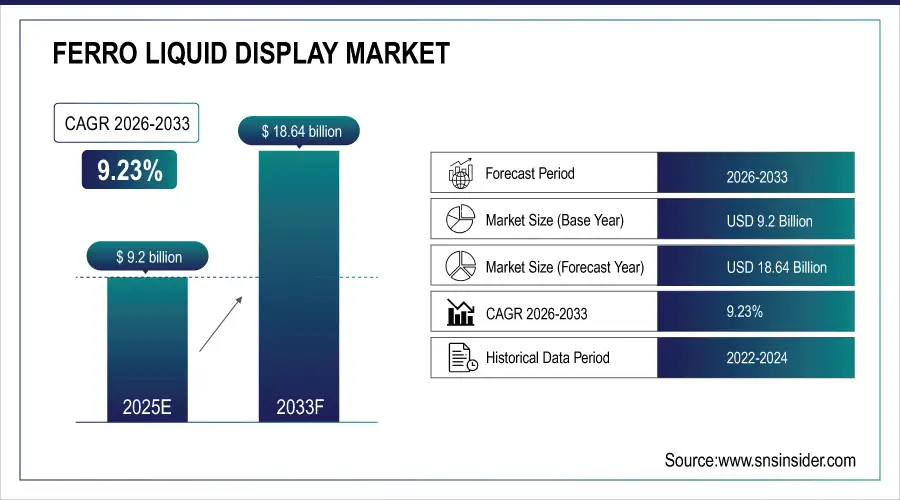

Ferro Liquid Display Market Size Insights:

The Ferro Liquid Display Market size was valued at USD 10.04 Billion in 2025 and is projected to grow at a CAGR of 9.23% to reach USD 20.36 Billion by 2033.

The Ferro Liquid Display market is witnessing steady growth driven by the rising adoption of energy efficient lightweight, sun readable display technologies across end use sectors. Due to their excellent contrast, low power consumption, and high durability, these displays have a brief for automotive dashboards, industrial instruments, and portable consumer electronics. With a renewed focus on sustainability, along with cost-effective technology, a new era of display solution is emerging, and this information highlights the changing landscape of the competitive solution to put FLDs in front of businesses and industries which reflects the capacity in environments like reflective or bistable LCD displays. With development on the materials side of ferrofluid, e.g., ferrofluid material and magneto-optic response, the performance of the display would be further improved. In addition, end-market demand for cost-effective flexible and non-emissive display solutions, in line with trends in low-power electronics, smart wearables, and ruggedized outdoor systems, is also contributing to the growth of the market.

At SID Displayweek 2025, LG Display announced its new 4th-gen WOLED panels with 4,000 nits of brightness and 20% increased energy efficiency. And the company also unveiled hybrid-PHOLED panels, slidable OLEDs, and 5K2K automotive and high-end gaming displays.

To Get more information on Ferro Liquid Display Market - Request Free Sample Report

Market Size and Forecast: 2025E

-

Market Size in 2025 USD 10.04 Billion

-

Market Size by 2033 USD 20.36 Billion

-

CAGR of 9.23% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Ferro Liquid Display Market Trends:

-

Increasing integration of advanced ceramic materials such as silicon nitride to enhance durability, thermal performance, and reliability of next-generation display components.

-

Growing collaboration and consolidation among materials and electronics companies to scale ceramic-based display technologies.

-

Rising demand for energy-efficient, low-power displays to support longer battery life in consumer electronics.

-

Expansion of specialized display solutions for harsh environments in electric vehicles, industrial systems, and medical imaging.

-

Shifting consumer preference toward lightweight, high-clarity, and sustainable display technologies in tablets, e-readers, and smart devices.

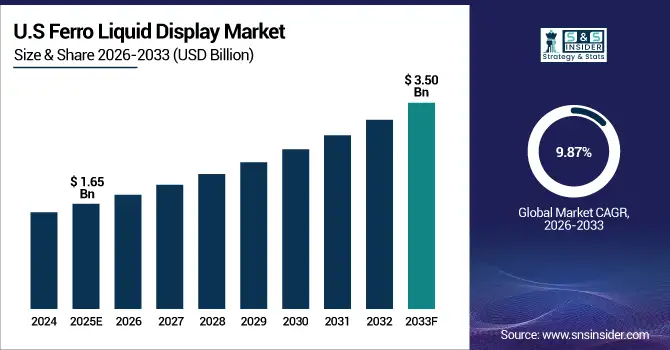

The U.S Ferro Liquid Display Market size was valued at USD 1.65 Billion in 2025 and is projected to reach USD 3.50 Billion by 2033, growing at a CAGR of 9.87% during 2026-2033. This growth is driven by rising demand for low-power, high-contrast displays in automotive, healthcare, and industrial applications, along with advancements in ferrofluid display technology. The Ferro Liquid Display market trends include increasing adoption in low-power and sunlight-readable applications, particularly in automotive dashboards, industrial controls, and outdoor signage. Advancements in Ferro fluid materials and magneto-optic technology are enhancing display clarity, response time, and flexibility. There is a growing shift toward customized display solutions tailored for rugged and compact environments. Additionally, demand for sustainable and energy-efficient alternatives to traditional LCDs is driving innovation.

Ferro Liquid Display Market Growth Drivers:

-

Synergistic Integration of Ceramic Technologies Driving Display Market Innovation

The integration of advanced ceramic technologies with precision material design is driving innovation in display applications such as ferro liquid displays. High performance ceramics such as silicon nitride shine in their thermal conductivity, mechanical strength, and corrosion resistance, all properties necessary for next gen displays being utilized in electric vehicles, industrial systems, and medical imaging. These ceramics, when industrially scaled via targeted collaborations, will also provide increased durability, efficiency, and miniaturization of individual display components. That sets off a chain reaction further down the line, accelerating adoption in industries that require reliable visual interfaces driven in harsh environments. This leads to increasing movements toward more specific display solutions.

On December 25, 2023, Toshiba Corporation announced its decision to transfer all shares of Toshiba Materials Co., Ltd. to Niterra Co., Ltd. as part of a present transaction and it expects completion of the transaction by May 30, 2025. The transaction is aimed at unlocking synergies in ceramic materials, power electronics and mobility technologies, increasing Toshiba Materials global competitiveness and corporate value.

Ferro Liquid Display Market Restraints:

-

High Material Sensitivity and Cost Constraints Hindering Mass Adoption of Ferro Liquid Displays

The ferro liquid display market faces key restraints primarily due to the complex nature of ferrofluid materials and their sensitivity to temperature, magnetic interference, and contamination. This causes challenges in ensuring consistent performance, especially in demanding environments such as automotive or outdoor applications. Additionally, the effect of high production costs stemming from precision manufacturing requirements and limited large-scale suppliers reduces competitiveness against more mature technologies like LCD and OLED. Limited scalability and integration hurdles with conventional electronics further delay widespread commercialization. These factors collectively restrain the market's ability to expand beyond niche applications, slowing the pace of adoption despite the inherent advantages of ferro liquid displays in terms of power efficiency and readability.

Ferro Liquid Display Market Opportunities:

-

Rising Demand for Energy-Efficient Displays in Consumer Devices Creating Growth Opportunity for Ferro Liquid Displays

The growing popularity of mid-range tablets that emphasize energy efficiency, high-resolution displays, and all-day battery life reflects a rising consumer preference for low-power, high-clarity screens. This trend creates a significant opportunity for ferro liquid displays (FLDs), which are known for their minimal energy consumption and excellent readability across varying lighting conditions. As consumer electronics manufacturers increasingly prioritize longer battery life and sleek, lightweight designs, demand is shifting toward display technologies that offer energy efficiency without compromising visual performance. As a result, the market potential for FLDs is expanding in devices such as tablets, e-readers, and smart gadgets, where their reflective display characteristics and durability align well with user expectations around portability, performance, and sustainability.

Apple’s 10th Gen iPad with a 10.9″ Liquid Retina Display is now available for just USD 269, offering a sleek design, A14 Bionic performance, and all-day battery life.With Wi-Fi 6, 64GB storage, and 12MP cameras, it’s a value-packed option for work, streaming, and video calls.

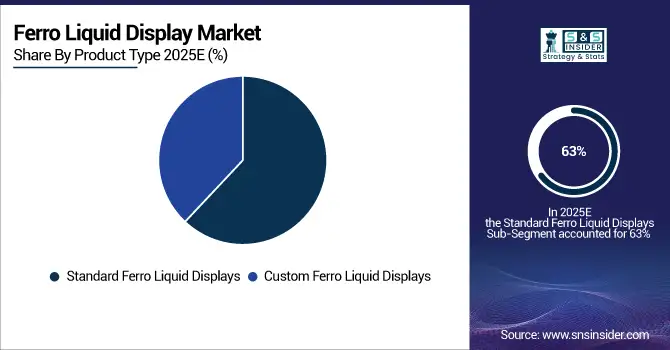

Ferro Liquid Display Market Segment Analysis:

By Product Type

In 2025, the Standard Ferro Liquid Displays segment accounted for approximately 63% of the Ferro Liquid Display Market share, driven by their widespread use in cost-sensitive applications such as consumer electronics, industrial panels, and signage. Their proven reliability, simpler manufacturing processes, and ease of integration with existing systems made them the preferred choice for OEMs. The Custom Ferro Liquid Displays segment is expected to experience the fastest growth in Ferro Liquid Display Market over 2026-2033 with a CAGR of 14.04%, fueled by rising demand for application-specific displays in medical devices, automotive dashboards, aerospace systems, and advanced instrumentation. Their flexibility in design and performance customization drives adoption in high-value, precision-focused sectors.

By Application

In 2025, the Consumer Electronics segment accounted for approximately 39% of the Ferro Liquid Display Market share, due to proliferation of low-power, high-contrast displays in tablets, smartwatches, e-readers, and portable devices. Strengthening consumer demand for energy-efficient displays, improved outdoor readability and slim design has really helped the segment. The Healthcare segment is expected to experience the fastest growth in Ferro Liquid Display Market over 2026-2033 with a CAGR of 14.05%, owing to rising demand for reliable, low-power displays in medical imaging, patient monitoring systems, and wearable health devices. These are easy to read, portable, long-lasting, and power-efficient, which makes them suitable for any crucial healthcare setting.

By Display Size

In 2025, the Small segment accounted for approximately 46% of the Ferro Liquid Display Market share, primarily due to the high demand for compact, energy-efficient displays in portable electronics such as smartwatches, handheld devices, and e-readers. These displays offer excellent sunlight readability and low power consumption, making them ideal for battery-operated products. The rising popularity of wearables and IoT devices further reinforced growth in this segment. The Large segment is expected to experience the fastest growth in Ferro Liquid Display Market over 2026-2033 with a CAGR of 13.81%, due to the growing utility of these products in a variety of applications, such as digital signage, industrial control panels, and automotive displays. In particular, energy-efficient and highly visible display makes demand grow rapidly in outdoor and large-format applications, including smart transportation systems and commercial advertising. We are witnessing growth in Ferro fluid technology leading to enhanced scalability and visual performance on the big screen.

By End User

In 2025, the Automotive segment accounted for approximately 26% of the Ferro Liquid Display Market share, driven by the increasing integration of advanced display technologies in modern vehicles. Ferro liquid displays are favored for their durability, low power consumption, and excellent readability in diverse lighting conditions, making them ideal for instrument clusters, infotainment systems, and HUDs. Rising demand for smart and electric vehicles further supports segment growth across global automotive markets. The Education segment is expected to experience the fastest growth in Ferro Liquid Display Market over 2026-2033 with a CAGR of 12.66%, owing to growing adoption of interactive display panels along with rising demand for energy-efficient digital learning tools in schools and universities. Offering high visibility, lessen eye strain and long-lasting, Ferro liquid display becomes an ideal candidate for educational purposes which demands usage for longer duration.

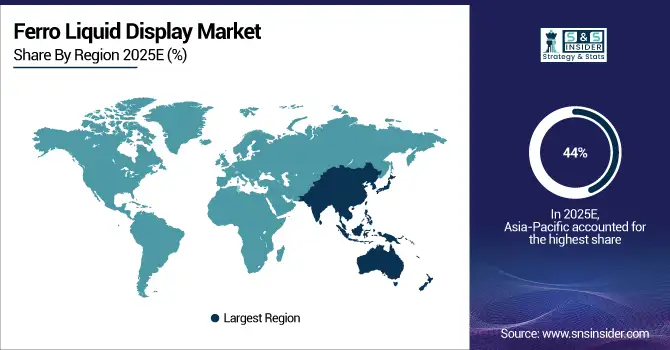

Ferro Liquid Display Market Regional Analysis:

Asia Pacific Ferro Liquid Display Market Insights

In 2025 Asia-Pacific dominated the Ferro Liquid Display market and accounted for 44% of revenue share. This growth is owing to the region majorly being a manufacturing hub for electronics and the increasing demand from consumer electronics and automotive segments along with, government initiatives in boosting display technological innovations. Production and consumption hubs are mainly located in China, Japan and South Korea, strengthening the regional leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Ferro Liquid Display Market Insights

North America is expected to witness the fastest growth in the Ferro Liquid Display market over 2026-2033, with a projected CAGR of 10.94% This growth is fueled by expanding adoption of high-resolution display technologies across automotive dashboards, smart wearables, and advanced medical imaging systems. Strong R&D initiatives, increasing demand for energy-efficient display solutions, and the presence of key electronics manufacturers are expected to further boost the region’s market expansion during the forecast period.

Europe Ferro Liquid Display Market Insights

In 2025, Europe emerged as a promising region in the Ferro Liquid Display market, owing to increasing demand for energy efficient and compact display solutions in automotive and industrial sectors []. This is mainly due to strong research infrastructure, the increasing penetration of smart devices, and governmental regulations in favoring sustainable forms of electronics in these countries. Moreover, increasing investments in healthcare and consumer electronics are another factor aiding the growth of market and is expected to be a dominant region over the globe, when we talk about market growth.

Latin America (LATAM) and Middle East & Africa (MEA) Ferro Liquid Display Market Insights

LATAM and MEA are experiencing steady growth in the Ferro Liquid Display market, increasing demand for low-cost display technologies in education, automotive, and consumer electronics. Adoption is driven partly by government-led digital transformation initiatives, partly by growing urbanization and improving tech infrastructure. Although market penetration is still low relative to other regions, growing investments and localisation show promise for greater opportunities in the near future.

Ferro Liquid Display Market Key Players:

The Key Players in Ferro Liquid Display Market are

- Samsung Electronics

- LG Display

- Toshiba Corporation

- Fujitsu Limited

- NEC Display Solutions

- HannStar Display Corporation

- Videocon Industries Limited

- Semex Group

- Panasonic Corporation

- BOE Technology

- AU Optronics

- Sharp Corporation

- Innolux Corporation

- E Ink Holdings

- Chunghwa Picture Tubes

- Kyocera Display

- Sony Corporation

- Tianma Microelectronics

- Philips (TPV Technology)

- Universal Display Corporation

Competitive Landscape for Ferro Liquid Display Market:

Samsung Electronics is a global South Korean technology leader that drives display innovation with advanced OLED, QD-OLED, Micro LED, and energy-efficient screen technologies for consumer and professional devices; its display arm focuses on next-gen panels that deliver high resolution, low power consumption, and versatile applications across mobile, TV, and signage markets

-

In Sept 2024, Samsung unveiled its Transparent MICRO LED Display at CES 2024, showcasing a crystal-clear, glass-like screen that redefines immersive visuals.The innovation marks six years of R&D and signals a bold step in display technology evolution.

LG Display is a South Korean leader in advanced display technologies focused on energy‑efficient, high‑performance panels including OLED, Micro LED, and next‑gen low‑power screens supporting diverse applications from consumer devices to automotive and industrial interfaces, with innovations that promise reduced power use and enhanced visual quality aligned with emerging efficient display demands.

-

In April 2025, LG Display verified commercialization of blue phosphorescent OLED panels, a major step toward highly energy‑efficient, high‑performance displays suitable for next‑generation devices and low‑power applications

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 10.04 Billion |

| Market Size by 2033 | USD 20.36 Billion |

| CAGR | CAGR of 9.23% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Standard Ferro Liquid Displays and Custom Ferro Liquid Displays) • By Application(Consumer Electronics, Automotive, Healthcare, Industrial and Others) • By Display Size(Small, Medium and Large) • By End User(BFSI, Retail, Education, Healthcare, Automotive and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Ferro Liquid Display companies are Samsung Electronics, LG Display, Toshiba Corporation, Fujitsu Limited, NEC Display Solutions, HannStar Display Corporation, Videocon Industries Limited, Semex Group, Panasonic Corporation, BOE Technology, AU Optronics, Sharp Corporation, Innolux Corporation, E Ink Holdings, Chunghwa Picture Tubes, Kyocera Display, Sony Corporation, Tianma Microelectronics, Philips (TPV Technology), Universal Display Corporation and Others. |