Aircraft Heat Exchanger Market Report Scope & Overview:

To get more information on Aircraft Heat Exchanger Market - Request Free Sample Report

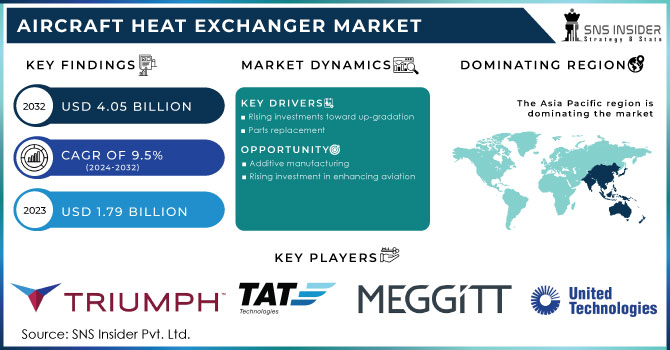

The Aircraft Heat Exchanger Market was valued at US$ 1.79 billion in 2023 and is expected to reach USD 4.05 billion by 2032 and grow at a CAGR of 9.5% over the forecast period 2024-2032.

The increasing fleet of commercial and combat aircrafts, as well as military spending by various countries, are driving the expansion of the aircraft heat exchanger market. Heat exchangers are vital components in mission-critical aviation and other aerospace applications. They are critical to the optimal performance of jet engines, the proper operation of aircraft electronics, and the capacity of a satellite to execute a variety of tasks without overheating. Rising energy consumption in the petrochemical, oil and gas, and power industries, as well as increased investments in upgrading existing aviation, space, and energy infrastructure, has spurred the demand for heat transfer equipment.

MARKET DYNAMICS

KEY DRIVERS

-

Rising investments toward up-gradation

-

Parts replacement

OPPORTUNITIES

-

Rising investment in enhancing aviation

CHALLENGES

-

Heat exchanger fouling

-

Anti-de-icing and Rain dispersion

THE IMPACT OF COVID-19

COVID-19 is an unprecedented public health crisis that has affected almost every business, and the long-term impact is expected to have an impact on industry growth during forecasting. The study provides information on COVID-19 by considering changes in consumer behavior and demand, purchasing patterns, supply chain reorganization, modern market forces, and major government initiatives. The revised study contains data analysis, estimates, and predictions based on the COVID-19 market impact.

Manufacturers of aircraft heat exchangers are forced to suspend production due to a government-imposed suspension to monitor the distribution of COVID-19 worldwide. Aircraft manufacturers are facing operational problems due to supply disruptions caused by transport restrictions following the collapse of COVID-19. Aircraft maintenance, repair, and repair services are being damaged due to a shortage of immature materials and essential components as a result of government efforts to combat COVID-19. The R&D of heat exchangers on aircraft, especially for military purposes, has stalled due to staff shortages caused by government-imposed closures during COVID-19.

by Type

There are primarily two types of heat exchangers used in aircraft based on design: plate and fin and flat tube. Flat tube aircraft heat exchangers are predicted to have a higher CAGR during the forecast period than plate and fin aircraft heat exchangers. In addition, a flat tube heat exchanger would power the replacement or aftermarket.

by Vendor

The aviation heat exchanger market has been divided into OEM and aftermarket segments. Maintenance, repair, upgrading, and replacement of aviation heat exchanger components and systems are all part of the aftermarket industry. Due to significant spending on improved avionics systems and replacement of overused thermal management components and systems, the aftermarket vendor sub-segment is likely to lead the aviation heat exchanger market. However, increased aircraft deliveries and domestic aircraft manufacturing will drive the expansion of the OEM segment.

by Application

The electronic pod cooling segment generated significant revenue in 2022 and is expected to rise in prominence during the forecast period. Heat exchangers, which are installed inside the gasoline tank, are used to reduce the temperature of hydraulic fluid. Electronic Pod cooling refers to the cooling of electronic devices such as IC packages, chips, and a variety of other hermetically packaged devices. With increased automation demand, more electronics packages must be packed in smaller and tighter spaces, which is expected to drive up demand for electronic pod cooling during the forecast period.

by Platform

The aircraft heat exchanger market is divided into rotary-wing aircraft, fixed-wing aircraft, and UAV’s. Aircraft heat exchangers vary in application and configuration among aircraft types. They are further divided into narrow-body aircraft, broad body aircraft, very large body aircraft, and business jets. Rising demand for narrow-body commercial aircrafts and increased connectivity across regions are factors positively impacting the aircraft heat exchanger market in this area.

COMPETITIVE LANDSCAPE

The Competition Strategic Window investigates the competitive landscape in terms of markets, applications, and geographies to help suppliers define an alignment or fit between their capabilities and future growth prospects. It describes the greatest or most advantageous fit for vendors to pursue successive merger and acquisition tactics, regional expansion, R&D, and new product launch methods in order to execute future business expansion and growth throughout a projected time period.

KEY MARKET SEGMENTATION

By Type

-

Plate-Fin

-

Flat Tube

By Vendor

-

OEM

-

Aftermarket

By Application

-

Environmental Control System

-

Engine System

-

Electronic Pod Cooling

-

Hydraulics

By Platform

-

Fixed-Wing Aircraft

-

Rotary-Wing Aircraft

-

UAV

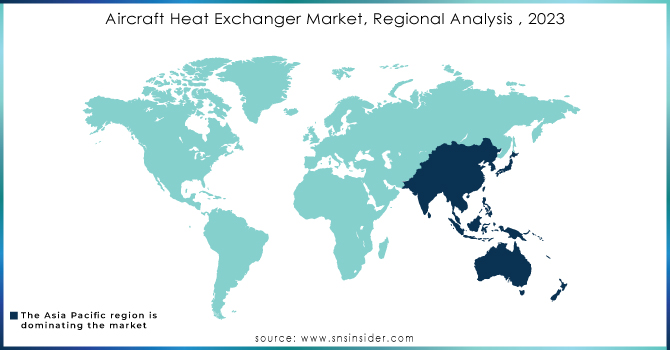

REGIONAL ANALYSIS:

Asia Pacific is one of the few emerging markets heat exchangers in terms of research and development activities, shipping, and the presence of some of the key market players. The major countries under this region are Japan, India and China. Drivers of Japan's aerospace heat exchange market include the need to improve Japan Self-Defense Forces, including the Japan Air Self-Defense Force, Japan Ground Self-Defense Force, and the escalation. the need for a better heat management system for commercial aircraft. A growing government focus on military and defense will improve the market in India. China is one of the fastest growing economies in the world. The country is expected to increase its military spending on aviation systems, including aircraft heat exchangers, as well as modern military equipment to stay technologically advanced in the defense sector. Domestic airlines in China are increasingly involved in contracts with aftermarket service providers to improve the performance of their aircraft. Also, features such as cheap and highly skilled workers in the aircraft heat exchangers are expanding the market in the Asia Pacific region.

Need any customization research on Aircraft Heat Exchanger Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Lytron, Meggitt, TAT Technologies, Triumph Group, United Technologies, Wall Colmonoy, Boyd Corporation, Eaton, Honeywell International, Jamco, Liebherr-International, Woodward, Aavid Thermalloy, Airmark Components, Ametek & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.79 Billion |

| Market Size by 2032 | US$ 4.05 Billion |

| CAGR | CAGR of 9.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Plate-Fin, Flat Tube) • By Vendor (OEM, Aftermarket) • By Application (Environmental Control System and Engine System, Electronic Pod Cooling, Hydraulics) • By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, and UAVS) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lytron, Meggitt, TAT Technologies, Triumph Group, United Technologies, Wall Colmonoy, Boyd Corporation, Eaton, Honeywell International, Jamco, Liebherr-International, Woodward, Aavid Thermalloy, Airmark Components, Ametek. |

| DRIVERS | • Rising investments toward up-gradation • Parts replacement |

| OPPORTUNITIES | • Additive manufacturing • Rising investment in enhancing aviation |