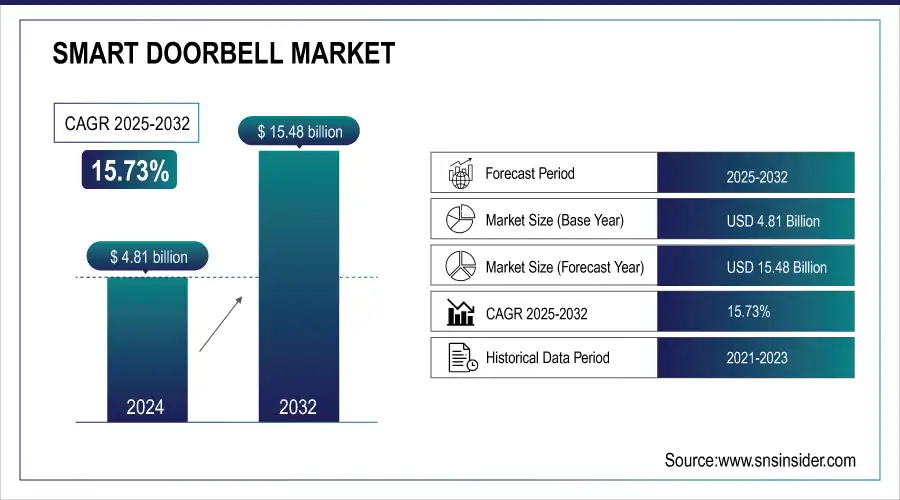

Smart Doorbell Market Size Analysis:

The Smart Doorbell Market size was valued at USD 4.81 Billion in 2024 and is projected to reach USD 15.48 Billion by 2032, growing at a CAGR of 15.73% during 2025-2032.

The smart doorbell market is experiencing strong growth owing to surging demand for home security devices, supporting inconvenient features such as longer battery life and extra functionality. People are looking for devices that offer wide-angle viewing, HD night vision and include person detection capabilities along with wireless connectivity. Support for smart home ecosystems, mobile notifications and cloud storage, and advanced analytics through a subscription-based business model are increasing user convenience and revenues. The market is also expanding toward affordable, quick-install types of equipment that are easy to operate and require less maintenance. With an accelerating demand for smart doorbell system in areas across urban residential belts, smart doorbells have gained robust traction as a critical element of advanced home security infrastructure in the modern times.

To Get more information on Smart Doorbell Market - Request Free Sample Report

Blink today announced its first video doorbell, the Blink Video Doorbell ($49.99), an entry-level smart home device that goes easy on your wallet and offers what many low-cost alternatives do not: free cloud storage. It is available at £59.99, and offers a 150° field of view and 1:1 video aspect ratio, connects through the Blink Sync Module Core to access smarter home software features.

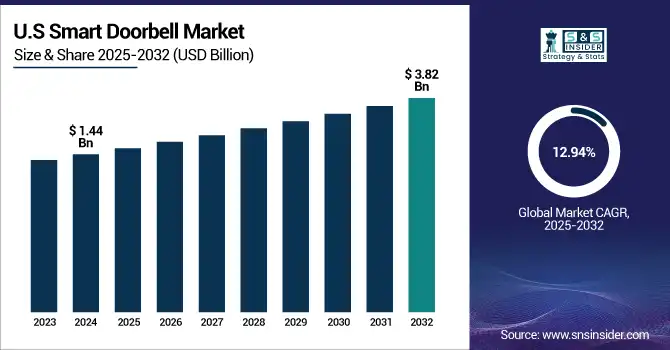

The U.S Smart Doorbell Market size was valued at USD 1.44 Billion in 2024 and is projected to reach USD 3.82 Billion by 2032, growing at a CAGR of 12.94% during 2025-2032. These are driven by the growing penetration of smart home devices, heightened consumer awareness about home security and preference for DIY wireless applications. Consequently, also fueling consumer interest are some of the more advanced features such as HD video, night vision, and AI-based person detection that have been at long last added to the cameras line-up in recent years helping to bolster the overall expansion of the market towards both households and businesses.

The smart doorbell market trends include the growing integration of AI for person detection and facial recognition, increasing adoption of cloud-based storage and subscription services, and rising demand for wireless, battery-efficient devices with long life. Consumers are seeking smart doorbells with HD video, night vision, and mobile app connectivity for real-time alerts. Additionally, compatibility with smart home ecosystems like Alexa and Google Assistant is becoming essential. The trend toward affordable, easy-to-install solutions is further accelerating market penetration across residential and commercial spaces.

Smart Doorbell Market Dynamics:

Drivers:

-

Rising Demand for Enhanced Doorstep Security Drives Smart Doorbell Adoption

As safety concerns grow and consumers seek more control over home entry points, the demand for smart doorbells is rising rapidly. With features like HD video, infrared night vision, motion detection, and two-way communication on-board the camera-equipped version of these things, they give homeowners an extra set of eyes -- and a few more mouths as well. In home and car thefts, this change is to such an extreme extent more again in urban and suburban areas especially since shoplifting package culture all doors visits pop. Furthermore, the compatibly of these doorbells with more extensive smart home systems takes that convenience and user experience to another level. Thus, the rapidly increasing demand for real-time monitoring and secure communication at entry points remains a key force propelling the expansion of the smart doorbell market.

Ring's newest smart doorbells pack in a high-resolution video, night vision and two-way communication to round out the full-feature set for added front porch scrutiny. They're straightforward to set up and come in several finishes, as well as delivering flexible power options (battery, wired or Ethernet) for modern home security.

Restraints:

-

High Costs, Privacy Concerns, and Technical Limitations Restrain Smart Doorbell Market Growth

Despite rising adoption, the smart doorbell market faces key restraints that may hinder its growth. High initial costs and subscription fees for cloud storage or advanced features can deter price-sensitive consumers. Privacy also remains a top regulatory and ethical challenge, especially with widespread surveillance and data sharing in densely populated areas. In addition, technical limitations like poor internet connection can cause your battery to wear down too fast and produce false motion alerts—or even make the installation difficult for several of the successful models which might affect user experience and satisfaction. But it is hard to simply retrofit a wireless technology like this, and compatibility issues with existing smart home systems are an impediment. Combined, these generate several barriers which especially in poorer tech-averse regions has so far prevented wide scale dominance of smart doorbells within the global residential security market.

Opportunities:

-

Integration of Advanced Display and AI Features Creates New Growth Opportunities in the Smart Doorbell Market

The growing demand for intelligent, interactive home security devices is creating significant opportunities in the smart doorbell market. Built-in indoor displays, 2K resolution in addition to wide-angle viewing and color night vision are the kinds of features that consumers are enjoying to improve their experience with smart doorbells. It also comes with support for AI-driven motion detection and works with Alexa, Google Assistant, and Siri. This gives users greater options for both wired and battery-powered use As the pace with which consumers demand smarter and more versatile controls for monitoring their homes quickens, so too are manufacturers of smart doorbells that can easily be this Swiss Army knife of functionality — all while integrating seamlessly into multiple smart home ecosystems to capitalize on market growth in an industry experiencing its most rapid evolution yet.

SwitchBot’s new video doorbell features a 4.3-inch indoor display, 2K resolution, AI motion detection, and Alexa integration for smart, seamless home security.Available in wired and battery-powered versions, it also includes color night vision and a 165° wide-angle view for enhanced doorstep monitoring.

Challenges:

-

Data Privacy, Connectivity Issues, and Market Fragmentation Pose Key Challenges in the Smart Doorbell Market

As smart doorbells become more connected and data-driven, rising concerns over data privacy, cybersecurity threats, and unauthorized surveillance are emerging as major challenges. Consumers are increasingly wary of devices capturing audio and video data, especially when stored on cloud servers. Additionally, poor or unstable internet connectivity can affect real-time monitoring and alerts, reducing product reliability. The market is also highly fragmented, with compatibility issues between different smart home platforms creating integration difficulties. These factors lead to consumer hesitation, reduced trust, and slower adoption rates, particularly in less tech-savvy or rural markets. Addressing these challenges is essential for ensuring user confidence, improving interoperability, and supporting sustained market growth in the evolving smart doorbell ecosystem.

Smart Doorbell Market Segmentation Analysis:

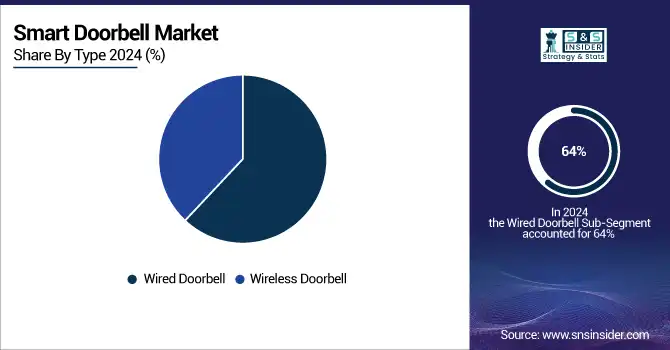

By Type

In 2024, the Wired Doorbell segment accounted for approximately 64% of the Smart Doorbell Market share, due to availability of the continuous power supply, enhance performance reliability and its compatibility with existing home wiring systems. As wired models tend to be more secure — especially with continuous video steaming and in some cases advanced surveillance features, which is leeching into this arena even though wireless solutions are becoming a preference among the security-aware consumer.

The Wireless Doorbell segment is expected to experience the fastest growth in Smart Doorbell Market over 2025-2032 with a CAGR of 22.64%. This growth is driven by increasing consumer preference for hassle-free installation, portability, and compatibility with modern smart home systems. The rise in battery-efficient models, AI-based features, and mobile app connectivity further boosts demand, making wireless doorbells ideal for tech-savvy users and renters seeking flexible security solutions.

By Component

In 2024, the Hardware segment accounted for approximately 78% of the Smart Doorbell Market share, driven by consumer spending on physical devices like cameras, sensors, and mounting systems. As more consumers look for high-definition video, rugged bodies, and some powerful bits inside means this is still a purchase many first-time users find themselves demanding. This dominance underscores the importance of durable hardware in driving consistent performance, as well as enabling a wealth of advanced smart home security capabilities.

The Software segment is expected to experience the fastest growth in Smart Doorbell Market over 2025-2032 with a CAGR of 24.48% This growth is fueled by rising demand for AI-powered features such as facial recognition, smart alerts, cloud storage, and app-based controls. As smart doorbells evolve, software innovations are becoming key to enhancing user experience and driving recurring revenue through subscriptions.

By Distribution Channel

In 2024, the Offline segment accounted for approximately 78% of the Smart Doorbell Market share, due to the consumer inclination for purchasing from stores in particular for home safety devices. Physical retail channels provide consumers with tactile experience, professional advice, and installation services that have considerable fondness for relatively technology-illiterate groups. That dominance indicates that, for all the expanding interest in online shopping for smart home stuff, when shoppers do open their wallets they continue to buy a lot of it at traditional retail.

The Online segment is expected to experience the fastest growth in Smart Doorbell Market over 2025-2032 with a CAGR of 22.89%.This surge is driven by the convenience of e-commerce, wider product availability, competitive pricing, and increasing consumer trust in online platforms. Growing digital adoption and preference for doorstep delivery are accelerating online sales of smart home security devices, including video doorbells.

By End-User

In 2024, the Commercial segment accounted for approximately 59% of the Smart Doorbell Market share, owing to growing demand throughout offices, retail spaces, rental properties and hospitality sector. Those firms have a growing range of smart security products that can keep tabs on entrances, handle deliveries and better manage visitors. The commercial sector has a strong hold in the nascent market ecosystem due to surging demand of advanced features such as remote access, motion alerts and integration with wider security system landscape.

The Residential segment is expected to experience the fastest growth in Smart Doorbell Market over 2025-2032 with a CAGR of 22.69% driven by increasing smart home adoption and growing concerns over home security which have spurred demand for convenient DIY-friendly, connected doorbell systems. The residential sector is seeing rapid growth as more homeowners warm to the video monitoring capability and now feature mobile app control, video monitoring and even voice assistant integrations.

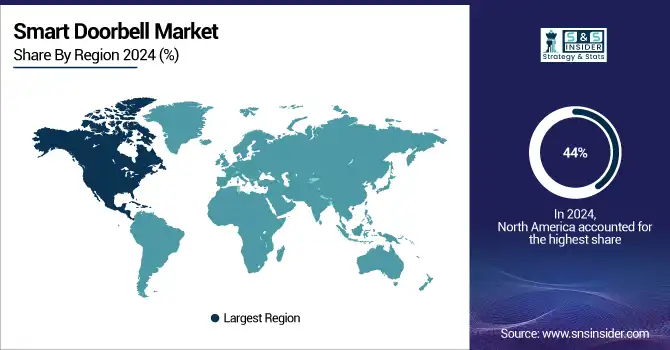

Smart Doorbell Market Regional Outlook:

In 2024 North America dominated the Smart Doorbell Market and accounted for 44% of revenue share, due to high penetration of smart homes, well-aware consumer population and increasing deployment of intelligent security devices. The availability of key market players, rising remote monitoring consumers, and inclination for app-enabled devices supported developments in the market. The presence of favorable income levels and growing safety concerns among consumers across regions is expected to help justify position of the smart doorbell market at regional level.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is expected to witness the fastest growth in the Smart Doorbell Market over 2025-2032, with a projected CAGR of 17.54%, This rapid expansion is driven by rising urbanization, growing middle-class income, and increasing adoption of smart home technologies across countries like China, India, and Southeast Asia. Improved internet infrastructure, smartphone penetration, and heightened focus on home security are further accelerating demand for smart doorbells in residential and multi-family housing segments.

In 2024, Europe emerged as a promising region in the Smart Doorbell Market, supported by rising use of smart homes, and government initiative to promote connected devices and energy-efficient technologies. The growing popularity of integrated security systems and the development of new e-commerce channels as well as improved broadband infrastructure would continue to bolster demand. Among these, the UK, Germany, and France forerunning the regional upsurge and are serving Europe to be a significant lucrative market in enforcing market proliferation.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Smart Doorbell Market, driven by improving urban infrastructure, rising security concerns, and increasing smartphone and internet penetration. Growing awareness of smart home technologies, coupled with expanding middle-class populations and government efforts to enhance residential safety, is fueling gradual adoption. Local retail expansion and affordable wireless solutions are also supporting market development across both regions.

Smart Doorbell Market Companies are

The Key Players in Smart Doorbell Market are include Ring Inc., Vivint Inc., Smartwares Group, Intelligent Technology Co. Ltd., SkyBell Technologies Inc., Aeotec Technology, Arlo Technologies Inc., August Home Inc., Eques Inc., iseeBell Inc., Google LLC (Nest), Amazon.com Inc., Xiaomi Corporation, TP-Link Technologies, Bosch Security Systems, Netatmo (Legrand), SimpliSafe Inc., Zmodo Technology, ADT Inc., Anker Innovations (Eufy Security). and Others.

Recent Developments:

-

In Jul 2025, Ring partners with Axon to reintroduce police video requests, enabling users to share encrypted footage through Axon’s system — with a possible livestream feature in development.

-

In February 2025, TP-Link Tapo D210, launched, is a budget-friendly video doorbell that offers solid performance with a bundled chime. Positioned as a “lite” version of the Tapo D235, it provides great value with reliable features and easy setup.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.81 Billion |

| Market Size by 2032 | USD 15.48 Billion |

| CAGR | CAGR of 15.73% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wired Doorbell and Wireless Doorbell) • By Component (Hardware and Software) • By Distribution Channel (Online and Offline) • By End-User (Residential and Commercial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Smart Doorbell Market Companies are include Ring Inc., Vivint Inc., Smartwares Group, Intelligent Technology Co. Ltd., SkyBell Technologies Inc., Aeotec Technology, Arlo Technologies Inc., August Home Inc., Eques Inc., iseeBell Inc., Google LLC (Nest), Amazon.com Inc., Xiaomi Corporation, TP-Link Technologies, Bosch Security Systems, Netatmo (Legrand), SimpliSafe Inc., Zmodo Technology, ADT Inc., Anker Innovations (Eufy Security). and Others. |