Aircraft Fuel Cells Market Report Scope & Overview:

To get more information on Aircraft Fuel Cells Market - Request Free Sample Report

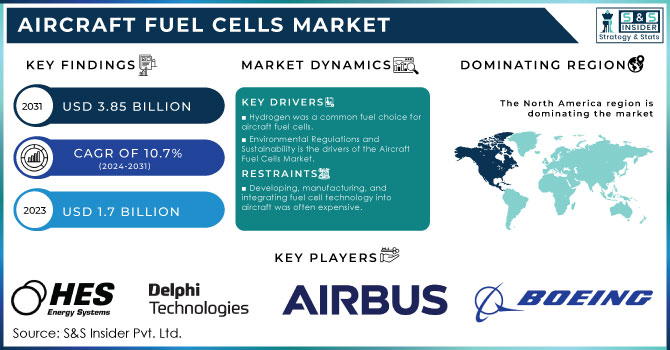

The Aircraft Fuel Cells Market size was valued at USD 1.7 Billion in 2023 & is estimated to reach USD 3.85 Billion by 2031 and increase at a compound annual growth rate (CAGR) of 10.7% between 2024 and 2031.

Aircraft fuel cells have gained attention as a potential solution for improving aircraft efficiency and reducing environmental impact. Fuel cells offer advantages such as increased fuel efficiency, reduced emissions, and potential weight savings compared to traditional combustion engines. As concerns over environmental regulations and fuel efficiency grew, the aircraft industry started exploring alternative power sources, including fuel cells.

There are different types of fuel cells that have been considered for aircraft applications, including proton exchange membrane fuel cells (PEMFCs) and solid oxide fuel cells (SOFCs). PEMFCs are lightweight and have fast start-up times, making them suitable for aviation applications. SOFCs are known for their high operating temperature and potential for high efficiency. While aircraft fuel cells show promise, there are several challenges that need to be addressed. These include developing lightweight and compact fuel cell systems, ensuring efficient hydrogen storage and distribution, dealing with safety concerns, and developing infrastructure for refuelling hydrogen-powered aircraft.

Aircraft fuel cells have been primarily considered for auxiliary power units (APUs) and range extenders in hybrid-electric or all-electric aircraft. APUs provide power for various functions when the main engines are not running, such as ground operations and emergency backup. Range extenders are used to generate additional power to extend the flying range of electric aircraft. The adoption of fuel cells in aviation was expected to be a gradual process, with hybrid-electric and all-electric aircraft likely to be among the first beneficiaries. As technology advances and regulatory pressures increase, fuel cells could play a more significant role in reducing the aviation industry's carbon footprint.

Conventional Unmanned Aerial Vehicles (UAVs) are driven on petrol or jet fuel. Petrol and kerosene are nonrenewable commodities that are rapidly diminishing over the world. The constant usage of such nonrenewable energy sources depletes them. These fuels are becoming more costly due to increased demand and limited availability. Because of the depletion of fossil resources, experts are investigating alternate fuel sources to power UAVs.

Hydrogen fuel cells have just emerged as a potential alternative fuel to replace Li-ion batteries in mid- to large-size drones, and their efficiency in terms of weight/power ratios is constantly growing. Because of their increased reliability compared to small internal combustion engines, they provide an appealing value for unmanned aerial vehicles, resulting in safe and low maintenance operations.

MARKET DYNAMICS

DRIVERS:

-

Hydrogen was a common fuel choice for aircraft fuel cells.

-

Environmental Regulations and Sustainability is the drivers of the Aircraft Fuel Cells Market.

Increasingly stringent regulations on emissions and environmental concerns were driving the aviation industry to seek cleaner and more sustainable alternatives to traditional fossil fuels. Aircraft fuel cells presented a promising solution due to their potential to reduce greenhouse gas emissions and other pollutants.

RESTRAIN:

-

Developing, manufacturing, and integrating fuel cell technology into aircraft was often expensive.

-

Hydrogen Infrastructure and Supply are restraints of the Aircraft Fuel Cells Market.

Hydrogen is a common fuel choice for aircraft fuel cells, but the infrastructure for producing, storing, and distributing hydrogen was limited in many parts of the world. The lack of a robust hydrogen supply chain hindered the widespread adoption of hydrogen-powered fuel cells.

OPPORTUNITY:

-

Developing regions with growing aviation sectors presented opportunities for the adoption of fuel cells.

-

Environmental Concerns & Emissions Reduction is the opportunity of the Aircraft Fuel Cells Market.

The global push to reduce carbon emissions and combat climate change presented a significant opportunity for aircraft fuel cells. Airlines and aviation companies seeking to meet stringent emissions regulations and demonstrate their commitment to sustainability could adopt fuel cell technology to lower their environmental impact.

CHALLENGES:

-

Developing, manufacturing, and integrating fuel cell technology into aircraft was often expensive.

-

Hydrogen Infrastructure is the challenge of the Aircraft Fuel Cells Market.

Hydrogen is a common fuel choice for aircraft fuel cells, but the infrastructure for producing, storing, and distributing hydrogen was limited and expensive to develop. The lack of a comprehensive hydrogen infrastructure hindered the widespread adoption of hydrogen-powered fuel cells in aviation.

IMPACT OF RUSSIAN UKRAINE WAR

The impact on aviation is minor in comparison to the emerging humanitarian crisis, despite the fact that the business promotes peace and freedom by bringing people together, and its ramifications must be analysed and handled. As of 2021, the Ukrainian airspace is restricted, halting around 3.45% of all aviation passenger travel in Europe and 1.2% of total traffic globally. Belarus has banned planes over sections of its country, while Moldova has completely closed its airspace. These two nations have small regional and worldwide air passenger traffic shares. Oil prices have been influenced by Russia's invasion of Ukraine. This will have a significant influence on the aviation industry, as fuel prices are a big factor in airline operational expenses. Rising fuel costs will have an impact on airline profitability. The impact of the Ukraine-Russian war on the aircraft fuel cells market increases their prices by 3.23-4.5%.

IMPACT OF ONGOING RECESSION

Transport economics in general, and air transport in particular, may be thought of as the economic activity's laboratory. The derivative nature of transportation is clear. Growth in economic activity, industrial output, and trade ties will unavoidably result in an increase in the need for transportation. A decrease in the same characteristics will result in a drop in transportation demand. Based on the United States DOE's Hydrogen Analysis (H2A) case studies, a National Renewable Energy Laboratory (NREL) report estimates the capital expenditure necessary for an onsite electrolysis refuelling station in 2025 (Melaina & Penev, 2013). After deducting the cost of hydrogen generation, the needed capital expenditure is $1,625 per kilogramme per day (in 2007 USD). For a 2,000 kg/day refuelling station in 2025, this amounts to a total capital investment of $4,175,000 in 2020 USD. This estimate assumes a factor of 1.90 increase in absolute capital cost to allow for a 10% cost decrease owing to economies of scale when extrapolated to a 2,000 kg/day refilling station. To calculate the cost of a fuelling station between 2020 and 2025.

KEY MARKET SEGMENTATION

By Fuel Type

-

Hydrocarbon

-

Hydrogen

-

Others

By Power Output

-

100 kW- 1MW

-

0-100kW

-

1MW

-

Above

By Aircraft Type

-

Rotary Wing

-

Fixed-Wing

-

AAMs

-

UAVs

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

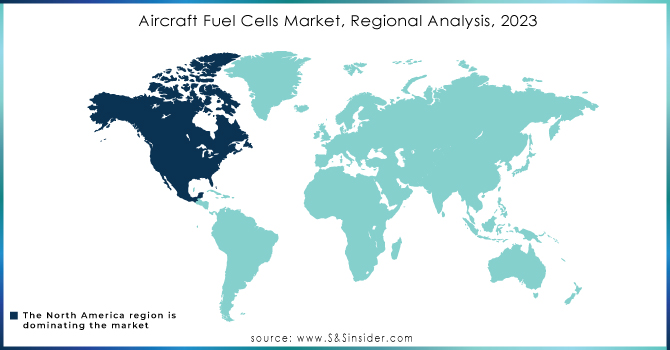

REGIONAL ANALYSIS

North America: The United States has a large border; surveillance measures are required to guarantee national security. This has resulted in a surge in demand for fuel-cell-powered unmanned aerial vehicles (UAVs) with greater endurance capabilities to meet the operational capabilities of US border patrol personnel. Furthermore, the domestic UAV fuel cell industry of the region benefits from a large deployment of unmanned aerial vehicles in military and tactical defence applications. A large chunk of the market for fuel cell UAVs is driven by their inherent longer endurance, which makes them ideal for a variety of tasks such as surveillance and real-time data transfer.

Asia Pacific: Due to a variety of factors that support the area's growth potential, Asia Pacific is expected to be the fastest-growing region in the aeroplane fuel cell market during the forecast period. Significant economic growth in the region has resulted in increased air travel demand and a growing commercial aviation sector. The growing emphasis on environmentally friendly aviation practises, as well as the rise of urban air mobility and innovative air mobility solutions, will increase demand for aircraft fuel cells.

Need any customization research on Aircraft Fuel Cells Market - Enquiry Now

KEY PLAYERS

The Major Players are HES Energy Systems Pte. Ltd., Delphi Technologies, Airbus Americas Inc, Hydrogenics Corporation, Boeing Company, SerEnergy A/S., EnergyOR Technologies Inc., Nuvera Fuel Cells LLC, Ballard Power Systems Inc., IAI Group and other players.

RECENT DEVELOPMENT

Airbus: The famed French aircraft firm, has announced plans to create a hydrogen-powered fuel cell engine and undergo extensive testing. The engine will be mounted between the aircraft's wings and tail in a modified A380 superjumbo. This important step is part of Airbus' ambitious ZEROe effort, which aims to introduce a zero-emission aeroplane by 2035. The first test flights for this hydrogen-powered engine are scheduled for 2026.

PowerCell: A premier fuel cell technology business, has reached a watershed moment by inking a historic agreement with ZeroAvia, a pioneering zero-emission aircraft company. This is the first contract in the world for the serial delivery of hydrogen fuel stacks to the aviation industry. The arrangement, worth up to SEK 1.51 billion, is conditional on ZeroAvia acquiring the required certifications and includes the supply of 5,000 hydrogen fuel cell stacks. The deliveries are set to begin in 2024. ZeroAvia, which specialises in hydrogen-electric aviation systems, plans to debut a 19-seat aircraft with a range of 300 miles by 2025.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.7 Billion |

| Market Size by 2031 | US$ 3.85 Billion |

| CAGR | CAGR of 10.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fuel Type (Hydrocarbon, Hydrogen, Others) • By Power Output (100 kW- 1MW, 0-100kW, 1MW & Above) • By Aircraft Type (Rotary Wing, Fixed-Wing, AAMs, UAVs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HES Energy Systems Pte. Ltd., Delphi Technologies, Airbus Americas Inc, Hydrogenics Corporation, Boeing Company, SerEnergy A/S., EnergyOR Technologies Inc., Nuvera Fuel Cells LLC, Ballard Power Systems Inc., IAI Group |

| Key Drivers | • Hydrogen was a common fuel choice for aircraft fuel cells. • Environmental Regulations and Sustainability is the drivers of the Aircraft Fuel Cells Market. |

| Market Challenges | • Developing, manufacturing, and integrating fuel cell technology into aircraft was often expensive. • Hydrogen Infrastructure is the challenge of the Aircraft Fuel Cells Market. |