Aircraft Fairings Market Report Scope & Overview:

To get more information on Aircraft Fairings Market - Request Free Sample Report

The Aircraft Fairings Market Size was valued at USD 2.10 billion in 2023 and is expected to grow to USD 3.76 billion by 2032, achieving a compound annual growth rate (CAGR) of 6.72% over the forecast period from 2024 to 2032.

The Aircraft Fairings are critical components of the aircraft's body for proper finishing and operation. The Aircraft Fairings are critical for reducing dragging and thus boosting fuel efficiency and overall aircraft operation. In recent years, increased demand in the commercial and military sectors has fueled the overall growth of the aircraft fairings industry.

Because of the introduction of new-generation aircraft, aviation OEMs and manufacturers are raising their production rates. Furthermore, the requirement for lightweight Aircraft Fairings has compelled manufacturers to employ a variety of composite materials. These are the primary drivers of growth in the Aircraft Fairings industry.

MARKET DYNAMICS

KEY DRIVERS

-

The use of advanced composite materials in aircraft fairings is becoming more common.

-

UAVs are becoming more popular in commercial and military applications.

RESTRAINTS

-

The lack of recycling alternatives for composites used in the manufacture of Aircraft Fairings

OPPORTUNITIES

-

3D Printing Adoption in Aircraft Fairing Manufacturing

-

Cost Reduction for Composite Materials

CHALLENGES

-

The Recyclability of Composite Materials

-

Complex Aircraft Fairing Design Causes Maintenance Difficulties

IMPACT OF COVID-19

The decreasing economic condition caused by the pandemic has had a substantial impact on the growth of the Aircraft Fairings market. The government's severe regulations and travel limitations around the world have had a substantial impact on the market value of aircraft fairings. However, some aviation organizations have engaged in the acquisition of this equipment in order to improve fuel efficiency and operational efficiency. As a result, the expansion of the Aircraft Fairings business has been balanced during the epidemic.

This market is divided into four segments based on platform: commercial, military, regional, and general aviation. The commercial segment dominated the Market. However, the business sector has advanced and developed significantly. Because of the increased acquisition of new generation aircraft, the commercial segment is likely to dominate the market over the forecast period. Modern aeroplanes are lightweight, with passenger comfort as a key emphasis.

Military aircraft are expected to expand at the fastest CAGR in the near future. The segment's significant expansion can be due to increased purchase of multi-role, combat, and transport aircraft. Furthermore, increasing military budgets in both developed and emerging economies are important drivers of category growth during the predicted period. The market is divided into fuselage, engine, control surfaces, radars and antenna, and landing gear.

The fuselage segment had the biggest market share in 2020 and is predicted to maintain that position with the highest CAGR over the forecast period. This expansion can be ascribed to developments in structural elements and components that are lighter and more efficient.

Because of the use of lighter and more robust landing gear, the landing gear market is one of the developing segments. The participants in the manufacturing industry are producing stronger and lighter landing gear without compromising its functions, operations, performance, safety, and maintenance requirements. As a result, higher growth rates are predicted during the forecast period.

The market is divided into three materials: metallic, composite, and alloys.

The composite segment has the largest market share. One of the primary reasons driving segment expansion during the projection period is the increasing demand for lightweight and fuel-efficient aero structures, power plants, and other global systems. Furthermore, the major players in this industry get a sizable portion of their revenue from the sale of composite parts and components.

The Metallic category is expected to expand slowly. This decrease is attributable to a fall in demand for metal aero structures due to their high operating and maintenance costs.

KEY MARKET SEGMENTATION

By Platform

-

Commercial

-

Military

-

General aviation

By Material

-

Composite

-

Metallic

-

Alloy

By End User

-

OEM

-

Aftermarket

By Application

-

Flight Control Surface

-

Fuselage

-

Engine

-

Nose

-

Cockpit

-

Wings

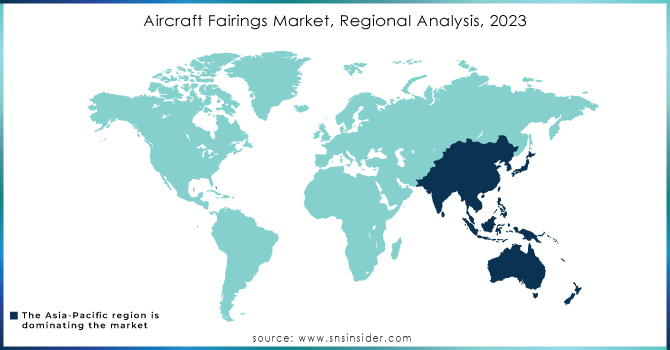

REGIONAL ANALYSIS

Global defence spending has been rising in recent years. North America and Western Europe, for example, have boosted defence spending, and the purchase of new military aircraft is projected to boost demand for aircraft fairings. However, a decline in defence spending in nations such as Saudi Arabia, Russia, and several Latin American countries as a result of lower oil prices would result in a weakened aircraft fairing market.

Regional trends like as demographic change, rising e-commerce, travel and tourism activities, population density, and urbanization all have an impact on the worldwide aeroplane fairing industry. Commercial aeroplane demand is high, notably in the constantly expanding Asia Pacific area.

This long-term demand projection, combined with favourable market circumstances in many areas and a robust backlog, presents a positive prognosis for the aeroplane fairing market. Aside from North America, Europe will continue to be the primary hubs for the global aeroplane fairing market in the near future. Because both regions are home to some of the world's top aircraft manufacturers, demand for aircraft fairing remains high.

Need any customization research on Aircraft Fairings Market - Enquiry Now

REGIONAL COVERAEGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are ShinMaywa, Strata Manufacturing, Malibu Aerospace, FACC AG, Daher, NORDAM, Airbus, Boeing, Avcorp, and Barnes Group, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.10 Billion |

| Market Size by 2032 | US$ 3.76 Billion |

| CAGR | CAGR of 6.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform(Commercial, Military, General aviation) • By Material (Composite, Metallic, and Alloy) • By End User (OEM and Aftermarket) • By Application (Flight Control Surface, Fuselage, Engine, Nose, Cockpit, Wings, and Landing Gear) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ShinMaywa , Strata Manufacturing, Malibu Aerospace, FACC AG, Daher, NORDAM, Airbus, Boeing, Avcorp, and Barnes Group, and other players. |

| DRIVERS | • The use of advanced composite materials in aircraft fairings is becoming more common. • UAVs are becoming more popular in commercial and military applications. |

| RESTRAINTS | • The lack of recycling alternatives for composites used in the manufacture of Aircraft Fairings |