Aircraft Exhaust System Market Report Scope & Overview:

The Aircraft Exhaust System Market Size was valued at USD 1029 Million in 2023 & is estimated to reach USD 2028 Million by 2032 and increase at a compound annual growth rate (CAGR) of 7.82% between 2024 and 2032.

To get more information on Aircraft Exhaust System Market - Request Free Sample Report

One essential part of the aeroplane is the exhaust system. Weepers, exhaust mufflers, exhaust stacks, risers, and tailpipes all coexist with exhaust systems. The safety of flights depends on these mechanisms. They assist with preventing leaks into the cabin and fire hazards by collecting and disposing of the heat and gases that are being released by the engine. These systems are also essential for improving performance and reducing noise.

The market for aeroplane exhaust systems is expanding due in large part to an increase in air travellers and a growing need for new aircraft. Additionally, the market share of aircraft exhaust is growing due to the desire for energy-efficient, lightweight aircraft with lower petrol emissions. The industry is expanding because of the usage of composite materials in system advances and the development of 3D printing technology for exhaust system fabrication. Nonetheless, it is projected that high installation, operating, and maintenance costs will impede the growth of the aviation exhaust system industry. The growth of the aircraft exhaust system market is impacted by delays in the delivery of new aircraft and strict laws and regulations about aircraft safety and maintenance.

The market for aircraft exhaust systems is divided into segments based on end users, aviation types, regions, systems, components, and mechanisms. The market is segmented into turbochargers, exhaust pipes, auxiliary power unit exhaust tubes, exhaust nozzle, exhaust pipes and exhaust cones based on the component. It is divided into three categories: engine exhaust system, piston engine, and auxiliary power unit exhaust engine. The collector system and short stack system are two additional categories for piston engines. There are four types of engine exhaust systems: reciprocating (piston-based), turboprop, turboshaft and turbofan. The market for aircraft exhaust systems is further divided into manual and hydraulic mechanisms. It is further divided into original equipment manufacturer (OEM) repair, maintenance, and overhaul (MRO) based on the end user.

Aircraft Exhaust System Market Dynamics

DRIVERS:

-

Increasing Demand for New Aircraft.

The global aviation industry is expanding at a steady pace, driven by factors such as rising disposable incomes, expanding low-cost carrier operations, and growing demand for air travel in developing economies. This growth translates into a higher demand for new aircraft, which in turn necessitates robust and reliable aircraft exhaust systems to ensure their safe and efficient operation.

-

Rising Air Traffic Density.

The number of air passengers is projected to increase significantly, reaching an estimated. This surge in air traffic puts immense pressure on airspace management and navigation systems, leading to a demand for more sophisticated aircraft exhaust systems that can meet the stringent safety and regulatory requirements of the aviation industry.

RESTRAIN:

-

High Cost of Exhaust Systems.

The development and manufacturing of advanced aircraft exhaust systems involve substantial investments in research, design, and production. This translates into a higher cost for the equipment, which may limit its adoption by smaller aviation operators or those in developing economies.

-

Complexity of Integration with Existing Aircraft Systems.

Integrating new aircraft exhaust systems into existing aircraft avionics and fuel management systems can be a complex and time-consuming process. This complexity may hinder the adoption of new technologies, especially in legacy aircraft fleets.

OPPORTUNITY:

-

Growing Demand for Self-Service Fueling Solutions.

Airlines and maintenance providers are increasingly seeking self-service fueling solutions to streamline their operations and reduce downtime. This presents an opportunity for manufacturers to develop user-friendly and autonomous exhaust system components that can be operated by technicians without extensive training.

-

Adoption of Predictive Maintenance Strategies.

Predictive maintenance strategies, which involve monitoring equipment condition data to anticipate potential failures, are gaining traction in the aviation industry. This opens up opportunities for the development of exhaust systems that can collect and analyze real-time data on exhaust gas temperature, pressure, and flow rates, enabling predictive maintenance practices.

CHALLENGES:

-

Cybersecurity Threats and Data Privacy Concerns.

As aircraft exhaust systems become increasingly connected and digitized, they become more vulnerable to cybersecurity attacks. Manufacturers and operators need to implement robust cybersecurity measures to protect sensitive data and prevent unauthorized access to critical exhaust system information.

-

Integration with Emerging Technologies.

Integrating aircraft exhaust systems with emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI) can pose technical challenges. Manufacturers need to develop expertise in these technologies to ensure seamless integration and maximize the benefits of these advancements.

IMPACT OF RUSSIAN RUSSIAN-UKRAINE WAR

Airlines are delaying the procurement of new aircraft and exhaust systems, which is hurting the demand for aviation exhaust systems. Manufacturers of aircraft exhaust systems are cutting back on manufacturing and terminating employees. The war is causing uncertainty in the commercial world, which is deterring airlines and makers of aircraft exhaust systems from investing in new technologies.

The supply chain for parts of aircraft exhaust systems has been disrupted by the war, making it more difficult for manufacturers to get the parts and materials they need. Delays in manufacturing and higher expenses have resulted from this. Due to airline operational reductions and postponed investments in new technologies, the war has also increased uncertainty in the aviation sector. The market for aeroplane exhaust systems is growing more slowly as a result of this uncertainty. Because of the war, governments everywhere are focusing more on using aircraft exhaust systems for military purposes as a means of strengthening their air defences. This might result in more money being spent on aircraft exhaust systems of the military calibre, but it might also take funds away from commercial uses. In 2023, aviation travel is predicted by the International Aviation Transport Association (IATA) to decrease by 5.3%. The need for new aircraft has decreased as a result of the drop in air travel, and this has also decreased the demand for aircraft exhaust systems.

According to a recent poll, 72% of producers of aircraft exhaust systems said they expected the war to negatively affect their business. This implies that the market for aircraft exhaust systems is already being significantly impacted by the war.

IMPACT OF ONGOING RECESSION

During a recession, businesses are cutting expenditures and tightening their budgets. This might result in less demand for new aeroplanes, which would then lessen the need for aircraft exhaust systems. Reduced funding for aviation exhaust system research and development could potentially result from the recession. This can impede the industry's march towards innovation.

Because they might not be able to acquire capital, new businesses entering the aviation exhaust system market may find it challenging to do so during the recession. This might result in less innovation and competition. The global economy is expected to increase by 3.2% in 2023, according to the International Monetary Fund (IMF), down from 6.1% in 2021. It is anticipated that this deceleration in economic expansion will hurt several sectors, among them the aviation exhaust system industry. According to a recent poll, 50% of producers of aviation exhaust systems said they thought the recession would hurt their business. This implies that the aviation exhaust system business is already experiencing anxiety as a result of the recession.

Need any customization research on Aircraft Exhaust System Market - Enquiry Now

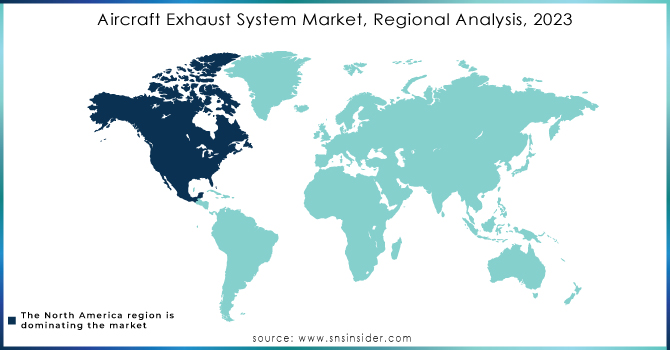

Aircraft Exhaust System Market Regional Analysis

North America: North America is expected to be the largest market for Aircraft Exhaust System in the forecast period. This is due to several factors, including, the presence of several major Aircraft Exhaust System manufacturers, such as Boeing, Lockheed Martin, and Northrop Grumman A strong regulatory environment that supports the development and deployment of Aircraft Exhaust System. A growing demand for Aircraft Exhaust System from the military, logistics, and agriculture industries.

Asia Pacific: The Asia Pacific region is expected to be the fastest-growing market for Aircraft Exhaust System in the forecast period. This is due to several factors, including, Rapid economic growth and urbanization A growing demand for Aircraft Exhaust System for a variety of applications, such as logistics, agriculture, and inspection Increasing government support for the development of Aircraft Exhaust System technology.

Key Players

Some major key players in the Aircraft Exhaust System Market are Safran Aircraft Engines, Pratt & Whitney, Rolls-Royce, GE Aviation, Honeywell Aerospace, United Technologies Aerospace Systems, Avio Aero, MTU Aero Engines, Safran Nacelles, Goodrich Corporation and other players.

RECENT DEVELOPMENTS

In 2023: Aircraft Exhaust Systems are equipped with a variety of sensors, including cameras, lidar, and radar, to gather information about their surroundings. Sensor fusion technology combines data from multiple sensors to create a more comprehensive and accurate understanding of the environment, enabling more precise navigation and decision-making.

In 2022: Battery life has been a limiting factor for Aircraft Exhaust Systems, but advancements in battery technology are improving energy storage capacity and reducing weight. This allows for longer flight times and enables the development of larger and more capable Aircraft Exhaust Systems.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1029 Million |

| Market Size by 2032 | US$ 2028 Million |

| CAGR | CAGR of 7.82 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Auxiliary Power Unit Exhaust Liner, Exhaust Pipe, Exhaust Cone, Turbo Charger, Exhaust Nozzle, Auxiliary Power Unit Exhaust Tube) • By Systems (Piston Engine, Short Stack System, Auxiliary Power Unit Exhaust Engine, Collector System, Engine Exhaust System, Turbofan, Turboshaft, Turboprop, Reciprocating (Piston Based) • By Mechanism (Manual, Hydraulic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Safran Aircraft Engines, Pratt & Whitney, Rolls-Royce, GE Aviation, Honeywell Aerospace, United Technologies Aerospace Systems, Avio Aero, MTU Aero Engines, Safran Nacelles, Goodrich Corporation |

| Key Drivers | • Increasing Demand for New Aircraft. • Rising Air Traffic Density. |

| Market Challenges | • Cybersecurity Threats and Data Privacy Concerns. • Integration with Emerging Technologies. |