AI in Insurance Market Report Scope & Overview:

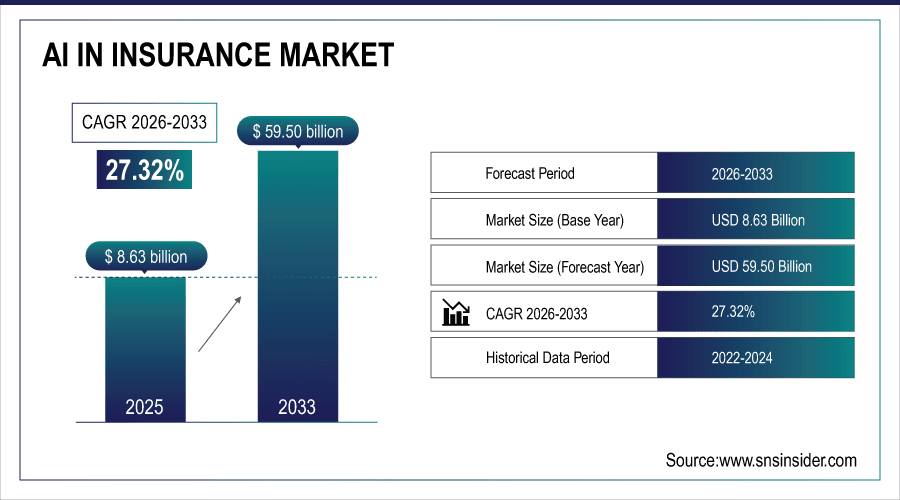

The AI in Insurance Market size was valued at USD 8.63 billion in 2025E and is projected to reach USD 59.50 billion by 2033, growing at a CAGR of 27.32% during the forecast period 2026–2033.

The AI in Insurance market takes a deep dive into both the software and services that are making use of technologies such as machine learning, NLP, and RPA among others to improve underwriting, claims, fraud detection and customer experience. In 2025, there were 12.4 million AI-powered insurance processes in use worldwide, predictive analytics making up the majority at 41%. Insurance firms made up 52% of end users. Growing digitalization, need for operating efficiency and enhanced risk management solutions are fuelling market growth.

Fraud detection and predictive analytics accounted for 42% of demand in 2025, highlighting focus on risk management.

To Get More Information On AI in Insurance Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 8.63 Billion

-

Market Size by 2033: USD 59.50 Billion

-

CAGR: 27.32% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

AI in Insurance Market Trends:

-

Over 8,500 papers in the field of AI for insurance application around the world has been published in 2025 which means that technology have increased at a rapid pace.

-

In 2025, there were more than 1,900 test programs involving AI-based claims processing, underwriting and fraud detection.

-

In 2025, the number of AI software and service deployments at insurance companies will explode to 7,200 as growth expands.

-

50% of AI technology programs had a machine-learning or NLP project in 2025.

-

AI will be mainstreamed in the operations of more than 1,100 insurers and their service providers by 2025.

U.S. AI in Insurance Insights:

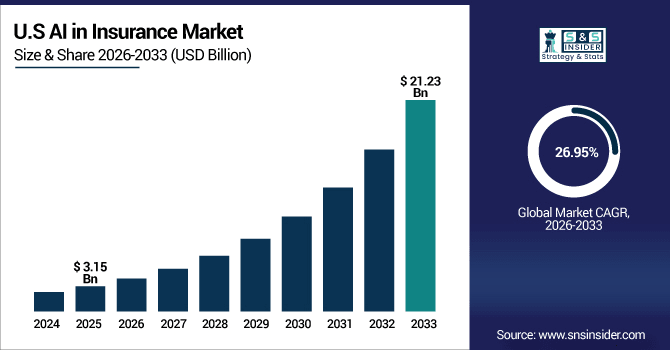

The U.S. AI in Insurance Market was USD 3.15 billion in 2025E, projected to reach USD 21.23 billion by 2033 at a CAGR of 26.95%. AI-driven fraud detection, predictive analytics, and customer service dominate, while underwriting automation and digital insurance platforms grow rapidly, fueled by technology investments and insurer-tech collaborations.

AI in Insurance Market Growth Drivers:

-

Rising Demand for Automated Risk Assessment and Fraud Detection Drives AI Adoption in Insurance Operations.

The AI in Insurance Market growth is fueled by rising demand for automated risk assessment and fraud detection. AI processed more than 5.6 million insurance claims worldwide in 2025 and predictive analytics was used to analyze 42% of the total number of claims. There was about 275 new AI patents filed in the insurance technologies, suggesting work exploring innovation in areas like underwriting and claims. 61% of worldwide AI-insurance collaborations were carried out in North America and Europe, showcasing regional investment and engagement.

Cloud-based AI deployments represented 44% of total implementations in 2025, highlighting preference for scalable, flexible solutions.

AI in Insurance Market Restraints:

-

Data Privacy Concerns and Strict Compliance Regulations Limit Widespread AI Adoption in Insurance Operations.

Data privacy concerns and strict compliance regulations remain major barriers to AI in Insurance Market growth. In 2025, some 33% of AI pilot programs fell at the scaling hurdle because of regulatory and security concerns, compared with just 9% for established insurers. The absence of qualified data specialists, secure cloud systems and compliance standards are also impeding adoption. Wide-ranging regional laws, strict data protection laws and lack of transparency in algorithms are preventing mass AI adoption despite increasing demand for automation and fraud prevention.

AI in Insurance Market Opportunities:

-

Integration of AI-Powered Analytics and IoT Data Offers Significant Growth Potential in Risk Management and Customer Engagement.

AI-driven analytics combined with IoT data are opening up major growth opportunities for insurance. As of 2025, over 2,100 risk management and customer engagement ones with AI were initiated in places around the world such as underwriting, claims handling and fraud detection. By 2033, the number of such programs is anticipated to exceed 5,000. A trend of early Adoption and a Big Market opportunity 62% of active deployment were in North America and Europe.

Predictive analytics and IoT integration represented 48% of new AI initiatives in 2025, highlighting focus on efficiency.

AI in Insurance Market Segmentation Analysis:

-

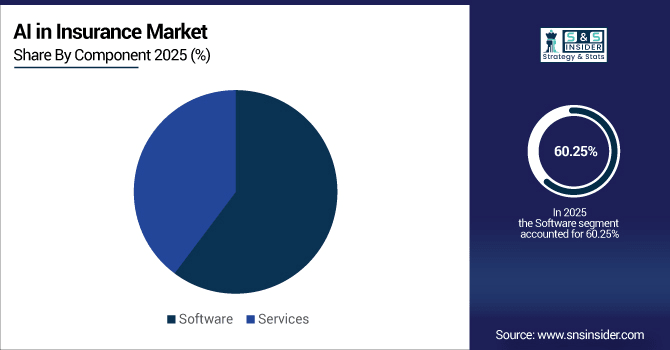

By Component, Software held the largest market share of 60.25% in 2025, while Services are expected to grow at the fastest CAGR of 34.76%.

-

By Technology, Machine Learning contributed the highest market share of 44.78% in 2025, while Natural Language Processing (NLP) is forecasted to expand at the fastest CAGR of 34.88%.

-

By Application, Fraud Detection & Risk Management held the largest share of 35.46% in 2025, while Customer Service & Chatbots are expected to grow at the fastest CAGR of 34.92%.

-

By Insurance Type, Property & Casualty Insurance held the largest share of 40.67% in 2025, while Health Insurance is anticipated to grow at the fastest CAGR of 34.81%.

-

By Deployment Mode, Cloud-Based Solutions contributed the highest market share of 50.33% in 2025, while On-Premise is expected to grow at the fastest CAGR of 34.79%.

-

By End User, Insurance Companies held the largest share of 69.84% in 2025, while Third-Party Service Providers are anticipated to grow at the fastest CAGR of 34.85%.

-

By Distribution Channel, Direct Sales contributed the highest market share of 59.72% in 2025, while Online Platforms are expected to grow at the fastest CAGR of 34.91%.

By Component, Software Leads While Services Expand Rapidly:

By 2025 more than 4,950 software were deployed globally for AI in the Insurance market with clams’ process and fraud detection being by far the largest use case. Services, as AI consulting and system integration surged with 2,180 projects in 2025 all set to exceed 5,120 by 2033. Increasing demand for end-to-end automation, operational efficiency, and AI-led digital transformation across North America, Europe, and Asia Pacific is accelerating adoption.

By Technology, Machine Learning Dominates While NLP Expands Quickly:

AI applications, driven by machine learning with over 5,230 deployments in 2025 for predictive risk assessment and underwriting. The NLP technologies saw fast growth with 1,910 active projects in 2025 and forecast to rise to 4,580 by 2033. NLP is adopted by insurance companies for chatbots, document processing and voice recognition needed for automation, multilingual support and advanced analytics throughout North America, Europe and APAC insurance market.

By Application, Fraud Detection & Risk Management Lead While Chatbots Grow Fast:

Portends fraud detection and risk management made the headlines with more than 3,480 AI deployments in 2025 that revolved around claim validation and anomaly detection. Customer service chatbots expanded rapidly with 2,070 applications in 2025, projected to surpass 4,790 in 2033. In North America, Europe, and Asia Pacific, adoption is being fueled by heightened customer expectations digital engagement programs and cost-effective automation.

By Insurance Type, Property & Casualty Insurance Leads While Health Insurance Expands:

P&C insurance used AI in its underwriting and claims automation applications across more than 3,860 projects in 2025. Health insurance showed the most rapid increase with 2,430 AI applications in 2025 and predicted to rise to 5,110 by 2033. Growth is associated with rising need for predictive risk management, customized policies and telehealth inclusion in the U.S., Europe as well as APAC regions.

By Deployment Mode, Cloud-Based Solutions Lead While On-Premise Expands Rapidly:

Cloud-based AI solutions seemed to be preferred with 4,620-plus deployments in 2025, as they are scalable and cost-effective. On-site options boomed with 1,970 in-place installations in 2025 and anticipated to grow to 4,210 by 2033 due to preferences for data security, regulatory compliance and enterprise control. Adoption includes multinational insurers in North America, Europe and Asia-Pacific.

By End User, Insurance Companies Lead While Third-Party Providers Expand:

Insurance companies used AI across more than 5,110 programs in 2025, mostly for claims, underwriting and fraud detection. They saw third-party services expand rapidly from 2050 AI projects in 2025, to over 4520 in 2033 providing consulting, integration and analytics. This expansion is driven by the outsourcing of AI solutions and digital transformation throughout North America, Europe and Asia Pacific.

By Distribution Channel, Direct Sales Lead While Online Platforms Expand:

Direct sales were the main channel for AI adoption, accounting for more than 4,430 implementations by 2025 through enterprise contracts and bulk software purchases. Online grew rapidly to have 2,120 programs in 2025 and an expected 4,710 by 2033 driven by digital adoption, e-commerce outlets and self-service systems for small and medium insurers. North America, Europe and APAC drive growth through digitization of insurance distribution and AI-powered engagement.

AI in Insurance Market Regional Analysis:

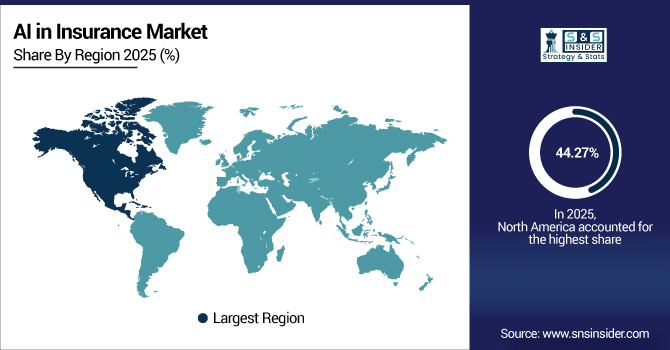

North America AI in Insurance Market Insights:

North America accounted for 44.27% of the global AI in Insurance Market in 2025, with over 5,100 AI implementations across underwriting, claims, and fraud detection. Early adoption of innovative analytics, predictive modeling and AI-enabled customer engagement is propelling the region. Increasing investments in digital transformation, cloud infrastructure, and AI research and development, as well as insurers partnering with tech companies, are speeding up adoption. Its outlook is expected to be solid until 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. AI in Insurance Market Insights:

The U.S. had 5,430 AI projects in 2025 across claims processing, underwriting and customer engagement. AI-powered analytics platforms were adopted by over 320 insurers, and more than 210 digital insurance startups integrated AI. Increasing attention on predictive modeling, automation and AI-driven customer service will continue to drive market growth through 2033.

Asia-Pacific AI in Insurance Market Insights:

The Asia-Pacific AI in Insurance Market is projected to grow at a CAGR of 28.68% during 2026–2033. In 2025, at least 3,150 AI implementations were reported in China, Japan, India and Australia with a focus on underwriting and claims automation as well as customer engagement. Increasing use of predictive analytics, AI driven chatbots and digital insurance platforms, technology collaborations & R&D are enhancing Artificial Intelligence and regional market throughout the analysis period, 2033.

China AI in Insurance Market Insights:

The largest AI in Insurance market based on region is China, where 1,720 implementations of AI will take place across underwriting, claims automation and customer engagement in 2025. Rising uptake of predictive analytics, AI-based chatbots and digital insurance platforms in addition to government support & technology collaborations are the key trends driving quick innovations and growth of the market till 2033.

Europe AI in Insurance Market Insights:

In 2025, Europe recorded over 2,480 AI projects in insurance, led by Germany, the UK, and France. Predictive analytics, claims automation and fraud detection solutions are also contributing towards adoption. More than 310 insurers adopted AI-based platforms, with good academic–industry collaborations and regulatory facilitating efforts. Growth will be moderate across APEJ over the next 14 years, with more AI-centric pilot programs, digital insurance ideas and R&D partnerships spurring market expansion.

Germany AI in Insurance Market Insights:

As one of the leading European AI in Insurance hotspots, Germany will be home to more than 1,120 AI projects in 2025. Solid uptake in underwriting, claims automation and fraud detection as well as mature tech infrastructure, friendly regulations Insurer-tech partnerships et cetera brings Germany ahead of Europe. More R&D will keep it going to 2033.

Latin America AI in Insurance Market Insights:

The Latin America AI in Insurance Market recorded over 710 AI projects in 2025, led by Brazil, Mexico, and Argentina. Growth is due to the uptake in claims automation, underwriting and customer service as digitalisation infrastructure grows, insurer-tech partnerships grow and governments get more involved. Market growth will also be supported to the turn of 2033 by widening AI flight test programs and R&D joint ventures.

Middle East and Africa AI in Insurance Market Insights:

The Middle East & Africa AI in Insurance Market recorded over 430 AI projects in 2025, with the UAE, Saudi Arabia, and South Africa leading adoption. Predictive analytics, claims automation, and digital insurance initiatives help drive growth with support from government programs, technology partnerships and increasing insurer-tech collaborations throughout the region.

AI in Insurance Market Competitive Landscape:

Ant Group leads the AI in Insurance market, with over 7.25 million claims processed using AI in 2025, spanning health, property, and life insurance. Its AI platforms automate underwriting, uncover fraudulent activity in over 1.1 million cases and improve customer engagement with AI chatbots that serve more than 18 million customers. Heavy insurer partnerships and deep machine-learning integration place Ant Group as the market leader.

-

In September 2025, Ant Group launched “Yixiaobao,” an AI-powered insurance advisor offering policy guidance, product comparisons, and claims assistance.

Guidewire Software dominates property & casualty AI adoption, supporting over 450 insurers across North America, Europe, and Asia-Pacific in 2025. Its artificial intelligence (AI)-powered solutions handled automated claims processing for five million files and improved predictive risk scoring for 2.1 million policies, leading to quicker claims resolution and better fraud detection. Guidewire’s deep investment in AI and analytics enhances its position in the worldwide AI in Insurance market.

-

In May 2025, Guidewire launched IndustryIntel, an AI solution automating underwriting and claims document handling.

DXC Technology is a key AI in Insurance player, serving 1,000+ insurance clients and automating underwriting for over 1.2 billion policies in 2025. Its shield of AI platforms enables claims processing, fraud detection within 1.3 million suspicious claims and customer support automation for its 9.5 million customers. Through its ability to deliver AI solutions at scale against multiple lines of insurance business, DXC Technology maintains its position of leadership in the worldwide AI insurance marketplace.

-

In July 2025, DXC introduced Assure Illustrations, an AI solution for life insurance policy projections.

AI in Insurance Market Key Players:

Some of the AI in Insurance Market Companies are:

-

Ant Group

-

Guidewire Software

-

DXC Technology

-

Shift Technology

-

Quantiphi

-

Cape Analytics

-

Zesty.ai

-

Mind Foundry

-

EXL Service

-

Policybazaar

-

Clearcover

-

Lemonade

-

Sixfold

-

DataRobot

-

LeewayHertz

-

ZBrain

-

Markovate

-

AI Insurance Solutions Inc.

-

Quantitative Risk Management (QRM)

-

Counterforce Health

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 8.63 Billion |

| Market Size by 2033 | USD 59.50 Billion |

| CAGR | CAGR of 27.32% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Technology (Machine Learning, Natural Language Processing, Robotic Process Automation, Computer Vision, Others) • By Application (Fraud Detection & Risk Management, Customer Service & Chatbots, Underwriting & Claims Processing, Predictive Analytics, Others) • By Insurance Type (Life Insurance, Health Insurance, Property & Casualty Insurance, Reinsurance, Others) • By Deployment Mode (Cloud, On-Premise) • By End User (Insurance Companies, Brokers & Agents, Third-Party Service Providers, Others) • By Distribution Channel (Direct Sales, Online Platforms, Partners & Resellers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ant Group, Guidewire Software, DXC Technology, Shift Technology, Quantiphi, Cape Analytics, Zesty.ai, Mind Foundry, EXL Service, Policybazaar, Clearcover, Lemonade, Sixfold, DataRobot, LeewayHertz, ZBrain, Markovate, AI Insurance Solutions Inc., Quantitative Risk Management (QRM), Counterforce Health |