Aerospace & Defense Market Report Scope & Overview:

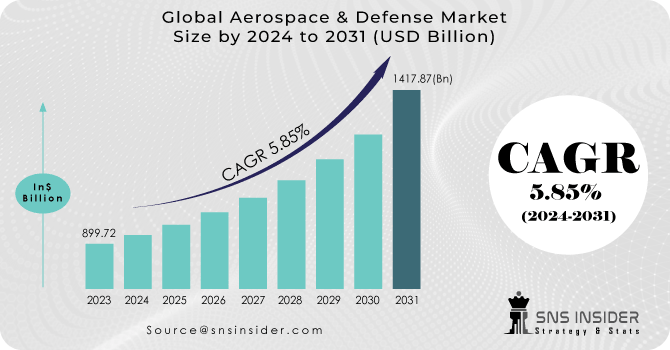

The Global Aerospace & Defense Market Size is valued to reach USD 1417.87 Bn by 2031, and the market size in 2023 was recorded at USD 899.72 Bn. The CAGR calculated for this market is 5.85% for the forecast period of 2024-2031.

Rising urbanization and rising incomes in emerging nations are expected to create a major increase in the worldwide demand for commercial air travel in the upcoming years. Strong demand is being generated for new airplanes and associated services as a result. The protracted war in Ukraine and other geopolitical unrest globally are driving up defense budget investments. This is increasing the need for military ships, planes, and other armaments. The A&D sector is always changing as a result of the quick development of new technology. As a result, new, more competent, economical, and efficient aircraft and defense systems are being developed. The growing industry for on-demand transportation employing electric vertical take-off and landing (eVTOL) aircraft is referred to as AAM. With the potential to completely change how people travel, AAM is receiving significant investment from several large A&D businesses. The importance of space is growing for both military and commercial reasons. To keep up with this increasing demand, several A&D companies are creating new launch vehicles and satellites. The growing adoption of digital technology.

To get more information on Aerospace & Defense Market - Request Free Sample Report

The design, production, and maintenance processes for A&D products are being revolutionized by digital technologies. Increased production, quality, and efficiency are the results of this. The necessity to upgrade their armed forces, geopolitical conflicts, and security concerns have prompted several nations to allocate substantial sums for defense. Tensions in the Middle East, Eastern Europe, and the South China Sea were particularly high. Defense acquisition and military modernization initiatives were motivated by these tensions. The aerospace and military industry has been placing a greater emphasis on cutting-edge technologies like cyberwarfare, quantum computing, and artificial intelligence. These technological advancements could revolutionize military power.

As nations build space-based assets for communication, reconnaissance, and navigation, there is growing worry about the militarization of space. The Space Force was specifically created by the US as a new military branch.

Market Dynamics:

Driver

The A&D sector is always changing as a result of the quick development of new technology. The necessity to create new and more sophisticated spacecraft, planes, and military systems is what motivates this innovation.

Cryptography and code-breaking, which are essential components of intelligence and cybersecurity, could undergo a radical transformation thanks to quantum computing. constellations of tiny satellites were being launched for a variety of uses, such as Earth observation, communication, and military surveillance. Miniaturized satellites, or CubeSats, were also becoming increasingly common. Designed to deliver precise firepower at a long range at high speed, electromagnetic railguns were being developed for both land-based and marine uses. In both defense and reconnaissance applications, the employment of swarm technology—in which numerous drones or autonomous vehicles collaborate in coordinated missions—is becoming more common.

Restrain

The complexity of aircraft and defense systems, as well as the rising cost of raw materials, are some of the factors driving up the costs of developing and manufacturing A&D products. This is straining A&D companies' profit margins.

Opportunity

The increasing urbanization and rising incomes in emerging markets are driving a rapid increase in the global demand for commercial air travel. Strong demand is being generated for new aircraft and associated services as a result.

Rising urbanization and rising incomes in emerging markets are expected to drive a significant increase in the global demand for commercial air travel in the upcoming years. Over the next 20 years, the International Air Transport Association (IATA) projects that passenger traffic will increase by 3.6% annually on average. Over the next 20 years, the Asia-Pacific region is expected to account for more than half of the global increase in passenger traffic, with this growth expected to be especially strong there. Latin America and Africa are two other regions where demand for air travel is predicted to rise significantly.

The demand for air travel is rising as a result of the world's population becoming more urbanized. This is due to the fact that travel for both business and pleasure is more common among city dwellers. As a result of these countries' citizens' fast rising incomes, demand for air travel is expanding. This is due to the fact that those who earn more money are more likely to be able to afford air travel. A greater range of income groups can now afford to travel by air thanks to low-cost airlines. This is increasing demand and growing the market for air travel.

Challenges

The importance of space is growing for both military and commercial reasons. For A&D companies, this means new opportunities, but it also means new challenges, like the need to manage the increasing volume of space traffic and develop new space technologies.

Impact of Recession:

On the one hand, the pandemic and the ensuing recession severely damaged the commercial aviation industry. The demand for air travel fell precipitously, which decreased the supply of new aircraft and related services. The income and earnings of suppliers and manufacturers of commercial aircraft were negatively impacted by this. However, the defense industry fared better during the recession. Driven by geopolitical tensions and other threats, governments continued to spend money on defense. This supported the need for military ships, planes, and other armaments.

The 2022 recession had a variety of effects on the A&D sector overall. While the defense sector fared better, the commercial aviation sector took a serious blow. Compared to 2021, aircraft deliveries decreased by 15% in 2022. Billions of dollars' worth of airplane orders were canceled or postponed by airlines. Thousands of workers were laid off by suppliers and manufacturers of commercial aircraft. Compared to 2021, global defense spending grew by 2.6% in 2022. For the fiscal year 2023, the US Congress approved a record-breaking $810 billion defense budget. Strong demand was observed for the goods and services provided by defense contractors.

Impact of Russia Ukraine War:

On the one hand, the war has raised demand for armaments, defense systems, and military aircraft. This is due to the fact that governments everywhere are spending more on defense as a result of the perceived threat that Russia poses. However, the war has also presented the A&D sector with a number of difficulties. These consist of: For A&D companies, the war has caused supply chain disruptions. This is due to Russia's prominence as a supplier of components and raw materials for the production of aircraft and other defense systems.

Moreover, the war has increased expenses for A&D firms. This is brought on by things like rising energy and raw material costs. The A&D industry is experiencing uncertainty and disruption as a result of the war. This can be attributed to various factors, including the sanctions imposed on Russia and the possibility of the conflict intensifying.

The A&D industry is anticipated to be affected by the conflict in Ukraine in the long run. The war has brought attention to the significance of defense spending, and it is probably going to spur more funding for defense initiatives globally. A&D firms that manufacture weapons, military aircraft, and other defense systems will profit from this. But the war has also presented the A&D sector with a number of difficulties. The war's effects on the supply chain will probably last for a while, and A&D companies' profit margins will likely continue to be squeezed by the rising cost of energy and raw materials.

KEY MARKET SEGMENTATION

Global Aerospace & Defense Market, By Marine Electric Vehicle

-

By Vehicle Type

Global Aerospace & Defense Market, By Space Navigation

- By Offering

Global Aerospace & Defense Market, By UAV Propulsion’s Systems

- By Range

Global Aerospace & Defense Market, By Satellite launch vehicle

- By Orbit

Global Aerospace & Defense Market, By Drone Telematics

- By End User

Global Aerospace & Defense Market, By Aviation Software

- By Technology

Need any customization research on Aerospace & Defense Market - Enquiry Now

Competitive landscape

Big Defense Vendors:

One of the biggest defense contractors in the world, Lockheed Martin is renowned for creating a variety of military hardware, such as fighter planes, missile systems, and space-related technologies. Boeing is a well-known aerospace and defense corporation that produces defense systems, space exploration vehicles, and aircraft. Northrop Grumman: Has expertise in unmanned aircraft systems, missile defense systems, cybersecurity, and defense technology. The diversified company Raytheon Technologies is well-known for its defense electronics and missile systems. It has interests in commercial, military, and aerospace aviation.

Makers of Aircraft:

A significant participant in the production of military and commercial aircraft, Airbus manufactures a variety of military transport and surveillance aircraft. Boeing: This company produces military aircraft like the F-15, F-18, and KC-46 tanker in addition to its commercial aircraft. Brazilian aerospace firm Embraer specializes in military and regional aircraft, such as the EMB 314 Super Tucano. Russian aerospace company Sukhoi is well-known for creating military aircraft such as the Su-57 and Su-35.

New and creative small businesses are frequently involved in creating cutting-edge technologies for the aerospace and defense industry. These businesses might focus on advanced materials, space exploration, or unmanned systems. A large number of nations have their own defense industries, which add to the market's competitiveness. For instance, AVIC in China, HAL in India, and Rostec in Russia are all major players in their respective regions. The larger defense and aerospace companies rely on a multitude of subcontractors and suppliers to supply essential systems and components. These businesses might produce specialized materials or cutting-edge sensors.

Regional Analysis

Numerous significant defense contractors are based in the United States, including Raytheon Technologies, General Dynamics, Northrop Grumman, Lockheed Martin, and Boeing. These businesses produce a broad variety of military hardware, such as sophisticated electronics, aircraft, missiles, and naval systems. The biggest defense procurement organization in the world is the Department of Defense (DoD) in the United States. Defense companies both domestically and internationally benefit greatly from the contracts it awards for defense systems and technology development. There are a lot of military bases and installations in the United States. These bases provide chances for technology development and testing in addition to acting as important operational centers for the US military.

Growing urbanization and rising incomes are expected to fuel a significant increase in the demand for commercial aircraft in the APAC region in the upcoming years. Over the next 20 years, the International Air Transport Association (IATA) projects that passenger traffic in the Asia-Pacific area will increase by an average of 5.4% annually. It is anticipated that this expansion will result in a high demand for new aircraft and associated services.

Geopolitical tensions and other threats are causing the APAC region's defense spending to rise quickly. Defense spending in the Asia-Pacific region is expected to rise by 4.9% in real terms in 2022, according to estimates from the Stockholm International Peace Research Institute (SIPRI). In the Asia-Pacific area, space is becoming more and more significant for both military and commercial reasons. To keep up with this growing demand, several APAC nations are investing in new launch vehicles and satellites. For instance, India is creating its own reusable launch vehicle, and China is building its own space station.

Growing usage of digital technologies: In the APAC area, the A&D sector is changing as a result of the usage of digital technologies. For instance, A&D businesses are employing artificial intelligence (AI) to enhance maintenance and repair processes and 3D printing to produce new aircraft components.

| Report Attributes | Details |

| Market Size in 2023 | US$ 899.72 Bn |

| Market Size by 2031 | US$ 1417.87 Bn |

| CAGR | CAGR of 5.85 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

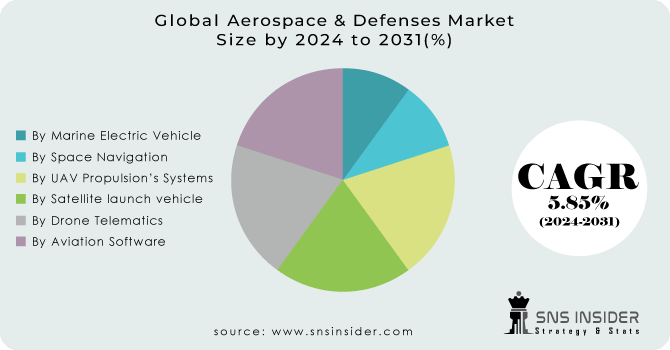

| Key Segments | • By Marine Electric Vehicle • By Space Navigation • By UAV Propulsion’s Systems • By Satellite launch vehicle • By Drone Telematics • By Aviation Software |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | The key players have been mentioned in the table of content according to several markets. |

| The A&D sector is always changing as a result of the quick development of new technology. The necessity to create new and more sophisticated spacecraft, planes, and military systems is what motivates this innovation. | |

| Market Restraints | The complexity of aircraft and defense systems, as well as the rising cost of raw materials, are some of the factors driving up the costs of developing and manufacturing A&D products. This is straining A&D companies' profit margins. |