Industrial PC Market Report Scope & Overview:

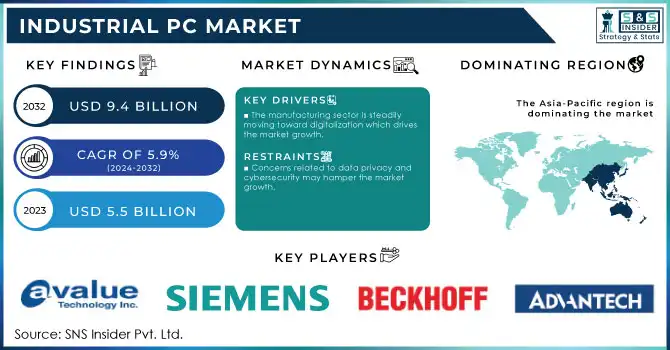

The Industrial PC Market Size was USD 5.5 Billion in 2023 and is expected to reach USD 9.4 Billion by 2032 and grow at a CAGR of 5.9% over the forecast period of 2024-2032.

Get More Information on Industrial PC Market - Request Sample Report

Industry 4.0 enables operational automation and digitalization across industries, and hence the growing penetration of Industry 4.0 is playing a pivotal role in transforming industrial operations. This 'GEO' transformation, characterized by advanced concepts called smart manufacturing, depicts interlinked systems powered by real-time data and processes being at the core of the optimization. Industrial PCs (IPCs) are one of the most important elements of this trend as they provide serious computing and control power for complex industrial applications. This seamless integration with Internet of Things (IoT) devices allows industries to benefit from real-time data collection, analysis, and action.

This enables predictive maintenance, process automation, and better decision-making, leading to increased efficiency and lower operating costs. In addition to this IPC also provides data analytics platforms that extract data using AI (Artificial Intelligence) and machine learning to provide actionable insights that drive innovation and competitive advantages for smart factories. With the rapid adoption of Industry 4.0, the need for high-performance and reliable IPCs will continue to expand, solidifying their place as a staple of the digital industrial space.

A World Economic Forum report highlights that countries implementing Industry 4.0 innovations are experiencing significant productivity gains. Germany’s Industrie 4.0 initiative has demonstrated a potential 10-15% increase in manufacturing output through advanced automation and data analytics integration.

Fanless industrial PCs enjoy increasing popularity due to the advantage of design in difficult locations. Fanless models, this means, make use of passive cooling systems rather than cooling fans common on industrial PCs, eliminating moving components that are most susceptible to wear and failure. Such design incurs lesser maintenance than traditional T-6 designs leading to enhanced operational availability, and lower downtime. Moreover, fanless IPCs are very energy efficient, leading to lower operational costs and enabling green initiatives.

In 2023, Advantech launched advanced fanless embedded systems, focusing on scalability and rugged performance for edge computing. This helped the company to increase its service in the market.

Industrial PC Market Dynamics

Drivers

-

The manufacturing sector is steadily moving toward digitalization which drives the market growth.

One of the most important factors responsible for the growth of the industries including the industrial PC (IPC) market is the digitization of the manufacturing sector. With the increasing integration of smart technologies, such as the Internet of Things (IoT), big data analytics, and automation in manufacturing, efforts that require advanced computing often require computers capable of handling complex data processing and enabling real-time decision-making by processing large volumes of data. Industrial PCs are at the core of this shift, providing processing capability for powered connected devices, production lines, and operational data analytics.

This digitization drives the need for IPCs with reliability and high performance, thus contributing to the growth of the market. These systems silently build the foundation for smart manufacturing, enabling activities ranging from predictive maintenance to process automation and lowering the operational risk in the process.

In the U.S., the circular economy is expected to be significantly supported by policy frameworks such as the Bipartisan Infrastructure Law and Inflation Reduction Act (2022), both aimed at sustainable investment. These policies, backed by billions in funding for clean energy, waste reduction, and recycling, are key to creating a more circular, resilient economy.

Restraint

-

Concerns related to data privacy and cybersecurity may hamper the market growth.

Data privacy and cybersecurity concerns remain some of the key impediments acting upon the growth through industrial PC market. With the growing prevalence of digitalization and Industry 4.0, industries are more vulnerable to cyber-attacks, which steals and leaks sensitive operational data and accesses unauthorized sources. Industrial PCs form the backbone of smart factories and automated systems, and are also home to enormous quantities of sensitive data such as stored data, and high-volume processing, making them a key target for cybercriminals. The National Institute of Standards and Technology (NIST) states that as legacy systems are being integrated with modern digital solutions to stay relevant, the manufacturing sector is facing rising cyberattacks and an increased number of vulnerabilities.

Opportunities

-

Raising awareness of the advantages of effective IT infrastructure.

-

Smart manufacturing solutions are increasingly being deployed.

Industrial PC Market Segmentation Overview

By Type

The DIN rail segment held the largest market share around 28% in 2023. It is owing to its versatility, and compact nature, and also because it is widely used in industries where space and reliable computing solution is required. DIN rail industrial PCs are optimized for space-constrained environments found in various applications, including industrial control systems, automation, and factory floors. Their modular and expandable design enables straightforward installations in control cabinets or industrial racks, making them well-suited for industries associated with manufacturing, transportation, and energy management.

By Technology

The Capacitive held the largest market share around 62% in 2023. It is due to their improved performance including accuracy, responsiveness, and durability. Capacitive displays enable multi-touch functions, which is an advantage when operators need to provide rapid, accurate input. A real benefit of wearables with capacitive screens is gloves which make them fit for manufacturing, automotive, and medical environments, where hands/operating gloves must be protected.

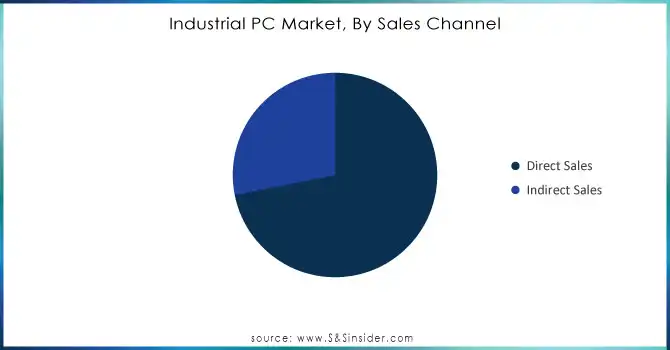

By Sales Channel

Direct Sales held the largest market share around 68% in 2023. Direct sales allow companies to sell their Industrial PCs directly to the manufacturers or end-users and involve little to no involvement from intermediaries like retailers. Such direct interaction enables tailored offerings to fulfill particular industrial requirements thereby ensuring the product is matched to the function and use case of the customer, e.g. for process automation or industrial control applications. Avoiding third-party distributors allows whichever manufacturer to save on stock costs and lower retail price markup, making the direct sales model also economical.

Get Customized Report as per your Business Requirement - Request For Customized Report

Industrial PC Market Regional Analysis

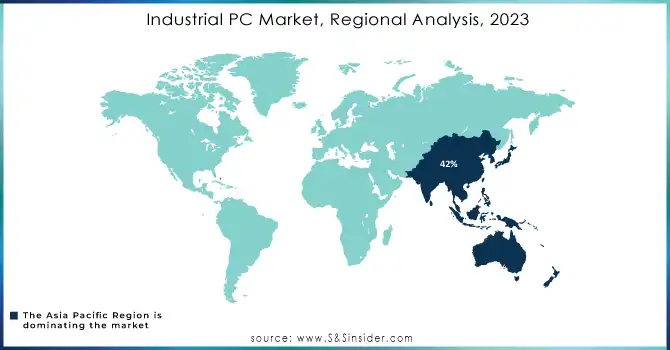

Asia Pacific held the highest market share around 42% in 2023. It is driven by rapid industrialization, increased demand for industrial automation in the industries, and massive manufacturing and infrastructure investments in the region. Nations like China, Japan, South Korea, and India have been at the forefront of this growth, with their manufacturing sectors continuing to expand and drive the need for advanced industrial computing solutions. Industry 4.0 technologies focusing on automation, data exchange, and real-time analytics have been rapidly adopted in this region, and industrial PCs form the backbone of these operations. In addition, the rise of IoT, The Internet of Things, artificial intelligence, and robotics in manufacturing has heightened the need for rugged, high-performance computing.

Apart from that, favorable government policies and initiatives to enhance manufacturing capabilities in emerging economies are also impelling the adoption of industrial PCs. China is undergoing a change towards more advanced manufacturing, such as with their “Made in China 2025” initiative which further digitizes their manufacturing capabilities, positively impacting the industrial PC space. Strong investments in smart city, transportation, and energy management across the region are also driving demand for industrial PCs.

Key Players in Industrial PC Market

-

Avalue Technology (MEC-4000, ACP-1100)

-

American Portwell Technology (PCOM-B601VG, RSB-4410)

-

Beckhoff Automation (CX9000 Embedded PC, C6920 Panel PC)

-

IEI Integration Corporation (BOXER-6641, TANK-600)

-

Advantech (IPC-610, ARK-1120)

-

Siemens (SIMATIC IPC277E, SIMATIC Industrial PC)

-

Kontron S&T (KBox A-150, KISS 4U)

-

B&R Automation (X90 Controller, Power Panel 4000)

-

DFI (EC70A-BT, GHF51)

-

Nexcom International (NISE 3000, VTC 1000)

-

Rugged Computers (Panasonic Toughbook, Getac F110)

-

Comark (CPT-2500, CPT-3000)

-

Nanolike (SBC X5, 5045)

-

Arbor Technology (Ares-1531, Ares-1941)

-

Onyx Healthcare (CPC-1000, PPC-8150)

-

Neousys Technology (Nuvo-8108, Nuvo-7160GC)

-

Winmate (R10ID3, M101B)

-

WinSystems (PPC2-100, PPM-100)

-

Lanner Electronics (LPC-5100, FHE-50)

-

ASRock Industrial (IMB-150, 4X4 BOX-6000)

Recent Development:

-

In 2024, Advantech has developed new industrial PC models to meet the changing requirements of Industry 4.0. They are well-suited IPC for IoT applications and for automation in manufacturing environments. Advantech specializes in developing sophisticated edge computing solutions that enable businesses to optimize and enhance their operations, as well as real-time monitoring.

-

In 2023 OnLogic produces state-of-the-art industrial computers and has recently released a new series of embedded IPCs designed for industrial applications delivering improved machine and automation performance to production and digital signage use cases.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.15 Billion |

| Market Size by 2032 | US$ 8.23 Billion |

| CAGR | CAGR of 5.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Rack Mount, Embedded, Thin, Panel, Box, DIN Rail) • By Technology (Capacitive, Resistive) • By Sales Channel (Direct Sales, Indirect Sales) • By End-User Industry (Process Industries, Discrete Industries) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Avalue Technology, American Portwell Technology, Beckhoff Automation, IEI Integration Corporation, Advantech, Siemens, Kontron S&T, B&R Automation, DFI, Nexcom International and other key players. |

| DRIVERS | • Strict regulatory requirements are in place to ensure the safety and security of manufacturing plants. • The manufacturing sector is steadily moving toward digitalization. • Manufacturing companies have a high demand for industrial IoT. |

| Restraints | • Concerns about data privacy and cybersecurity • Huge initial investment. |