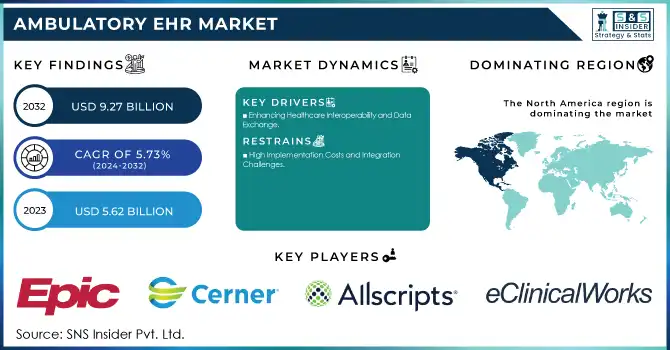

Ambulatory EHR Market Size & Growth:

The Ambulatory EHR Market size was valued at USD 5.62 billion in 2023 and is expected to reach USD 9.27 billion by 2032, growing at a CAGR of 5.73%. over the forecast period 2024-2032.

The ambulatory EHR market shows considerable growth, driven by ongoing technological advancements, regulatory incentives, and the push for improved patient data management in outpatient care settings. In 2021, approximately 89.9% of the office-based physicians in the U.S. had adopted certified EHR systems, which has been a significant increase from 71.8% in 2015. This growth showcases the dedication of healthcare industry to use digital solutions for improving care coordination and patient outcomes. According to a recent data, the use of EHRs continues to grow, with 75% of physicians reporting that they are actively using EHRs for decision support and clinical documentation.

Get more information on Ambulatory EHR Market - Request Sample Report

The COVID-19 pandemic further propelled the ambulatory EHR systems’ adoption, mainly in conjunction with telehealth services. During the COVID-19 pandemic, the shift to remote care has raised the demand for virtual health solutions, and 60% of the U.S. healthcare visits were conducted through telehealth in 2020. This growth has mandated the integration of EHR systems with telehealth platforms, leading to a surge in the use of features including clinician review, virtual charting, and patient messaging, all of which became important for delivering remote care. Moreover, about 62% of healthcare organizations reported that their EHR systems were integral to provide support to telehealth visits, stressing the systems' adaptability in the face of a rapidly changing healthcare environment globally.

Technological developments, particularly in cloud computing, have also been critical in expanding the EHR market. Cloud-based EHR systems provide significant advantages such as reduced upfront costs, ease of scaling, and remote access to patient data, making these systems more attractive to smaller ambulatory care providers. As per a survey, 45% of small and medium-sized practices prefer cloud-based EHRs due to their lower initial investments and ability to offer flexible payment options. This shift toward cloud computing has further driven the adoption of digital healthcare solutions, improving accessibility and cost-efficiency.

Government initiatives have played a significant role in promoting EHR adoption. For instance, the Medicare and Medicaid EHR Incentive Programs provided over USD 30 billion in incentives to healthcare providers who adopted EHRs in compliance with Meaningful Use standards, ultimately improving quality and safety in healthcare settings. This ongoing support from the government continues to drive the adoption of EHRs across ambulatory care providers.

Key ambulatory EHR industry players including Epic Systems Corporation and Cerner Corporation remain dominant in the ambulatory EHR market, offering solutions tailored to outpatient providers. These companies continue to innovate, with Cerner's collaboration with Amazon Web Services to integrate cloud technologies and Epic's development of new mobile solutions to streamline patient care. These partnerships and innovations have enabled them to maintain their leadership positions and propel advancements in EHR technology.

Ambulatory EHR Market Dynamics:

Drivers:

-

Enhancing Healthcare Interoperability and Data Exchange Propel Market Expansion

A key driver propelling the growth of the ambulatory EHR market is the demand for improved interoperability between healthcare systems. As healthcare evolves, the need for seamless data sharing among providers, specialists, and various healthcare systems becomes crucial to delivering coordinated care. Ambulatory EHR solutions facilitate the smooth transfer of essential patient information, such as medical histories, lab results, and prescriptions, across different platforms. This integration minimizes redundant testing, reduces errors, and ensures patient safety, allowing for better-informed decision-making. By providing healthcare providers with comprehensive and up-to-date patient data, EHR systems play a pivotal role in enhancing collaborative care and improving overall healthcare quality, which is driving the increased adoption of EHR solutions in outpatient settings.

-

Empowering Patient-Centric Care and Decision Support to Drive Market Growth

The shift toward patient-centric care is another significant factor driving the adoption of ambulatory EHR systems. These systems provide healthcare professionals with quick access to detailed patient records, enabling them to make well-informed and personalized treatment decisions. With comprehensive patient information at their fingertips, clinicians can tailor interventions to individual needs, improving the quality of care. EHRs also reduce medical errors and improve diagnostic accuracy by ensuring that all relevant data is available to the physician at the point of care. This focus on providing care that prioritizes the patient's health journey enhances treatment outcomes and underscores the value of adopting EHR technology in ambulatory care settings.

-

Facilitating Value-Based Care and Outcome Improvement to Augment Market Expansion

The ongoing transition to value-based care models has been a significant driving force for the ambulatory EHR market growth. In this model, healthcare providers are incentivized to improve patient outcomes while minimizing costs, emphasizing quality over quantity. EHR systems are essential in supporting this shift, as they enable providers to track important performance metrics, such as patient satisfaction, adherence to treatment plans, and overall health outcomes. By offering insights into patient health trends, EHR solutions allow for improved care management, particularly in chronic disease management and preventive care. This performance-tracking capability enhances care quality and supports higher reimbursement rates, making EHR adoption critical in achieving the goals of value-based care.

Restraints:

-

High Implementation Costs and Integration Challenges May Impede Market Growth

A significant restraint on the growth of the ambulatory EHR market is the substantial upfront investment and complexity involved in the system's implementation. While EHR systems offer long-term advantages, such as better care coordination and increased efficiency, the initial costs covering software, hardware, staff training, and system customization can be burdensome for smaller healthcare practices.

Additionally, integrating new EHR systems with existing infrastructure can be time-consuming and resource-intensive, often leading to disruptions in daily operations during the transition. The learning curve associated with adopting EHR technology also presents challenges, particularly for healthcare staff who may be unfamiliar with digital solutions. This combination of high costs and integration difficulties creates barriers, especially for smaller ambulatory care providers, and limits the pace at which EHR adoption can expand in these settings.

Ambulatory EHR Market Segmentation Insights:

By Delivery Mode

In 2023, the cloud-based delivery mode dominated the ambulatory EHR market, capturing 62.2% of the total market share. The increasing adoption of cloud-based EHR systems is primarily driven by their scalability, cost-effectiveness, and remote accessibility. Cloud solutions significantly reduce the upfront costs for healthcare providers, eliminating the need for extensive IT infrastructure and maintenance. These systems also allow providers to access patient data securely from anywhere, which is crucial for improving care coordination, especially in remote or multi-site healthcare settings.

The shift toward cloud-based platforms has been further propelled by the growing demand for telehealth and virtual care, particularly after the COVID-19 pandemic. Cloud-based EHRs offer greater flexibility, integration with other healthcare technologies, and enhanced data-sharing capabilities, making them highly appealing to small and medium-sized healthcare providers. As the healthcare industry continues to focus on digital transformation, the cloud-based EHR segment is expected to maintain its dominance and experience continued growth.

By Application

Practice management was the leading application in the ambulatory EHR market share of 33.5% in 2023 as practice management solutions are essential in streamlining the operational aspects of healthcare practices, such as scheduling, billing, and patient management. These applications simplify day-to-day administrative tasks, reducing the workload for healthcare providers and improving workflow efficiency. They also enable smoother patient interactions and more effective management of financial operations, which are key to maintaining a successful ambulatory practice. The demand for practice management systems has grown as healthcare practices seek to reduce operational costs and enhance patient care. These solutions integrate seamlessly with EHR systems, improving both clinical and administrative outcomes. Their central role in the operation of outpatient clinics ensures they continue to hold a dominant share of the market.

The fastest-growing application is Population Health Management, driven by the increasing shift toward value-based care and the need to improve health outcomes on a larger scale. These tools help healthcare providers manage entire populations, identify at-risk groups, and deliver targeted interventions to improve health outcomes, making them essential as healthcare focuses more on preventive care and long-term health management. With the growing emphasis on managing chronic conditions and improving healthcare quality, the demand for population health management systems is expected to continue accelerating.

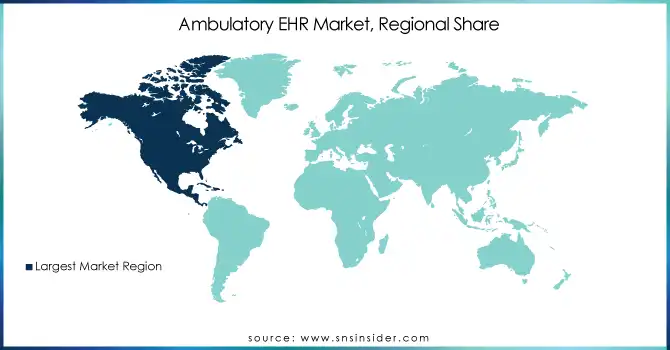

Ambulatory EHR Market Regional Analysis:

North America was the dominant region in the ambulatory EHR market, where adoption rates among healthcare providers have been bolstered by government incentives and regulatory initiatives including the Medicaid and Medicare EHR incentive programs. As of 2021, more than 89% of the office-based physicians in the U.S. had adopted certified EHR systems, a number that is highlighting the strong policy support and technological readiness. The ongoing shift toward value-based care and the rapid adoption of telehealth has further accelerated the use of ambulatory EHR systems in this region.

Europe followed as a significant market, with countries including Germany, the U.K., and France leading in EHR adoption. The European Union's Digital Health Strategy and various national initiatives are propelling digital healthcare solutions, including EHR systems. For instance, in the U.K., the National Health Service (NHS) has focused on improving interoperability across healthcare systems, making EHRs a critical part of the strategy. In addition, European countries are increasingly adopting cloud-based EHR solutions due to their cost-efficiency and flexibility.

Asia Pacific is expected to be the fastest growing region in the market owing to the surging healthcare investments, rising digitalization, and enhanced healthcare access. Countries including Japan, China, and India are highly concentrating on healthcare infrastructure improvements, and adoption of EHR growing rapidly, especially in urban areas. Government initiatives and a rise in healthcare spending by public-sector are key factors behind this growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Ambulatory EHR Market

-

Epic Systems Corporation (U.S.)

-

Cerner Corporation (U.S.)

-

Allscripts Healthcare Solutions, Inc. (U.S.)

-

Medical Information Technology, Inc. (MEDITECH) (U.S.)

-

Computer Programs and Systems, Inc. (CPSI) (U.S.)

-

athenahealth, Inc. (U.S.)

-

NextGen Healthcare, Inc. (U.S.)

-

eClinicalWorks (U.S.)

-

Greenway Health, LLC (U.S.)

-

CureMD Healthcare (U.S.)

-

AdvancedMD, Inc. (U.S.)

Recent Developments in the Ambulatory EHR Market:

-

In Jan 2025, Surgical Information Systems (SIS) ranked #1 in Ambulatory Surgical Center (ASC) IT user satisfaction for the tenth consecutive year, according to a client experience survey of 1,914 physicians, clinicians, and administrative staff. SIS earned top ratings in 12 out of 18 key performance indicators related to outpatient perioperative software solutions.

-

In June 2024, Oracle's new Clinical Digital Assistant, powered by generative AI, integrates with ambulatory clinic EHRs to streamline workflows. This voice-enabled tool aims to reduce physicians' documentation time by up to 40% by minimizing the need for managing drop-down menus and excessive scrolling.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 5.62 Billion |

|

Market Size by 2032 |

USD 9.27 Billion |

|

CAGR |

CAGR of 5.73% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Delivery Mode [On-premise, Cloud-based] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, Inc., Medical Information Technology, Inc. (MEDITECH), Computer Programs and Systems, Inc. (CPSI), athenahealth, Inc., NextGen Healthcare, Inc., eClinicalWorks, Greenway Health, LLC, CureMD Healthcare, and AdvancedMD, Inc. |

|

Key Drivers |

• Enhancing Healthcare Interoperability and Data Exchange |

|

Restraints |

• High Implementation Costs and Integration Challenges |