Solid oxide fuel cell for CHP application market Report Scope & Overview:

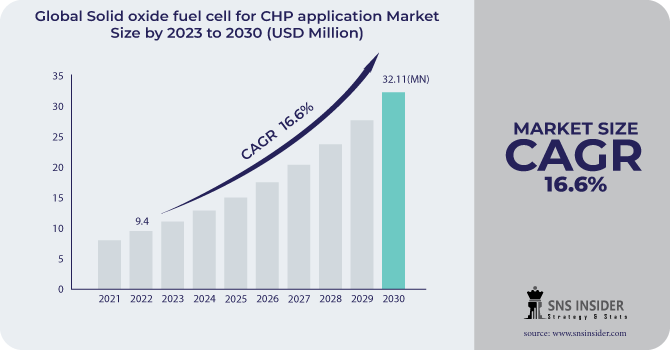

The Solid oxide fuel cell for CHP application market size was valued at USD 10.97 Million in 2023 and is expected to grow to USD 38.04 Million by 2031 and grow at a CAGR of 16.8% over the forecast period of 2024-2031.

It is possible to define a solid oxide fuel cell (SOFC) as a machine that produces energy by oxidising a fuel electrochemically. Their electrolyte composition distinguishes different types of fuel cells. In SOFCs, negative oxygen ions are transported from the cathode to the anode using a solid oxide electrolyte. The CHP of these fuel cells is high efficiency, increased stability, reduced emissions, and fuel adaptability. SOFCs are comparatively economical. In contrast to other devices, these ones often function at greater temperatures and don't require pricey platinum catalyst materials.

Get more information on Solid Oxide Fuel Cell for CHP Application Market - Request Sample Report

An electrochemical cell that turns fuel into electricity is a fuel cell. The anode and cathode electrodes are included in every fuel cell. That aid in power production. The cathode of a solid oxide fuel cell (SOFC) converts oxygen atoms into oxygen ions.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing demand of clean source of energy to reduce carbon emission

-

Growing demand for reducing dependency on Conventional Fuels for Power Generation

Burning fossil fuels produces damaging greenhouse gases that cause a variety of concerns, including ocean acidification, global warming, and other serious problems. Governments and other private organisations have so intensified their efforts in the EU to reduce carbon footprint and limit other hazardous emissions. Hydrogen Fuel Cell, which is widely available and serves as the principal fuel for solid oxide fuel cells, reduces their reliance on fossil fuels. Additionally, it does not produce harmful pollutants like CO, CO2, SOx, NOx, and other substances released by traditional fuels, which encourages the widespread use of fuel cells. Fuel Cells and Hydrogen Joint Undertaking, a private-public European research and development effort

RESTRAIN:

-

Other Fuel Cell Technologies' Predominance Will Limit Market Growth

The rise of solid oxide fuel cell devices may be hampered by the availability of other fuel cell solutions, which also have certain advantages. For instance, the Proton-Exchange Membrane Fuel Cell (PEMFC) is favoured for stationary and mobile applications because to its advantages of low operating temperatures, the elimination of electrode corrosion due to the absence of liquid electrolyte, high efficiency, and rapid startup times.

OPPORTUNITY:

-

Commitment to carbon neutrality to fuel Europe SOFC market

Europe's SOFC market will be fuelled by commitment to carbon neutrality. Leading SOFC manufacturers, research organisations, and creative startups that are pushing technical developments and renewable energy generation.

CHALLENGES:

-

Growing focus towards sustainable transportation

-

Adoption of alternative fuel

IMPACT OF RUSSIAN-UKRAINE WAR

The conflict between Russia and Ukraine has heightened geopolitical tensions. Any interruption in the energy supply might affect the market for alternative energy sources like SOFCs because Ukraine is an important transit nation for natural gas pipelines from Russia to Europe. Decentralised energy generation may attract more attention as people become more concerned about energy security, which might be advantageous for the SOFC industry. The conflict may hasten attempts at energy transition and decentralisation in the neighbouring nations of Ukraine. Governments and energy stakeholders could be encouraged to diversify their energy mix and lessen reliance on Russian energy supplies. This change may open up new possibilities for SOFCs as a more environmentally friendly and long-lasting CHP technology.

KEY MARKET SEGMENTATION

By Application

- Residential

-

Commercial

-

Industrial

Get Customized Report as per your Business Requirement - Request For Customized Report

SEGMENTAL ANALYSIS

Data on the Solid Oxide Fuel Cell Market has been divided into Combined Heat and Power applications based on application. the force category led the market in 2021 and is anticipated to expand at the fastest rate from 2022 to 2030. Rising need for the creation of renewable energy is predicted to drive the industry. Power generation for home, industrial, and commercial applications such data centres, telecom towers, retail establishments, and residential communities includes distributed power storage as well as remote and backup power alternatives.

Another profitable market for SOFC-based CHPs in Europe is the business sector. Due to expanding public awareness of the need of an emission-free environment and the widespread use of hydrogen, there is an increase in the demand for commercial CHP systems. The market is divided into residential, industrial, and commercial segments based on application. Due to the widespread deployment of fuel cell-based CHPs for residential applications for space heating, water heating, and numerous other functions, the residential sector leads the Europe solid oxide fuel cell for CHP application market by 67%.

REGIONAL ANALYSIS

In Europe, Germany holds a substantial market share. Numerous programmes, including PACE, KAW 433, and others, have greatly increased the demand for and usage of these systems. The government offers national subsidies that complement PACE incentives. KfW 433 has grown to be crucial for fuel cell-based micro-CHPs since the majority of Europe's fuel cell inventors are either headquartered in Germany or have a presence there.

The installation of solid oxide fuel cells for CHP applications is a lucrative business in the United Kingdom. As the emphasis on hydrogen grows, such systems are being adopted more and more quickly across the nation. Bosch and Ceres, located in the UK, have reached an agreement allowing the latter to exploit Steel Cell SOFC technology for commercial-scale applications. With growing concerns and government efforts to promote hydrogen fuel the market for SOFC for CHP applications are expanding.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

RECENT DEVELOPMENTS

-

Doosan Fuel Cell Co., Ltd. established a partnership with KIER (Korea Institute of Energy Research), Samsung, C&qT, and KOSPO (Korea Southern Power) in June 2022. These businesses have a memorandum of understanding (MOU) that covers their cooperation on initiatives relating to ammonia research and CCU technology for fuel cells.

-

In April 2022, SFC Energy AG and its partner FC TecNrgy Pvt Ltd inked the "Make in India" agreement. According to the deal, all of the parts for its EFOY Methanol fuel cells, hydrogen, and energy solutions would be manufactured in India.

-

In February 2022, Ceres Power Holdings Plc announced a partnership between China's Weichai Power and Robert Bosch GmbH for the development and production of solid oxide fuel cells for the Chinese market. These three businesses are working together on this.

-

A joint venture to create a fully integrated LOHC- SOFC (Liquid Organic Hydrogen Carrier based SOFC) power system was signed in March 2023 by Alma Clean Power, Hydrogenious LOHC Technologies, and Hydrogenious LOHC Maritime. This collaboration seeks to develop a 100kW pilot powertrain for the "HyNjord" project, which is sponsored by Enova and located aboard the Edda Ferd, an offshore supply vessel run by stensjo Rederi.

KEY PLAYERS

The Major Players are Ballard Power Systems, Nedstack Fuel Cell Technology, Bloom Energy, Doosan Fuel Cell Americ Inc., Hydrogenics, Ceres Power, Plug Power, Nuvera Fuel Cells, LLC, FuelCell Energy, SFS Energy AG and other players

Bloom Energy (U.S.)-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.97 Mn |

| Market Size by 2031 | US$ 38.04 Mn |

| CAGR | CAGR of 16.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Ballard Power Systems (Canada), Nedstack Fuel Cell Technology (Netherlands), Bloom Energy (U.S.), Doosan Fuel Cell Americ Inc. (U.S.), Hydrogenics (Canada), Ceres Power (U.K.), Plug Power (U.S.), Nuvera Fuel Cells, LLC (U.S.), FuelCell Energy (U.S.), SFS Energy AG (Germany) |

| Key Drivers | • Increasing demand of clean source of energy to reduce carbon emission • Growing demand for reducing dependency on Conventional Fuels for Power Generation |

| Market Restraints | • Other Fuel Cell Technologies' Predominance Will Limit Market Growth |