Industrial Gases Market Report Scope & Overview:

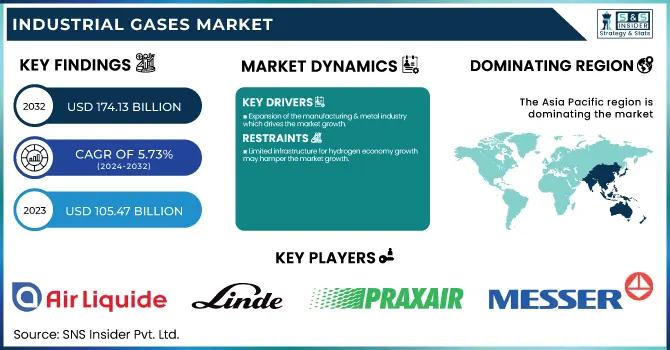

The Industrial Gases Market size was USD 105.47 Billion in 2023 and is expected to reach USD 174.13 Billion by 2032 and grow at a CAGR of 5.73 % over the forecast period of 2024-2032. The industrial gases market report provides an in-depth analysis of production capacity and utilization rates, highlighting the increasing demand for oxygen and nitrogen across various industries. It examines feedstock price fluctuations, particularly the impact of natural gas and electricity costs on hydrogen production and air separation processes. The report explores regulatory developments, including incentives and policies driving the adoption of low-carbon gases and carbon capture technologies. Additionally, it assesses sustainability initiatives, such as CO₂ capture projects and energy-efficient air separation technologies. Lastly, it highlights R&D advancements, focusing on green hydrogen, AI-driven gas optimization, and blockchain-based traceability solutions.

To Get more information on Industrial Gases Market - Request Free Sample Report

Industrial Gases Market Dynamics

Drivers

-

Expansion of the manufacturing & metal industry which drives the market growth.

Growing manufacturing and metal activity, where industrial gases are widely used in many metal processing applications, is one of the main drivers of industrial gases market expansion. In steelmaking, welding, metal cutting, and heat treatment, generally, oxygen, nitrogen, argon, and hydrogen are used. Increased consumption of industrial gases is driven by the growing automotive, aerospace, building & construction, and heavy machinery industries, where steel, aluminum, and fabricated metal products have larger applications. Advances in automated welding technologies and additive manufacturing (3D printing) continually require high-purity shielding gases such as argon and helium as well. Oxy-fuel combustion technology can improve combustion efficiency and reduce CO₂ emissions, thus, it has been widely used in energy-efficient and low-carbon metal production. The industrial gas market is also anticipated to grow in the upcoming years due to swift industrialization, growing infrastructural activities, and governments encouraging the prospect of manufacturing.

Restraint

-

Limited infrastructure for hydrogen economy growth may hamper the market growth.

The limited infrastructure for hydrogen economy growth has emerged as a major obstacle for the hydrogen industrial gases market. Even though we are witnessing a gradual transition to the use of green hydrogen and hydrogen fuel cells as a clean energy source, the current absence of hydrogen refueling stations, dedicated pipelines, and large-scale electrolysis plants limits widespread adoption. Shipping it requires cryogenic tanks and highly pressurized tankers, which makes the overall logistically pricey and raises safety concerns. Slow market growth is exacerbated by a lack of harmonization in policies and infrastructure investments in hydrogen in general. The lack of support from governments in the form of policies, subsidies, and public deployment projects, accompanied by a missing upscaling of the necessary technology, and involvement of the private sector, will slow the transition to a hydrogen economy, limiting the development of the overall industrial gases market.

Opportunity

-

Increasing adoption of carbon capture, utilization & storage creates an opportunity in the market.

Carbon Capture, Utilization, and Storage (CCUS) is gaining wider adoption across industries, which will be a major opportunity for the industrial gases market as companies seek sustainable means to decarbonize. Carbon capture, CCUS technology captures CO₂ emissions that will prevent CO₂ from being released into the atmosphere out of power plants, refineries, and industrial facilities. The CO₂ captured is then either injected underground and stored in geological formations, or used for enhanced oil recovery (EOR), and in some applications for chemical synthesis and food & beverage carbonation. As government regulations on carbon emissions become more stringent, numerous industries are stepping up investments in carbon capture infrastructure, which in turn is increasing the demand for high-purity industrial gases such as nitrogen and CO₂ used in carbon storage and transportation. Furthermore, technological improvement concerning gas separation, associated with blue hydrogen projects (which embeds CCUS) will translate into a robust market potential. The industrial gas market will see tremendous growth due to the growing penetration of CCUS technologies as governments and corporations place higher priority on decarbonization initiatives.

Challenges

-

Complex storage and transportation requirements may create a challenge for the market.

The unique storage and transport needs of industrial gases are a primary obstacle to market expansion. Infrastructure costs are very high due to the necessity of high-pressure cylinders, cryogenic tanks (for low-density gases like hydrogen), or dedicated pipelines (for liquefied natural gas (LNG)). Moving these gases long distances necessitates dedicated insulated tankers, requiring ultra-low temperature holding and greatly increasing logistical costs and supply chain complexities. The threat of leakage, the need for regulatory compliance regarding hazardous materials, and strict safety measures all make distribution more complicated. For industries dependent on bulk gas supply, transport which involves continuous monitoring, prompt handling, and compliance with international safety standards is a major challenge to their operations. The market may probably be constrained to meet the growing demand of the industry without progressing storage technology and its rationalized distribution network.

Industrial Gases Market Segmentation Analysis

By Gas Type

Oxygen held the largest market share around 32% in 2023. It is due to its wide range of end-use industries, oxygen accounted for the largest share of the market in the industrial gases market. Oxygen is an important aspect of medical products in the healthcare industry as it is used mainly for therapeutic & respiratory treatment or life support applications, where the demand from hospitals and home healthcare facilities is growing. Another significant end use in the steel & metal production industry, where oxygen is used in basic oxygen furnaces (BOF) and oxy-fuel combustion processes. Oxygen also acts as an important element in oxidation reactions, wastewater treatment, and better oil recovery (EOR) in chemical and petrochemical industries. Its application in waste incineration and water treatment plants has also been assisted by the increased focus on environmental sustainability.

By End Use Industry

Manufacturing held the largest market share around 28% in 2023. This manufacturing industry is the largest one in the industrial gas market since this industry depends on gaseous resources for production purposes. Industrial gases like oxygen, nitrogen, argon, and hydrogen play an important role in metal fabrication, welding, cutting, and heat treatment, which is an important sector e.g. automotive, aerospace, and heavy machinery production industries. Despite air separation becoming a bigger part of energy generation and gas consumer industries progressively utilizing clean energy solutions and advanced production techniques, the manufacturing industry is and will continue to be the largest consumer of industrial gases, cementing the dominant market position of this sector.

Industrial Gases Market Regional Outlook

Asia Pacific held the largest market share around 38% in 2023. It is owing to its rapid industrialization, growing manufacturing sector, and high demand from key end-use industry. The steel, automotive, electronics, and chemicals production have grown massively in the countries of the region that depend heavily on oxygen, nitrogen, argon, and hydrogen gases for various processes. Also, the rapidly growing healthcare sector, due to the increasing aging population and growing medical infrastructure, is another factor driving the demand medical oxygen. The region is also the world leader in semiconductor and electronics manufacturing, where fab and process demand high-purity gases. Asia Pacific has strengthened its dominance due to availability of cheaper labor, growing foreign investments and government policies supporting industrial developments. To that end, clean energy and hydrogen infrastructure development is ongoing across the region making it an industrial gas consumption hub.

North America held a significant market share in 2023. This is due to the solid industrial base, demand from core industries, and growth in gas technologies to boost the industrial branches-across the country. Healthcare, chemicals, oil & gas, metal fabrication, and food & beverage are some of the industries that are present in high numbers in the region and these industries consume industrial gases extensively for performing critical operations. Market growth is also fueled by rising adoption of hydrogen in clean energy applications, increased investments in hydrogen infrastructure by governments around the world. In addition to that high concentration of technologically advanced R &D and high regulatory standard guarantees strong innovativeness, and supply chain. A rising requirement for medical oxygen in hospitals and home healthcare centers as well as surge in demand for specialty gases in electronics and semiconductor production is also augmenting North America position in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Air Liquide (Alphagaz, Scott)

-

Linde plc (HiQ, Spectra)

-

Praxair (StarFlame, Medipure)

-

Messer Group (Gasevo, Variocarb)

-

Air Products & Chemicals (Freshline, Halia)

-

Taiyo Nippon Sanso Corporation (SanFresh, Argamax)

-

Mitsui Chemicals (SunForce, AURUM)

-

SOL Group (SolMet, SolMed)

-

Showa Denko K.K. (Shodex, EAGLEBURGMANN)

-

Iwatani Corporation (Hydrocut, Thermotron)

-

Gulf Cryo (CryoPlus, Helion)

-

Ellenbarrie Industrial Gases (EllOxy, EllWeld)

-

Buzwair Industrial Gases (BuzzGas, CryoTech)

-

INOX Air Products (INOX-Weld, CryoShield)

-

Coregas Pty Ltd (CoreShield, CoreWeld)

-

Air Water Inc. (KryoTech, FreseniusGas)

-

Matheson Tri-Gas (Pureshield, TriMix)

-

SIAD Group (GreenShield, LASERLINE)

-

Leland Limited (LelOx, CO2Boost)

-

Universal Industrial Gases (UIG-Oxygen, UIG-Argon)

Recent Development:

-

In July 2024, Honeywell announced the acquisition of Air Products' LNG process technology and equipment business for USD 1.81 billion in an all-cash deal. This strategic move enhances Honeywell’s position in the LNG sector, expanding its energy solutions portfolio.

-

In July 2023, NovaAir Technologies unveiled plans to establish a medical and industrial gases plant in Karnataka, India. The initiative aims to address the rising demand for medical gases in the healthcare sector. This expansion reinforces the company's commitment to enhancing gas supply infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 105.47 Billion |

| Market Size by 2032 | USD 174.13 Billion |

| CAGR | CAGR of 5.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Gas Type (Oxygen, Nitrogen, Hydrogen, Carbon dioxide, Acetylene, Argon) •By End-Use Industry (Healthcare, Manufacturing, Metallurgy & Glass, Food & Beverage, Retail, Chemicals & Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Air Liquide, Linde plc, Praxair, Messer Group, Air Products & Chemicals, Taiyo Nippon Sanso Corporation, Mitsui Chemicals, SOL Group, Showa Denko K.K., Iwatani Corporation, Gulf Cryo, Ellenbarrie Industrial Gases, Buzwair Industrial Gases, INOX Air Products, Coregas Pty Ltd, Air Water Inc., Matheson Tri-Gas, SIAD Group, Leland Limited, Universal Industrial Gases |