Air Handling Units Market Report Scope & Overview:

Get More Information on Air Handling Units Market - Request Sample Report

The Air Handling Units Market Size was valued at USD 12.64 billion in 2023, and is expected to reach USD 20.10 billion by 2032, and grow at a CAGR of 5.29% over the forecast period 2024-2032.

The Air Handling Units (AHU) market growth is driven by global urbanization and increasing demand for effective ventilation and air conditioning systems. As cities continue to expand, the need for advanced air quality solutions has become more pressing. According to the World Health Organization (WHO), 55% of the global population currently resides in urban areas, a figure projected to rise to 68% by 2050. This rapid urbanization results in higher demand for buildings and infrastructure, consequently driving the need for efficient AHUs that can address indoor air quality concerns and mitigate the impact of urban pollution and heat islands.

In addition to improving indoor air quality, AHUs play a vital role in energy conservation, a growing priority as sustainability becomes central to urban planning and development. As environmental awareness intensifies, both residential and commercial sectors are increasingly opting for AHUs equipped with energy-efficient technologies and smart controls, ensuring a balance between comfort and reduced energy consumption. These units contribute to better regulation of air temperature, humidity, and particulate matter, making them essential for promoting health and well-being in urban environments. Furthermore, the global focus on environmental health and indoor air quality further fuels the demand for AHUs. With rising concerns about air pollution, especially in densely populated cities, governments and organizations are implementing stringent regulations and guidelines to improve air quality standards. This trend aligns with the growing interest in installing advanced AHUs that meet these evolving regulations.

As urban populations are expected to grow, and environmental consciousness continues to shape consumer preferences, the AHU market is set to experience sustained demand across residential, commercial, and industrial sectors. The market's future is poised for innovation, driven by technological advancements and an increasing focus on sustainability, making AHUs a key component in the development of smart, healthy, and energy-efficient urban environments.

Air Handling Units Market Dynamics

DRIVERS

-

The growing construction and infrastructure development, driven by urbanization and the demand for efficient ventilation systems in buildings, is a key driver of the Air Handling Units (AHU) market.

The growing construction and infrastructure development is one of the key drivers of the Air Handling Units (AHU) market. As global urbanization accelerates, there is an increasing demand for new commercial, residential, and industrial buildings. These buildings require efficient ventilation systems to ensure optimal indoor air quality and comfort for occupants. AHUs play a vital role in providing the necessary airflow, temperature control, and air filtration, which are essential for maintaining healthy environments in large spaces. This increasing demand for high-quality air handling solutions in buildings is directly contributing to the growth of the AHU market.

Additionally, the rise in green building initiatives and energy-efficient construction practices further boosts AHU adoption. As governments and organizations prioritize sustainability and energy savings, AHUs, with their ability to improve air quality while reducing energy consumption, have become integral to modern HVAC systems. Furthermore, the trend towards high-rise buildings and large-scale industrial complexes increases the need for more advanced and efficient air handling systems. As construction activities expand in emerging markets, the AHU market is expected to witness continued growth, driven by the expanding infrastructure needs and the growing focus on indoor air quality, comfort, and energy efficiency.

RESTRAINT

-

The high initial installation costs of air handling units (AHUs), especially in developing regions with limited resources, present a significant market restraint, although growing demand driven by energy efficiency and health concerns is expected to fuel market growth.

The high initial installation costs of air handling units (AHUs) are a key restraint in the market, particularly in developing regions with limited financial resources. AHUs, which are complex systems designed to regulate air quality and temperature in large buildings, require substantial investment in both equipment and installation. This can be a significant barrier for small- and medium-sized businesses, as well as construction projects in price-sensitive markets. The costs include not only the unit itself but also the infrastructure needed for integration, such as ductwork, electrical systems, and control systems. While the long-term benefits of AHUs such as energy efficiency, improved indoor air quality, and compliance with environmental standards can outweigh the initial costs, the capital required for installation may deter potential customers.

However, the market for AHUs is expected to grow despite these challenges. As awareness of energy efficiency and health concerns rise, the demand for advanced air handling systems is increasing, particularly in large commercial buildings, hospitals, and industrial sectors.

Air Handling Units Market Segmentation

By Type

The packaged type segment dominated with the market share over 35% in 2023. This significant share can be attributed to the system's simplified installation process and cost-effectiveness. Packaged HVAC units are pre-engineered, with multiple components integrated into a single unit, which reduces installation complexity. This streamlined design makes them an attractive option for businesses and industries looking for efficient and reliable HVAC solutions. Additionally, the reduced need for space and easier maintenance further boosts their appeal, as they require less installation time and fewer resources compared to other HVAC systems. The cost savings, combined with their ease of use and reliability, have made packaged systems a popular choice for commercial and industrial applications, where operational efficiency and minimized downtime are critical.

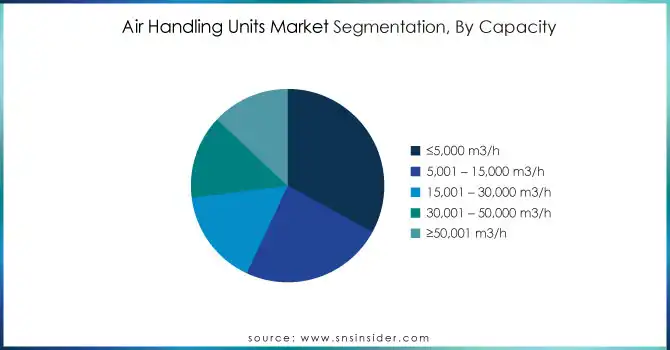

By Capacity

≤5,000 M3/H segment dominated with the market share over 33% in 2023. This dominance is driven by the widespread use of small to medium-sized commercial and residential buildings, which typically require AHUs (Air Handling Units) with lower capacities to meet their ventilation and air quality needs. These units are preferred due to their cost-effectiveness, energy efficiency, and adaptability for various applications. Their ability to offer reliable performance at a lower cost makes them a popular choice, driving their significant market presence and growth in this capacity range.

By Application

The commercial segment dominated with the market share over 55% in 2023. This dominance stems from strong demand across office, retail, and hospitality sectors, where efficient ventilation and indoor air quality are prioritized for occupant comfort. Stringent regulations governing workplace environments also play a key role in driving AHU adoption in commercial spaces. These factors collectively contribute to the commercial segment's substantial share of the market, as businesses aim to meet regulatory standards while ensuring optimal indoor air conditions for employees and customers alike.

Air Handling Units Market Regional Analysis

North America region dominated with the market share over 38% in 2023, driven by its well-established industrial infrastructure and advanced technological landscape. The region’s high demand for HVAC systems, particularly in commercial and residential buildings, plays a crucial role in market leadership. Key industry players, along with extensive investment in research and development, have facilitated the growth of innovative and energy-efficient AHU solutions. The increasing focus on improving indoor air quality and meeting stringent energy efficiency standards has further bolstered the market in North America. Additionally, the adoption of smart building technologies and the shift towards sustainable building practices are contributing factors to the market’s expansion. The region also benefits from a well-developed regulatory framework, which encourages the implementation of energy-efficient systems, ensuring that AHUs meet both environmental and performance standards.

Asia-Pacific is experiencing the fastest growth in the Air Handling Units (AHU) market, fueled by rapid urbanization, industrialization, and escalating construction activities across emerging economies such as China, India, and Japan. The region's expanding commercial, residential, and healthcare sectors are driving the demand for AHUs, as there is a growing focus on air quality and energy efficiency. Government regulations mandating improved ventilation systems further boost the market. Additionally, the rising awareness about the importance of indoor air quality and the ongoing development of infrastructure projects are key factors contributing to the region's rapid market expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players of the Air Handling Units Market

- Systemair AB (HVAC Systems, Ventilation Equipment)

- Trox GmbH (Air Distribution, Ventilation Solutions)

- Daikin Industries Ltd. (Air Conditioning, Refrigeration Equipment)

- Lennox International, Inc. (HVAC Systems, Indoor Climate Control)

- Carrier Corporation (Air Conditioning, Heating Systems)

- Flakt Woods Group (Air Movement, Ventilation Products)

- Trane Inc. (HVAC Systems, Building Climate Control)

- Johnson Controls Inc (HVAC Systems, Building Management Solutions)

- GEA Group AG (Refrigeration, HVAC Solutions)

- Hitachi Ventus (Air Conditioning, HVAC Systems)

- United Technologies Corporation (HVAC Systems, Building Equipment)

- Mitsubishi Electric Corporation (Air Conditioning, Heating Solutions)

- Rheem Manufacturing Company (HVAC Systems, Water Heaters)

- Honeywell International Inc. (HVAC Controls, Building Management)

- Bosch Thermotechnology (Heating, Cooling Solutions)

- Daikin Applied (Commercial HVAC Systems, Air Purification)

- Siemens AG (Building Technologies, HVAC Controls)

- Lennox International (Residential and Commercial HVAC Systems)

- Vaisala (Weather Sensors, Environmental Monitoring Systems)

- Eaton Corporation (HVAC Solutions, Electrical Systems)

Suppliers for (Air Handling Units (AHUs), HVAC systems, ventilation solutions, and related climate control equipment) of Air Handling Units Market

- Trane Inc.

- Carrier Corporation

- Daikin Industries Ltd.

- Johnson Controls Inc.

- Lennox International Inc.

- Systemair AB

- Flakt Woods Group

- Mitsubishi Electric Corporation

- Greenheck Fan Corporation

- Trox GmbH

RECENT DEVELOPMENT

In January 2024: Carrier expanded its HVAC product range produced in India, adding a variety of air handling units (AHUs) and fan coil units (FCUs). These units are tailored to meet the diverse requirements of commercial buildings in India, providing customized solutions to promote healthy indoor environments with high-efficiency air filtration.

In November 2023: Daikin launched the Daikin Indoor Environmental Quality (IEQ) Sensor along with the Air Handling Unit (AHU) Modular T Series. Following this, the company unveiled a fully integrated solution combining the benefits of both products.

In January 2023: Lennox Industries, a leading provider of home comfort solutions and a pioneer in energy efficiency for over 127 years, introduced the latest additions to its advanced range of smart products.

| Report Attributes | Details |

| Market Size in 2023 | USD 12.64 Billion |

| Market Size by 2032 | USD 20.10 Billion |

| CAGR | CAGR of 5.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Packaged, Modular, Custom, DX Integrated, Low Profile (Ceiling), Rooftop Mounted, Others) • By Capacity: ≤5,000 m3/h, 5,001 – 15,000 m3/h, 15,001 – 30,000 m3/h, 30,001 – 50,000 m3/h, ≥50,001 m3/h) • By Application (Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Systemair AB, Trox GmbH, Daikin Industries Ltd., Lennox International, Inc., Carrier Corporation, Flakt Woods Group, Trane Inc., Johnson Controls Inc., GEA Group AG, Hitachi Ventus, United Technologies Corporation, Mitsubishi Electric Corporation, Rheem Manufacturing Company, Honeywell International Inc., Bosch Thermotechnology, Daikin Applied, Siemens AG, Lennox International, Vaisala, Eaton Corporation. |

| Key Drivers | • The growing construction and infrastructure development, driven by urbanization and the demand for efficient ventilation systems in buildings, is a key driver of the Air Handling Units (AHU) market. |

| Restraints | • The high initial installation costs of air handling units (AHUs), especially in developing regions with limited resources, present a significant market restraint, although growing demand driven by energy efficiency and health concerns is expected to fuel market growth. |