Aircraft Transparencies Market Report Scope & Overview:

To get more information on Aircraft Transparencies Market - Request Free Sample Report

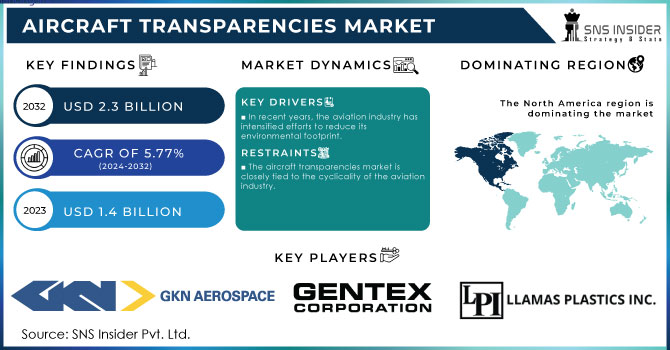

The Aircraft Transparencies Market size was valued at USD 1.4 Billion in 2023 & is estimated to reach USD 2.3 Billion by 2032 with a growing CAGR of 5.77% Over the Forecast period of 2024-2032.

Aircraft transparencies, which include windows, windshields, and canopies made from various materials like glass and advanced composites, are essential components of any aircraft. They play a crucial role in providing visibility to pilots, protecting the cabin from external elements, and maintaining structural integrity.

Market Size and Growth The aircraft transparencies market has historically been influenced by factors like the growth of the commercial aviation sector, military aviation developments, and advancements in materials and technologies. The market tends to experience moderate growth in line with the overall aerospace industry.

The market can be segmented into different categories based on factors such as transparency type, aircraft type, material type, and application. The commercial aviation sector, including passenger and cargo aircraft, represents a significant portion of the market. Demand for high-quality transparencies for passenger comfort and safety remains a driving factor.

Military aircraft, including fighters, transport planes, and helicopters, require specialized transparencies that offer features like ballistic resistance and stealth capabilities. Ongoing research and development in materials science have led to the emergence of advanced composite materials that are lighter, stronger, and more durable than traditional materials. These innovations are driving the market towards higher-performance transparencies.

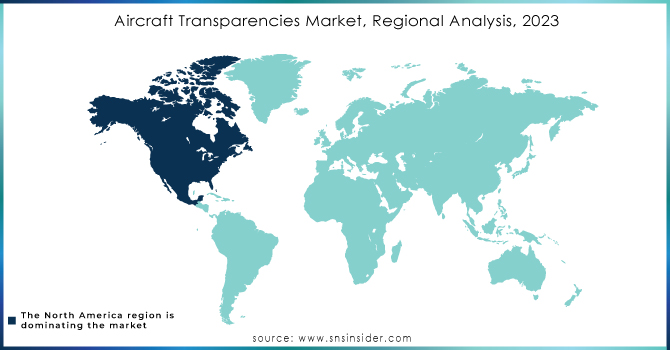

Maintenance, Repair, and Overhaul the MRO segment of the aircraft transparencies market is crucial, as ageing aircraft fleets require replacements and upgrades of their transparencies. This segment offers steady revenue for companies specializing in transparency maintenance and replacement. The demand for aircraft transparencies varies across regions, with North America, Europe, and Asia-Pacific being major markets due to their substantial aerospace industries.

Stringent safety and quality standards set by aviation regulatory authorities influence the market by ensuring that transparencies meet strict safety and performance requirements. The market is competitive, with several established players and a few key suppliers dominating the industry. Companies often compete based on product quality, innovation, and customer relationships. The aircraft transparencies market faces challenges related to cost pressures, environmental concerns, and the need to continually develop materials that can withstand extreme conditions while maintaining clarity.

MARKET DYNAMICS

DRIVERS:

-

In recent years, the aviation industry has intensified efforts to reduce its environmental footprint.

-

Aircraft Production and Fleet Expansion is the driver of the Aircraft Transparencies Market.

The overall growth in the aviation industry, particularly the production of new aircraft and the expansion of commercial and military aircraft fleets is a significant driver for the aircraft transparencies market. As airlines and defense forces acquire new aircraft, they require a corresponding number of high-quality transparencies for windows, windshields, and canopies.

RESTRAIN:

-

The aircraft transparencies market is closely tied to the cyclicality of the aviation industry.

-

High Development and Certification Costs is the restraint of the Aircraft Transparencies Market.

Developing and certifying aircraft transparencies, especially those for commercial aircraft, can be a costly and time-consuming process. Manufacturers must invest heavily in research, development, and testing to meet stringent aviation safety and quality standards.

OPPORTUNITY:

-

The aircraft transparencies market is closely tied to the cyclicality of the aviation industry.

-

High Development and Certification Costs are an opportunity for the Aircraft Transparencies Market.

Developing and certifying aircraft transparencies, especially those for commercial aircraft, can be a costly and time-consuming process. Manufacturers must invest heavily in research, development, and testing to meet stringent aviation safety and quality standards.

CHALLENGES:

-

While technological advancements can drive innovation, they also pose challenges.

-

Global Supply Chain Complexities are a challenge to the Aircraft Transparencies Market.

The aircraft transparencies market relies on a complex global supply chain for raw materials, components, and manufacturing processes. Supply chain disruptions, such as shortages or geopolitical tensions, can impact production timelines and costs.

IMPACT OF RUSSIA-UKRAINE WAR

The conflict between Russia and Ukraine has had an impact on oil prices. With fuel prices being so important to the aviation industry, they will have a significant impact on the sector's operational costs. A Well-designed Russia-Ukraine War Impact on the Aviation Industry. This PowerPoint presentation examines the impact of Russia's invasion of Ukraine on the global aviation industry. This lecture focuses on Ukraine, Russia, and the global aviation business. It also displays revenue generated by the global aviation sector before the conflict, as well as aviation industry forecasts prior to the invasion.

It also shows the financial impact of the continuous invasion of aircraft. Finally, it depicts the recovery of the aviation sector in various scenarios and techniques that aviation firms might use to recover from conflict. In this conflict, the Aircraft Transparencies Market is gaining profit 4-5% in upcoming years.

IMPACT OF ONGOING RECESSION

Although the global economy is on track for modest growth in 2022, there is a growing likelihood of a recession that could reduce cross-border trade in the following year. The Global Air Transport Affiliation, as of late doled out a 20% gamble to a downturn soon.

2022 could be somewhat of a perfect balance where individuals couldn't care less about the expansion and they have such a compelling impulse to return to some similarity to ordinariness as far as movement and spending, from that point forward, taking off costs on labour and products could drive buyers to pull back. Specialists are foreseeing monetary development of 3.3% to 3.8% this year, down from 6.1% in 2021, with the conflict in Europe shaving a point from projected Gross domestic product.

KEY MARKET SEGMENTATION

By Material

-

Acrylic

-

Polycarbonate

-

Glass

By Aircraft Type

-

Commercial Aviation

-

Military Aviation

-

Business & General Aviation

-

Advanced Air Mobility

By Application

-

Windows

-

Chin Bubbles

-

Cabin Interiors (Separators)

-

Windshields

-

Landing Lights & Wingtip Lenses

-

Skylights

-

Canopies

By End-use

-

Aftermarket

-

OEM

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

North America: The aircraft Transparencies market is segmented into North America, which was valued at a significant growth rate and is expected to maintain its position in terms of revenue over the forecast period due to increasing aviation activities in the region, a major manufacturing hub for aircraft, the presence of key manufacturers in this region, technological advancement, and an increase in aircraft orders and supplies, which is encouraging manufacturers of aircraft transparencies to increase the production of aircraft transparencies. The United States leads the regional market and is likely to be the fastest expanding market in terms of growth and volume due to the presence of significant key manufacturers operating in the market, such as PG Industries, which are expected to enhance market growth in the future years.

Asia Pacific: During the anticipated period, the Asia Pacific region is expected to emerge as the dominant sector in the aircraft transparencies market. Rapid economic growth in the region, increased air travel, and the expansion of the aviation industry are driving demand for new aircraft and upgrading current fleets. Furthermore, the presence of major aircraft manufacturers and suppliers in countries such as India, China, and Japan helps regional market growth. The Asia Pacific region has considerable growth prospects for aeroplane transparency, making it a critical focal area for industry participants.

Need any customization research on Aircraft Transparencies Market - Enquiry Now

Key Players

The Major Players are are GKN Aerospace, Gentex Corporation, PPG Industries, Inc., Llamas Plastics, Inc., Saint-Gobain Aerospace, Lee Aerospace, The NORDAM Group LLO, Control Logistics Inc., Mecaplex, Spartech LLC and other players.

RECENT DEVELOPMENT

In 2023: KN Aerospace is expanding its Chihuahua, Mexico factory by 80,000 square feet to accommodate future demand for advanced, complicated composite fabrication and assembly for the business jet industry. The expansion is scheduled to be finished in 2023.

In 2021: Dassault Aviation, a French aircraft manufacturer, has chosen PG Industries to supply coatings for the Falcon 6X business jet. PG Industries will provide external and interior paint finishes for the aircraft.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.4 Billion |

| Market Size by 2032 | US$ 2.3 Billion |

| CAGR | CAGR of 5.77 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Acrylic, Polycarbonate, Glass) • By Aircraft Type (Commercial Aviation, Military Aviation, Business & General Aviation, Advanced Air Mobility) • By Application (Windows, Chin Bubbles, Cabin Interiors (Separators), Windshields, Landing Lights & Wingtip Lenses, Skylights, Canopies) • By End-use (Aftermarket, OEM) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GN Aerospace, Gentex Corporation, PPG Industries, Inc., Llamas Plastics, Inc., Saint-Gobain Aerospace, Lee Aerospace, The NORDAM Group LLO, Control Logistics Inc., Mecaplex, Spartech LLC |

| Key Drivers | • In recent years, the aviation industry has intensified efforts to reduce its environmental footprint. • Aircraft Production and Fleet Expansion is the driver of the Aircraft Transparencies Market. |

| Market Restrain | • The aircraft transparencies market is closely tied to the cyclicality of the aviation industry. • High Development and Certification Costs is the restraint of the Aircraft Transparencies Market. |