Signal Generator Market Size Analysis:

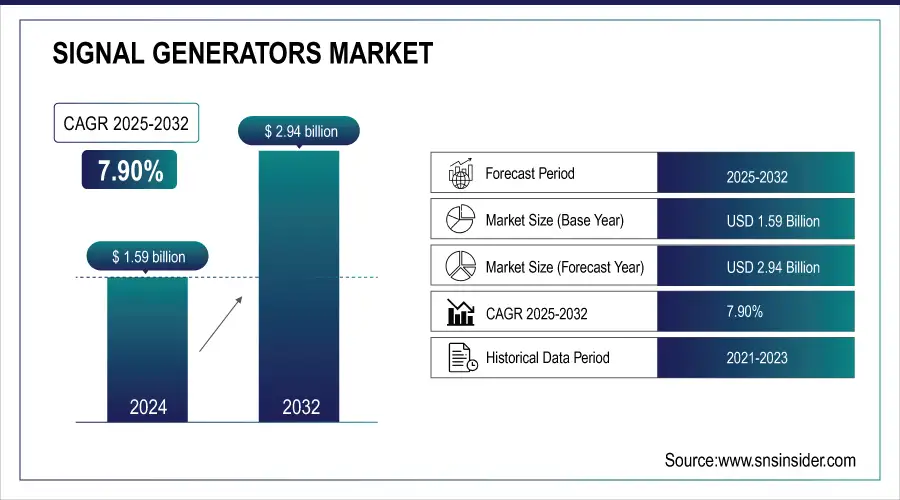

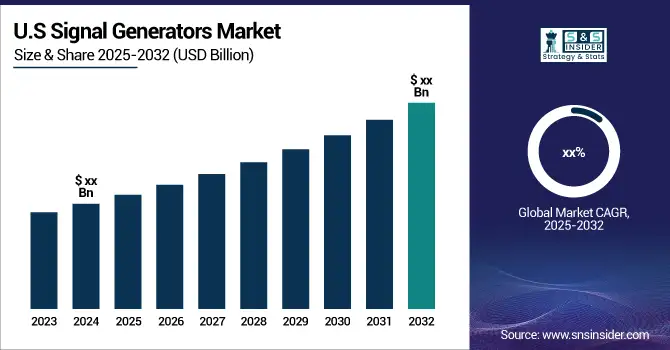

The Signal Generator Market Size was valued at USD 1.59 Billion in 2024 and is expected to grow at a CAGR of 7.90% to reach USD 2.94 Billion by 2032.

The Signal Generator Market is growing at a remarkable pace in 2024 and 2025, due to technological advancements, increasing adoption across industries, and supportive government initiatives. Signal generators are an essential tool for designing, testing, and troubleshooting electronic systems, playing a crucial role in sectors like telecommunications, aerospace, automotive, and healthcare. Some of the top leaders of this market include countries such as the USA, China, Japan, Germany, France, and India. They have a good industrial infrastructure and make huge investments in R&D. The USA recently launched initiatives in 2023 related to strengthening semiconductor manufacturing with a special emphasis on high-precision testing tools, like signal generators. Similarly, China's rapid 5G deployment, which has reached more than 3.84 million 5G base stations, which is 60% global coverage of base stations - according to the Ministry of Industry and Information Technology, China - is driving demand for advanced communication testing equipment.

Government policies are also significantly impacting the Signal Generator Market. India's "Make in India" initiative promotes local electronics manufacturing, while the focus by the EU on the 'digital transformation' emphasizes the need for state-of-the-art testing tools. The latest advancements involve a software-defined signal generator for higher precision, flexibility, and integration capabilities, fitting to the modern requirements of high frequency testing and compatibility with AI systems. In Japan and Germany, electric and autonomous vehicles are driving demand for signal generators in testing radar systems, communication modules, and other automotive components.

Get PDF Sample Report on Signal Generator Market - Request Sample Report

Potential in future developments with integration and usage of IoT and quantum computing technologies. Ideas generated by organizations like NIST.gov, showing that things can and most probably will head towards becoming modular and multifunctional design applications for versatile purposes. Launch of innovative products released within the period 2023 to 2024 signal generators such as compact size portable. Rohde & Schwarz releases R&S SMB100B. These products operate analogue at speeds as fast as up to 40 GHz. It offers excellent output power, spectral purity, and low close-in phase noise with four frequency options that range from 8 kHz to 12.75 GHz, 20 GHz, 31.8 GHz, or 40 GHz. This versatile generator is ideal for radar receiver testing, semiconductor components, and amplifier simulations. With increasing applications across industries and regions, the market for signal generators will keep growing in the coming years, driven by innovation and governmental strategic support.

Signal Generator Market Trends:

-

Increasing adoption of signal generators for 5G component testing, including antennas, transceivers, and base stations.

-

Rapid expansion of RF testing equipment demand, growing by approximately 25% annually due to 5G rollouts.

-

Rising use of signal generators in electric and autonomous vehicle testing for radar, communication, and ADAS systems.

-

Growing focus on high-frequency signal reliability to meet stringent automotive safety and performance standards.

-

Expanding applications of signal generators in developing 5G-enabled IoT ecosystems, smart cities, and connected mobility solutions.

Signal Generator Market Growth Drivers:

-

The Impact of 5G Rollout on the Growing Demand for Signal Generators in Testing and Design

The advent of 5G networks has dramatically changed the communication industry, and there is a growing demand for sophisticated test and design equipment. Signal generators are highly essential for testing and verification of the performance of 5G components, including antennas and transceivers. Countries such as the USA and China have taken the lead in 5G deployment, with more than 60% of base stations established in china by 2023. Research indicates that rollouts of 5G have increased the demand for RF testing equipment, including signal generators, by 25% annually. This trend is going to continue as industries make a transition to 5G-enabled IoT ecosystems, autonomous systems, and smart cities.

-

Signal Generators Driving Innovation in Electric Vehicles and Autonomous Automotive Technologies

The rise in electric vehicles and autonomous driving technologies has increased the usage of signal generators for the testing and simulation of different automotive components. They encompass the radar sensors, communication modules, and advanced driver assistance systems. Japan and Germany are the leaders in electric vehicle development, where electric registration was reported at 30% for new vehicle registrations in those regions in 2023. Signal generators allow the exacting testing of high-frequency signals, and this will have to be reliable to get through automotive electronics without safety and performance issues. The growing demand for EV infrastructure as well as the need to have stringent testing protocols of autonomous vehicles further fuels growth in the market.

Signal Generator Market Restraints:

-

Addressing Cost Barriers to Broader Adoption of Signal Generators Among SMEs

The reason why signal generators find limited applicability among the SMEs is that signal generator offers high value, but initial money pays all due to advanced features. Any general model exceeds USD 10,000, whereas advanced models reach several hundred thousand dollars and find limited usage among smaller-sized manufacturers and research labs. A research states that the cost of signal generators constitutes 15-20% of the total equipment budget for a typical electronics testing lab.

Moreover, the rapid pace of technological advancements makes it difficult for SMEs to invest in equipment that may become outdated within a few years. Although leasing and rental options are available, they do not provide the long-term reliability that ownership ensures. Democratization of signal generator technology by eliminating the cost-related issues to penetrate the market broadly is a necessity.

Signal Generator Market Segment Analysis:

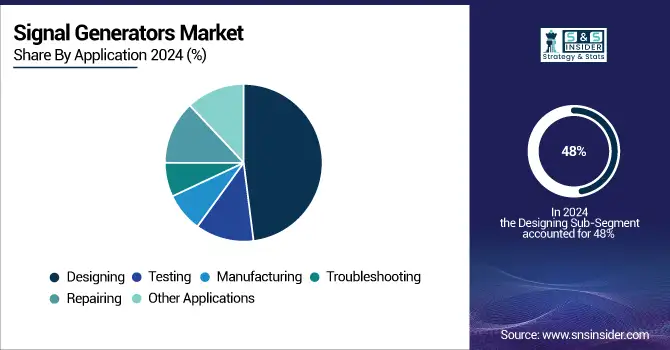

By Application

The Designing segment dominated in 2024 with an enviable 48% share in the market because this function is critical in producing some advanced electronic circuits and their accompanying parts. Signal generators remain highly essential tools for engineers as engineers make designs, ensuring that products like communications devises, automotive systems, as well as aerospace electronics, remain performance optimally and to fine tolerances.

The Testing segment is anticipated to grow with the highest CAGR of 8.73% over the forecast period 2025-2032 due to the increasing demand for reliable and high-performance devices across industries. Testing applications employ signal generators to verify and check compliance with stringent regulatory requirements and are, therefore, in high demand in industries like healthcare, defense, and consumer electronics.

In November 2024, Siglent released the SDG1000X Plus series Function/Arbitrary Waveform Generator. This gives engineers a more versatile and effective signal generation option. The SDG1000X Plus has 8 Mpts of waveform memory, which allows the creation of long, complex modulated signals for accurate testing.

By End User

The Communications segment led the market in 2024 with 42% of the market share, underlining the sector's dependence on signal generators to develop and test advanced telecommunication systems. From mobile networks to satellite communications, signal generators play a crucial role in ensuring seamless connectivity and performance.

The Communications segment is expected to grow with the highest CAGR of 8.12% in the forecast period 2025-2032, mainly due to rapid advancement in 5G technology, IoT adoption, and increasing demand for efficient spectrum utilization. Moreover, the continuous evolution of wireless standards demands robust testing and prototyping tools, further amplifying the growth of the segment. Automotive and healthcare industries also benefit from the advancements in communications technology, as they integrate connected systems and devices.

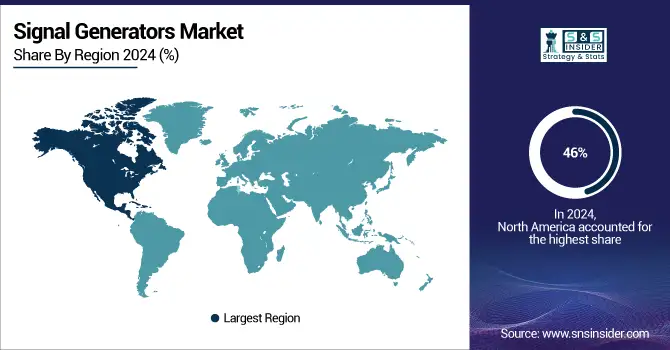

Signal Generator Market Regional Analysis:

North America Signal Generator Market Insights

North America dominated the market in 2024 with 46% market share, mainly due to high investments in aerospace, defense, and telecommunication sectors. The USA leads the region due to its focus on cutting-edge technologies and R&D initiatives.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Signal Generator Market Insights

Asia Pacific is expected to grow the fastest with a CAGR of 8.35% during the forecast period (2025–2032), driven by fast industrialization and advancement in communication infrastructure in countries like China, India, and Japan.

Government-backed initiatives, such as China's 5G deployment strategy and India's "Digital India" campaign, are further driving growth in the region. Europe is also a strong contender, with Germany and France emphasizing automotive and electronics advancements. The global nature of the market ensures that the innovations and policies in one region are significantly impactful to the trends and opportunities worldwide.

Europe Signal Generator Market Insights

Europe’s Signal Generator Market is driven by 5G infrastructure expansion, aerospace testing, and automotive innovation, emphasizing precision, frequency stability, and advanced R&D applications across industrial and defense sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Signal Generator Market Insights

LATAM and MEA witness steady signal generator adoption, fueled by telecom modernization, growing defense investments, and increasing demand for test equipment in wireless communication and electronic manufacturing industries.

Top Signal Generator Companies are:

-

Keysight Technologies Inc. (N6100B 5G Signal Generator, CXG Series Signal Generators)

-

Rohde & Schwarz GmbH & Co. KG (R&S SMA100A Signal Generator, R&S SFE100 Signal Generator Family)

-

National Instruments Corporation (NI PXIe-5654 RF Analog Signal Generator, NI PXIe-5673E Vector Signal Generator)

-

Anritsu Corporation (MG3710E Vector Signal Generator, MG3740A Analog Signal Generator)

-

Tektronix Inc. (AWG70000B Series Arbitrary Waveform Generators, TSG4100A Vector Signal Generator)

-

Teledyne Technologies Incorporated (T3AWG3252 Arbitrary Waveform Generator, T3VNA1500 Vector Network Analyzer)

-

B&K Precision Corporation (4050B Series Dual Channel Function/Arbitrary Waveform Generators, 9801 Programmable AC Power Source)

-

Fluke Corporation (Fluke 5502A Multi-Product Calibrator, Fluke 9500B Oscilloscope Calibrator)

-

Stanford Research Systems (SG380 Series RF Signal Generators, DS360 Ultra Low Distortion Function Generator)

-

Good Will Instrument Co. Ltd. (AFG-3000 Series Arbitrary Function Generators, GDS-3000 Series Digital Storage Oscilloscopes)

-

Yokogawa Electric Corporation (FG400 Series Function/Arbitrary Waveform Generators, DL950 ScopeCorder)

-

Aaronia AG (BPSG4 RF Signal Generator, Spectran V6 VSG Vector Signal Generator)

-

Vaunix Technology Corporation (Lab Brick LMS-802DX Signal Generator, LSG-402 Signal Generator)

-

Berkeley Nucleonics Corporation (Model 845-M Microwave Signal Generator, Model 865-M-40 Signal Generator)

-

Rigol Technologies Inc. (DG800 Series Arbitrary Waveform Generators, DSG800 Series RF Signal Generators)

-

Siglent Technologies (SDG6000X Series Arbitrary Waveform Generators, SSG5000X Series RF Signal Generators)

-

Aim-TTi (Aim and Thurlby Thandar Instruments) (TGR2050 Series RF Signal Generators, TGF3000 Series Function/Arbitrary Generators)

-

AnaPico AG (APSIN20G Signal Generator, APPH6000 Phase Noise Analyzer)

-

Marconi Instruments (2024 Signal Generator, 2031 Signal Generator)

-

Giga-tronics Incorporated (GT-1000A Microwave Signal Generator, GT-9000 Series Signal Generators)

Competitive Landscape for Signal Generator Market:

Keysight Technologies is a global leader in electronic design and test solutions, offering advanced signal generators, oscilloscopes, and network analyzers that support 5G, aerospace, and semiconductor industries with precise measurement, performance validation, and cutting-edge testing innovations.

-

May 2024: Syntony GNSS has collaborated with Keysight Technologies, manufacturer of RF testing solutions. The company will advance GNSS testing and simulation capabilities for Syntony through partnership with Keysight's VXG advanced signal generator. With the ability to generate thousands of simultaneous signals across all GNSS constellations and bands, it is a feature that includes time and phase synchronization for high-fidelity accuracy in simulation scenarios.

Anritsu Corporation is a leading provider of innovative test and measurement solutions, offering advanced signal generators, spectrum analyzers, and network testing equipment that enhance performance validation across telecom, 5G, IoT, and aerospace industries.

-

March 2023: In a joint development partnership with Virginia Diodes, Inc., Anritsu Company introduced frequency extender modules for its Rubidium line of signal generators, which offer coverage from 50 GHz to 1100 GHz, making them the industry's broadest in frequency coverage and best output power in their class, in order to create a sub-THz signal generator solution for emerging scientific, wireless communications systems, and body scanner and material scanner applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.59 Billion |

| Market Size by 2032 | USD 2.94 Billion |

| CAGR | CAGR of 7.90% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (RF Signal Generator, Microwave Signal Generator, Arbitrary Waveform Generator, Vector Signal Generator, Other Product Types), • By Technology (Global Systems for Mobile Phones (GSM), Code Division Multiple Access (CDMA), Wideband Code Division Multiple Access (WCDMA), Long Term Evolution (LTE), Other Technologies), • By Application (Designing, Testing, Manufacturing, Troubleshooting, Repairing, Others), • By End User (Communications, Aerospace & Defense, Automotive, Electronics Manufacturing, Chemical Industry, Healthcare, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Keysight Technologies Inc., Rohde & Schwarz GmbH & Co. KG, National Instruments Corporation, Anritsu Corporation, Tektronix Inc., Teledyne Technologies Incorporated, B&K Precision Corporation, Fluke Corporation, Stanford Research Systems, Good Will Instrument Co. Ltd., Yokogawa Electric Corporation, Aaronia AG, Vaunix Technology Corporation, Berkeley Nucleonics Corporation, Rigol Technologies Inc., Siglent Technologies, Aim-TTi (Aim and Thurlby Thandar Instruments), AnaPico AG, Marconi Instruments, Giga-tronics Incorporated. |