Medical Mask Market Size:

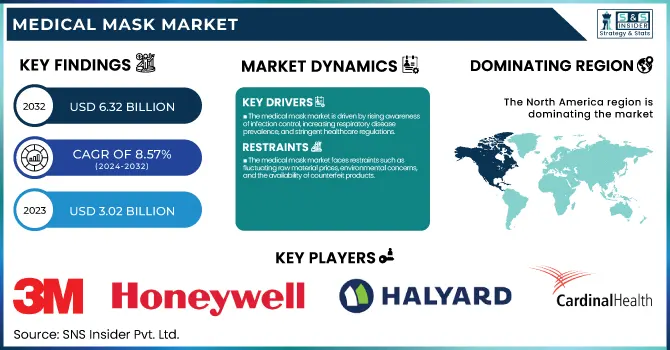

The Medical Mask Market Size was valued at USD 3.02 billion in 2023 and is expected to reach USD 6.32 billion by 2032 and grow at a CAGR of 8.57% over the forecast period 2024-2032.

To Get More Information on Medical Mask Market - Request Sample Report

The report focuses on price movements and cost analyses based on raw material availability, technology improvements, and fluctuations in global demand. The research considers medical mask consumption trends between regions with added consumption noted in regions with higher rates of respiratory illnesses. It also discusses import and export trends between regions, reflecting the dynamics of trade and supply chain disruptions. The report determines the regulatory effect on the medical masks market, with a particular focus on changing safety standards and compliance.

The U.S. Medical Mask Market Size was valued at USD 0.97 billion in 2023 and is expected to reach USD 2.10 billion by 2032 and grow at a CAGR of 8.9% over the forecast period 2024-2032. In the US, demand for medical masks remains on the rise with rising air pollution, exposure to wildfire smoke, and increasing focus on workplace safety laws in healthcare and manufacturing industries. Higher awareness of infection control within hospitals and long-term care settings has also propelled adoption, with ongoing market growth ensured.

Medical Mask Market Dynamics

Drivers

-

The medical mask market is driven by rising awareness of infection control, increasing respiratory disease prevalence, and stringent healthcare regulations.

The increasing number of infectious diseases like COVID-19, tuberculosis, and influenza has contributed enormously to the demand for medical masks. As per the WHO, more than 2.5 million deaths every year are caused by respiratory infections, which require protective action. Owing to the increased focus of the healthcare sector on personal protective equipment (PPE) compliance, most people have now adopted masks. The increasing aging population that is more susceptible to infections also contributes to market expansion. Additionally, the growth in pollution levels and fears about airborne pathogens have driven increased public mask usage outside healthcare. The widespread increase in surgical activity across the globe also supports continuous demand as medical masks are a critical input in operating rooms. Government policy, including stockpiling PPE as part of pandemic preparation and subsidizing manufacturers, has further fueled expansion. The advent of new mask technologies, including antimicrobial treatments and clear masks to facilitate communication, is also increasing adoption. Increasing investments in healthcare infrastructure and the increasing safety standards in workplaces, especially in the industrial and construction industries, contribute to market growth. Overall, the growing concern for personal and occupational safety is driving the demand for medical masks.

Restraints

-

The medical mask market faces restraints such as fluctuating raw material prices, environmental concerns, and the availability of counterfeit products.

The raw material of choice for mask manufacture, polypropylene, has experienced price volatility as a result of supply chain disruptions and fluctuations in crude oil prices, influencing manufacturing costs. The improper disposal of single-use masks has also created serious environmental issues. It is estimated that the WHO calculates that approximately 75% of COVID-19-associated plastic waste, including masks, is being sent to landfills or the ocean, thus subjecting single-use plastics to greater regulatory pressures. In addition, the increased availability of fake medical masks, especially uncertified N95 respirators, is a risk to consumers and healthcare professionals alike. Research conducted by the CDC revealed that 60% of KN95 imported masks failed to conform to U.S. filtration requirements, raising issues regarding product effectiveness. Approval issues, such as rigorous approval procedures by entities such as the FDA and NIOSH, also hinder the launching of a new product. Also contributing is saturation in developed nations, where hoarding during the pandemic left countries with a surplus of supply that has momentarily depressed demand. All of these factors pose considerable challenges to sustained growth within the medical mask market.

Opportunities

-

The medical mask market offers vast opportunities through technological advancements, product diversification, and expanding application areas.

Self-sterilizing masks, nanofiber filtration technology, and biodegradable masks are the latest developments in progress, and these cater to medical personnel as well as environmentally friendly buyers. Growing interest in reusable and sustainable masks creates opportunities for companies to increase product lines. Further, the growing acceptance of smart masks with sensors that track filtration levels and Bluetooth capability is creating new business opportunities. Growing industrial safety standards and workplace protection protocols are also fueling demand outside of hospitals, with industries such as construction, manufacturing, and mining stepping up the use of high-filtration masks. In addition, the increasing trend of mask usage in areas with high air pollution levels, including Southeast Asia and some areas of Africa, offers untapped market potential. Government support for pandemic preparedness and research on next-generation PPE is also driving market growth. Firms are also benefiting from e-commerce expansion by increasing direct-to-consumer sales channels, providing subscription-based delivery services for masks, and enhancing online accessibility. These developments and expansions in the market offer profitable avenues for medical mask makers, opening doors to long-term growth over the coming years.

Challenges

-

The medical mask market faces challenges such as supply chain disruptions, shifting consumer preferences, and regulatory compliance issues.

Global supply chains are still at risk of raw material shortages, strikes by labor, and delivery delays, affecting manufacturing and distribution. Increased freight rates and volatile oil prices also contribute to supply uncertainty. Changing consumer demand towards more breathable and reusable masks lowers the demand for traditional disposable masks. Regulatory compliance is also a major issue, as companies have to comply with diverse certification requirements like NIOSH (U.S.), CE (Europe), and BIS (India) to penetrate various markets. Non-compliance with these regulations can result in recalls, penalties, and loss of reputation. In addition, the rise in counterfeit products in the market has generated trust problems among consumers and healthcare professionals. Extended mask use also generates concerns about skin irritation, breathability, and tolerance, prompting some consumers to look for alternative protective products. Meeting these challenges calls for ongoing innovation, quality control, and supply chain management to sustain stable and consistent growth in the market.

Medical Mask Market Segmentation Analysis

By Type

Respirators dominated the global medical mask market in 2023, with a 54.3% share of total revenue. Their dominance is fueled by their higher filtration efficiency, extensive use in healthcare and industrial applications, and increasing recognition of airborne transmission of diseases. The COVID-19 pandemic solidified the need for respirators, especially N95 and FFP2/FFP3 masks, and this has created consistent demand from hospitals, laboratories, and the general public. Tough workplace safety regulations and stockpiling activities by governments only added to their market dominance.

Surgical masks are the most rapidly growing segment, witnessing a sudden surge in usage because of their cost-effectiveness, simple of use, and capability to curb infection transmission. They have extensive usage in hospitals, dental offices, and outpatient procedures, aiding their accelerated growth. Greater awareness among the masses about infection prevention, especially in overpopulated areas, and enhanced healthcare facilities in developing nations are major driving factors behind their increased demand.

By Distribution Channel

Retail pharmacies became the largest distribution channel in 2023, with the greatest market share. They gained their dominance through easy access, extensive product offerings, and high consumer demand for purchases in person, especially in metropolitan and suburban territories. Retail pharmacies also gain from group purchasing by healthcare organizations and companies, providing a consistent supply of medical masks for demand to be covered.

Online pharmacies are the most rapidly increasing distribution channel with a hike in sales, powered by deepening e-commerce penetration, ease, and competitiveness in pricing. There is a greater inclination towards online forums for buying items in bulk quantities, door delivery, and availability of different types of masks. Greater usage of digital solutions for healthcare along with deeper engagement between manufacturers and e-commerce companies have further triggered the rise in this segment.

Medical Mask Market Regional Insights

North America led the world in the medical mask market in 2023, with a share of 42.5% of the total revenue. This is fueled by high healthcare spending, stringent infection control policies, and extensive use of personal protective equipment (PPE) in hospitals and industrial settings. The availability of large market players, government stockpiling initiatives, and robust demand from healthcare institutions also supported North America's leadership. The U.S. played a major role in market leadership because of its established healthcare infrastructure, high level of awareness of respiratory protection, and widespread use of masks in medical and public areas.

Asia-Pacific was the fastest-growing region, driven by increased healthcare spending, rising disease outbreaks, and enhanced awareness of infection prevention. Countries like China, India, and Japan saw a sudden uptick in the production and consumption of medical masks due to a growing healthcare base and government initiatives to increase the use of PPEs. The growth of the region is also buttressed by a huge population base, increasing urbanization, and a flourishing e-commerce space that has increased the availability of medical masks. Further, the availability of major manufacturing centers in China and India has supported supply chains, enabling cheap production and export, which has further aided market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Medical Mask Market

-

3M – N95 Respirators, Surgical Masks, Reusable Respirators

-

Honeywell International Inc. – N95 Respirators, Surgical Masks, Disposable Face Masks

-

Halyard Worldwide, Inc. – Surgical Masks, N95 Respirators, Fluid-Resistant Masks

-

KCWW (Kimberly-Clark Worldwide, Inc.) – N95 Respirators, Surgical Masks, Procedural Masks

-

Henry Schein, Inc. – Surgical Masks, Face Shields, N95 Respirators

-

ANSELL LTD. – Surgical Masks, N95 Respirators, Single-Use Face Masks

-

Cardinal Health – N95 Respirators, Surgical Masks, Procedural Masks

-

Prestige Ameritech – N95 Respirators, Surgical Masks, ASTM Level 1-3 Masks

-

Moldex-Metric, Inc. – N95 Respirators, Disposable Face Masks, AirWave Respirators

-

Medline Industries, LP – Surgical Masks, N95 Respirators, Pediatric Face Masks

Recent Developments

In Jan 2025, The Federal Trade Commission (FTC) announced refunds exceeding USD 1 million for consumers misled by deceptive marketing of Razer's Zephyr face mask. The FTC took action in April 2024, citing false claims about the mask's "wearable air purifier" features, which were sold between 2021 and 2024 at prices ranging from USD 29.99 to USD 149.99

| Report Attributes | Details |

| Market Size in 2023 | USD 3.02 billion |

| Market Size by 2032 | USD 6.32 billion |

| CAGR | CAGR of 8.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Surgical Mask, Respirators, Others] • By Distribution Channel [Hospital Pharmacies, Retail Pharmacies, Online Pharmacies] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Honeywell International Inc., Halyard Worldwide, Inc., KCWW (Kimberly-Clark Worldwide, Inc.), Henry Schein, Inc., ANSELL LTD., Cardinal Health, Prestige Ameritech, Moldex-Metric, Inc., Medline Industries, LP. |