Nanowire Battery Market Size & Growth Trends:

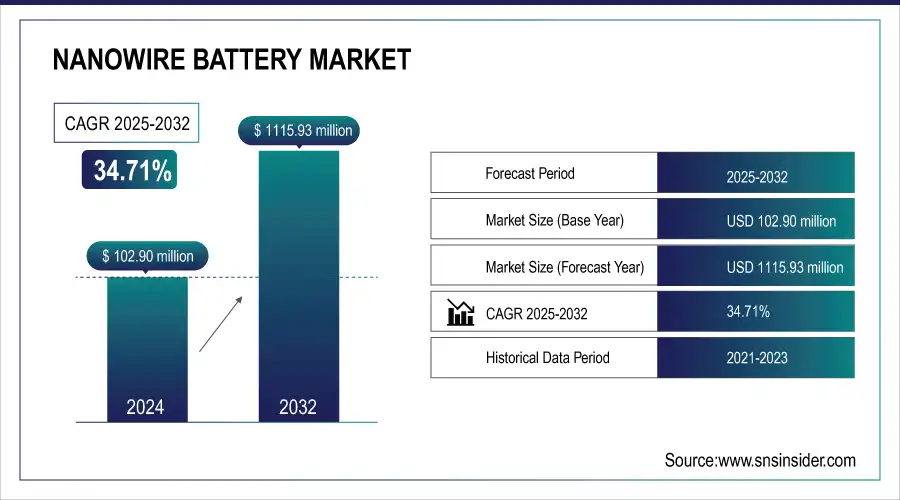

The Nanowire Battery Market was valued at USD 102.90 Million in 2024 and is expected to reach USD 1115.93 Million by 2032, growing at a CAGR of 34.71% from 2025-2032.

To Get more information on Nanowire Battery Market - Request Free Sample Report

Material innovation trends shaping the nanowire battery market are largely silicon nanowires to assure battery durability and performance. With the rise of pilot-scale production and automation, manufacturers are driving utilization rates at their facilities. With the help of high-performance anode design and increased conductivity, average energy density has been improved gradually. Nanowire battery ecosystem workforce distribution includes a rich representation of R&D, materials science, and production workers, indicating that the industry is maturing in its focus on the balance between novel technology development, scalability, and manufacturing approach. U.S. nanowire battery makers achieved over 400 Wh/kg at battery-optimized design in 2024 also a 20% improvement from the past designs. Utilization rates for the facilities hovered at ~85%, which is a result of optimized production processes. It was composed of 60% R&D and 40% manufacturing, indicating significant effort on innovation and scalable production.

Nanowire Battery Market Size and Forecast

-

Nanowire Battery Market Size in 2024: USD 102.90 Million

-

Nanowire Battery Market Size by 2032: USD 1115.93 Million

-

CAGR: 34.71% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Nanowire Battery Market Trends

-

Rising demand for high-capacity, fast-charging, and long-life batteries is driving the nanowire battery Nanowire Battery Market.

-

Advancements in silicon nanowire and lithium-ion technologies are enhancing energy density and cycle life.

-

Growing adoption in electric vehicles, consumer electronics, and renewable energy storage is boosting Nanowire Battery Market growth.

-

Integration with AI and battery management systems is improving performance and safety.

-

Expansion of EV infrastructure and energy storage projects is fueling demand.

-

Focus on sustainable, lightweight, and flexible battery solutions is shaping innovation trends.

-

Collaborations between battery manufacturers, research institutes, and tech companies are accelerating commercialization and R&D.

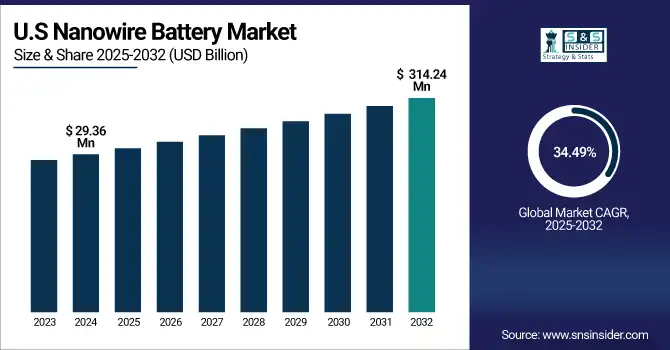

U.S. Nanowire Battery Market was valued at USD 29.36 Million in 2024 and is expected to reach USD 314.24 Million by 2032, growing at a CAGR of 34.49% from 2025-2032.

The U.S. nanowire battery market is driven by the rising demand for energy-dense storage solutions the silicon nanowire anode technology development, growing investment in EV and portable electronics, and sound government regulatory support for clean energy technologies. Rapid growth and commercialization are also fueled by innovation-driven startups and strategic partnerships.

Nanowire Battery Market Growth Drivers:

-

Nanowire Batteries Powering the Future of EVs Consumer Electronics and Next Generation Energy Solutions

Rising demand for high-performance energy storage solutions in consumer electronics, automotive, and aerospace industries has been a key driving force for the nanowire battery market (Graphical Research). Compared with conventional lithium-ion batteries, nanowire batteries have an energy density that is several times higher, faster charging times, and longer lifecycles. These benefits also play a key role in the adoption of electric vehicles (EVs) as they are instrumental in performance, weight, and charge time. Moreover, the fast advancement of the miniature electronics and wearables industry demands small-size high-capacity battery cells. Companies are investing in advanced battery R&D and green energy, and governments are supporting electric mobility.

Nanowire Battery Market Restraints:

-

Challenges Hindering Nanowire Battery Commercialization Despite High Potential in Energy Storage Applications

The absence of an infrastructure for large-scale production is one of the key constraints in the market for nanowire batteries. Though nanowire batteries show great promise, they are as yet largely a research and prototype material with little commercialization to date. Nanowires while having attractive characteristics, are at the same time quite challenging to handle/ use because they are very soft and reactive, which causes technical hurdles in the synthesis, and complications in the system integration with the battery systems. Furthermore, the inability to retain structural stability over continuous charging and discharging also compromises performance, which prevents them from functioning over several practical lifetimes in certain applications. And this makes it harder for nanowire batteries to be adopted in consumer and industrial markets.

Nanowire Battery Market Opportunities:

-

Emerging Opportunities for Nanowire Batteries in Aviation Medical Devices and Scalable Renewable Energy Applications

Nanowire batteries are especially attractive for new applications in aircraft and medical equipment, offering an opportunity for implementation because of their low-weight form and ability to operate in extreme conditions. With the global transition to renewable energy, nanowire batteries could also be used in-grid storage systems for efficient energy management and peak load handling! Furthermore, the development of nanomaterial—in terms of particularly silicon and transition metal oxide will provide ease of scale-up and reduce the price, which will eventually create more commercial applications of specific nanowire batteries. Partnerships between tech firms, battery makers, and research organizations offer attractive growth opportunities over the next few years.

Nanowire Battery Market Challenges:

-

Overcoming Uniformity Challenges and Regulatory Barriers to Unlock Nanowire Battery Potential Across Sectors

One of the biggest obstacles is being able to have uniform nanowire battery tech across sectors (as they all have their performance, durability, and safety requirements). As an example, consumer electronics performance may differ from what is required for something like an electric vehicle or aviation system. Moreover, a shortage of qualified staff and experience in nanotech-based battery engineering impedes innovations and hinders time-to-market. Even more so in medical and aerospace sectors which are typically safety-critical, regulatory hurdles combined with long certification timelines for new battery chemistries provide a further barrier. One major remaining hurdle would be creating a bridge toward real-world reliability the millisecond-level timing for switch rates that have been achieved in the lab is not too useful without R&D and pilot production efforts aimed at translating that into real-world capabilities.

Nanowire Battery Market Segment Analysis

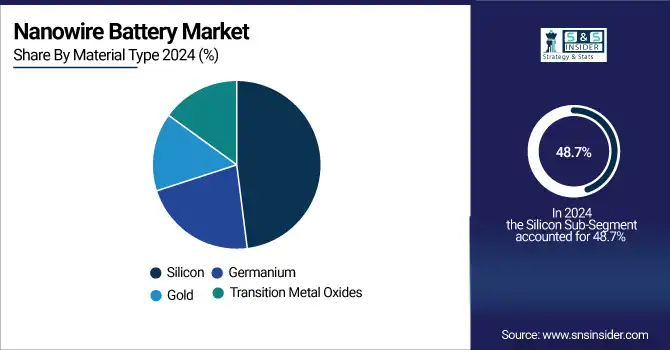

By Material Type, Silicon segment dominates the Nanowire Battery Market and is expected to witness the fastest growth.

In 2024, the silicon segment accounted for the largest share of 48.7% in the nanowire battery market and is also anticipated to witness the fastest growth during the forecast period from 2025 to 2032. This is due to its ability to supply plenty of energy per weight of material used, its relatively plentiful availability, and its compatibility with current lithium-ion battery technologies. They provide a higher surface area and higher charge-retention capability than existing gold materials, making them practical for next-generation battery applications. They can also help improve battery life and efficiency, especially when used in electric vehicles and portable electronics, thanks to their ability to accommodate volume expansion during charge cycles. This synopsis helps reinforce silicon as commercial players continue to research and push further into the market. Nanowire batteries using silicon on the other hand are the future of advanced energy storage as they will take over as industries move and are looking for high-performance, small device solutions with fast charging capabilities.

By Industry, Consumer Electronics segment dominates the Nanowire Battery Market, while the Automotive segment is expected to grow at the fastest CAGR.

The consumer electronics segment accounted for the largest market share of 36.6% in 2024, owing to the rising demand for portable energy storage systems with high performance and compactness for smartphones, wearable gadgets, and other portable devices. As the trend for miniaturization grows and requirements for longer-lasting batteries, as well as faster charging also, nanowire batteries have become appealing to device makers. With their lightweight construction, high energy density, and improved charge retention, they are key to driving next-gen consumer tech and keeping this segment at the forefront.

The automotive segment is expected to have the highest compound annual growth rated during the forecast period from 2025 to 2032, owing to the growing global shift towards electric vehicles (EVs). Silicon nanowire batteries hold major advantages for EVs such as longer range, faster charging, and longer life. Composite material and use of nanowires made it possible to break traditional patterns in the field of Electric Vehicle Batteries, making it an ideal candidate for various applications in the new design paradigms that automakers are exploring to meet both performance and sustainability challenges as they prepare to make next-generation battery technologies a commercial reality.

Nanowire Battery Market Regional Analysis

North America Nanowire Battery Market Insights

North America dominated the nanowire battery market with a 35.7% share in 2024, led by rising investments in advanced battery research and technology as well as increasing demand for consumer electronics, electric vehicles, and, defense applications in the region. Key players like Amprius Technologies, which is developing over 400 Wh/kg silicon nanowire batteries for aerospace and EVs, underscore the region’s leadership. Public initiatives pushing toward next-generation battery storage such as the U.S. Department of Energy's new program alongside collaboration between academia and tech companies are speeding commercialization. Furthermore, the region's dominance was reinforced by a matured EV infrastructure and high-performance battery technologies being adopted earlier in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Nanowire Battery Market Insights

The Asia Pacific is anticipated to be the fastest-growing region over the forecast period 2025 to 2032 in light of rapid industrialization, increasing production of EVs, and an enthusiastic consumer electronics market, especially in China, Japan, and South Korea. Various businesses like Samsung SDI and Panasonic concentrate on nanowire systems to advance battery effectiveness and energy density. China, meanwhile, is pouring billions into local assembly and R&D facilities to cut down on imports and ensure its dominance over the global energy transition. Increased government support, urbanization, and demand for compact energy storage options are driving nanowire battery research and development and deployment in the Asia Pacific region.

Europe Nanowire Battery Market Insights

Europe holds a significant position in the Nanowire Battery Market, driven by growing adoption of electric vehicles, renewable energy storage, and advanced consumer electronics. Supportive government policies promoting clean energy and sustainable mobility, coupled with investments in research, development, and manufacturing facilities, are accelerating market growth. Regional collaborations between battery manufacturers, automotive companies, and tech innovators are further fostering innovation and deployment of high-energy-density silicon nanowire batteries across Europe.

Middle East & Africa and Latin America Nanowire Battery Market Insights

Middle East & Africa and Latin America are emerging markets for nanowire batteries, fueled by increasing investments in renewable energy, electric mobility, and industrial applications. Growing focus on sustainable energy storage solutions, government incentives, and infrastructure development are driving adoption. Expanding EV markets, coupled with collaborations between regional manufacturers and global technology providers, are expected to accelerate the deployment of high-performance, silicon nanowire-based batteries in these regions.

Nanowire Battery Market Competitive Landscape:

Amprius Technologies

Amprius Technologies is a U.S.-based advanced battery technology company specializing in high-energy-density lithium-ion batteries with silicon nanowire anodes. Its innovative designs focus on delivering higher energy capacity, faster charging, and longer lifecycle performance for electric vehicles, aerospace, and portable electronics. By integrating cutting-edge nanomaterials and proprietary manufacturing techniques, Amprius aims to address the growing demand for lightweight, high-performance batteries, positioning itself as a leader in next-generation energy storage solutions.

-

In December 2023, Amprius Technologies unveiled its expanded silicon nanowire battery manufacturing line in Fremont, California, boosting capacity tenfold.

Nexeon

Nexeon is a UK-based company focused on silicon anode materials for lithium-ion batteries. Its proprietary nanostructured silicon technology enhances energy density, charging speed, and battery longevity, targeting applications in electric vehicles, consumer electronics, and grid storage. By developing scalable, high-performance anode solutions, Nexeon supports the transition toward sustainable energy and next-generation battery systems. The company collaborates with global automotive and battery manufacturers to integrate its silicon-based innovations.

-

In April 2024, Nexeon began construction of its first silicon anode material production site in Gunsan, South Korea, targeting 2025 delivery. The facility will support EV battery advancements through its high-energy-density silicon technology.

Key Players Listed in Nanowire Battery Market are:

-

Amprius Technologies (Amprius 450 Wh/kg Battery)

-

Nexeon (Silicon Nanowire Anode Material)

-

OneD Battery Sciences (Sinanode)

-

Sila Nanotechnologies (Titan Silicon™)

-

Enovix Corporation (BrakeFlow™ Battery)

-

Samsung SDI (Silicon-based Nanowire Anode Battery)

-

Panasonic Corporation (Next-gen Li-ion with Si Nanowire Anode)

-

LG Energy Solution (High-Capacity Nanowire Prototype Cell)

-

Nanotech Energy (Nanowire-enhanced Graphene Battery)

-

XNRGI (Powerchip™ Battery)

-

Hitachi Chemical (Silicon Nanowire Composite Anode)

-

BASF (Si-nanowire Anode Material)

-

3M (Advanced Anode with Nanowire Structure)

-

Angstron Materials (Nanowire-Graphene Hybrid Battery)

-

Apple Inc. (Si Nanowire Battery Patent Technology)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 102.90 Million |

| Market Size by 2032 | USD 1115.93 Million |

| CAGR | CAGR of 34.71% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Silicon, Germanium, Transition Metal Oxides, Gold) • By Industry (Consumer Electronics, Automotive, Aviation, Energy, Medical Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amprius Technologies, Nexeon, OneD Battery Sciences, Sila Nanotechnologies, Enovix Corporation, Samsung SDI, Panasonic Corporation, LG Energy Solution, Nanotech Energy, XNRGI, Hitachi Chemical, BASF, 3M, Angstron Materials, Apple Inc. |