about 40.45% from 2025 to 2032, driven by growing R&D funding and application of AR/VR in different industries. The region’s smart device, digital healthcare, and immersive education platforms are all seeing investments grow. The region’s robust electronics manufacturing sector, growing urban population, and increasing disposable income levels are further boosting penetration. Moreover, government initiatives towards innovation along with increased adoption of wearable tech, further augments the virtual retinal display market progress.

-

China leads the market in the Asia Pacific Virtual Retinal Display Market on account of the huge consumer base, strong electronics manufacturing, rapid deployment of AR/VR, and government support for innovation, all creating a center for production and technology improvisation.

Europe holds a significant position in the Market, due to the growing investments in R&D and the applications of AR/VR technology in various industry verticals such as the healthcare, automobile, and manufacturing sectors. The area is underpinned by robust public sector efforts in both digital innovation and sustainability. Furthermore, growth in adoption of immersive learning techniques and visualization technologies is driving growing market opportunity in other European nations.

-

Germany dominates the Europe Market due to the presence of a large number of automotive, healthcare, and manufacturing companies along with a highly developed industrial sector that has led to the adoption of VRDs solutions and consequently to market growth.

In the Middle East & Africa, growth is driven by the UAE’s emphasis on smart technologies and healthcare, and in Latin America the large consumer base and expanding digital and medical sectors in Brazil help drive adoption, contributing to regional growth overall.

Get Customized Report as per Your Business Requirement - Enquiry Now

Virtual Retinal Display Companies:

Major Key Players in Virtual Retinal Display Market are Magic Leap Inc., eMagin Corporation, Avegant Corporation, Texas Instruments Inc., Vuzix Corporation, QD Laser Co., Ltd., Analogix Semiconductor Inc., Himax Technologies Inc., Lumus Ltd., MicroVision Inc and others.

Recent Trends:

-

In May 2024, Magic Leap and Google announced a strategic partnership to advance the potential of XR technologies, focusing on innovative waveguide development and device ideation

-

February 2024, Vuzix introduced the M4000 Smart Glasses, featuring enhanced optics and processing capabilities, designed to deliver superior augmented reality experiences in various industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.47 Billion |

| Market Size by 2032 | USD 33.85 Billion |

| CAGR | CAGR of 38.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Optics, Driver and Controller Electronics, Light Source, Others) • By Application (Aerospace, Medical, Gaming and Entertainment, Sports, Training and Simulation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Magic Leap Inc., eMagin Corporation, Avegant Corporation, Texas Instruments Inc., Vuzix Corporation, QD Laser Co., Ltd., Analogix Semiconductor Inc., Himax Technologies Inc., Lumus Ltd., MicroVision Inc. |