Amyloidosis Treatment Market Report Scope & Overview:

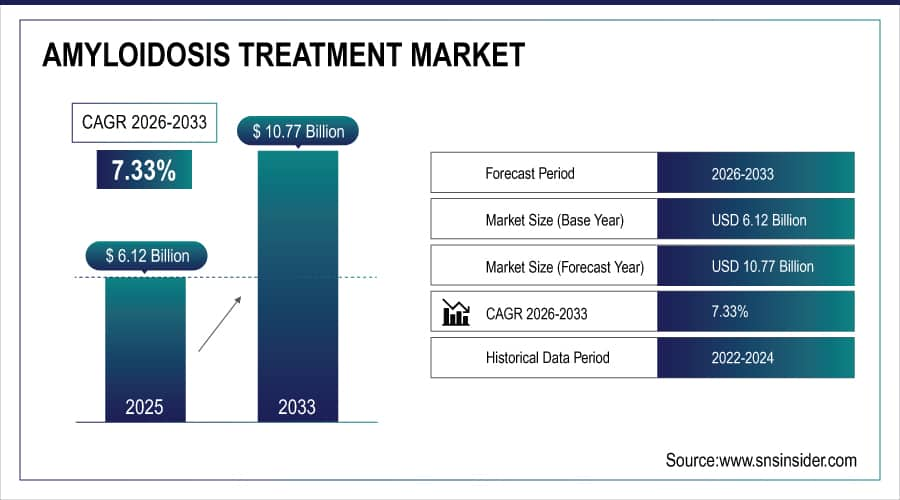

The Amyloidosis Treatment Market size is estimated at USD 6.12 billion in 2025 and is expected to reach USD 10.77 billion by 2033, growing at a CAGR of 7.33% from 2026-2033.

The Amyloidosis Treatment Market is growing due to increasing disease diagnosis rates, advancements in targeted therapies, and expanding treatment options for different amyloidosis subtypes. Key factors including the development of innovative monoclonal antibodies, TTR stabilizers and gene-silencing therapies and better diagnostics such as mass spectrometry and nuclear imaging are contributing to market growth. An increasing awareness among healthcare professionals, aging population in developed regions, and orphan drug designations with market exclusivity further expedite therapeutic innovation and adoption globally.

Clinical data shows 72% of amyloidosis patients now receive disease-modifying treatments within 6 months of diagnosis, compared to 35% in 2020, driven by advanced diagnostics and targeted therapies improving survival outcomes by 40%.

To Get More Information On Amyloidosis Treatment Market - Request Free Sample Report

Amyloidosis Treatment Market Size and Forecast

-

Market Size in 2025: USD 6.12 Billion

-

Market Size by 2033: USD 10.77 Billion

-

CAGR: 7.33% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Amyloidosis Treatment Market Trends

-

Increasing adoption of monoclonal antibody therapies targeting amyloid fibril formation and deposition across multiple organ systems

-

Growing utilization of RNA interference (RNAi) and antisense oligonucleotide therapies for transthyretin (TTR) amyloidosis treatment

-

Rising integration of precision medicine approaches through biomarker identification and genetic testing for treatment personalization

-

Expansion of combination therapy regimens incorporating chemotherapy, immunomodulators, and novel targeted agents

-

Increasing focus on early detection through advanced imaging techniques and blood biomarker panels to enable pre-symptomatic intervention

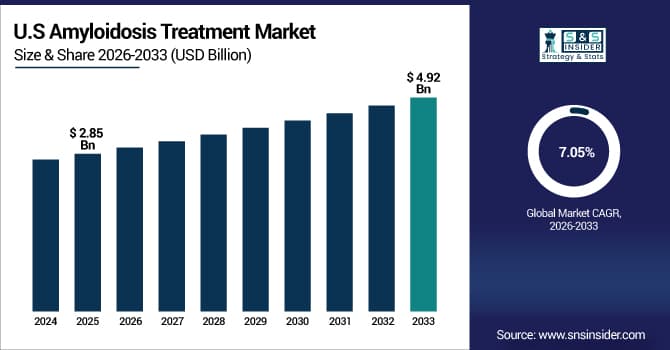

The U.S. Amyloidosis Treatment Market is estimated at USD 2.85 billion in 2025 and is expected to reach USD 4.92 billion by 2033, growing at a CAGR of 7.05% from 2026-2033. The U.S. Amyloidosis Treatment Market is driven by high diagnostic rates, advanced healthcare infrastructure, strong insurance coverage for orphan drugs, and presence of leading research institutions. FDA accelerated approvals for novel therapies, increasing specialist amyloidosis centers, and patient advocacy initiatives further accelerate market growth.

Amyloidosis Treatment Market Growth Drivers:

-

Rising amyloidosis prevalence and better diagnostics are accelerating global demand for targeted specialty therapies.

This increase in the number of diagnosed patients is fueled by the observational nature of the disease including ATTR amyloidosis in the elderly, improved sensitivity of laboratory technologies, such as cardiac MRI, bone scintigraphy and mass spectrometry, and increase in population size. Anticipating even better diagnosis can only take place at the time of such interventions with disease-modifying therapies. Due to the orphan drug incentives and highly unmet medical needs for patients with the disease, the pharmaceutical industry has increasingly invested in amyloidosis R&D. Growing initiatives for awareness of the disease and advanced diagnostic including better physician knowledge regarding the different subtypes of amyloidosis are resulting into more patients getting treatment initiated thus propelling the market growth in developed and developing healthcare markets.

Clinical registry data indicates 65% increase in amyloidosis diagnoses since 2020, with 78% of newly diagnosed patients initiating FDA-approved targeted therapies within 3 months, improving 5-year survival rates from 35% to 52%.

Amyloidosis Treatment Market Restraints:

-

High therapy costs and limited reimbursement continue to constrain access, especially in developing markets.

New and promising treatment options for amyloidosis are available, but the orphan drug prices exceeding USD 200,000 per year, leaving them out of reach even if covered by insurance. Numerous health systems enforce onerous prior authorization practices, step therapy protocols, and specialty pharmacy limitations. Financial barriers in emerging markets inhibit global access to advanced therapies. These systemic barriers can lead to financial toxicity for the patient with high out-of-pocket costs, restrictions on off-label use, and formulary requirements that delay initiation of therapy. Such economic obstacles disproportionately affect older patients on a fixed income and patients with multiple comorbidities needing complicated therapeutic regimens.

Market access analysis reveals 42% of amyloidosis patients in developed countries face insurance denials for first-line targeted therapies, with average appeal processes delaying treatment by 4-6 months and increasing irreversible organ damage risk.

Amyloidosis Treatment Market Opportunities:

-

Oral and Subcutaneous Formulations are Improving Treatment Adherence and Expanding Patient Reach

This transition from intravenous to oral and subcutaneous delivery systems present a large market growth opportunity globally. Novel approaches, such as next-generation TTR stabilizers, small molecule inhibitors, and oral proteasome inhibitors in development, hold the potential to ease treatment burden, remove the need for infusion center visits, and enhance quality of life. The availability of these convenient formulations allows for a very early treatment initiation in low and moderate disease severity stages, and allows for long-term maintenance therapy. Pharma companies that invest in patient centric delivery systems will be able to take share from existing infusion-based regimens and also enter the outpatient and homecare markets around the world.

Patient preference studies indicate 85% of amyloidosis patients favor oral therapies over intravenous options, with projected adherence improvements from 65% to 88% when switching to convenient administration formats.

Amyloidosis Treatment Market Segment Highlights

-

By Treatment: Chemotherapy led with 38.4% share, while Transplantation is the fastest-growing segment with CAGR of 9.2%.

-

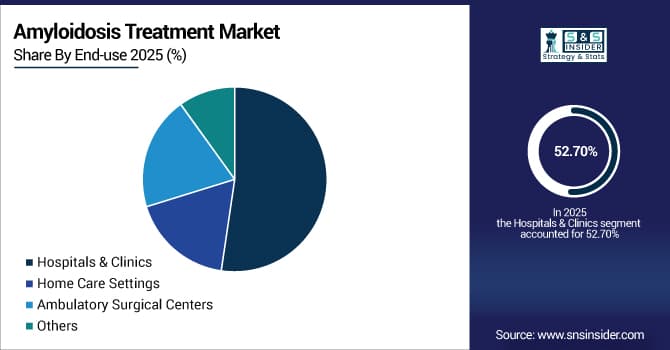

By End-use: Hospitals & Clinics led with 52.7% share, while Home Care Settings is the fastest-growing segment with CAGR of 8.9%.

By Treatment: Chemotherapy led, while Transplantation is the fastest-growing segment.

Chemotherapy, with bortezomib, cyclophosphamide, and dexamethasone, is a backbone of AL amyloidosis management, and dominates the amyloidosis treatment market. These protocols target the plasma cell dyscrasias responsible for AL amyloidosis, leading to reduced amyloid production and the possibility of organ recovery. Ongoing developments of new chemotherapy agents, optimal support care, and better patient selection for specific therapies have increased efficacy and simultaneously minimized toxicity.

Transplantation is the fastest growing treatment segment owing to improving outcomes with ASCT in eligible AL amyloidosis patients Progress in selection criteria for patient selection, conditioning regimens, and care around the transplant has resulted in reduced mortality rates and more durable responses. Growth is driven by the development of sequential approaches that combine chemotherapy with transplantation and improvement in the availability of specialized transplant centers.

By End-use: Hospitals & Clinics Led the Market, while Home Care Settings is the Fastest-growing Segment

Hospitals & Clinics dominate the market as amyloidosis management need multidisciplinary care from cardiologists, hematologists, nephrologists, and other specialists, which are typically available in the hospital settings. These facilities also offer comprehensive diagnostic capabilities, along with transplantation programs, infusion services, and emergency care during treatment complications.

Home Care Settings are projected to be the fastest-growing segment in the market owing to the surging administration of subcutaneous therapies, remote monitoring capabilities, and oral medications. The shift toward patient-centered care, reduced infection risk during immunosuppression, and cost-containment pressures favor home-based treatment.

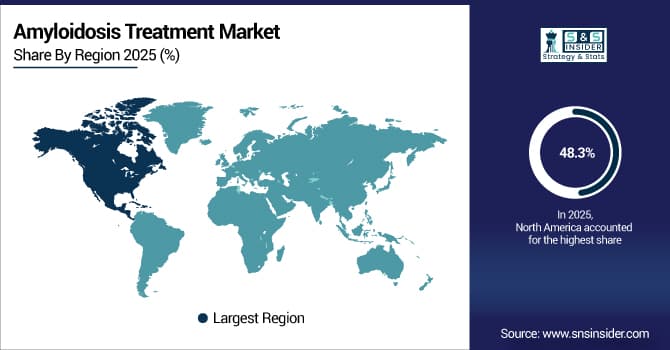

Amyloidosis Treatment Market Regional Analysis

North America Amyloidosis Treatment Market Insights:

In 2025, North America held the largest Amyloidosis Treatment Market share at 48.3% owing to high diagnostic rates, well developed healthcare infrastructure, strong insurance coverage for orphan drugs, high concentration of research institutions, and strong adoption of newly developed therapies. Additionally, the region was complemented with early-phase innovations, specific amyloidosis treatment centers, patient advocacy organization, and favorable regulatory pathways followed by leading pharmaceutical entities which paved the way for market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Amyloidosis Treatment Market Insights

Europe accounted for the largest share of the market in 2025, at 28.7%, due to universal healthcare systems and a well-established network for academic research, along with 17 orphan drug designations by the EMA and relatively well-established national amyloidosis registries. Greater awareness at specialist levels, broader genetic testing programs, and standardized treatment guidelines across EU member states, further cemented Europe at the forefront of the global market.

Asia Pacific Amyloidosis Treatment Market Insights

Asia Pacific is anticipated to register the fastest CAGR of 9.2% during 2026 to 2033 propelled by better adoption for diagnostic facilities, augmentation in healthcare revenue, rising knowledge in physicians, escalation in acceptance of clinical trials participation and growing senile citizen-in both the geographical fields. Market expansion has accelerated increasingly given local manufacturing partnerships, government support for rare disease management and growing insurance coverage for specialty therapies across the region.

Latin America and Middle East & Africa Amyloidosis Treatment Market Insights

Moderate growth over the period from 2023 to 2025 was seen in Latin America and Middle East & Africa, supported by enhanced specialist training, further openings in diagnostic capacity, continued investment by pharmaceutical companies in patient assistance programs, and governmental prioritization of rare disease frameworks. Although access challenges remain, the increasing numbers of middle-class populations, medical tourism for complex cases, and regional clinical trial initiatives will help the market continue to develop step-wise through all of these territories.

Amyloidosis Treatment Market Competitive Landscape:

Pfizer Inc.

Pfizer Inc. is a global pharmaceutical leader headquartered in the United States, with dominant position in ATTR amyloidosis treatment through its TTR stabilizer tafamidis (Vyndaqel/Vyndamax). The company's cardiology and rare disease portfolio focuses on transforming ATTR amyloidosis from progressive fatal condition to manageable chronic disease. Pfizer invests significantly in diagnostic education, screening initiatives, and real-world evidence generation.

-

August 2024, Pfizer received FDA expanded approval for tafamidis in early-stage ATTR cardiomyopathy, increasing addressable patient population by 40% based on Phase 4 trial demonstrating 54% reduction in cardiovascular events.

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, headquartered in the United States, pioneered RNA interference therapeutics for ATTR amyloidosis with patisiran (Onpattro) and vutrisiran (Amvuttra). The company's RNAi platform specifically reduces production of disease-causing proteins at genetic level. Alnylam's focused rare disease strategy includes comprehensive patient access programs, specialist education initiatives, and ongoing research into next-generation formulations.

-

June 2024, Alnylam announced positive 5-year follow-up data for patisiran showing sustained TTR reduction and neurological function stabilization, supporting long-term treatment benefit in polyneuropathy patients.

Johnson & Johnson (Janssen Pharmaceutical)

Johnson & Johnson's Janssen Pharmaceutical division revolutionized AL amyloidosis treatment through daratumumab (Darzalex) approval in combination regimens. The company leverages its hematology-oncology expertise to address light chain amyloidosis, with clinical programs exploring novel combinations and earlier treatment intervention.

-

March 2025, Janssen received FDA priority review for daratumumab combination as first-line AL amyloidosis therapy based on ANDROMEDA trial showing 68% complete hematologic response rate and 71% reduction in organ progression.

Amyloidosis Treatment Market Key Players

Some of the Amyloidosis Treatment Market Companies

-

Pfizer Inc.

-

Alnylam Pharmaceuticals

-

Johnson & Johnson (Janssen Pharmaceutical)

-

Ionis Pharmaceuticals

-

BridgeBio Pharma

-

GlaxoSmithKline (GSK)

-

Prothena Corporation

-

Eidos Therapeutics

-

Attralus Inc.

-

Corino Therapeutics

-

Caelum Biosciences

-

Intellia Therapeutics

-

Neuroimmune AG

-

Sobi (Swedish Orphan Biovitrum)

-

Spectrum Pharmaceuticals

-

Teva Pharmaceutical

-

Celgene (Bristol Myers Squibb)

-

Takeda Pharmaceutical

-

AstraZeneca

-

Sanofi

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.12 Billion |

| Market Size by 2033 | USD 10.77 Billion |

| CAGR | CAGR of 7.33% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Treatment (Chemotherapy, Transplantation, Immunosuppressive Drugs, Surgery, Supportive Care, and Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Pfizer Inc., Alnylam Pharmaceuticals, Johnson & Johnson (Janssen Pharmaceutical), Ionis Pharmaceuticals, BridgeBio Pharma, GlaxoSmithKline (GSK), Prothena Corporation, Eidos Therapeutics, Attralus Inc., Corino Therapeutics, Caelum Biosciences, Intellia Therapeutics, Neuroimmune AG, Sobi (Swedish Orphan Biovitrum), Spectrum Pharmaceuticals, Teva Pharmaceuticalm Celgene (Bristol Myers Squibb), Takeda Pharmaceutical, AstraZeneca, Sanofi |